Energy Musings - October 13, 2023

Offshore wind projects to help New York meet its clean energy mandates were dealt a body blow likely knocking them out of the game. The NYPSC unanimously rejected their supersized rate increases.

Offshore Wind Momentum Runs Into A Roadblock

The roadblock is called the New York Public Service Commission. It unanimously rejected the request from four proposed offshore wind projects and 86 land-based renewable projects for increases to their previously negotiated contracts to sell their electricity output in the state. The four offshore wind petitions were submitted by Empire Offshore Wind LLC which owns two projects, Beacon Wind LLC, and Sunrise Wind LLC. The Alliance for Clean Energy New York Inc. submitted a petition asking for rate relief for onshore wind and solar projects.

The offshore wind projects were seeking sizeable adjustments to the renewable energy credit and offshore wind REC purchase and sales agreements entered with the New York State Energy Research and Development Authority (NYSERDA) to address recent inflationary pressures that are impacting project economics. The four projects are requesting an average rate increase of 48% to $167.25 per megawatt-hour.

Block Island Wind turbine #5 has a blade apparently held together with tape. It may reflect the current state of the offshore wind industry’s future.

Specifically, the four offshore wind project developers have proposed different strike price hikes. Sunrise Wind, being developed by Ørsted, has filed for a 27% increase in its 2019 strike price. Empire Wind 1 and 2, developed by a joint venture of Norwegian energy company Equinor and U.K.’s BP plc, requested adjustments estimated by NYSERDA to raise prices by 35% and 66% to $159.64/MWh and $177.84/MWh, respectively. The final project, Beacon Wind 1, another Equinor/BP joint venture, requested a strike price increase of 62% to $190.82/MWh, according to NYSERDA.

Interestingly, the average rate increase requested by these offshore wind projects is 46% higher than the $114.20/MWh levelized cost of offshore wind energy calculated by BloombergNEF, a leading green energy promoter. The huge discrepancy between the theoretical LCOE estimate and real-world economics suggests that BloombergNEF needs to acknowledge that their calculations are woefully low. They should not be relied upon by green energy promoters and the media when telling the public how ‘cheap’ renewable energy is. The true cost of renewable energy is not what the LCOE estimates suggest because they do not reflect the cost for backup power necessitated by renewable energy’s part-time performance.

The ACENY petition to NYSERDA requested that the onshore wind contract price be increased by 71% on average to $115.66/MWh, while solar project prices should be increased by 63% to $102.22/MWh. It was suggested that collectively the rate increases would boost New York residents’ monthly electricity bills by 4%, with offshore wind contributing 2.5% and onshore wind 1.5%. The combined impact of just the wind hikes on a consumer’s electricity bill is $4.67 per month, which is a $56 annual increase from just this small portion of the state’s electricity grid.

According to the New York Times, these renewable energy projects were expected to have a present value cost of about $10 billion. The requested rate relief would have more than doubled that estimate to $22 billion. One can almost see New York ratepayer backs bending under the burden of complying with the state’s green energy mandates. Just how much is too much for the public to bear?

New York state law requires that by 2030, renewable energy – primarily wind and solar – must provide 70% of the electricity consumed in the state. It also stipulates that by 2035, offshore wind farms are to be able to generate nine gigawatts of electricity. That might happen briefly on a very windy day, but as we have demonstrated by tracking the wind energy output from Rhode Island’s Block Island Wind farm, the first and largest U.S. offshore wind farm, it has yet to reach even 47.5% of its capacity on an annual basis. If New York politicians think they will get 9 GW of offshore power steadily, they must build roughly 20 GW or capacity. New York ratepayers will be flattened by the weight of the cost of such a project.

You can read our extended discussion of the profitability challenge for offshore wind in our September 20, 2023, Energy Musings article. The following is an abbreviated discussion incorporating the comments from the commissioner members of the New York Public Service Commission that rejected the renewable energy rate hike requests.

The renewable energy developers all blamed the need for higher New York contract strike prices on increased inflation, supply chain issues, and higher interest rates. This has been a popular refrain by renewable energy developers who are pointing to the “economic disruptions” created, by the Russia/Ukraine war. NYSERDA turned to a Boston economic consulting firm, Industrial Economics, Incorporated (IEc) for an evaluation of the developers’ arguments. The conclusion of NYSERDA’s report to the NYPSC stated:

“In conclusion, review of the Petitioners’ claims through NYSERDA’s internal analysis with support of the independent information provided by IEc shows that the costs to develop clean energy generation projects have increased materially. These market conditions, driven in large part by increased demand for raw materials, an increased demand for large-scale renewable energy caused primarily by the COVID-19 pandemic and the war in Ukraine, as well as supply chain constraints and bottlenecks, are unprecedented in recent history, outside of reasonable developer control, and were unforeseeable at the time of each bid. These renewable energy market conditions are global in nature, and their impacts are not unique to New York.”

