Energy Musings - October 2, 2024

Energy was the worst performing sector of the S&P 500 Index in September. That was not surprising given the continuing decline in oil prices. Middle East tensions helped lift prices but what's next?

September Was Disastrous For Energy

October is starting with a bang. Oil prices jumped early in the day by nearly 5% as Middle East tensions exploded with Iran firing intercontinental ballistic missiles at Israel. CNBC showed television images of Israel’s Iron Dome missile defense system destroying many of the 181 incoming missiles. We know from other reports that some missiles were not destroyed. This attack ups the risk of a Middle East region-wide war. That is especially true given that the Iranians used hypersonic rockets for the first time. Such a development is likely to increase the level of retaliation by Israel.

Military experts are warning that Iran is closer to developing a nuclear bomb, which could radically alter the power balance in the Middle East. This prospect also plays into Israel’s response and the diplomacy efforts of non-participants.

Fear of a wider war escalated as Israeli military forces began entering Lebanon to search out and destroy Hezbollah warriors. This operation followed the killing of Hassan Nasrallah, the leader of Hezbollah, as he was attending a periodic military planning session in Beirut.

Also, last week, Israel hit Houthi rocket launch sites that have been firing missiles into Israel and at ships transiting the Red Sea. In retaliation, the Houthis fired missiles at Tel Aviv. Although it appears that Israel has successfully dismantled Hamas, which controlled Gaza allowing them to launch the deadly October 7 attack on Israelis, that effort is taking a backseat to Israel’s efforts to dismantle Hezbollah.

Before the current escalation of Middle East hostilities, oil markets were worried about the weak economic data from China and the rumblings from Saudi Arabia that it was contemplating busting the OPEC+ agreement to withhold roughly 2-3 million barrels per day of crude oil which has supported elevated oil prices. The possibility of this oil supply hitting the market when demand is weak and U.S. producers continue to boost shale oil output, has traders convinced the next major move in oil prices is down.

The Federal Reserve’s decision to cut short-term interest rates by 50 basis points to stimulate the economy has given a glimmer of hope that global oil demand will begin picking up. However, the growing overhang of supply and Saudi Arabia’s warnings have turned the oil market bearish.

Recently, commodity traders became so negative toward oil prices that they shorted so many crude oil futures contracts that the total exceeded their long positions. Such bearishness likely crashed crude oil prices during the first week of September. The price drop coincided with the initial rumors of Saudi Arabia’s decision to seek to recover lost market share at the risk of lower oil prices. Reportedly, the kingdom needs to earn more money for its economic development plans.

The negative tone of the oil market carried over into the stock market. September marked the second consecutive month the Energy sector within the Standard & Poor’s 500 Index posted negative results. Energy landed in last place.

Energy was the only sector posting negative results for the third quarter – a loss of 2.3%. The S&P 500 Index had a gain of 5.9% for the quarter. Interestingly, eight of the 11 industry sectors performed better than the Index. The three underperformers included Communications Services, Information Technology, and Energy, which is an interesting mix. Two of these three sectors have led the stock market higher for years.

Energy finished in last place for the second consecutive month.

Will the escalating Middle East tensions and the recent Chinese government financial stimulus change crude oil’s fortunes? The anti-oil rhetoric is growing as we inch toward the UN’s COP conference dealing with climate change in November. This conference will be interesting given the growing pushback against government climate change policies proving economically and socially disruptive.

The physical inability of wind and solar energy to deliver the “cheap” and “reliable” power the public wants is becoming increasingly evident. Moreover, the buildout of wind, solar, and battery power is proving more costly than advertised, jacking up electricity prices. Soaring renewable energy subsidies are driving up global debt levels creating fears about an impending global financial crisis.

The mandates behind the green energy transition – electric vehicles, heat pumps, shutting down dispatchable power plants - which seemed way in the distance when enacted are suddenly in the public’s face. These realities are costing those countries leading the clean energy transition parade to lose manufacturing jobs since the policies have gutted their economies. People fear for their jobs amid the high energy prices and weak manufacturing activity, contributing to the growing pushback. Politicians reading election results are beginning to fear for their jobs, which may cause clean energy policy adjustments. Will they happen soon enough, and be sufficiently powerful enough to assuage the public’s pushback?

The Oil Market

In examining the year-to-date path of crude oil prices through September 30, we find that the WTI price is 7.3% lower than on January 2, 2024.

