Energy Musings - October 21, 2024

Climate activists are ramping up their warfare against the petroleum industry. California continues to lead the activist parade. Big Oil is fighting back and Phillips 66 fired the latest shot.

War Against The Oil Industry Continues

It is no secret climate that activists aim to end the fossil fuel era. They dream of a world with no carbon emissions. Energy physics and economics continue to challenge that possibility. Climate change policies pushed by activists steps are slamming the public with higher energy costs. Family budgets are under pressure, and lifestyle changes are needed to survive.

These energy challenges have slowed the pace of the net-zero-emissions transition. To accelerate the pace, activists now embrace lawfare against petroleum companies. The goal is to strip the oil companies of their social license while bankrupting them.

A recent article in the Financial Times suggested that U.S. oil companies could face large bills for their fossil fuel infrastructure clean-up liabilities. According to a letter from a group of international investors to the Securities and Exchange Commission (SEC), shareholders would be surprised because U.S. oil companies have wrongfully reported their environmental liabilities. They claim the companies are not providing the details and “critical accounting assumptions” used when calculating the assets and liabilities reported in their financial statements.

The investor letter was sent last week to the SEC. It addresses the companies’ estimates of their legally required costs for decommissioning their fossil fuel infrastructure assets. Last December, Carbon Tracker estimated that decommissioning the U.S. fossil fuel infrastructure would cost more than $1.2 trillion.

According to the Financial Times article, “The investor letter warned that the six most valuable listed European oil companies, including BP and TotalEnergies, have given far more detail on this front than seven of their biggest counterparts in the U.S., which include ExxonMobil and Chevron.”

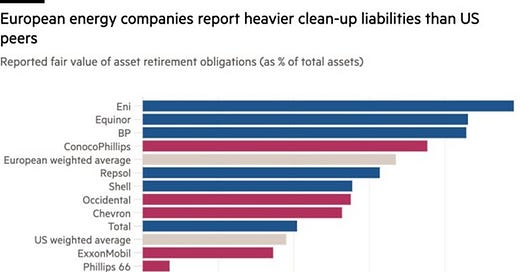

The Financial Times studied the 2023 financial reports of 13 major oil companies. It published a chart showing the percentage of each company’s estimated decommissioning liabilities to its total assets and included a weighted average for the European and U.S. oil companies. The analysis showed that the seven U.S. oil companies reported aggregated $38.9 billion in clean-up liabilities, equal to 3.8% of their total assets. In contrast, the six European companies reported a $90.2 billion liability or 6.7% of their assets.

European oil companies show greater decommissioning expenses.

Understand that the current estimate of the clean-up liabilities depends on two numbers. One is the estimated retirement date of the asset. The other is the discount rate used to adjust the value of the future liability. The higher the discount rate and the longer the asset will operate the lower the current value of the clean-up liability.

Recently, ExxonMobil, BP, and TotalEnergies produced long-term global energy outlooks. These companies see petroleum supplying a substantial share of the world’s energy in 2050. Such an outlook suggests that petroleum will be used for decades after 2050. These views counter that of the International Energy Agency which expects peak oil soon and a punishing glut in oil a few years later.

An important consideration in calculating clean-up liabilities is that European environmental regulations are stricter than in the U.S. Additionally, there is the materiality issue for financial reporting requirements. The larger the company, the smaller the share a liability represents. Why is that important? Statista listed the top 12 global oil companies by market capitalization as of June 2024. Three companies are in the U.S., three are in Europe, and six are international. The combined market capitalization of the three European oil companies is just 53% of the $912 billion market capitalization of the three U.S. ones.

The top two companies, ExxonMobil and Chevron, have a combined market capitalization of $781.84 billion, or one-third larger than the total capitalization of the three European oil companies. The total U.S. oil companies’ market capitalization is almost 40% of the total of the dozen largest global oil companies. ExxonMobil and Chevron account for a third of the group’s market capitalization. Size does matter and it impacts the materiality metric.

Another interesting and important consideration will be how much the European oil company figures change at the end of 2024, given their revised thinking about their corporate strategies to boost oil and gas output and decrease their commitments to renewable energy. Those shifts occurred this year as management recognized that the pace of the energy transition is slower than they previously believed. Their new views reflect a realization of the technological and economic challenges facing the transition and the pushback from European residents because of skyrocketing energy prices.

