Energy Musings - November 27, 2023

Sorry for the long read, but addressing the New England power market outlook requires examining many issues. If it is not going to be offshore wind, we need nuclear as the best option.

Summary

Offshore wind has become a popular energy source for helping New England meet its clean energy mandates. It creates environmental and economic issues such as whale deaths and devastation of the region’s commercial fishing industry. Now the industry’s economic problems are jeopardizing its future, along with ISO-NE meeting its net zero emissions goal. Relying on renewables for all of New England’s power will escalate costs, increase blackout risks, and fail to cut emissions as much as needed. Nuclear power could be a better alternative. Emotional issues with nuclear are ill-founded, and its cost and construction time problems can be overcome. Nuclear offers positive economic benefits that offshore wind does not offer. These include high job creation, better wages for workers, and eliminating the need for new transmission lines and offshore cables. There needs to be a public discussion of nuclear as a better long-term energy source for the region’s long-term power future.

If Not Offshore Wind, What?

New England residents have been focused on cleaning up the region’s energy systems for years. They were early in the movement for clean energy that now numbers 30 states, Washington, D.C., and two territories. In recent years, several New England states have adopted very aggressive clean energy mandates, with Rhode Island enacting the nation’s most aggressive mandate by setting a 2033 date for its utilities to secure 100% of their energy from renewable sources.

There are at least 11 states, two territories, and the District of Columbia with clean energy mandates of 100% of retail electricity sales with deadlines ranging between 2030 and 2050. Included in that group are four New England states – Connecticut, Maine, Massachusetts, and Rhode Island. To meet such aggressive targets, utilities will need to secure large amounts of renewable energy from solar and wind facilities.

Offshore wind has been identified as the easiest way to build massive renewable energy generating capacity. The East Coast is known for its strong and steady offshore winds, leading to the coastal states referring to themselves as the “Saudi Arabia of Wind.” That is only one reason why offshore wind is the popular fuel to meet state clean energy mandates. There are other reasons for choosing wind, especially offshore wind. They were spelled out in a 2010 report – New England Wind Integration Study – prepared for ISO-New England, Inc., the non-profit corporation that serves as the Regional Transmission Organization and Independent System Operator for the six-state New England region.

ISO-NE is responsible for the reliable operation of New England’s power generation, demand-response program, and transmission system. It also administers the region’s wholesale electricity markets and manages the comprehensive planning of the regional power system for both short-term and long-term reliability.

The 2010 report stated the following about why wind was being favored for cleaning up the region’s grid.

The increasing use of wind power is due to the emissions-free electrical energy it can generate; the speed with which wind power plants can be constructed; the generation fuel source diversity it adds to the resource mix; the long-term fuel-cost-certainty it possesses; and, in some instances, the cost-competitiveness of modern utility-scale wind power. Emissions-free generation helps meet environmental goals, such as Renewable Portfolio Standards (RPS).

The report went on to cite other advantages of wind as a New England power source. The authors said that some wind facilities can be constructed in as little as 3-6 months after approval. Such speed would help facilitate financing and provide a quick response to market price signals. Wind power also has a fixed fuel cost at essentially zero. That can provide fuel-cost certainty. The authors said such certainty would reduce New England’s dependence on natural gas. They pointed out that “the economics of wind power are directly affected by the outlook for the price of natural gas.” In their view, higher fuel prices generally support the development of more renewable energy supplies while lower fuel prices tend to slow such development.

Energy In New England

Natural gas prices did play a role in its increased use, but importantly, New England’s total power consumption fell dramatically between 2008 and 2022. The total megawatt-hours of power used on the ISO-NE system fell by almost 17%. However, at the same time, natural gas’ share of ISO-NE’s power mix climbed from 30.7% in 2008 to 48.5% in 2015, and even higher to 51.8% in 2022. Through November 12, 2023, while total power consumption is only 84.9% of 2022’s total, natural gas’ share of its 2022 power contribution rose to 90.1%, and it represented 55% of the system’s total power supply mix so far this year.

The dramatic decline in natural gas prices since 2008 partially explains the increase, but not completely. In 2008, natural gas futures prices traded in the range of $8-$13 per thousand cubic feet. By 2015, gas prices had collapsed to $2-$3/Mcf, as the shale revolution swamped consuming markets with greater gas supplies. Therefore, it was not surprising that gas’ share of the total ISO-NE fuel supply jumped by nearly 18 percentage points. However, as gas share rose further by 2022, going from 48.5% to 51.8%, average gas prices traded up into the $4-$9/Mcf range. Although total power consumption fell by about 4 million megawatt-hours between 2015 and 2022, natural gas power generation rose by 1.5 million MWh.

While the authors of the 2010 wind integration report were largely correct that natural gas prices would impact wind economics, the decline in power consumption played a role, as did the shutting down of coal and nuclear generating capacity, goals of the anti-fossil fuel movement.

