Energy Musings - October 5, 2023

"No bailouts" for wind farms from a renewable energy company CEO was a surprise, but his letter to the WSJ ignored that his major accomplishment came from a government bailout.

No Bailouts. Plummer Greenwashes Offshore Wind’s History

We recently read the following letter to the Editors of The Wall Street Journal. We found it interesting the misinformation and greenwashing of the history of offshore wind contained in the letter. Clint Plummer, CEO of Rise Light & Power, a company retiring and replacing New York’s largest fossil fuel plant with renewables, and repurposing a former coal-fired plant in New Jersey into a gateway for offshore wind power, was the letter’s author. The owner of his company is an investment firm utilizing limited partnerships, just as almost every offshore wind project is. Plummer has worked in the offshore wind industry, which one might think would lead to him supporting government efforts to help offshore wind developers deal with their cost pressures from inflation, supply chains, and high-interest rates. Thus, the letter’s heading, “No Government Bailouts for Offshore Wind,” was surprising.

Plummer’s letter, as it appeared on The Wall Street Journal website, is below.

No Government Bailouts for Offshore Wind

This is a textbook moral hazard.

Sept. 29, 2023, 5:36 pm ET

Plummer forgets or ignores that Block Island Wind only was approved after the Rhode Island legislature bailed it out.

Wind turbines off Block Island, R.I., Aug. 15, 2016. Photo: Michael Dwyer/Associated Press

America is poised to be a global leader in offshore wind. Our coastal communities, currently powered by the nation’s oldest electric infrastructure, need new sources of power, which offshore wind can deliver. There is much to be optimistic about: America’s two largest offshore projects are under construction, and many states are expected to award more contracts soon.

Unfortunately, a few developers are begging for bailouts instead of fixing their failures (“The Great Northeast Wind Bailout,” Review & Outlook, Sept. 22). But the business of offshore wind is bigger than these mismanaged projects. It’s also wrong to suggest that offshore wind can’t be cost-effective. The project off Long Island won a technology-neutral competition over fossil and solar. Nor is it a problem of “government policies” promoting U.S. renewables. The world is going green; America should be leading innovation and exporting our homegrown technologies.

The problem is the few developers who, failing to grasp the complexities of developing offshore in America, bid too aggressively on their first projects. Now, realizing they are underwater, they want a government bailout. This is a textbook moral hazard.

Having developed America’s first offshore wind farm, I believe the best thing for our industry would be for government to say no to bailouts. To be globally competitive, U.S. companies must have the competence that comes from honoring contracts and the credibility that comes from following through on commitments.

Clint Plummer

CEO, Rise Light & Power

New York

There is no doubt the U.S. will become a major offshore wind market assuming it builds all the capacity in its projected pipeline. However, the cost problems that have plagued projects, making many “unfinanceable,” jeopardize this pipeline. With the recent disclosure of Avangrid, a subsidiary of Spanish utility company Iberdrola, terminating its power purchase agreement with Connecticut utilities, roughly 60% of the current near-term offshore wind pipeline is in jeopardy of not being built. The move cost Avangrid another $16 million in penalties, to go along with the $48 million it is paying Massachusetts utilities. That gets added to the $60 million SouthCoast Wind paid to terminate its utility contracts. Those payments are chickenfeed when offshore wind projects costs billions of dollars and would generate losses for decades.

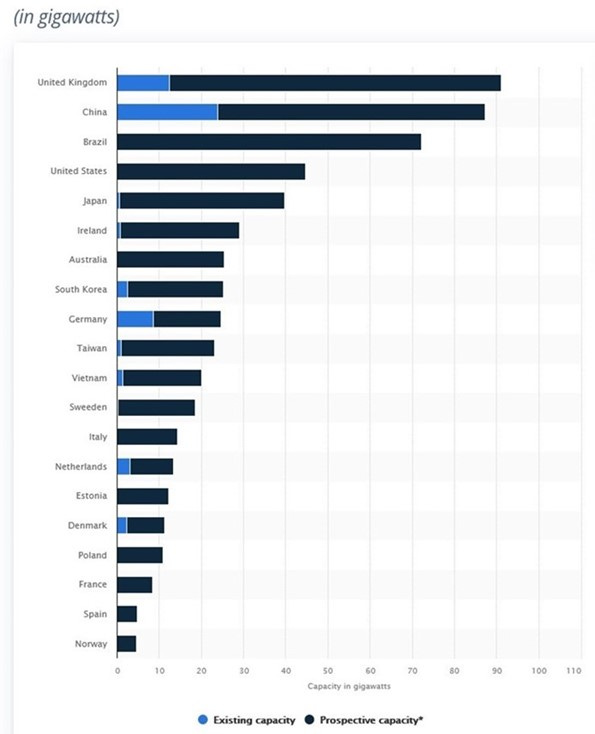

The chart below shows the leading countries with offshore wind projects either under construction, in pre-construction, or announced as of the end of 2022. The U.K. leads the world’s nations in offshore wind capacity, followed by China and Brazil. The United States is in fourth place.

In terms of installed capacity, China leads the U.K. by a substantial margin. The U.S. failed to register because it only has two operating offshore wind farms – the 30-megawatt Block Island Wind and the 12 MW Coastal Virginia Offshore Wind projects – for a total of 42 MW. Therefore, any commercial offshore wind project being built dwarfs the installed capacity.