“With regards to petitioners’ claims that high-interest rates were unforeseen, it does not appear reasonable for developers to have assumed that a low interest rate environment would persist throughout the period in which their projects were to be financed, given that the levels of interest rates witnessed today are indeed precedented.”

What was not noted in the conclusion is that interest rates have a disproportionate impact on renewable power project costs than how they are impacted by supply chain disruptions and overall inflation. To amplify that point, we quoted from a speech earlier this year by a member of the Executive Board of the European Central Bank. Below is what we wrote in our earlier Energy Musings.

“A speech last January by Isabel Schnabel, a member of the Executive Board of the European Central Bank, at the International Symposium on Central Bank Independence in Stockholm, Sweden was titled: “Monetary tightening and the green transition.” The speech focused on the impact of monetary policy in fighting inflation by raising interest rates and slowing the green energy transition. Schnabel pointed out that “Low and declining interest rates have measurably contributed to the fall in the ‘levelized cost of electricity,’ or LCOE, of renewable energies.” This is a fact many people fail to appreciate because, in their business careers, they have lived in a zero-interest-rate world for 14 years from 2008 to 2022, and consider that world to be normal. To them, today’s higher interest rate world is abnormal.

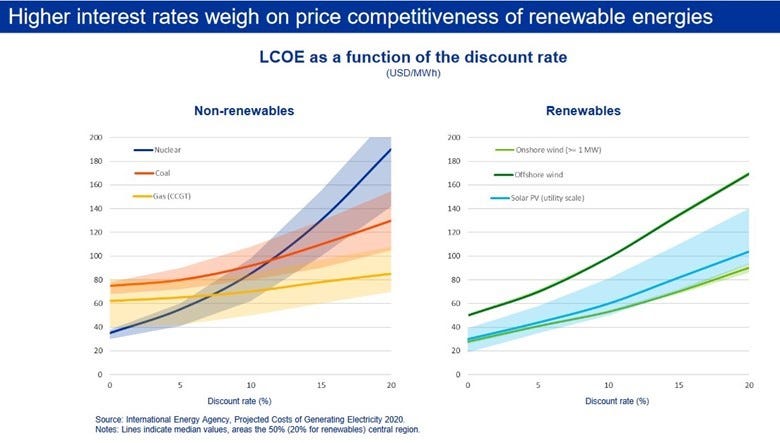

“Because monetary policy is the primary tool for fighting inflation, Schnabel points out that using that tool necessitates a different tool – fiscal policy – to counter the adverse impact higher interest rates have on the competitive landscape for renewable energy. She said, “Put simply, renewable energies are more competitive when interest rates are low. While simulations suggest that the LCOE of a gas-fired power plant would change only marginally if discount rates were to double, that of offshore wind could rise by nearly 45%.” She presented a slide showing how the slopes of various LCOEs rise as discount rates increase. Higher discount rates are driven up by higher interest rates. Renewable energies start at a lower LCOE than coal and natural gas when at a zero discount rate. As the discount rate increases, the slope of renewable energy LCOEs rises more sharply than those of non-renewable energies. At a 20% discount rate, the LCOE for offshore wind is about $170/MWh, which is higher than coal ($130/MWh) and natural gas ($80/MWh). Natural gas is the prime competitor for renewables, and it is also the backup fuel for the part-time nature of renewable energy. Thus, natural gas is gaining a competitive advantage over offshore wind as interest rates rise.”

That text was accompanied by the following chart from Ms. Schnabel’s talk demonstrating her point about how little fossil fuel projects are impacted by higher interest rates and how devastating they are for renewable energy project economics.

Interest rates have a significant impact on the LCOE of renewable energy projects and only a minor impact on fossil fuel projects.

Where do the offshore wind developers find themselves today after the NYPSC decision? According to Marco Padula, the director of markets and innovation at the Department of Public Service, in his statement to the commission before its vote, “The relief sought is inconsistent with commission policy favoring competition in electric generation procurement to ensure just and reasonable rates.” His staff estimated approving the requested rates could boost bills by as much as 6.7% for residential customers and as high as 10.5% for commercial or industrial customers, depending on the utility.