During 2008-2022, wind power went from a zero contribution to the ISO-NE power mix to 2.0% and ultimately to 3.7%. The drive to clean up the grid was partially responsible, but federal government subsidies such as the production tax credit, which rewarded wind producers for every kilowatt of power produced in addition to the contracted price for their power, encouraged developers to construct new projects. But this push came at a cost to consumers.

Residential electricity prices in New England are substantially above the U.S. average, and since 2008 they have increased at a faster pace leading to a widening per-kilowatt-hour price spread. In 2008, the New England average residential power price was 16.83 cents/kWh compared to the U.S. average (including New England) of 11.26 cents/kWh. The price spread of 5.57 cents/kWh widened by 2022 to 8.77 cents/kWh, as New England’s average price increased to 23.89 cents/kWh versus the U.S. average price of 15.12 cents/kWh. From 2008-2022, New England’s power price rose 41.9% compared to the U.S. average price increasing by only 34.3%.

Clean Energy Mandates

The state clean energy programs help explain why power prices are so high in New England and continue to rise despite increased amounts of renewable energy that are supposed to be cheaper. ISO-NE data shows that in 2020, the wholesale cost of power on its grid cost 6.7 cents/kWh, or roughly a third of the average of the electricity prices for the six states whose individual prices ranged between 16.80 cents to 22.44/kWh. The roughly two-thirds of the cost spread not consumed by grid expenses represents the bill for ratepayers for their state clean energy mandates. Given the increasing percentages of state power that must be met by clean energy in the future, it is likely this cost spread will further widen and add to consumer bills.

According to a report earlier this year by the Fiscal Alliance Foundation:

New England’s renewable energy mandates represent some of the most complex and costly in the entire country. Twenty-six separate programs are active across the six states, with nine in Massachusetts alone. Each covers different technologies with different annual compliance requirements and costs. Entities that sell electricity retail in New England are obligated to satisfy the mandates in every state where their electricity is sold. The annual cost of Massachusetts renewable energy policies has quadrupled in 10 years from $250 million in 2011 to $1 billion in 2020. Cumulatively, this has cost Massachusetts ratepayers $6 billion in increased electricity prices in that period. In 2020 alone, Massachusetts ratepayers were billed an average of $1 billion for its Renewable Portfolio Standards (RPS) policies, which works out to between 2¢ and 3¢ per kilowatt hour of electricity consumed. Given an average monthly consumption of electricity of 600 kilowatt hours per household, the RPS costs each ratepayer as much as $191 a year.

Another climate program that New England states participate in is the Regional Greenhouse Gas Initiative. Members of the program include the six New England states plus New York, New Jersey, Pennsylvania, Delaware, Maryland, and Virginia. The program is a cooperative effort by the states to reduce carbon dioxide emissions from power plants within each participating state. The plan is a market-based cap-and-invest initiative whereby regulated power plants must acquire one CO2 allowance for every short ton of CO2 they emit. The money raised from selling these allowances is returned to the states which can use the funds for clean energy programs, energy efficiency efforts, and support for business and local community bills. The Fiscal Alliance report found that the RGGI program cost ratepayers in the participating states $3.8 billion in higher electricity rates from 2008 to 2020. While 53% of the funds went to energy efficiency programs, the report notes that there is insufficient data to evaluate the success of those efforts. Wasted dollars?

The recent ISO-NE report, 2023 Systems Outlook, sets forth a path for achieving a net zero carbon emissions scenario by 2050, but the details and observations by the report’s authors suggest potential problems for power users. The goal of the net zero scenario is to eliminate fossil fuels from the region’s power supply, although not from its primary energy mix. Natural gas, which is supplying 55% of the electricity grid’s power so far this year, will continue to provide a substantial amount of home heating during New England winters. Oil heating will also continue to play a role. The master plan is to ultimately replace these fossil fuel markets with electric heat pumps as part of the plan to “electrify everything.” The assumption in the ISO-NE plan is that this switch will occur, but we are not sure of the economics and/or the timing of the shift.

As the report’s key findings note, electrifying the region’s economy will create a huge increase in power demand – an 875% increase if transportation and heating are included. It also means that the peak demand for power will shift to the winter and be 100% greater than the current peak. For the first time, winter electricity demand will exceed the traditional summer peak, and the daily demand peak will move to mornings and away from nights.

The following chart illustrates what the demand peak will look like with transportation and heating demand being electrified. This means both increased generation and transmission capacities will have to be built. In almost every case, the wind and solar facilities are located well away from demand sites increasing transmission challenges that increase the blackout risk to the grid. None of this increased transmission capacity will be cheap to build, nor will it be popular with residents living near the lines and cables. This expansion comes with social and economic costs that are seldom mentioned.

Electrifying transportation and heating will add tremendously to the peak power needs of ISO-NE.

