Energy Musings - October 29, 2023

We complete our series analyzing Rhode Island Energy's rejection of Orsted's offshore wind power bid. We look at some of the testimony, the structure of the evaluation, and other data.

Summary: In Part 4, we examine some of the problems cited by Rhode Island Energy executives involved in evaluating the Ørsted/Eversource offshore wind power bid. We also look at the summary cost data that led the executives to conclude this offshore wind power would be too expensive for its customers, in contrast to the state requirement for it to be cheaper. Lastly, we examine the costs of the various power supplies to be added to the New England grid which finds offshore wind power is 6x the cost of natural gas-generated power. Lastly, the company’s consultant found that Rhode Island already has contracted offshore power that will be curtailed in the future. This raises a question about what curtailments might additional offshore wind power experience, and how it hurts the state’s clean energy mandate.

Revolution Wind 2 Bid Rejection Analysis – Part 4

Included in the exhibit submitted to the Rhode Island Division of Public Utilities Commission (DPUC) ahead of the November 6 public hearing, along with the testimony of Rhode Island Energy (RIE) officials, were tables summarizing the evaluation of the cost of each of the six proposed contracts with Bay State Wind for 884 megawatts (MW) of offshore wind power. Bay State Wind is a joint venture of Danish offshore wind developer Ørsted N/A and New England utility company Eversource Energy. It was the sole bid submitted in response to RIE’s Request For Proposal for offshore wind issued this past spring. After a four-month evaluation by RIE, assisted by the staff of the DPUC and Rhode Island’s Office of Energy Resources (OER), the bid was rejected. That decision required a DPUC hearing to examine RIE’s conclusion and the analysis to support it.

We have covered much of the testimony and data contained in the accompanying exhibit in Parts 1-3 of this series. Part 4 will examine the summary of the six pricing contract proposals from Bay State Wind and additional information from RIE’s consultant that we felt was pertinent for readers as we follow the upcoming hearing and future developments in the offshore wind saga.

In the pre-filed testimony of James Rouland, Director Regulatory Policy & Energy Procurement for PPL Services Corporation, the owner of Rhode Island Energy, he described his company’s conclusion about the Bay State Wind contract proposals.

Specifically, the Quantitative Evaluation determined that the net benefits of all price offerings were negative, resulting in a cost to customers over the life of the contract of more than $3 billion. After the Company completed a sensitivity analysis to evaluate the potential benefits of transmission system upgrades beyond what the Bidder originally proposed, and to account for substantial negative revenues due to negative locational marginal prices (“LMPs”) – which would contractually be the responsibility of the Bidder – and the result was still an estimated $1.78 billion cost to customers over the life of the contract. Said another way, even after substantial sensitivities were modeled, the Company determined that moving forward with the Project would add an estimated $1.78 billion in costs to customers. As a result, the Company determined that the Proposal was not commercially reasonable and was not in the best interest of Rhode Island customers.

The key controlling policy for the contract is ACES, or Rhode Island’s Affordable Clean Energy and Security Act, which has several conditions that power purchase agreements and offshore wind developers must meet, with the primary one being delivering cheaper energy. The Bay State Wind proposal failed miserably on that last condition based on the evaluation conducted by RIE.

In Rouland’s testimony, he discussed what the evaluation concluded after considering the “Qualitative Factor criteria.” RIE concluded there were problems with “interconnection, siting and permitting, and environmental assessments.” RIE also “found the proposed project failed to provide adequate plan documentation, descriptions, and supporting information.” As a result, RIE concluded the bid failed “to meet the Minimum Threshold requirements of the OSW RFP.” That meant RIE believed the proposed operating date for the wind farm was “not credible.”

In response to a follow-up question, Rouland stated that RIE found that Bay State Wind had subsequently withdrawn from the Independent System Operator – New England (ISO-NE) interconnection queue on September 8. That move would make the project unlikely to meet its proposed operational date, rendering it “no longer a viable project.”

While this conclusion likely kills the Rhode Island project. Given the offshore wind industry’s turmoil, understanding what the Bay State Wind’s true costs were is important for understanding how the industry moves forward with other projects in the region, especially since RIE is preparing for another RFP for offshore wind in 2024. In particular, we are curious about what constitutes “cheap” offshore wind energy.

