Will New BP CEO Toe The Green Agenda Or Target O&G?

Tuesday, the BP family was rocked with news that CEO Bernard Looney was resigning immediately to be replaced on an interim basis by current CFO Murray Auchincloss. The company’s press release, “bp CEO resigns,” outlined the basics of the story. Two years after Looney was appointed CEO, the Board of Directors received information from an anonymous source that he had personal relationships with company employees that had not been previously disclosed. With the assistance of outside counsel, the Board reviewed the allegations.

During the Board’s investigation, Looney told the directors of a “small number of historical relationships with colleagues prior to becoming CEO.” The Board’s review of the information concluded no breach of the Company’s Code of Conduct had occurred. At that time, the Board was given assurances by Looney about the details of these relationships and his future behavior. Recently, another anonymous source provided information questioning Looney’s assurances that reopened the investigation that is reportedly still ongoing. We assume the ongoing investigation is involved in helping the Board determine what compensation is owed to Looney.

As the BP press release stated: “Mr. Looney has today informed the Company that he now accepts that he was not fully transparent in his previous disclosures. He did not provide details of all relationships and accepts he was obligated to make more complete disclosure.”

According to Wikipedia, Looney married British life coach Jacqueline Hurst in October 2017. They separated in 2018 and divorced in 2019, three months before Looney became CEO. According to her 2021 book, in a chapter on anxiety, Hurst claims Looney only married her to get promoted at BP. She also said that he ended the marriage with a WhatsApp message.

At the time, The Sunday Times interviewed a friend of Looney’s who said, “He was briefly married during a period in which he wasn’t promoted. So, if he married her to get promoted, that didn’t seem to have worked. Maybe he divorced her to get promoted.”

For the second time in two decades, BP has lost its CEO over undisclosed personal relationships that question honesty and judgment. It also raises questions about the integrity of the Board’s CEO search process. Interestingly, the other CEO, Lord John Brown, had his previously undisclosed personal relationship publicized by a London newspaper. Some investors are wondering whether another judgment issue is playing a greater role in Looney’s departure than his dalliances. This question underlays a recent Wall Street Journal article about BP’s future strategy.

BP’s stock price has performed poorly since Looney became CEO and investors are unhappy. Before Looney became CEO, BP’s share price performance was in line with that of its main competitors and the oil and gas stock index. Many investors attribute the recent poor share price performance to Looney’s embrace of the green energy revolution. That was the focus of his initial press conference when he introduced his management team and their commitment to environmental, social, and governance (ESG) issues. During that press meeting, Looney said the management team would introduce a more detailed plan for BP and its transition to becoming a greener company and reducing its oil and gas exposure. He promised a detailed plan in the fall of 2020 once they had time to map out the plan and establish goals.

In discussing renewable energy investment opportunities during that initial press conference, Looney warned investors and BP pensioners that their future stock price returns and dividends might not match the company’s historical record. A prescient statement. The warning, however, was an implicit acknowledgment that renewable energy investments have lower financial returns than traditional oil and gas investments. More recently and in response to rising oil prices and prospects for a sustained tighter oil supply/demand balance, Looney announced BP would slow its push into renewable energy and slow the cutbacks in their oil and gas division. Looney was following the moves announced by the new Shell Oil Co. CEO Wael Sawan and the CEOs of his American oil company competitors who are determined to make renewable energy profitable and not a virtue-signaling investment wasteland.

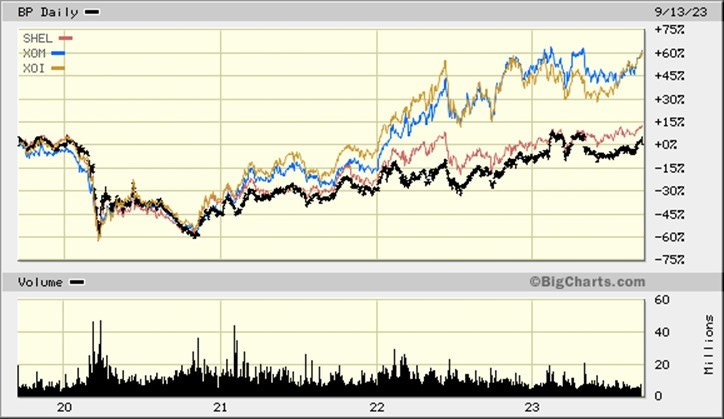

We are using two stock charts showing the performance of BP shares to bracket Looney’s tenure as BP CEO. He was appointed CEO in February 2020, following the Board’s announcement in late 2019 of him being chosen. Looney headed BP for just over three and a half years. Therefore, we selected charts covering three years and four years. They show similar patterns.

