Energy Musings - November 30, 2023

Energy consultant Timera Energy believes that things will get better for offshore wind once interest rates decline and government's adjust policies to help make that happen. IEc has a different view.

Consultants Disagree On Offshore Wind’s Problems

In a recent email teaser for its consulting services, London-based Timera Energy offered up a blog from late September with the title: Energy investment impact of surging cost of capital. This is a theme we have been writing about since last year, so we were struck by a couple of points in the blog. First, they offered up the observation that after five years of negative interest rates in Europe, borrowing costs have surged over the past 18 months. In their view, “the pace of central bank rate hikes across the developed world is unprecedented in modern history.”

Unfortunately, other economic and energy consulting firms disagree. The most notable example is from the report of Industrial Economics, Inc. in support of the evaluation of rate hike requests from offshore wind developers and other renewable energy projects by the New York State Energy Research and Development Authority. These developers leaned heavily on inflation, supply chain disruptions, and high-interest rates as justification for the higher contracted rates they were requesting. This triumvirate of problems has become a mantra for any problems surfacing in the renewable energy business. Seldom do managements acknowledge that they were the ultimate decision-makers about how to guard against economic forces such as those cited to disrupt their project economics.

IEc studied each of the three issues. It was generous (in our opinion) in stating that inflation and supply chain issues were “surprises” to renewable energy developers. What they didn’t support was that the rise in interest rates was a surprise. IEc said this potential should have been considered by examining history.

Timera Energy points to the rise in interest rates after the past 12 years of low rates as a surprise when actually that period was a historical anomaly.

That is what makes Timera Energy’s claim (shown in the above chart) that the sharp rise in interest rates is what caused the problems for offshore wind developers and once rates decline things should improve. However, governments should take this condition into account and adjust their policies for the developers. That usually means giving developers greater subsidies, which we are seeing in the U.K.’s recent decision to significantly boost its offshore wind subsidies for its next solicitation round.

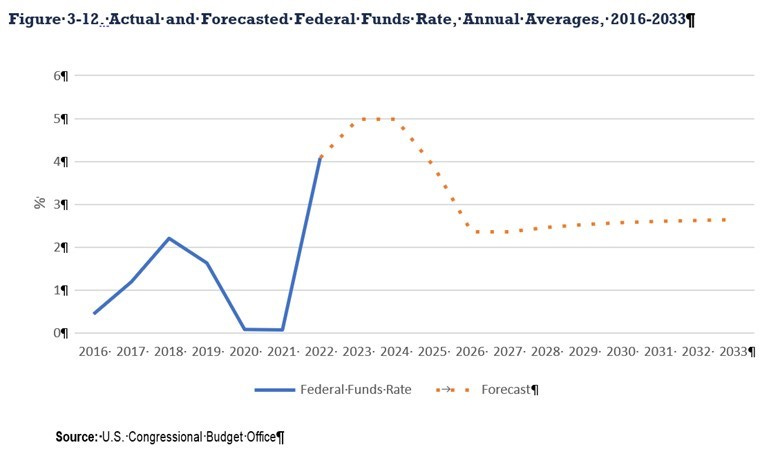

We would point to the charts and interest rate forecasts from the U.S. Congressional Budget Office which is charged with assessing the future economy and its impact on government spending. Interest rates are a key component of projecting future budgetary expenditures. IEc utilized the following two charts – short-term interest rates (Federal Funds) and longer-term interest rates (10-year Treasury Notes) - to make their point that the future will be more like history than the last several years.

Short-term rates will decline soon but will remain in the 2-3 percent range for the foreseeable future.

Long-term interest rates are unlikely to decline much in the next decade which will pressure offshore wind returns and their business models.

While the forecasted interest rates show some relief shortly, their long-term outlooks are for sustained higher than recent levels. In IEc’s commentary on interest rates, it wrote the following:

The projected interest rates shown in both figures are also within historical norms. For example, in 2007 both the Federal Funds rate and the 10-year U.S. Treasury rate were as high as the corresponding CBO projections for 2024 in Figures 3-12 and 3-13. Similarly, the rate at which interest rates recently changed is also precedented, with historical examples including the sharp decline in the Federal Funds rate between July 2007 and November 2008, the decline between December 2000 and December 2001, and the increase in the Federal Funds rate between July 1980 and December 1980. Because interest rates are driven in part by Fed policy, it would have been appropriate for developers to consider the pace of both interest rate increases and reductions when developing their proposals.

IEc’s conclusions to the NYSERDA report made the following points about inflation and supply chains. They are not particularly encouraging.

…the consensus narrative that inflation of goods, services, and labor will moderate, but remain positive, over the next ten years is reasonable. Persistent supply chain constraints are likely to contribute to higher costs in renewable energy sectors and could potentially offset or outweigh the secular downward trend in prices driven by efficiency gains in these sectors. It is uncertain if supply will keep pace with the heightened global demand for clean energy to alleviate the inflationary pressures specific to the solar PV, onshore wind, and offshore wind development. Even optimistic forecasts that do not incorporate these constraints show that solar PV, onshore wind, and offshore wind project costs will remain above pre-2022 levels until at least 2025 and potentially to 2030. Reconciling the economic forecasts that show immediate declines in project CAPEX beginning in 2023 with existing macroeconomic uncertainty and supply-side challenges requires more data and a greater degree of certainty than are available as of this writing.

In effect, the consultants are warning that expecting offshore wind costs to come down before 2025 is unlikely, and it is possible costs may not decline before the 2030s. With the projection of high interest rates as far as 2033, offshore wind developers will need both higher subsidies, and less debt in their business model. Will governments be willing to inflict more financial pain on their citizens through higher taxes and higher electricity prices? The backlashes unfolding in Europe and the United States against renewable energy is a sign that offshore wind developers need to reassess their business plans.