Energy Musings - June 19, 2025

Congressional Republicans are debating their tax reconciliation bill details. Energy tax credits are a prominent component of proposed changes. People should learn about the PTC history.

Will The OBBB End The Wind PTC?

United States senators are debating changes to the House of Representatives’ One Big Beautiful Bill Act of 2025 (OBBB). The 1,000+ page bill has many provisions, many of which are receiving attention from the senators. However, according to Senate Majority Leader John Thune (R-SD), following a meeting with President Donald Trump at the White House on June 11, the senators are focused on five significant changes to government policies contained in the bill: SNAP (Supplemental Nutrition Assistance Program), SALT (state and local tax deduction), border funding, Medicaid, and energy tax credits.

According to a May 28 article by Brian Coddington, Tax, Senior Manager at accounting firm Wipfli, the current draft of the OBBB includes the following proposed changes to energy tax incentives:

“Renewable and clean energy credits: Section 45Y (Clean Energy Production Credit) and Section 48E (Clean Electricity Investment Credit) would see accelerated phaseouts and tight deadlines. In the House-approved bill, eligible projects must begin construction within 60 days of enactment and be operational by December 31, 2028, to qualify.

“Manufacturing and industrial credits: The bill phases out advanced manufacturing credits (Section 45X), with wind energy components becoming ineligible after 2027 and other components after 2031.

“Transportation and vehicle credits: Section 25E, 30C, 30D, and 45W tax credits would be eliminated for vehicles and equipment placed in service after December 31, 2025. This includes credits for new, previously owned, and commercial electric vehicles, as well as alternative fuel vehicle refueling property.

“Residential energy efficiency credits: Section 25C (Energy Efficient Home Improvement Credit) and 25D (Residential Clean Energy Credit) would be repealed for systems placed in service after December 31, 2025. The Section 48 energy credit would also prohibit a credit for certain third-party-owned leased wind and solar property if the lessee would be eligible for the section 25D credit if it owned the property.

“Residential developer credit: The Section 45L credit for new energy-efficient homes would be eliminated for homes acquired after 2025, unless construction began before May 12, 2025. In that case, taxpayers receive an extra year to sell or lease the homes and claim the credit.

“Transferability: Section 6418, which allows the transfer of many clean energy credits to unrelated parties, would be eliminated for clean fuel production and advanced manufacturing production credits, potentially affecting how these clean energy projects are financed.

“Foreign entity of concern (FEOC) rules: Phased in over several years, the bill would add new rules to limit certain foreign entities and companies receiving assistance from foreign entities to receive some green credits.”

These changes would mark a significant shift in U.S. energy policy, reversing many of the new policies implemented by Joe Biden’s misnamed Inflation Reduction Act of 2022. Because some of the tax credits and payments introduced have spawned new projects, lobbying has become intense for preserving or delaying some tax credits.

It seems the lobbying has impacted Republican senators who have proposed slower phase-outs of wind and solar tax credits and a longer time for their construction to begin on projects that would be eligible for the subsidies. These are some provisions in the Senate version of the reconciliation tax bill. The Senate has yet to vote on its bill. Given the differences in the two bill versions, the journey to the final passage remains long. Expect additional shifts in the final bill.

Renewable energy organizations cite ending the renewable energy production tax credit and the renewable investment tax credit as a ticket to higher electricity prices. That would only happen if renewable energy developers continue to build these projects without the tax credits because they are expensive. What promoters fail to acknowledge is how expensive renewable electricity is due to its need to maintain backup power and make substantial infrastructure investments. While the developer receives the renewable energy tax credits, the ratepayer must pay for the system cost in addition to the price of the renewable power. In addition, ratepayers, as taxpayers, foot the bill for the tax credit subsidies.

The Production Tax Credit is a critical source of funding for wind projects. Few people realize that the wind PTC has existed for 33 years. The credit ended multiple times during its life, but was always extended retroactively. The on-again-off-again PTC history created periods of uncertainty for wind farm developers, causing them to stop building new projects until an extension was agreed upon. The chart of new wind energy capacity built during 1990-2017 shows the impact on annual additions from the PTC pauses.

PTC suspensions disrupted the growth in wind energy capacity.

Senator Chuck Grassley (R-IA) sponsored the creation of the wind PTC in 1992 with his Wind Energy Incentives Act. Grassley sponsored a new bill using the same name each time the PTC expired. These bills were attached to the final energy legislation extending the tax credit.