We will see how much of the U.S. offshore wind pipeline gets built given high interest rates and inflation.

Source: Statista

The two most recent global wind capacity forecasts have cut their predictions for how much offshore wind capacity will be installed by 2030. One forecast, Thunder Said Energy, cut its forecast by 50%, while the other, TGS-4C, cut it by 25%. These are not fine-tuning forecasts. They represent serious cuts based on the different economic world projects are confronting.

Plummer claims coastal communities are powered by the oldest systems and need new power sources, which offshore wind is supplying. The problem for the New England region, which is the center of the offshore wind industry, is that its sources of additional fuel supply have been restricted for years by the governors of New York and New Jersey who have blocked proposals to enlarge or construct new natural gas pipelines. ISO-NE, the operator of the region’s power grid, currently generates two-thirds of its electricity from natural gas. This dependency contributes to high electricity prices because, during winters, the system loses some of that gas supply, which is diverted to home heating. That forces ISO-NE to import expensive foreign LNG and also utilize coal- and oil-fired power plants that must be reactivated for a few months.

Significant supplies of affordable natural gas are found in the Marcellus shale formations covering parts of New York, Pennsylvania, West Virginia, and Ohio. The governor of New York has banned the drilling of its shale resources because completing the wells involves fracking the formation to extract the gas.

New England has further hurt its power mix by closing coal, oil, and nuclear power plants in the name of accelerating a switch to clean energy. These states have enacted clean energy mandates for their respective utilities to generate their power entirely from renewables by 2050 at the latest, or a decade earlier for a couple of states. Rhode Island has a more aggressive mandate with a 2033 date for 100% clean energy. New Jersey’s date is 2035. These mandates pressure utilities to back offshore wind projects because they may represent the only way to acquire large amounts of new clean generating capacity. But this begs the question of whether there are other fuel options better for the residents and customer pocketbooks.

With 60% of the offshore wind pipeline currently seeking price relief (bailouts), and more in line to possibly walk away from contracts, this is a little more than a “few developers” begging for help. Those offshore wind developers only terminated their contracts once they were assured, they would be allowed to bid in upcoming wind solicitations. Importantly, almost every developer is a European company with U.S. subsidiaries in limited liability companies, not American companies.

Those developers have the longest experience with the challenges of bidding, constructing, and operating offshore wind farms. Learning how to operate in the U.S. should not be that hard for international companies. Plummer’s former employer, Østed, is the dominant player in the U.S. market with a long history in the business. It has been pushing aggressively to access more of the federal government subsidies designed to build a domestic supply chain by asking for exemption from the American content requirement of the Inflation Reduction Act. More federal cash would ease the financial pain these developers are feeling, but being granted higher prices also helps.

Plummer ignores that the boom in offshore wind occurred during an extraordinary economic era of low inflation and zero interest rates. The latter is highly important in determining the economics of offshore wind projects. These are highly capital-intensive projects, which many people fail to appreciate because they only focus on their fuel is free. Offshore wind turbines require substantially more steel, cement, and other materials that are both costly and create emissions when they are manufactured. That is why the Bureau of Ocean Management, the regulator for offshore energy, has acknowledged offshore wind does not reduce emissions and help fight climate change.

Maybe the developers got carried away in their bidding for offshore wind leases, but they are earning “monopoly power” when they secure a lease. Their customers are directed by the states to purchase wind power, so they can be less sensitive to the price when blending it into their fuel portfolios. Besides these offshore wind developers are fulfilling local clean energy mandates. As a business development officer of Ørsted, what role did Plummer play in the company overpaying for its leases and failing to understand how to do business in the U.S.?

While we agree with Plummer’s claim that there should be no offshore wind bailouts, we found his statement ironic. He was involved in business development for Deepwater Wind, the developer of the Block Island Wind farm, the nation’s first and largest offshore wind farm. That project was saved by a government bailout. When the Rhode Island Public Utilities Commission rejected the initial power purchase contract because it was uneconomic for ratepayers, the state legislature, at the urging of the governor, rewrote the PUC rules for evaluating offshore wind contracts. The PUC was prevented from ever conducting a cost/benefit analysis for offshore wind projects in Rhode Island water. It was that analysis that sank the initial contract.

The “government policies” Plummer says are not the problem are the problem. Giving developers monopoly power in negotiations with utilities establishes an unlevel playing field. Offshore wind is and will remain an expensive energy source. Its advantage is that the power plant (wind turbines) is located beyond the horizon and out of sight for residents. The backlash will be loudest against those projects that can be seen from the beach and from the fishing industry that sees its catches disrupted. Environmentalists are upset over the growing number of dead whales washing ashore at the time of offshore wind construction activity. However, government regulators put it in the category of an unfortunate side-effect of clean energy development which carries a higher priority, so the impact of their protests will be ignored.

Who wins if the government follows Plummer’s recommendation of “no bailouts”? No one. Rational businessmen examining the economics will bid much higher electricity prices and put regulators in the middle of angering residents with high power bills or satisfying politicians wanting clean energy. It is time for nuclear power to ride to the rescue.