The 7-0 vote to reject the bill signals that there is no calvary coming over the New York hills to rescue the projects if they truly are “unfinanceable” as developers claim. That word only entered the offshore wind lexicon late last year, but has now come to characterize almost every offshore wind project in the planning stage or about to begin construction. We envision it dominating every project’s in-house “final investment decision” discussion.

NYPSC Chair Rory Christian stated, “By rejecting this relief, we signal to every vendor that our contracts, our commitments are worth the paper they are written on.” He went on to say, “To the developers: We have a deal. We expect all developers, no matter how large, to abide by their commitments.”

But Christian’s most telling comment was reflective of his and his fellow commissioners’ commitment to protecting the ratepayers of New York State. “We signal that ratepayer funds are not an unlimited piggy bank for anyone’s disposal,” he said. This position reflects regulators who are willing to buck the tide of popular sentiment, at least among the politicians in their state, to ensure that their ratepayers are not destroyed by unconscionable rate hikes in support of projects that developers and federal regulators acknowledge will have little or no impact on climate change.

Offshore wind developers were quick to respond with warnings about what was a risk for state politicians and their clean energy mandates. The decision has put at risk the planned 4.2 GW of offshore wind projects.

“Sunrise Wind’s viability and therefore ability to be constructed are extremely challenged without this adjustment,” said Ørsted Group EVP and CEO Americas Dave Hardy about the project off Long Island project. The decision probably ensures that Ørsted will be taking the $2.3 billion write-down of its U.S. offshore wind portfolio the company warned about earlier this fall. With CEO Mads Nipper having repeatedly stated that his company will only be moving forward with projects that create value for shareholders, the NYPSC decision is likely a death knell for several of Ørsted’s offshore wind projects. Barring the Biden administration finding additional money to throw to the offshore wind developers, its 30-GW goal for offshore wind generating capacity having been installed by 2030 is dead, although it was already on life-support before the commission’s vote.

At stake with the decision are developers’ commitments not only for their wind farms, but also the investment in onshore facilities, local labor, and coastal communities. That position was stated by New York Offshore Wind Alliance Director Fred Zalcman who said the decision puts offshore wind projects in “serious jeopardy and deals a potentially fatal blow to the progress these projects have made to localize clean energy manufacturing, reinvigorate New York’s ports and harbors, train and deploy New York’s skilled union workers, and revitalize environmental justice communities.”

New York Governor Kathy Hochul said her administration was committed to its clean energy mandate. “Make no mistake: my commitment to building a clean energy economy is as strong as ever. New York will continue to advance an affordable clean energy future, and I have directed state agencies to undertake an accelerated process to procure renewable energy as affordably and quickly as possible.”

The NYSERDA report warned that the PSC should consider the offshore wind developer requests in a positive light because there was no guarantee that by killing the projects, future ones would be cheaper given the observations of its economic consultant.

“F[f]orecasts indicate that inflation will moderate, but remain positive, over the next ten years. Inflation projections show that the GDP Deflator and the Consumer Price Index will stabilize slightly above the Federal Reserve’s 2% inflation target between 2024 and 2033. Economic analysts are not projecting that price deflation (a sustained drop in the general price level) will occur in the next ten years. Forecasts indicate that the price level in the U.S. will nearly double by 2033 relative to the end of 2020. Labor costs are also expected to increase, but at slower rates. Historical relationships between general measures of inflation and commodity prices indicate that the latter, despite peaks and troughs, will follow an upward trend over the next ten years.”

The IEc report also offered a view of offshore wind’s future costs:

“Renewable energy project costs will remain above pre-2022 levels until sometime during the 2025-2030 period, with the exact year dependent on the technology type…Though technology and efficiency gains are lowering costs for offshore wind development over the long term, recent press reports and industry analyses provide strong evidence that supply of key components will not keep pace with global demand for offshore wind generation, which will increase costs in the sector through 2030.”

There will be no easy path forward for offshore wind, especially after the NYPSC’s unanimous rejection of the supersized rate increase requests. East Coast states may be looking forward to offshore wind electricity prices starting close to $200/MWh in future solicitation requests. The days of sub-$80/MWh prices are gone with the wind. How many other public utility commissions will reject such expensive part-time energy with its additional issues such as harm to marine mammals and potential devastation to local fishing businesses? Other environmental issues are being raised by the long-term presence of offshore wind turbines, plus the absence of any solution to the radar disruption issue and the ending of Coast Guard search-and-rescue operations within offshore wind farms. The industrialization of U.S. offshore waters has hit a roadblock. It is currently being held together with tape like the Block Island Wind turbine pictured above.