The 15 bills that cover the 33-year history of the wind PTC.

We traced the history of 15 bills dealing with renewable energy issues and the wind PTC that Congress passed. Many bills extended the PTC for only a year, although some were multiple-year bills. Interestingly, the initial PTC bill had a 6.5-year life. Such length was designed to get the industry underway. We assume legislators believed renewable energy would eventually become financially viable without subsidies. History has shown that assumption to be wrong. That is because, as we have learned over the years, the only thing permanent is a temporary government program. Thirty-three years after the PTC was implemented, developers will not build new wind farms without government subsidies. They may soon face the prospect of a subsidy-free wind market.

Here is the timeline of the PTC. Although hard to read, only 13 of the 15 renewable energy bills involved creating and extending the PTC.

Thirty-three years of the PTC is a long time.

While the next chapter in the wind PTC has yet to be written, it will likely significantly impact activity. One wonders why an industry that has existed for hundreds of years – harnessing wind power for productive uses – still needs financial support. As we noted in our most recent Energy Musings addressing the economic costs of offshore wind, we used the term “uneconomic” to describe wind energy’s problem.

The primary issue for wind and other renewable energy projects is that their entire capital costs – construction and maintenance ‒ relative to the income they generate over their lives, are front-loaded. Furthermore, renewable projects have much shorter productive lives than traditional fossil fuel power plants.

The front-loading costs for renewable energy projects contribute to their low returns on investment. Developers boost the returns by loading on significant amounts of debt. The guaranteed longevity of the income stream encourages lenders to provide the financial leverage the developer needs to increase his return on equity to levels more competitive with traditional businesses. However, the leverage puts the projects at significant risk if the cost of the debt rises beyond expected levels.

At the recent Energy Future Forum, co-sponsored by the National Center for Energy Analytics (we are a scholar), Terrence Keeley, Chairman and CEO of 1PointSix, told attendees that an interest rate increase from 0% to 5% can triple the cost of capital in renewable energy projects. Failing to prepare for such an increase leads to projects quickly becoming uneconomic.

Iowa: The Poster Child Of Wind Energy

Iowa is considered the poster child of wind energy. That is because the state generates over 60% of its electricity from wind. Iowa owes its status to long-time Senator Grassley, who has actively promoted and defended the wind tax credit. He has vowed to negotiate further extensions to the proposed credit termination in the current version of the OBBB.

Grassley published an op-ed in the Des Moines Register last year: "The law helped catalyze Iowa’s leadership in renewable energy development. There wasn’t a single wind turbine in Iowa until after my wind energy tax credit. Today, clean energy sources account for 60% of Iowa’s electricity production.”

Here you see how wind nameplate capacity grew between 1998 and 2021. According to the latest government figures, Iowa's wind electricity generation capacity is about 13,000 megawatts (MW), with a total state capacity of 23,000 MW. Coal capacity is 5,300 MW, natural gas capacity is 4,300 MW, and petroleum capacity is 1,000 MW. Thus, the state’s grid supply is 54% wind and 44% fossil fuel power.

It wasn’t until 2008 that Iowa wind generation growth exploded.

From the electricity generated perspective, this chart shows how Iowa’s total electricity consumption has risen since 2001, and wind’s share has soared recently. According to renewable proponents, what has happened in Iowa should be the model for the rest of the United States.

Wind generation’s share of total electricity took off in 2019.

Another comment from Senator Grassley highlights issues unique to Iowa that have helped propel its wind energy growth. He wrote, “The proof is in the pudding. . . Wind is a critical part of our nation’s all-of-the-above energy strategy. It creates thousands of jobs, supports economic development, boosts tax receipts, attracts investment in our state, and puts extra money in farmers’ pockets. It delivers affordable energy for consumers that’s also safe for the environment and helps build American energy independence.” Unstated is that the key to Iowa’s wind success has been its generous tax credits.

Iowa’s wind business began in 1983 when the state adopted a policy to promote it. The law mandated investor-owned utilities in the state to purchase 105 MW of power from wind generation. Surprisingly, little wind capacity was built in subsequent years. It wasn’t until the Production Tax Credit was introduced a decade later that wind generation began to be built.

Why wind for Iowa? It helps to have the right environment.

