Energy Musings - March 12, 2024

Energy's minimal weight in the S&P 500 Index is mirrored by the recent history of investors shunning commodities in portfolios. The similarity is not surprising, but both could be changing.

Is Commodity Investing Poised For A Change?

For the last six months, watching the stock market has not been exactly like watching paint dry. Far from it. As the chart below of the performance of the Dow Jones Industrial Average, the Standard & Poor’s 500 Index, and the Nasdaq Index for the past year demonstrates, since November the markets have been in a strong, virtually uninterrupted, upward trajectory leading to record highs for all three indices this year.

The move started earlier. The indices began moving higher in May 2023 when investment sentiment began embracing the view that the Federal Reserve was nearing a peak for this interest rate cycle. Expectations focused on whether we were looking at one or two more hikes in the first half of 2023 before momentum would switch to rate cutting. The question was whether the remaining hikes would take the Federal Funds rate to 5.25% or 5.50%. These levels were a quarter to a half a point higher than where the rate was in early spring.

Would rates stop going up after June? As many investors and stock market strategists speculated that they would, the debate moved to when rate cuts might start. Equally important was the pace and size of the rate reductions being predicted. Could it be as many as six rate cuts of a quarter of a point each, taking the Federal Funds rate from 5.5% down to 4%? If the ensuing rate hikes only lifted the Federal Funds rate to 5.25%, then six quarter-point cuts would bring rates below 4%.

In either scenario, assuming that the number of cuts and the cumulative magnitude were correct, forecasters argued that there would be plenty of liquidity in the economy of which a substantial amount would flow into the stock market. Money seeking to be invested would target those companies and sectors that would respond to faster economic growth. Coupled with lower inflation, this combination would trigger higher stock market valuations for the earnings growth of those targeted companies.

The message of the market was “get aboard ‒ the stock market train is leaving the station.”

The stock market’s upward trajectory since last fall has carried it to record highs led by the Nasdaq and technology stocks.

While the Federal Reserve followed through with its rate hikes, as predicted, inflation readings continued to confound the conventional wisdom that the inflation battle was over, inflation would fall rapidly, and quick and frequent interest rate cuts would begin. Unfortunately, Federal Reserve Chairman Jerome Powell continued to remind the public that inflation was often sticky and the road to a sustained lower inflation rate was likely going to be bumpy. The market’s disappointment became evident and stocks, after reaching euphoric highs in July, began to slide as the last rate hike was envisioned but prospects for rapid rate cuts during 2023’s second half evaporated.

By November, inflation data improved, demonstrating a sustained downward trajectory which lent credence to the view idea that the Federal Reserve was finished with its tight monetary policy. With easing monetary policy on the horizon, speculation was directed to when in 2024 the first rate cut would occur. Secondarily, the question of how many cuts would occur in 2024 received much attention. The earlier cuts started; the more cuts were likely. Six became a popular number.

Since last November, stocks have essentially moved in one direction – up. They have been driven higher by the performance of the technology stocks, something we have chronicled with our reporting of the monthly performance of the 11 industry sectors composing the S&P 500 Index. Energy, which had blown away performance records in 2021 and 2022 (+30.8% and +65.7%, respectively), posted sector-leading performance for July, August, and September. When the monetary policy looked to switch from tight to easy, Energy’s leadership collapsed and the sector posted losses and last-place finishes for October, November, and December. For all of 2023, Energy was in second-to-last place with a negative 4.8% performance after record-leading finishes in 2021 and 2022.

Twenty-twenty-four opened with Energy posting a loss stretching its string of consecutive losing months to four, a record for 2020-2024. The string of monthly losses ended with February’s positive performance, helped by a solid month for crude oil prices after months of them sliding from the mid-to upper-$80s to below $70 a barrel. Oil prices rallied and remained in the upper $70s as geopolitical tensions supported them.

Crude oil is one of the most actively traded commodities besides gold. Given oil’s price performance, we were not surprised by the chart below courtesy of The Felder Report. It shows the allocation of financial assets between equities, bonds, and commodities, all measured by using ETFs as a proxy. The article was titled “Nobody Wants to Own Commodities” and highlighted the chart. It shows that at the opening of the 2000s, equities represented roughly 95% of financial assets with bonds accounting for the balance. It was only about 2005 when commodities became a notable asset class. Commodity investments in portfolios grew reaching 8%-10% between 2009-2013, a period associated with the bull market in oil and gas investments and soaring crude oil prices driven by China’s insatiable consumption. During that period, portfolios became more diversified as bonds grew to represent 15%-20% of assets and equities’ share shrank to 70%-75%.

Commodities along with crude oil are out of favor with investors.

As the oil and gas boom cooled with the Great Financial Crisis and ensuing global recession, commodity holdings declined to low single-digit shares where they remain today. Bonds have remained fairly steady at around 20%. This chart was used by The Felder Report to show how investors were rejecting interest in all commodities, but especially gold. Amazingly, gold prices have reached new highs after trading flat for the past three years.

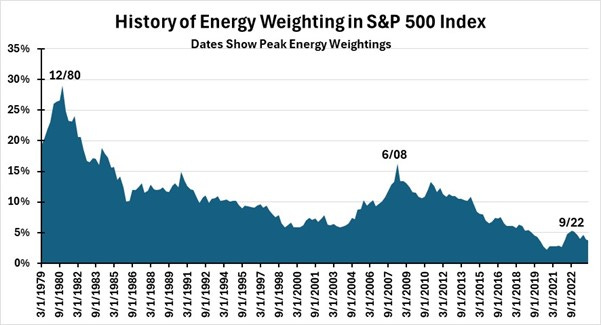

In our March 4, 2024, Energy Musings article about Energy’s February performance, we produced a chart of the history of the Energy sector weight in the S&P 500 Index from 1979 to now. It showed just how low Energy’s weight in the S&P 500 Index was today. However, we thought it appropriate to create an Energy weight chart to match the time of the commodity chart. Just as commodities grew in their importance as financial assets, Energy’s weight rose. Likewise, commodity holdings and Energy’s weight in the S&P 500 Index fell in parallel. That should not be a surprise.

Energy’s S&P 500 Index weight pattern reflects the same pattern as commodity holdings in investors’ financial assets.

We thought it was worthwhile to reproduce the 1979-2024 Energy weight chart. This longer time history puts into context how Energy’s importance in the stock market has waned over the last 40+ years. It also confirms how industry cycles have led to Energy’s weight rising to high levels only to slide once events tamed the energy boom.

Energy’s weight in the S&P 500 Index makes it almost irrelevant.

In our estimation, the stock market is currently transitioning, which will see reduced importance for technology stocks as their valuations are too high. This is not surprising given how high technology stocks have traded recently. Currently, the handful of leading technology stocks (Magnificent 7) are suffering losses as investors question their earnings growth valuations in light of sustained higher interest rates, slowing economic growth, and stubbornly high inflation squeezing consumers and impacting their spending.

When money exits one sector it usually flows into other sectors offering more attractive rewards. That means investors believe those companies’ earnings growth prospects are not fully appreciated. When investors conclude that these stocks are too cheap, share prices increase. This is called rotation. A rotation is underway. Energy and commodities may benefit. We will examine why in an upcoming article.