Energy Musings - November 4, 2024

We are updating several stories we have covered in Energy Musings. Events happen quickly, so we often never get around to updating. California's oil industry, offshore wind, and Trump and whales.

California’s Refinery Industry Struggles

We wrote in our October 21 Energy Musings The War Against The Oil Industry Continues, in which we discussed California’s anti-oil industry legal warfare and its newly mandated operating regulations. Not only does California have its special blend of gasoline that boosts the cost, but the state also just enacted legislation requiring the California Energy Commission (CEC) to determine the minimum levels of gasoline and diesel storage refineries they must maintain. The belief is that these inventories will provide a fuel supply buffer against price spikes whenever there are refinery outages, either planned or unplanned.

Just days after California Governor Gavin Newsom signed the inventory legislation, Phillips 66 announced the planned closure of its Wilmington refinery by the end of 2025. Once closed, California will have only eight operating refineries, down from 11 in 2023. The industry’s refining capacity will shrink from 1.622 million barrels daily to 1.482 million in 2026.

On Valero’s October 24 third-quarter earnings call with analysts last week, CEO Lane Riggs said, in response to a question about the Phillips 66 decision, that "all options are on the table" for his company's two California refineries. "Clearly the California regulatory environment is putting pressure on operators out there and how they might think about going forward with their operations," Riggs said.

Riggs was asked to amplify his comments. To that end, he characterized the California situation as one in which policymakers were gung-ho about imposing costs and operating limitations on oil companies, but regulators struggled to figure out how to implement the mandates.

Valero operates two refineries in California. They are the 145,000-bpd Benicia refinery and the 91,300-bpd Wilmington refinery. Valero’s options include selling them, but finding buyers might be tough in this political environment.

California currently imports about 322,000 barrels per day of gasoline, which will increase due to the impending Phillips 66 refinery shutdown. We noted earlier that there are no available domestic ships to transport Gulf Coast oil and products, so all the additional supplies must come from abroad. Additionally, 900 workers will lose their jobs.

A big question is who the next oil company will be to conclude the toxic California business climate is not worth the effort. Chevron announced in August it was moving its headquarters out of California to Texas. The state has been Chevron’s home since 1879. The company operates the 240,000-bpd refinery in Richmond, California, near San Francisco. The city has been trying to impose a tax on the refinery and its council voted 7-0 to put a referendum on the November ballot for voters to approve the tax.

After fighting Richmond’s initiative, Chevron and the city agreed to a $550 million payment over ten years in exchange for the removal of the ballot initiative. Such extortion will add approximately two cents per gallon to the refinery’s output cost, further squeezing refining margins. What is the breaking point for Chevron? Will the For Sale sign go up once the corporate headquarters move is complete?

The California jitney is heading for a cliff. Just as it is modifying its electric truck mandate, forced by encountering the market reality that it will not work, we expect backtracking on California’s anti-oil business measures. If not, California may become the leading example of an economy crushed by climate change hysteria and policies.

Offshore Wind Puts On A Happy Face

There are four things to note about offshore wind. There is the Gulf of Maine’s lease sale, the latest on the blades of Vineyard Wind, Dominion Energy’s offshore wind cost, and Donald Trump as a whale psychiatrist.

Gulf of Maine

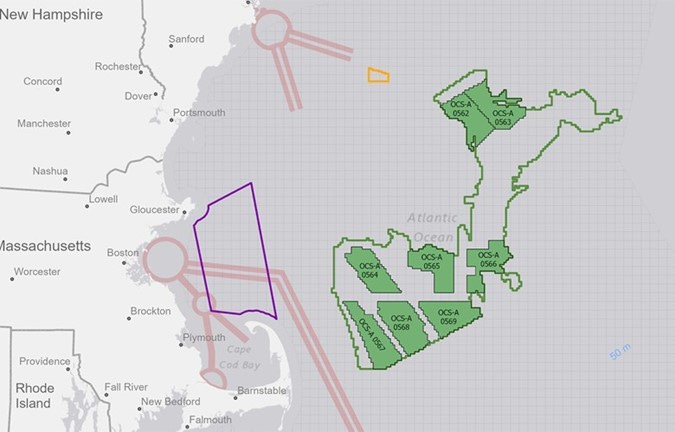

On October 29, the Bureau of Ocean Energy Management (BOEM) held the first offshore wind lease auction for the Gulf of Maine. One significant feature of this sale is that all the leases are in water depths exceeding the conventional technology for bottom-supported wind turbines. The water depths are estimated at 100-300 meters (330-990 feet). Developers will need to use floating wind turbines anchored to the seafloor. This technology, which is in its infancy, will make the electricity produced expensive.

While the oil and gas industry has perfected floating drilling and field development technology in thousands of feet of water depth, the normal wave movement of their floating structures does not interfere with operations. Floating wind structures require the turbine and blades to remain aligned with the wind to maximize output. That requirement is a challenge and can impact the utilization factor and the amount of electricity a turbine can generate, and in turn the venture’s profitability.