A critical variable for wind is supply. That means wind turbines should be located where the strong wind blows steadily. Those qualities impact the capacity factor – how much output comes from the maximum possible output – of wind turbines. According to the Energy Information Administration (EIA), the average national wind capacity factor is between 32% and 34%. Iowa does slightly better at 36%.

The U.S. has numerous areas where wind is a powerful resource.

Iowa is fortunate to be a Great Plains state in the heart of the U.S.’s windiest onshore region, as shown in the National Renewable Energy Laboratory (NREL) chart. The midcontinent region has an abundance of high winds, aided by a flat landscape, enabling the wind to blow steadier and faster than in areas with hills and mountains.

Iowa’s wind speed potential is shown on the following chart.

Iowa has pockets of mighty wind.

Unsurprisingly, wind farms are in the heart of Iowa’s windier locations. They host large numbers of wind farms, and most of the large ones.

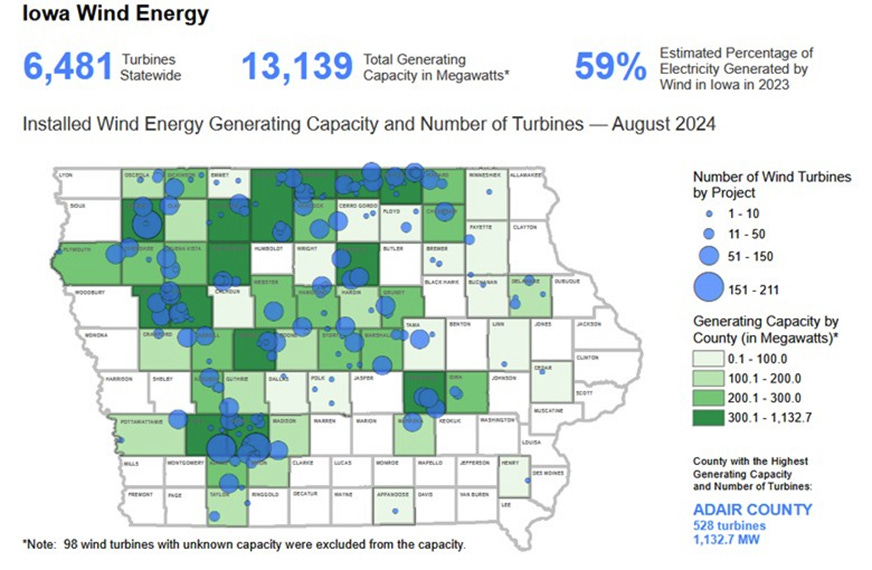

Where wind farms are located in Iowa.

The above chart comes from Iowa’s Legislative Services Agency and shows data through the summer of 2024. It confirms that the preponderance of Iowa wind farms is located in the windier regions of the state. Iowa’s wind data as of March 2025 from the EIA shows total generating capacity, both active and inactive, of 13,600 MW and nearly 7,100 wind turbines. Iowa’s wind turbines represent almost 10% of all U.S. installed turbines.

How does Iowa help its wind developers? First, they receive help from the federal Production Tax Credit. Under the 2024 Inflation Reduction Act, the tax credit for wind farms placed in service before January 1, 2022, is 2.9 cents per kilowatt-hour (kWh) produced. After that date, the rate declined to 0.6 cents/kWh, unless the project met the prevailing wage and apprenticeship requirements when built, in which case the rate is 3.0 cents/kWh.

According to Internal Revenue Service data, in 2022, the national average wind electricity price was 3.0 cents/kWh. Thus, a wind farm developer receives a tax credit equal to the cost of his electricity.

Iowa wind developers get additional help. The state is one of a small handful offering tax credits to wind producers. Early on, Iowa provided a tax credit of 1.5 cents/kWh for wind electricity up to a capacity limit. Once that cap was reached, the legislature adopted a new plan for wind projects placed in service after July 1, 2005, but before July 1, 2012. These wind farms could receive the 1.5 cents/kWh tax credit for ten years.

It would seem that those wind farms have reached the end of their subsidies. However, the state had passed a law in 1986 allowing wind farm operators to repower their turbines and recommence their 10-year tax credit payments. There does not seem to be a limit on how often such re-powerings may occur.

Lastly, the state has a very generous taxing system for wind turbines, which we will get to later. Combined, these subsidies and taxing policies make building and operating wind farms in Iowa lucrative, which has helped its wind industry to prosper, especially in recent years.