The clean grid power scenario also shows that New England will experience 26 days when natural gas demand exceeds the pipeline capacity into the region. If the shortfalls are during the winter, home heating will always be given preference, so the grid will need to find alternative power supplies. Currently, this means restarting mothballed oil and coal plants to provide the needed electricity. The decision to close nuclear power plants in the region, given the projected natural gas supply shortfall, means New England will produce six million tons of CO2 above state goals.

Getting more natural gas into New England has been a running battle for years, but one the gas industry has essentially given up on. Adding more gas to the region’s fuel mix has allowed the closure of coal and oil power plants leading to a reduction in CO2 emissions. Greater emissions reductions could have been achieved by keeping nuclear power plants operating and adding more gas supply. The bottleneck for pipeline expansions and new projects was that they were blocked by the governors of New Jersey and New York. Additionally, then-New York Governor Andrew Cuomo blocked drilling in his state that would have tapped the prolific Marcellus shale formation in the state.

The combination of these politically-motivate actions has prevented New England from tapping one of the nation’s most prolific natural gas basins – the Marcellus trend – with 200-300 trillion cubic feet of technically recoverable supply. The gas comes from a trend that stretches across West Virginia, Western Pennsylvania, Western New York, and into Eastern Ohio. It could supply New England with lower-cost natural gas, eliminating the need to import expensive liquefied natural gas and/or activate old oil- and coal-fired power plants to help meet the region’s winter fuel needs. It would also help reduce the region’s emissions reduction effort.

With the prospect of insufficient gas pipeline capacity, the ISO-NE points to increased dependence on LNG imports that will raise “energy adequacy concerns.” The report also said that non-carbon-emitting energy storage technologies may help address the adequacy concerns. However, according to the report, “studies suggest the quantity of energy storage needed is infeasible from an economic and physical perspective, and the required storage resources would not have adequate opportunity to charge.”

That final point is important because many people confuse batteries with primary energy. In reality, batteries are energy conveyors. So, once they deliver their load of power, they must be recharged before they can contribute to the energy supply again. That means their recharging adds to the energy load. Despite this limitation, 38% of the current queue of energy transmission hookups to the ISO-NE grid are for industrial-scale batteries.

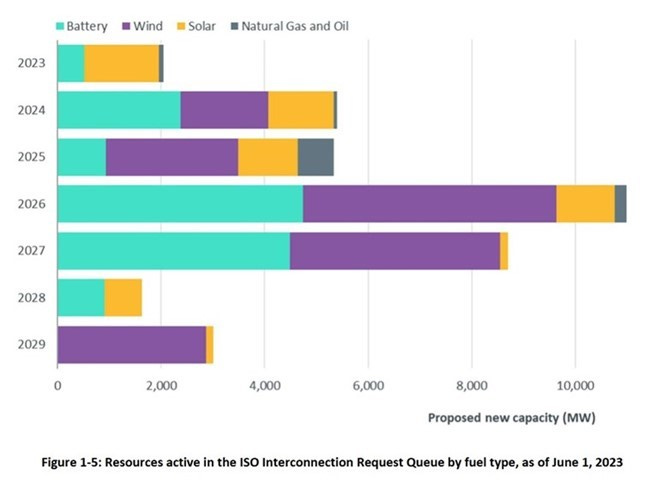

When we examine the distribution of new power capacity, it becomes clear that solar and batteries are dominating the planned additions to the grid. Batteries play a large role in additional supply expected to be added to the grid almost every year but especially in 2026 and 2027. Those two years also have large, planned wind additions, but we know that the rejection of the Revolution Wind 2 project will cut that queue by 884 MWs. What isn’t considered is how costly batteries are and how damaging they are to the environment from the mining and refining of the metals needed for batteries.

Batteries and wind are dominating the ISO-NE queue for transmission hookups.

What will be required to meet the ISO-NE clean energy scenario? In terms of solar capacity, the study projects more than a doubling of nameplate capacity over the next decade. We already know that states are looking to see where they can put industrial-scale solar installations as the public is pushing back on proposals to cover open space or clear-cut forests. In Rhode Island, the state is considering placing solar panels in the medians of highways.

We also know that such a massive increase in solar will drive the need for more batteries and natural gas backup power for nights and inclement weather when solar doesn’t produce. The promise of solar was highly touted by ISO-NE officials at a Federal Energy Regulatory Commission meeting last summer. They talked about how much the increased solar capacity had contributed to reduced power demand on the grid. That is because the solar installations are on housetops and powering the homes, at least for part of the day. The challenge of these behind-the-meter solar installations is how they should be compensated. If the home is hooked to the grid and uses grid power occasionally, it needs to be paying its fair share of maintenance costs for keeping the grid operating. Otherwise, homeowners without solar systems are subsidizing homes with solar. Every state is wrestling with the proper pricing for behind-the-meter solar systems.