BP’s share price has significantly underperformed the overall oil and gas sector as well as European competitor Shell Oil and American rival ExxonMobil.

The three-year chart above shows BP shares rising slightly more than 90%, while the oil and gas index climbed about 200%. In the chart, we also plotted the performance of European rival Shell, up about 130%, and American competitor Exxon Mobil Corp., up nearly 220%. All the stock prices have risen since the start of the second half of 2023 as oil prices began climbing, but both ExxonMobil and the oil and gas index shot up sharply while Shell and BP increased only modestly.

From pre-pandemic days, shareholders of BP have made no money as ExxonMobil shareholders made 60%.

The four-year stock chart above, which began at the tail-end of the most recent period of low oil prices during the 2010s and encompassed the market collapse in the early days of the Covid pandemic in 2020, shows BP’s stock price underperforming Shell’s, the oil and gas stock index, and ExxonMobil’s share price. For that period, BP’s stock price was essentially flat, while Shell’s was up about 13%. The oil and gas index climbed 60%, which essentially matched the performance of ExxonMobil’s stock.

A debate has been underway for several years about whether the oil and gas industry has a future. If you listen to the demands of the ‘stop-oil’ and ‘keep-it-in-the-ground’ environmental activists or the over-the-top comments by the secretary-general of the United Nations and other politically motivated leaders, you will think there is no future. To make it happen, politicians have established policies to make their economies carbon-neutral by 2050. That means a significant reorienting of today’s economy that will impact industrial competitiveness, economic growth, and residents’ living standards.

Political pressure is being levied against investment firms to cease lending for fossil fuel projects, cutting off capital flows to the oil and gas industry. This will mean slower growth in fossil fuel supplies that could cause a fly-up in prices in response to continuing demand growth.

While the ESG movement was very powerful during the pandemic years, Russia’s invasion of Ukraine upended the European energy world sending oil and gas prices up, accentuating the need to transition to renewable energy or find other sources of fossil fuel supplies. Absent the rapid response of the U.S. and other countries to ship more oil and gas to Europe and the unseasonably warm winter, the continent would have sustained a devastating humanitarian crisis. But it still is not out of the woods if this winter is colder than normal. Moreover, the European cost and economic fallout is a warning to other countries of the risk of aggressively pushing the abandonment of fossil fuels.

Europe is leading the anti-fossil fuel charge, and it is home to BP. The Board says it is beginning a CEO search that will include internal and external candidates. That is a boilerplate statement when boards are rushed to find a replacement CEO. The fact that they only had a temporary replacement ready to go does not speak well of the maturity of their executive succession planning scheme. Yes, Looney was young (53) and likely had many more years as CEO, assuming BP follows the age 60 retirement regime, but identifying successful candidates who will need additional coaching and training is important. This is a key responsibility of the Board as the selection of the CEO is the highest responsibility of a company’s board of directors.

Maybe after having such poor success with its recent CEOs BP’s Board should look outside. Besides Lord Brown and Looney with their problems, BP was also led by Tony Hayward during the Deepwater Horizon oil spill and its aftermath. Given Hayward’s inability to handle the challenge, the company turned to American Bob Dudley, who had been running its Russia joint venture, to guide BP. In our view, Mr. “lower for longer” Dudley performed the best of the lot – salvaging BP, refocusing it on making money in a low oil price environment following the OPEC oil price war that kicked off in 2015, and positioning it for success.

BP’s Board needs to clearly define what strategy, and how it should be balanced between green and traditional oil and gas, management should be following under its next CEO. Company strategy is the second most important responsibility of a board of directors. Investors will be anxiously watching, as will the environmental activists. Expect the CEO selection be to controversial no matter who is chosen. Hopefully, that person will be able to withstand the backlash and lead BP to a brighter future.

great read!