The RIE evaluation of the Bay State Wind project involved an in-depth study of the New England power market until 2052 and the role that this offshore wind project would play in that vision. To conduct the evaluation, a model was constructed that estimated what the per-hour-cost of power and the hourly value of the renewable energy certificates (RECs) would be, along with estimates of the operational costs that might be shifted back to the power provider, Bay State Wind, and not assumed by the power purchaser, RIE.

RIE’s consultants developed the models for completing the analysis. It started with developing the Pricing Factor, which included preparing a Base Case and then considering modifications from a study of Quantitative Protocols. Rouland testified that the “Base Case inputs … would be used to ‘test’ the economic model assumptions and ultimately be used to evaluate the costs or benefits of the Proposal Cases. [Consultant] TCR engaged the Company to consider various inputs into the Base Case, including in areas such as inflation, natural gas pricing, load forecasts, existing generation fleet and contracted additions, costs and other assumptions related to generic generator additions, production and investment tax credits assumptions, greenhouse gas (‘GHG’) inventory and emission constraints, and emissions costs.”

Rouland went on to testify that RIE evaluated each proposed bid “by comparing the results of each Proposal Case against the Base Case, and then used the Quantitative Protocol to calculate the levelized net unit benefit in 2023 $/MWh (megawatt-hour), which was further converted to points used to score the Project.”

The company calculated the total net benefit of each bid by estimating the total dollar value RIE customers would gain from procuring incremental offshore wind energy and renewable energy credits from the associated environmental attributes. “A positive total net benefit attributed to a bid indicates selecting that offshore wind project could result in long-term savings that exceed the projected contract costs of that bid; whereas a negative total net benefit indicates that a particular bid could result in a net increase in costs to the Company’s customers.”

Also involved in the evaluation were Capacity Expansion and Energy and Ancillary Services (E&AS) models. The Capacity Expansion model analyzes interconnected generation assets and those expected to be interconnected in ISO-NE and the New York Independent Systems Operator during the life of the contract. This generation and future generation portfolio interact with the E&AS model, which simulates the hourly operation of the grid. It is used to generate projections of ISO-NE energy market prices on an hourly basis during the life of the contract, as well as REC hourly prices.

RIE said it reviewed the inputs and assumptions of both models through the Phase 2 period while also generating a Base Case. The inputs for the Base Case include assumptions about the ISO-NE generation portfolio, its associated hourly energy prices, and its hourly REC prices during the term of the contract. The company also looked at the system’s status quo, which assumes no new proposals were received under the RFP.

Each of the bid proposal details – project size, interconnection location, proposed transmission upgrades, energy prices, and REC prices – were entered into the Capacity Expansion and E&AS models. RIE evaluated all the bid cases against the Base Case and then used the Quantitative Protocol to calculate the levelized net unit benefit in 2023$/MWh, which was then converted into points used to score the bid.

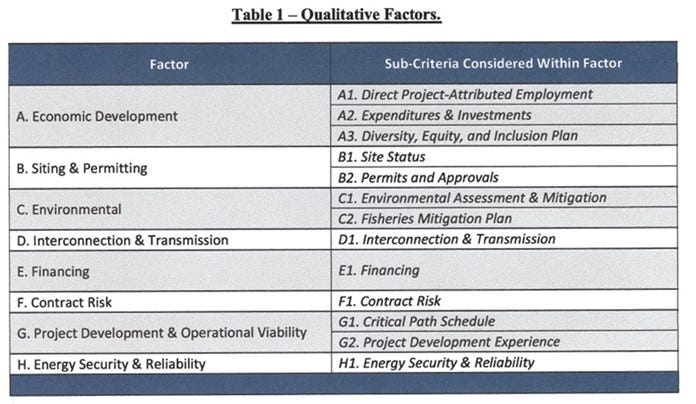

Below is the list of Qualitative Factors and sub-criteria used in the analyses of the bids. These are what we would call soft issues. However, as noted in our previous articles about this bid analysis, the RIE officials cited problems in the bid with many of the sub-criteria.

These are the soft factors that are structured to help expensive offshore wind power win regulator approval.