Oil prices in 2024 are mirroring 2014’s pattern leading to the 2015 industry collapse.

From the peak in early April, WTI has fallen 22.2%! The price dropped sharply during April and May, only to rebound and nearly recoup all the losses during June. Since mid-summer, the price decline has been steady with periods of sharp rebounds. Will the pattern continue? Might oil prices rebound and begin trading at a higher sustained level? Is the 2024 oil price decline a prelude to an even lower price in 2025?

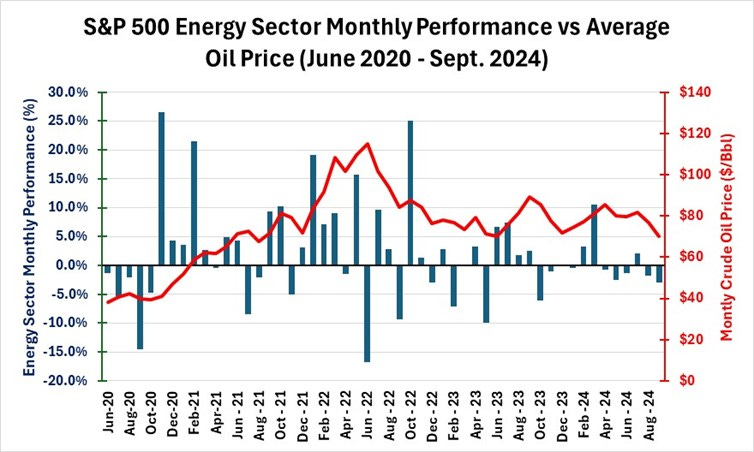

We are not about to attempt to answer those questions now. To do so would require a more extensive analysis. As a quick assessment, the following chart shows the monthly performance of the Energy sector since June 2020 and the monthly average oil price. It shows how Energy stocks move in response to oil price trends.

Energy stock performance has reflected oil price movements since 2020.

We can see how oil prices steadily recovered from mid-2020 through mid-2022 following the COVID-19 demand destruction in early 2020. The price rise was aided by Russia’s invasion of Ukraine which disrupted oil and gas markets. Sanctions on Russian oil cut supply temporarily, but workarounds eased the shortage. Soaring oil prices drove high inflation rates worldwide that crimped economies and forced central banks to increase interest rates sharply to dampen the inflation surge. That did dampen oil demand.

After being cut in half over the mid-2022 to mid-2023, oil prices traded in a rather narrow range of $70 to $84 a barrel in response to the weaker economic activity. Currently, oil prices have dipped below $70, depending on market sentiment about oil demand and surging supplies. When those narratives are muted, oil prices respond by moving higher.

Energy Stocks

The Energy sector weighting in the S&P 500 Index is low, which means the sector’s performance has little impact on the overall index’s results in any given month. The most recent peak in Energy’s weighting was in October 2022 when it hit 5.3%. In the past year, the weighting fell from 4.6% to 3.3%. While not as low as the three smallest sectors – Materials, Real Estate, and Utilities – Energy is much smaller than the other sectors. The three smallest sector weightings range from 2.23% to 2.53%.

The S&P 500 Index is dominated by Information Technology with a 31.70% weighting. Three other sectors have double-digit weightings – Consumer Discretionary, Health Services, and Financials. Therefore, if you want to know how the S&P 500 Index performs, check the stock prices of the leading tech companies.

The Energy sector is composed of 22 stocks. Only three have market capitalizations exceeding $100 billion. Those three, all international oil companies, represent 25% of the sector’s market capitalization, which makes them key to the sector’s performance. The remaining companies are widely dispersed across the energy industry. They represent the energy service, pipeline, refining, natural gas, and small oil production businesses. No company within that group or an industry subsector has sufficient market capitalization to move Energy without the help of the big three companies.

The reality is that energy stocks universally react to oil market news and sentiment, although individual stock performance can be impacted by company-specific news. Energy needs oil prices to rally to do well. The industry fundamentals to positively impact Energy are present, but so are those that could cripple it.

Energy prices tend to be volatile, and conditions are ripe for continued price volatility. In other words, don’t extrapolate any short-term price trend into a long-term trend. Energy is primarily a trading vehicle unless you are willing to hold your energy stocks for years betting on the world’s need for increased energy supplies making them more valuable. Shunning Energy stocks is just as dangerous as overweighting them. Trade Energy stocks while keeping their price risk in mind. Always protect against the worst possible outcomes.