Energy Musings - October 23, 2023

Part 2 of Rhode Island Energy's filing for rejected Revolution Wind 2 bid is our estimate of the cost of the project on customer bills. If we are close, it expensive power! Bid details were redacted.

Revolution Wind 2 Bid Rejection Analysis – Part 2

On July 18, Rhode Island Energy (RIE) announced it was rejecting the proposed power purchase agreement for offshore wind submitted in response to the company’s Request For Proposal “for at least 600 megawatts (MW) and no more than approximately 1,000 MW of newly developed offshore wind capacity.” Bay State Wind, a joint venture of Danish developer Ørsted and New England utility Eversource, submitted the only bid for 884 MW of power from its Revolution Wind 2 project off the coasts of Rhode Island and Massachusetts. This announcement kicked off the final step in the bid process.

Under provisions of the state’s Affordable Clean Energy and Security Act (ACES), RIE was required to provide an analysis to the RI Public Utilities Commission within 60 days of its rejection announcement explaining why it concluded the bid was unacceptable.

In Part 1 of this series (Energy Musings – October 20, 2023), we discussed the testimony of RIE officials involved in the bid evaluation that raised serious questions about the viability of the project. They listed problems with Bay State Wind’s dealings with the commercial fishing industry, its siting and permitting plan, its interconnection and transmission plan, its failure to complete ISO-NE interconnection studies, the problems with its Third-Party Feasibility Analysis, the ambiguity in the transmission cable’s landfall locations and the onshore substation location, the related impacts from the cable’s route selection, and environmental assessments all giving rise to credibility concerns about the project’s start-up date and even if it could be built. Those concerns sent RIE scurrying to find alternative offshore wind energy options.

However, ACES requires a detailed evaluation of the contract in light of the “good” things Bay State Wind would deliver. In other words, a net cost calculation weighing the good benefits against the outright cost of offshore power. The idea is that when the good benefits are considered, the offshore wind project will deliver cheaper energy and thus positive net benefits for customers.

This evaluation is called the Pricing Factor analysis. The challenge for RIE in conducting its evaluation is that Bay State Wind’s bid “consisted of six alternative price offerings.” Each plan needed to be analyzed. For the public, however, they are concerned with the bottom line of what happens to their monthly electricity bills. However, the pricing and contract terms are confidential. Thus, the public is left relying on the word of RIE officials that the bid was noncommercial. RIE’s conclusion was spelled out in the cover letter for the filing. It stated:

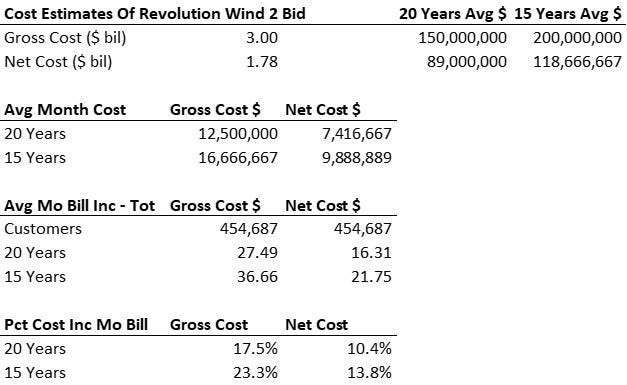

The Pricing Factor analysis concluded that all six bids resulted in substantial negative net benefits for customers, indicating a cost to customers over the life of the contract of more than $3 billion on a net present value basis (2023$). Even after modeling substantial sensitivities, the net benefits to customers of all six bids were still substantially negative, with estimated costs to customers at approximately -$1.78 billion over the life of the contract. The Company determined the Project was not commercially reasonable, as required by R.I. Gen. Laws §§ 39-31-6(a)(1)(vii)(A) and 39-31-10(c), nor was it consistent with the overall purpose of ACES. (Emphasis added.)

Cost to customers of “more than $3 billion?” That isn’t cheap power! Even after considering “substantial sensitivities” this offshore wind would still cost customers $1.78 billion. What we do not know is whether the offshore wind price was the only part of the contract studied, or if there were estimates for the cost of the transmission system needed to deliver the power to the ISO-NE grid included. We know the transmission system plan was a troubling aspect of the evaluation per the testimony.

While those estimates provide a rationale for RIE rejecting the bid, they are large numbers, and few people can relate to them. We wondered if it would be possible to break down the cost impact for ratepayers, especially as we are one. Given the lack of data, any estimate would be rough.

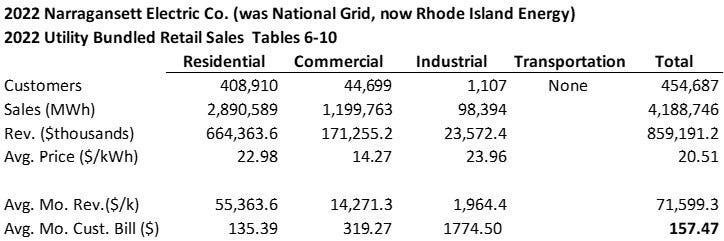

We started by assessing the RIE market. That meant going to the EIA website and locating the annual data for Narragansett Electric Co., the official name of RIE’s business. The 2022 data (latest available) provided the number of customers, the amount of power sold that year, the revenue earned, and the average price per kilowatt-hour. Using this data, we could calculate an average monthly bill by type of customer.

In conducting our analysis, we decided to utilize the total data for all RIE customers in 2022. While the nearly 409,000 residential customers had an estimated average monthly bill of $135, if we included the larger bills of commercial and industrial customers, the overall monthly average bill increased to $157. The much larger commercial and industrial customer bills had a significant impact on residential bills.