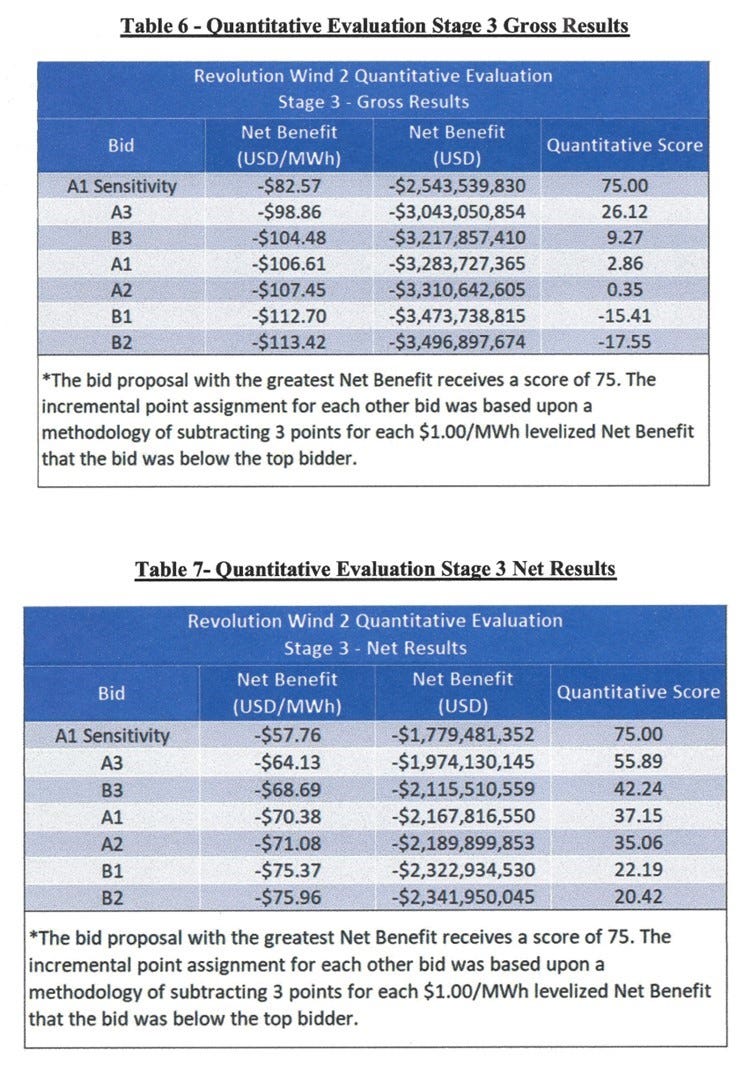

The heart of the evaluations was how the various bids fared on a gross and net benefit basis in Stage 2 and Stage 3 analyses. The following are the tables summarizing those evaluations. One key point with these tables is that they eliminate the value of the Total Unit Net Benefit (Cost) (2023$/MWh) from the underlying spreadsheet in the exhibit. Those summary spreadsheets listed the net benefit figure for each bid, but since the bids were not identified like they are in the summary charts below, it is impossible to match the two data sets.

The net benefit amounts ranged between $13.48 and $13.68 (2023$/MWh). Those amounts would need to be added to the Net Benefit figure for each corresponding bid to determine the Total Net Direct Benefit of Project (Cost) (2023$/MWh). In other words, we must add roughly $13.50/MWh to each bid to see that the unadjusted cost would be for RIE customers.

All six bids from Bay State Wind carried significant negative benefits for customers, meaning power costs outweighed any economic or social benefits.

Only with sensitivity considerations does offshore wind become less expensive, but still too expensive for Rhode Island ratepayers.

If we think about Mr. Rouland’s testimony, he listed the gross benefit cost at “more than $3.0 billion,” and the net benefit cost at “$1.78 billion.” We found the gross figure as the first bid listed in Table 4. We also see that the gross benefit costs for the six bids range up to $3.5 billion, or $113.42/MWh, which needs to be adjusted further by adding in the $13.50/MWh to reach a total of $127/MWh. The $3.0 billion cost has a net benefit of $98.86/MWh associated with it. The cost needs to be adjusted to an estimated $112.36/MWh.