In 2014, Warren Buffett, the head of Berkshire Hathaway, acknowledged the truth about wind energy. His company owns MidAmerican Energy, Iowa's largest electricity and gas utility, while serving customers in Illinois, Nebraska, and South Dakota. MidAmerican Energy serves about two-thirds of Iowa’s electricity customers.

In 2024, 62% of MidAmerican Energy’s generating capacity was wind. Coal, at 22%, was the company’s next largest source of power generation, followed by natural gas, nuclear, and solar. The company is routinely criticized for not shutting down its coal-fired power plants, although its long-term plan is to generate 100% of its power from net-zero carbon emission sources by 2050. Maybe the company understands that its coal and natural gas power plants are critical for minimizing the risk of brownouts and blackouts.

MidAmerican Energy’s electricity generation profile favors wind.

Buffett wrote, “I will do anything that is basically covered by the law to reduce Berkshire’s tax rate. We get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.”

Few people paid attention to Buffett’s comments. However, the legendary investor has used these tax credits to build MidAmerican Energy into a cash-generating machine for his holding company, and a major contributor to Berkshire’s low corporate tax rate.

In 2017, in a radio show interview, MidAmerican Energy CEO Bill Fehrman admitted that 100% of the cost of wind turbines comes from taxes. His statement was supported by comments from the company’s new CEO, Adam Wright, who was quoted in a 2018 Des Moines Register column. He stated, “MidAmerican will receive about $10 billion in federal production tax credits for the investment, covering the capital costs needed to build the wind farms.” The article noted that MidAmerican Energy had invested $12.3 billion to build 2,200 wind turbines in the state, covering over 80% of the total investment.

In September 2023, Yahoo Finance wrote, “Warren Buffett’s energy division has reported a negative income tax rate for five straight years, thanks to billions of dollars’ worth of tax credits it’s received for producing clean power.” It went on to note that for 2019-2022, Berkshire Hathaway Energy (BHE) had received $6.1 billion in tax payments from the federal government. In 2023’s first quarter, BHE reported a negative 163% tax rate. How is that possible? Easy. BHE’s profits from providing electricity were $223 million, yet it received tax credits of $363 million.

The insidious aspect of the energy tax credits is their transferability. They can be banked by the entity creating them or transferred to other subsidiaries to reduce their tax payments. Using this mechanism is a profitable tool for Berkshire Hathaway. Other developers may be able to sell the credits to companies that can utilize them to reduce their tax rates.

Iowa also has a very favorable wind turbine property tax system. Counties in Iowa assess and collect property taxes on the conversion of property hosting wind turbines. The value of wind energy conversion property is defined as the cost of the wind turbine plus all electrical equipment, power lines, substations, and transformers. Counties may create ordinances for special valuation of a wind energy system based on the net acquisition cost, which is defined as the total cost of the property plus the cost of installing the wind energy system.

The Center for Rural Affairs presented an analysis showing that a wind energy system with a net acquisition cost of $58.9 million would be assessed property taxes at 0% for the first year. In subsequent years, the valuation for tax purposes increases by five percentage points annually, or $2.9 million. The increase is capped in year seven at 30% of the net acquisition cost, or $17.6 million. Therefore, $41.3 million of the owner’s net acquisition cost remains untaxed forever — a very nice subsidy for wind farm developers.

Wind farms also help the local economy with jobs and tax revenues. Iowa farmers earn an average of $4,000/MW for annual land leases, so they are happy to host turbines. They can still farm the land around the turbines, so the yearly income helps offset the cost of farm operations, especially if they have poor crop harvests.

While we do not know the fate of energy tax credits in the OBBB, it is clear they will be changed significantly. Early termination of the PTC for wind and other renewable energies is likely. The exact timing is uncertain. The loss of transferability of tax credits could significantly impact developers who use the sale of surplus credits to supplement their income and finance their projects.

Given the likely changes, we wonder if Iowa will remain the poster child of wind energy. With Senator Grassley's support, developers hope he can negotiate more favorable financial conditions than the House of Representatives’ version of the reconciliation bill. Time will tell.

It would take divine intervention. Not likely to happen.

Allen

This is a great review of the history of wind tax credits, but you might have added a discussion of the rationale behind PDCs. These unusual instruments provide a credit regardless of the underlying demand for the product thereby creating negative pricing of the commodity. It seems the primary function is to accelerate the government subsidy during the early phases of a project's life.