Solar power is projected to double its capacity over the next decade but it will not add that much actual power output.

At the FERC meeting, ISO-NE officials commented that they have been modeling the contribution of renewables in different demand scenarios. In an extreme scenario based on conditions observed during the severe 1961 cold snap, their study predicted that renewables would generate 2,200 MW, or about 10% of peak demand, despite low wind speeds and little sun. However, with winter peak demand projected to grow at 3% per year through 2032-33, that contribution shrinks rapidly. But even at a 10% contribution, that still leaves 90% of power demand having to be met by other fuels. Moreover, the renewable contribution is not steady, which magnifies the challenge of supplying the other 90% of the energy demand. We need to remember that more people die from cold weather than from heat waves, a reality not appreciated by the public.

According to the recent ISO-NE load projections, winter peak demand will increase from 22,053 MW in 2023 to 28,810 MW under normal weather conditions. For a below-average winter, the peak is projected to increase from 22,816 MW in 2023 to 30,611 MW in 2032-3033. A significant portion of the 2032-3033 peak demand comes from the addition of transportation electrification (3,420 MW) and heating electrification (2,965 MW). Those demands are critical to sustaining the lives and livelihoods of New England residents.

Solar, wind, and battery additions to the grid will be needed to meet the net zero emissions goal of ISO-NE. To reach that target, the grid will need to add substantially large amounts of renewable energy capacity. It will mark a dramatic shift in the evolution of the New England power grid. From a natural gas-dominated grid expansion that has lasted for the past 27 years, the future is all about adding renewable energy capacity. Additionally, much of the existing fossil fuel generating capacity will need to be replaced, adding to the amount of new renewable energy capacity required.

The clean energy push will have renewables dominate all future generation capacity additions to ISO-NE’s grid.

Offshore Wind And The Grid

A major question for this planned reshaping of the ISO-NE grid is what impact it will have on carbon emissions. That is the rationale for the various state clean energy mandates. However, even the offshore wind regulator, the Bureau of Offshore Energy Management, stated in one of its early environmental assessment reports that "Overall, it is anticipated that there will be no impact on climate change as a result of offshore wind projects alone…construction of offshore wind facilities are not expected to impact climate change.”

BOEM tried to link offshore wind projects to lower greenhouse gas emissions by replacing other energy sources. It stated in an appendix: “Offshore wind projects will by themselves probably have little impact on climate change, but they may be significant and beneficial as a component of many actions addressing climate change.” The key to that statement is the use of the word “may” to signal that offshore wind can contribute to reduced GHG emissions. BOEM went on to state: “Increasing energy production from offshore wind projects will likely [lead] to [a] decrease [in] GHGs emissions by replacing energy from fossil fuels.” The problem with that logic is that fossil fuel generation is required to be available when offshore winds fail to generate power. Therefore, emissions continue regardless of the production of offshore wind.

It is the need for backup power that ISO-NE pointed out in its key conclusions to its 2023 Systems Outlook report. It fully expects natural gas generation to be operating in 2050 even with a grid fuel mix that meets the 100% renewable power target. That is why there will be more CO2 emissions than desired.

The travails of offshore wind are notable. The industry was shocked when offshore wind developers began proposing price adjustments to previously negotiated power purchase agreements in the fall of 2022. The hint of the need for higher prices quickly turned into a tsunami of requests for rate hikes. In every case, regulators and utilities balked. Price hikes were rejected by Massachusetts, Connecticut, and New York regulators. The contract for a high-priced offshore wind project for Rhode Island was recently rejected not only by the utility but its decision was backed by the staff of the state’s public utility commission and Office of Energy Resources. Higher energy prices are not popular with customers, utilities, or regulators. But they are caught between state clean energy mandates and substantially higher power prices. Politicians, regulators, and the public were led to believe that renewable energy, because its fuel supply is free, would be cheap and bring down electricity prices. The opposite is happening.

The reason why offshore wind has become the renewable fuel of choice is because utility executives and regulators accepted the conventional wisdom that offshore wind’s cost would continue to decline as it had for many years. Offshore wind also offered the potential for adding large increments of generating capacity, at least based on nameplate capacity, and with a higher capacity rate than either onshore wind or solar.

Additionally, offshore projects are located where residents cannot see them and there is no issue with land use. Finally, developers were happy to build wind farms since the federal government is willing to provide hefty subsidies and rapid project approval. Under the Inflation Reduction Act, the federal subsidies for wind, which traditionally had a life of only 10 years, were extended for the life of an operating wind farm, adding potentially 15-20 years of subsidies. These subsidies in the form of tax credits can also be freely traded which helps developers finance their multi-billion dollar projects.

Keep reading with a 7-day free trial

Subscribe to Energy Musings to keep reading this post and get 7 days of free access to the full post archives.