Table 5 does not show the lowest net benefit cost cited by Rouland. That number leads to the bids in Table 7, which shows the results of the Stage 3 analysis. That bid is listed as A1 Sensitivity. Does that mean the sensitivities modeled reduced the A1 net results listed further down in the table? That A1 bid had a total net benefit cost of $2.17 billion and a net benefit of $70.38/MWh, before being adjusted to $83.88/MWh. Thus, we would have to conclude that the sensitivities reduced the cost to RIE customers by $338 million.

However, in the associated gross benefit cost (Table 6) we see the lowest bid based on a sensitivities assessment at $2.5 billion, or $0.5 billion below the $3.0 billion cited by Mr. Rouland. Why was that lower cost number not cited by RIE when they announced it was rejecting the Bay State Wind bid since they cited the sensitivities net case?

We will be listening during the DPUC hearing on November 6 for an explanation of what all these estimates represent.

Other Interesting Data Points

In the report of RIE’s consultant who helped with the evaluation, we found two interesting charts. The first showed the input and modeling assumptions for New England used by the consultant in developing its Base Case and E&AS models. The chart shows the potential resource additions to the ISO-NE system by type of resource and amount of power. We were struck by their Overnight Capital Cost in 2023$ estimates. While the chart also shows the Fixed O&M and Variable O&M costs per MWh for each power source, these costs are minor.

The overnight cost of offshore wind ($6,249) is nearly 6x the overnight cost for a combined cycle gas turbine ($1,115). Onshore wind is twice as costly as natural gas power, while solar ranges from slightly more costly to as much as 1.5x natural gas cost. The problem with these renewable energy costs is that they do not reflect their full system cost, i.e., including the cost of backup power needed because these are part-time energy suppliers.

Offshore is hugely expensive compared to natural gas which provides much of New England’s power.

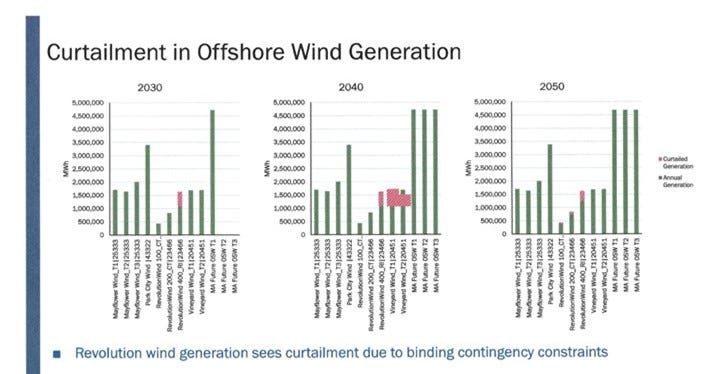

The second chart we found interesting relates to the amount of offshore wind scheduled to come online for ISO-NE. We were intrigued by how the three Revolution Wind contracts from the Revolution Wind 1 project are expected to perform. The 100 MW and 200 MW contracts for utilities in Connecticut are not expected to experience any operational curtailments until 2050. However, the 400 MW contract for Rhode Island is expected to be curtailed in 2030, 2040, and 2050. The chart shows that neighboring Vineyard Wind T1 and T2 projects will be curtailed in 2040 but not in either 2030 or 2050.

If new Rhode Island offshore wind projects will suffer from curtailment, why does that mean for Bay State Wind?

If the 400 MW of power from Revolution Wind 1 destined for Rhode Island is to suffer curtailments, what does it mean for Revolution Wind 2, which is the bid RIE rejected? Revolution Wind 2 is a project designed to be located in the same lease as Revolution Wind 1. Did the evaluation suggest that it would suffer curtailment, too? That would be a revenue loss for Bay State Wind unless the contract terms cover payments for curtailed power. We know from the RIE officials’ testimony that the company was stipulating it was only responsible for paying for the power Bay State Wind delivered to the ISO-NE grid.

As we wrap up this series on the rejection of the Bay State Wind proposal by RIE, we are left with many questions that hopefully will be answered during the upcoming hearing. For RIE, with the support of the DPUC and OER, to reject the bid as being non-commercial and costly for customers, the evaluation suggests this offshore wind project did not deliver cheaper power like the Rhode Island ACES calls for. Offshore wind has yet to meet that standard. Will it ever? Given the explosion in construction costs and the elevated cost of financing offshore wind due to higher interest rates, the outlook for cheaper power from turbines spinning in the Atlantic Ocean does not appear promising.