That was the easy part. It would have helped to know the details of the six pricing proposals, but that information was redacted. We know from hunting through the testimony and exhibits that contracts were either 15 or 20 years in length. How much more than $3 billion was the cost of the contract? Was that the least costly of the six contracts? There was no information about what sensitivities were modeled during the evaluation that cut the cost to only $1.78 billion. Essentially that was all the information we had to calculate our estimates.

We took the $3 billion and $1.78 billion costs and averaged them over 20- and 15-year contract terms. The annual cost estimate could then be divided into a monthly estimate. By dividing the monthly cost estimates by the 455,000 RIE customers, we get a rough estimate of the dollar increase to the average monthly bill.

On a gross basis, when you are talking about 17.5%-23.3% increases in a ratepayer’s average monthly bill, it will become a hardship for many. Even on a net basis, double-digit monthly increases are burdensome. What we do not know is how the cost estimate will be shared across the various types of ratepayers.

In 2022, when Dominion Energy was seeking approval for its Coastal Virginia Offshore Wind farm, a $9.8 billion project, it estimated the project would boost a Virginia ratepayer’s monthly bill for 1,000 kilowatt-hours of electricity by $3.29. When the State Corporation Commission approved the project with a tough performance standard, the company asked for a surcharge for the contract of $4.72. Since the project isn’t completed, we do not know what the surcharge will be. However, those surcharges are a fraction of what we have estimated for RIE ratepayers. If our estimates are close to reality, we fully understand RIE’s reluctance to enter into a contract for Bay State Wind’s power. Especially given the various uncertainties about the project that would likely impact the final project cost.

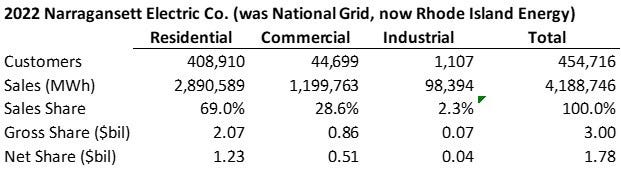

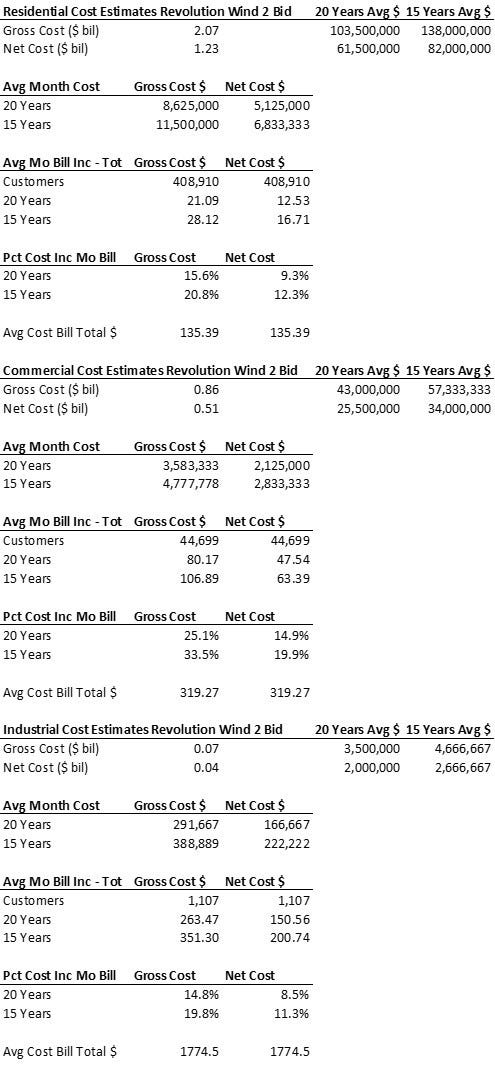

To check our estimate, we decided to calculate monthly bill impacts for each category of ratepayer – residential, commercial, and industrial. Residential customers accounted for 69% of RIE’s sales in 2022. Commercial sales came to 23.8% and industrial accounted for the remaining 2.3%. Commercial and industrial customers’ average monthly bills were multiples of residential bills.

Completing the same analysis as before, we develop the following estimates for residential, commercial, and industrial customers.

The disparity in ratepayer costs is notable. Commercial customers bear the brunt of the estimated offshore wind contract costs. Residential and industrial experience similar monthly bill increases.

Admittedly the above analyses are very rough. In the absence of additional contract information, it is impossible to know what the cost impacts. We will be interested in listening to the PUC hearing to hear if RIE officials break down the costs for each group of customers.

Since the staff of the PUC, along with the staff of the Rhode Island Office of Energy Resources, were involved with RIE in the evaluation of the Bay State Wind bid, we are sure the commissioners and RIE officials will be able to avoid discussing any confidential information in public. The only thing we are sure of is that offshore wind is proving to be much more expensive than promoters have contended. The New York State regulator’s rejection of the hefty rate increases requested by offshore wind and other renewable energy developers is only the latest confirmation of our assessment.

(In Part 3, we will discuss other observations from the RIE filing for the PUC hearing, along with providing an update on the offshore wind industry mess currently unfolding.)

As expensive as the project looked, if it was the legislature rather than RIE responsible for the analysis and decision, our guess is they would have approved it by somehow finding even more "good" stuff in the project. And by the way, we'd love to see the RIE's analysis that shows $1.2 billion in good stuff from the project.