Energy Musings - September 2, 2024

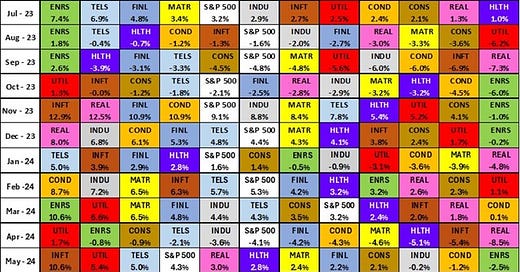

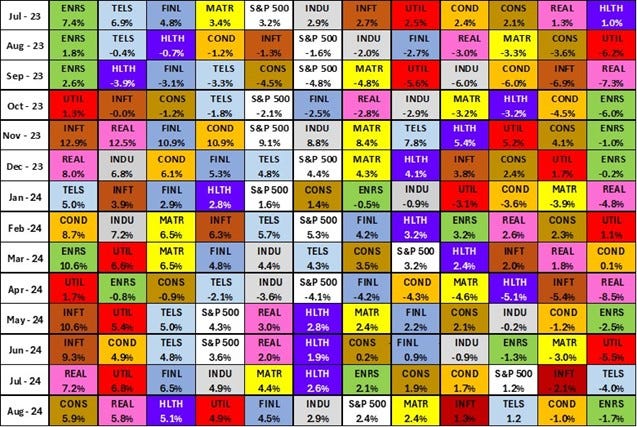

Our August monthly S&P 500 sector performance rundown shows how tough the month was for Energy. The positive momentum the sector exhibited in June and July was erased in August.

August Was Tough For Energy

After hitting bottom (literally) last May, the S&P 500’s Energy sector climbed progressively higher in the following two months. Then August rolled around. Traditionally, August is known as a difficult month for stocks – likely because it is the summer vacation month for Wall Street professionals.

August may no longer be the vacation month since more school systems are opening during August rather than after Labor Day enabling more vacation time during the school year. Regardless, August was tough on Energy. Once again, Energy fell to last place in the sector rankings. The sector’s negative 1.7% monthly performance left it behind the overall stock market by 4.1 percentage points.

The month was dominated by geopolitical events that spooked oil prices only to fail to follow through with worsening events. It seems the Middle East players – Israel, Iran, Hamas, Houthis, and now the Libyans – are not willing to escalate hostilities. Therefore, what proved good for geopolitical tensions was bad for oil prices and energy stocks.

Examining the monthly S&P 500 sector performance chart, we were surprised that there appeared to be a lack of market leadership. While the calls for interest rate cuts grew louder and more demanding, the Federal Reserve only gave lip service to the pleas. Maybe that is why Real Estate and Utilities which led July’s performance were not the top two sectors this month. They were among the top five along with Financials. However, the best-performing sector was Consumer Staples, which is considered defensive.

Monthly economic data showed further progress in slowing inflation. Now, greater focus is directed to the health of the labor market as the unemployment rate rose and the annual revision to the employment data showed an 800,000 job loss, meaning that most of the monthly improvements from mid-year 2023 to mid-year 2024 were erased. Therefore, while a soft landing for the economy remains Wall Street’s favored outcome, doubts persist. Modestly lower interest rates with continued liquidity increases are controlling the pace of the economy’s trajectory. However, if the labor market is deteriorating rapidly, interest rate cuts may have to be made to prevent a hard landing. Mixed economic signals always confound investor choices in the stock market. This time was no different.

August proved another difficult month for Energy, landing it in last place with a negative monthly return.

With the Democrat National Convention behind us and Kamala Harris their standard bearer, the presidential election campaign is fully underway. For Vice President Harris, it means finding how many ways she can avoid answering questions from serious reporters. Since there are so few of that breed in the media, the evasion should not prove difficult.

This political election will be studied and dissected by historians for years as it ranks as one of the most bazaar in modern times. We will save the political narrative for another platform but suffice that the fog of one candidate’s memory and his performance in a political debate upended what was seen as a settled outcome. Now, that party’s nominee is actively crab crawling away from her past radical policy positions, while claiming nothing has changed. Her success in obscuring her positions which might frighten away voters, will make the next two months a potentially volatile atmosphere for the stock market. Can you keep your head while those around you are losing theirs?

The Ukraine/Russia war continues to defy a reasonable resolution or provide a path to victory by either party. Minds are becoming numb to the conflict, although its resolution has significant implications for the European political map. Equally as important, this struggle is creating a stronger split between East and West.

Another unending war provides a backdrop for global political events. We are approaching the 11-month anniversary of the horrendous October 7 attack on Israel. This unending religious struggle is at a high level now, which frustrates political leaders who wish it would quickly fade away. The risk is this battle escalates as Israel strives to eliminate Hamas from Gaza. On the other side, Iran continues to finance its surrogates in their efforts to destroy Israel. The Middle East conflict’s escalation risks involving the superpowers, a scenario no one wants.

Lurking in the shadows is China. While it continues wrestling with economic and social issues, China continues to expand its economic and political dominance throughout Southeast Asia, Africa, and South America. Many nations struggle to determine if China is a friend or foe. On our current Southeast Asia trip, on every island we have visited, we were told that now Chinese interests own all the stores and businesses.

The geopolitical landscape has many themes that can send oil prices soaring with one misstep. But, unless the event remains escalated, the pattern of oil prices seen so far this year – spiking oil prices on geopolitical developments only to have them fall back when the spark fails to ignite a fire – will continue.

Oil prices have been yo-yoing in response to geopolitical events that fail to escalate.

This pattern of yo-yoing oil prices during 2024 in response to geopolitical sparks and duds is shown in the chart. Such a scenario is not good for energy stocks. However, the continuing energy sector consolidation is producing stronger companies. Moreover, the management of these companies continues to adhere to financial discipline. They do not see scenarios encouraging them to “swing for the fences” and risk their financial strength and potentially the CEO’s employment tenure. Investors remain convinced such discipline will eventually evaporate – it always has. Thus, investors refuse to reward these companies with higher price/earnings multiples, despite their strong balance sheets, healthy cash flows, and modest production increases.

The counterbalance is that the public and politicians reluctantly are accepting the future energy company CEOs are spelling out - there is no real energy transition. We remain in an energy “addition” period rather than a “substitution” phase. All the renewable energy we have added has only helped hydrocarbon fuels meet the world’s growing power needs. The substitution phase is not seen to happen for many years.

The idea that we will quickly replace hydrocarbon energy with renewable sources proves unworkable. The inability to scale renewables is a problem, let alone delivering power 100% of the time and at a reasonable cost. This reality is finally registering among those most sensitive to the realization – politicians. Since the first job of a politician is to get re-elected, continually slapping voters’ faces with high monthly utility bills and forced lifestyle adjustments is the fastest path to retirement.

We plan to sit back and watch all these issues fester. The next 60 days will provide much material for this soap opera. There will be events that will surprise us and markets, too. What they will be, we do not know. When they may happen is impossible to estimate, but October in a presidential election year is always a good bet. Grab your popcorn and settle in. The fun is just getting started.

Certainly agree. The story needs to be told because so few people understand it and the ramifications. My joining NCEA gives me a larger platform to deliver such messages.

Well written, Allen. The poor performance of the energy sector is important,’ but the self destructive act of harakiri being committed by the West in general in its declared war on hydrocarbons in the name of climate change is the real story that needs to be told to anyone who is interested in surviving the turmoil of our times.