Petroleum Warfare

Whether these investors can create an issue over management’s accounting assumptions remains to be seen. However, it is the latest effort to use the regulatory and legal systems to attack the fossil fuel industry. A briefing by Oil Change International and Zero Carbon Analytics last month highlighted that there have been 86 climate lawsuits filed against the world’s largest hydrocarbon-producing corporations. These cases were identified from the Climate Change Litigation Database of 2,761 cases developed and maintained by the Columbia Law School Sabin Center for Climate Change Law. Of these lawsuits, 38% are for compensation for climate damages, 16% for misleading advertising claims, and 12% for emissions reduction. A category yet to be filled is murder, as the activists are exploring charging oil companies for the assumed deaths of people due to climate change.

The number of legal cases climbed following the 2015 Paris Agreement. The trend shows no signs of slowing, especially as the hydrocarbon companies have figured out that they must conduct their business with less reliance on outside financial support. As a result of their more conservative financial management, these companies have become attractive investments for investors seeking steady dividends and stock buybacks. But importantly, they are less susceptible to pressure from activists applied to the financial institutions that have historically provided the oil industry’s capital for growth.

The number of Big Oil cases has soared since 2015.

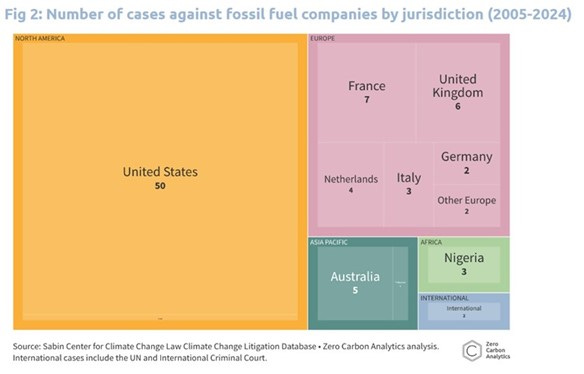

The U.S. remains the locus of the global anti-fossil fuel warfare effort. Nearly 60% of the cases brought against the industry have been filed in the U.S. Cases have been filed on every continent.

The United States dominates in lawsuits against Big Oil.

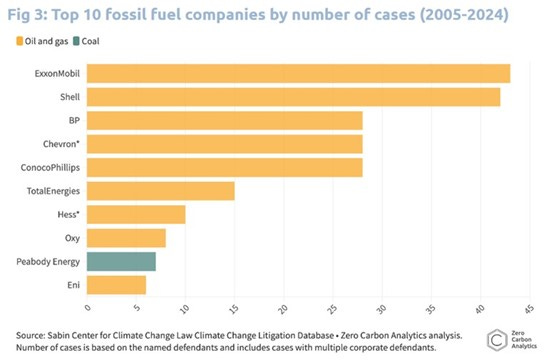

As climate cases represent the largest share of the lawfare, it is not surprising that the largest oil company, ExxonMobil, is the number one target in both the number of cases and responsibility for climate damages. Shell is also a favorite target, ranking second in both categories.

ExxonMobil and Shell lead the industry in legal cases.

If you are big, you are a prime target. To fight this lawfare, Big Oil has tried to shift the cases from state courts to federal ones to neutralize the home-field advantage of the claimants and in recognition that the issue of climate change is national in scope. So far, federal courts have not been persuaded by Big Oil’s arguments, although the climate change legal landscape may shift with the overturning of the Chevron Deference ruling. No longer can federal agencies claim murky legislation left it in the hands of agencies to determine the extent of their regulatory power. The battlefield for agencies and regulated companies has been leveled, which opens more issues to legal challenges based on data interpretation and the law.

Even before the Chevron Deference was overturned, Big Oil began fighting back. However, most anti-oil cases are being brought in states with liberal populations and judges influenced by their state’s political leaning. The companies will need to fight the battles state by state, or at least until the federal courts acknowledge that climate change is a national and international issue and needs to be addressed from that broader legal perspective. In the meantime, oil companies have other remedies to fight ill-conceived and deliberately punishing legislation. Phillips 66 fired the latest shot in that war.

Oil Industry Fights Back

Last week, Phillips 66 announced it would be closing its Los Angeles area refinery complex, consisting of units in Wilmington and Carson connected by a five-mile-long pipeline. The complex produces roughly 140,000 barrels a day of refined products (80,000 barrels of gasoline and 60,000 barrels of diesel and jet fuel). The refinery supplies 8.57% of California’s transportation fuel needs. The complex will be closed in the fourth quarter of 2025, ending the jobs of 600 employees and 300 contract workers, plus an unknown number of jobs dependent on the spending of these workers. The 650-acre site is already being evaluated for alternative development opportunities.

Although Phillips 66 says it will make up the difference in fuel supplies from its other refineries, including its Rodeo Renewable Energy biorefinery, and sources outside of its own refining operations. California’s fuel supply may become tighter resulting in higher prices. Phillips 66 is motivated to help California navigate its shrinking refining capacity as the company operates over 1,000 gasoline stations there.