Fourteen companies were registered to bid and BOEM said the auction might take 1-2 business days to complete. It was over in a few hours as only four leases were bid on by two competitors. The bids were at the low end of BOEM’s lease value range. That is the number assigned to leases based on BOEM assumptions about their productivity so that the public is paid a fair value for the asset (lease).

Gulf of Maine wind leases in sensitive areas.

Environmental investigations found deep-sea coral locations within one of the leases (OCS-A 0567). A recent survey indicated there may be additional habitats suitable for corals in lease areas (OCS-A 0567 and OCS-A 0568). As a result, BOEM added a requirement that lessees “use the best available information to avoid and minimize bottom-disturbing activity to sensitive biological resources or habitats to the maximum extent practicable.”

These leases are in the middle of the transit path of whales and other marine mammals. After accepting comments about this issue, BOEM added a lease stipulation “requiring lessees to collect a minimum of three years of passive acoustic monitoring data for large whales in the Gulf of Maine North Atlantic Right Whale Critical Habitat to support the submission of the COP [construction and operating plan].”

How will whales deal with floating wind turbines with their anchoring cables and underwater electrical lines connecting the structures? BOEM has no idea. When they initially proposed floating offshore wind projects for the U.S. West Coast, BOEM worked with the Northwest National Laboratory to research the issue. The result was a cartoon video showing how whales will have no problem swimming around or under the cables and electric lines. The reality is that they have no idea what may happen.

BOEM also noted that several leases are adjacent to the Stellwagen Bank National Marine Sanctuary. Installing power transmission cables through the sanctuary can be authorized by various mechanisms. A future issue that may create legal challenges.

Furthermore, BOEM acknowledges that wind turbines may interfere with the North American Aerospace Defense Command (NORAD) mission by restricting air surveillance and radar. BOEM is confident that these issues can be mitigated by using Radar Adverse-impact Management (RAM) and overlapping radar coverage. Where RAM technology mitigates the problem, lessees must notify NORAD within 30-60 days of completion of the wind farm commissioning. They must pay no less than $80,000 toward NORAD’s cost of implementing the RAM technology for each radar system affected. They also must curtail operations for national security or defense purposes.

The Gulf of Maine lease sale will certainly lead to future protests and potential legal challenges over whether BOEM’s lease stipulations are sufficient. Every requirement will add to the cost of developing wind farms and boost the price of power.

Vineyard Wind Blade Issue Status

After acknowledging there was a manufacturing defect in the blade of the Vineyard Wind AW-38 turbine that broke apart the evening of July 13, GE Vernova, the blade supplier, said it had completed the examination of all the blades and found more defects. The company shipped blades back to its factory in France, although the suspect blades came from the company’s Canadian plant. GE Vernona is removing other blades and plans to apply a material to strengthen others already installed or to be installed.

During GE Vernova’s October 23 earnings call with investment analysts, CEO Scott Strazik said, “In Offshore, we’ve had a difficult four months and are disappointed given the impact on our customers and on our financial results, with a significant loss we took this quarter.” The company took a $700 million charge for the blade incidents experienced at the U.K.’s Dogger Bank and Vineyard Wind and their knock-on effects on delivering the company’s backlog.

Strazik made another observation about GE Vernova’s financial struggles with its offshore wind business and the current market for its turbines. “Looking ahead, we’re focused on improving execution and delivering on the approximately $3 billion backlog in the safest, highest quality delivery model that makes economic sense for our customers and ourselves,” Strazik said. “We do not foresee adding to this backlog without substantially different industry economics than what we see in the marketplace today.”

We assume all prospective offshore wind customers have noticed that GE Vernova expects to charge more for its turbines. This comes after it scrapped building the industry’s largest wind turbine impacting the economics of several planned U.S. offshore wind farms. The company has also put the financial community and its employees on notice that it plans a significant headcount reduction at the offshore wind division, as a step to help financial and operating performance.

In the question and answer portion of the call, management said it had hoped to complete its $3 billion backlog by the end of 2025, but that date is “moving to the right.” The company is looking into steps such as adding incremental installation vessels to its operation to accelerate the pace of executing the backlog. Management said it would update the investment community about the expected date for completion of its backlog during its investor day on December 10.

A controversial comment was management’s statement, “In the case of Vineyard, we have been installing both towers and nacelles and just got guidance to start to begin reinstalling blades at Vineyard yesterday.” That statement prompted a reporter for the Nantucket Current to contact the Bureau of Safety and Environmental Enforcement (BSEE) which has been overseeing the Vineyard Wind blade incident and regulates the activity.

A BSEE official responded that the agency had issued an updated suspension order for Vineyard Wind on Tuesday (the day before GE Vernova’s earnings call) that continues to prohibit the company from resuming power production, installing blades, and conducting any activity on the damaged wind turbine. The email response stated that "At BSEE’s discretion, however, specific activities may be allowed on a case-by-case basis after sufficient risk analysis has been performed and mitigation measures are adopted."

This response from BSEE would seem to contradict the statement by GE Vernova’s CEO. Did he make his comments knowing that investors would consider the situation at Vineyard Wind to be less concerning financially?

Previously, we had noted that two wind turbine blades had been shipped back to GE Vernova’s French plant for strengthening. According to a French newspaper, six blades have been returned and more are anticipated. GE Vernova’s management stated in its call that the number of blades found to have the manufacturing deviation was in the "low single-digit proportion" of all the company's manufactured blades. What does that mean? Is that from all of the offshore wind blades it has ever manufactured? Or is it from those manufactured only by the Canadian plant? Maybe it is only from the blades for Vineyard Wind, which is 186 blades for the 62 wind turbines planned. Six blades represent about 3% of that universe of blades. Reportedly, additional blades are being taken down, which suggests a higher number. What work is being done on the blades returned to France, compared to those being strengthened on-site? More questions with few clear answers. The blade mystery continues.

Virginia’s Offshore Electricity Cost

Dominion Energy announced its third-quarter earnings last week and provided an update on the Coastal Virginia Offshore Wind project. The 176-wind turbine project, with a capacity of 2.6 gigawatts, is projected to be operational during 2027 and has a cost estimate of $9.8 billion. Management said there has been no change to that estimate.

The project initially cost $7 billion, but by the time it was approved in December 2022 by the State Corporation Commission (SCC), the cost was up to $9.0 billion. Since then, the cost escalated to $9.8 billion. The project’s cost can climb to $10.3 billion which Virginia ratepayers are obligated to fund. From that number to $11.3 billion, the expense is shared 50/50 between customers and the company. Above $11.3 billion and up to $13.7 billion, Dominion Energy must pay 100%. Above $13.7 billion, the SCC will need to determine the financing arrangement.

When initially approved by the SCC, the order included a performance guarantee. If the wind farm’s capacity factor fell below 42%, the company was responsible for paying for the power shortfall. That was a non-starter for the company. It threatened to scrap the project forcing the Commission to get a negotiated cost-sharing arrangement between the intervenors in the rate case and the company.

Dominion Energy’s management was happy to show progress on the levelized cost of the electricity (LCOE) that has a legislative cap of $125 per megawatt-hour (MWh) initially carried a $97 price. When the value of the renewable energy credits (REC) was included, the LCOE dropped to $80-$90. Last May, when the project economics were updated, the LCOE was down to $84/MWh before an $11 REC, netting a $73/MWh cost estimate. Now, the LCOE is $85/MWh, but the REC is up to $29, producing a net LCOE of $53/MWh. Virginia ratepayers should be happy. We caution that the price of RECs could drop in the future. What is interesting is that between May and October, the LCOE went up by $1. In an environment of lower interest rates, with all other factors equal, one would have thought the LCOE would go down. We will be watching for future project updates.

Whale Psychiatrist

During his three-hour podcast with Joe Rogan, President Donald Trump discussed offshore wind (he is and has been opposed to it) and said the noise is driving whales crazy.

“They say the wind drives them mad. It’s a vibration issue because those structures are as tall as 50-story buildings… The wind is howling, objects are moving, creating vibrations and noise. You know what I want to be? A whale psychiatrist.”

One of many memes about Trump and whales.

While BOEM and NOAA repeatedly say that there is no evidence connecting whale deaths and the noise from offshore wind construction. Studies in Europe show that marine mammals can become disoriented and even lose their hearing, which is critical for them when foraging for food, communicating with other whales, especially for mothers and calves, and avoiding predators and vessels.

We recently listened to a European expert discussing the state of knowledge about underwater noise and its impact on marine mammals. He repeatedly said, “We do not know” and “We need more studies.” Nothing about noise and marine mammal behavior is definitive. The people telling the public otherwise are bureaucrats adhering to the Biden administration’s pet project mandate – get 30 gigawatts of offshore wind approved and installed by 2030.

In BOEM’s recent Environmental Impact Statement for the New York Bight offshore wind area, it noted that the National Environmental Policy Act (NEPA) requires “analyses evaluate the potential unavoidable adverse impacts associated with a Proposed Action.” Concerning marine mammals, the report said:

“With implementation of mitigation measures developed in consultation with NMFS [National Marine Fisheries Service] (e.g., timing windows, vessel speed restrictions, safety zones), the potential for an ESA-listed species to experience behavioral effects with severe consequences or be injured or killed would be reduced or eliminated. No irreversible high-severity behavioral effects from NY Bight project activities are anticipated; however, due to the uncertainties from lack of information that are outlined in Appendix E, Analysis of Incomplete and Unavailable Information, these effects are still possible. Irretrievable impacts could occur if individuals or populations grow more slowly as a result of injury or mortality due to vessel strikes or entanglement with fisheries gear, or due to displacement from the NY Bight lease areas.”

The message is “relax, we have all of this under control.” Moreover, any impacts will be temporary, unless the marine mammal dies, in which case the outcome is permanent. Maybe it isn’t whales who need a psychiatrist but the people pushing offshore wind.