However, California’s air quality may deteriorate because of the refinery shutdown. According to shipping specialist Poten & Partners, the state will need to import more oil and refined products from East Asian refiners. In 2023, California imported 320,000 barrels per day of crude oil and gasoline from abroad, or 60% of the state’s supply. That share has nearly doubled over the past two decades as California oil output fell by more than half, and Alaskan volumes by slightly less than half.

Domestic tanker capacity is nearly at full utilization. Presently, there are no orders for new U.S.-built tankers, therefore, Poten believes it is unlikely there will be additional oil or product shipments from the Gulf Coast to California. The oil and refined products arriving in California from abroad may be dirtier than what came from the Phillips 66 refinery. The odds are the supplies will be more costly.

Much is being made of the timing of the Phillips 66 announcement as it came days after California Governor Gavin Newsome signed into law new rules governing the operations of refineries designed to ameliorate price spikes during unforeseen refinery shutdowns.

This was the latest rule impacting the operation of the state’s oil industry. The California Energy Commission (CEC) is required to determine the minimum level of gasoline and diesel inventories that must be maintained by refineries. This will require the construction of additional storage tanks and there is the cost of holding this inventory. Pump prices will rise.

Furthermore, this requirement might be unfeasible and lead to additional refinery closures and job losses. The legislation also authorizes the CEC to approve scheduled maintenance times to avoid supply issues. A wrong decision could make the fuel supply situation much worse. The reality of the impact on oil company operating costs contrasts with the political claims the bill will save California drivers money.

After signing the legislation, Newsome accused the oil industry of “manipulative” marketing practices. “You’re seeing gas prices drop across the rest of the country. But spike in California. And they buy all these ads saying somehow it’s California’s fault,” the governor said. “They’ve been manipulating you; they’ve been lying to you.”

Phillips 66 spokesperson Al Ortiz denied in an email to Politico that the refinery closure was a response to Newsom’s signing the new law. However, California’s treatment of its oil industry likely played a role in the final decision, with Newsome’s new rule governing operations of refineries in the state being the latest burden for the industry.

This is the second major announcement by an oil company about its California business strategy. In August, Chevron announced it would relocate its California headquarters to Texas, a move that will take place over the next five years. Chevron’s history in California dates back to 1879, and the original Phillips 66 refineries were built in the 1910s.

Environmentalists were happy to claim a victory over Big Oil, although acknowledging that consumers might face higher costs. Jamie Court, president of Consumer Watchdog, said such a price risk is why California needs to assert more control over gasoline supplies. “This is the reason for command and control over the refiners,” he said. “So, when one changes their plan, the others must make sure they have supply liquidity.” When has economic command and control benefited the public?

On the other side, State Sen. Steve Bradford (D-Gardena), who represents the Wilmington-area district where the refinery is located, said, "I feel for the men and women who live around that area who have depended on these jobs for decades. The refinery was there first, not the homes," he said. "These people made a conscious decision to buy homes in these communities to be close to jobs."

California had 11 gasoline refineries last year. Recently, the number was reduced to nine. Marathon’s 48,000-barrel-per-day refinery in Martinez, part of a joint venture with Neste Oyj, and the 50,000-barrel-per-day Phillips 66 Rodeo refinery have been converted to make renewable diesel from cooking oil, fats, grease, and vegetable oils.

There will be only eight refineries at the start of 2026, assuming no other operator views the carbon tax credits for renewable diesel as financially more attractive than continuing to operate a fossil fuel refinery. Oil companies could also find that California’s toxic operating environment makes exiting the state a better move. At the start of 2024, the CEC listed the state’s refining capacity at 1,622,171 barrels per day but that capacity is dwindling.

California has a law banning the sale of internal combustion vehicles by 2035, barely a decade away. The state is the home of the nation’s largest electric vehicle fleet and the highest share of new vehicle sales. Interestingly, the CEC reported that at the end of 2023, the state had 29.3 million registered light-duty vehicles. Only 1.5 million are electric or 5.2% of the state’s vehicle fleet. That suggests the state has a long way to go to meet its zero emissions by 2045 target. It would appear that by causing gasoline and diesel prices to climb, consumers with ICE vehicles will be squeezed and pushed to buy EVs. Of course, those buyers will also be facing soaring electricity costs.

Lawfare against Big Oil can be waged in staid courtrooms or legislative chambers. California has been waging its war against fossil fuels in both venues. The state wants to take the oil company profits on the one hand, while working hard to minimize them on the other. The political risk is that more oil companies decide it is better to exit California rather than fight these never-ending battles that cost their shareholders money. Is 2024 a tipping point for the California oil industry? If so, pity the state’s remaining residents. Their energy future will be far from golden.