Energy Musings - November 25, 2024

The EV market is in the midst of a difficult period. The problems the industry faces are not easily resolved, especially with Trump's administration likely changing the playing rules once in office.

The EV Market Continues To Unravel

At first, there was skepticism about the forecasts predicting electric vehicles (EVs) would displace internal combustion engine (ICE) vehicles. EV promoters assured the public that the nascent sales figures would soon experience the S-curve growth seen for other technology products. Initially, it means a sharp rise in sales followed by a slightly slower pace before coming to a crawl. That set the stage for an explosion in EV sales, pushing the market beyond 50% as the public fully embraced their value. The nagging question was, when would the S-curve bring that explosion in EV growth?

Initial EV buyer concerns were dismissed as teething issues that would quickly disappear once a driver experienced the joy of driving one. EV critics, however, suggested that what was driving sales were “early adopters” who were interested in impressing neighbors with their commitment to “new” technologies and solving the global warming problem, although the idea of “virtue signaling” was dismissed.

In the U.S., 17,763 plug-in EVs were sold in 2011 out of total car sales of 12.8 million units. EV sales climbed steadily to 118,882 in 2014 before suffering a setback the following year. Sales jumped by 40% in 2016 and continued climbing the following two years before plateauing during 2018-2020. With the arrival of the Biden administration in 2021, with its “green” agenda and aggressive support of EVs, sales soared.

Funny that President Joe Biden ignored Elon Musk and Tesla at the EV strategy unveiling, although his company was the most successful EV manufacturer. It was likely because Tesla had a non-union labor force, so it was unlikely to feel dependent on Biden for their jobs and vote for him. EV sales jumped by 107% in 2021 and 47% in 2022. They nearly reached 1.5 million units in 2023, a 56% increase. But then, the industry’s problems began to emerge.

The 2021-2023 sales increases were despite the lagging fallout from the pandemic and soaring inflation. However, in the second half of 2023, EV sales began to lag, especially in California, the center of the EV industry and home to the nation’s largest EV fleet. We were assured that slowing EV sales was temporary and would be corrected by the upcoming introduction of new EV models and lower-cost ones. Greater clarity about government subsidies was also cited as an upcoming positive, as the Inflation Reduction Act shifted the $7,500 per EV subsidy from a tax credit to a point-of-sale credit. However, the IRA did restrict the number of EV models qualifying for the tax subsidy because of their manufacturing location and the amount of foreign material input.

As 2024 dawned, BloombergNEF predicted that 16.9 million EVs would be sold globally, with 70% being battery-electric vehicles (BEVs). China would lead with 10 million EVs sold. However, the sales growth rate was slowing due to market saturation in China’s wealthiest regions. EVs would represent 38% of China’s light-duty vehicle sales and a 20% (14% BEV) share of global EV sales.

The second largest EV market, Europe, was expected to see limited sales growth of 3.4 million vehicles, an 8% increase. The small increase was reflected in the subsidy cuts in important markets and the heavy dependence on company-car taxation schemes.

For the U.S. market, BloombergNEF predicted EV sales of 1.9 million units, a 13% year-over-year increase. Because U.S. EV sales only represent 11% of global EV sales, BloombergNEF warned readers “to not over-interpret what happens here” because the upcoming election has politicized the market.

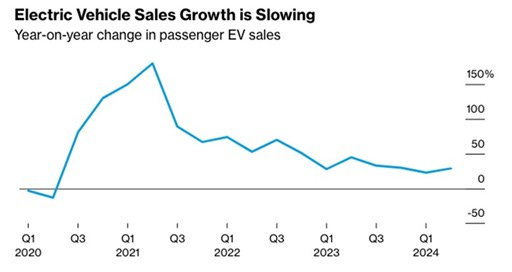

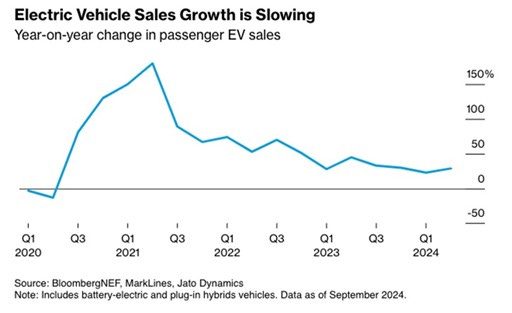

Writing about a presentation at the BloombergNEF Summit in London a week ago, the conclusion was that growth rates are slowing, but EV sales are headed for another record year. The speaker acknowledged the actions of Ford Motor Company and General Motors Company to slow EV investments. The message was that 2024 EV sales would hit the BloombergNEF January forecast of 16.9 million vehicles, up from 13.9 in 2023. Their forecast is supported by global EV sales rising 26% through the first half of 2024 and increasing around 30% in September. While solid growth, it is down from the 33% increase of 2023 and 60% the prior year.

The presenter acknowledged that the large auto markets of Japan and Germany have seen not just a slowdown but a decline in EV sales. They dismissed the German decline, pointing to past vehicle sales patterns ahead of emissions regulation changes. In other words, vehicle sales are pulled forward ahead of the new rules becoming effective, which distorts the year-on-year changes the following year.

Confirmation of slowing EV growth.

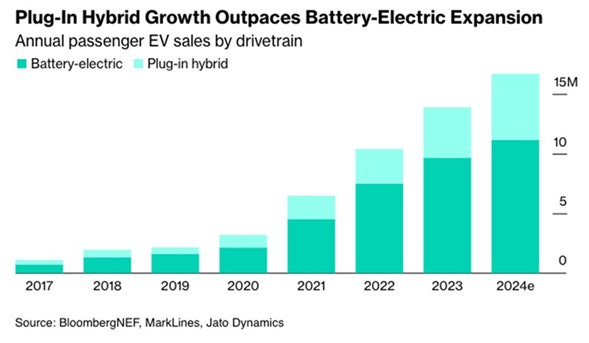

Another point about the evolving global EV market is buyers' embrace of plug-in EVs and regular hybrids over BEVs. Chinese total plug-in EV sales have increased 38% this year, while BEV sales have only increased 18%. What is being seen in China is happening across the automotive world.

Chinese EV buying shows plug-in hybrid gains.

The BloombergNEF Summit presentation report concluded that “EV sales growth is slowing, but volumes are still going up and will make up 20% of global vehicle sales this year.” We did not see any commentary referencing the January prediction that 70% of sales this year would be BEVs. Given the China sales data, we doubt that share will be reached.

Following the release of third-quarter sales data, Cox Automotive reviewed the EV market and commented that the record EV sales in Q3 were “thanks to higher incentives, more choices.” Cox presented a chart showing the incentive percentages of average transaction prices for conventional vehicle purchases and for EVs monthly for 2024. The gap is significant.

Car markets can be juiced by increasing buyer discounts.

We understand the larger incentives for EVs because they are more expensive. We experienced this when walking around a Lexus new car display while waiting for servicing to be completed on our hybrid Lexus. We were shocked when we found similar models on the showroom floor – one an ICE and the other an EV ‒ but sticker prices showed EVs being $25,000-35,000 more expensive than the ICE model.

Cox ended its commentary by writing: “Cox Automotive was expecting 2024 to be a ‘year of more’ for EVs in the U.S. – more products, more sales, more discounting, and more curious buyers jumping into the fray. With improving infrastructure, far more choices, and excellent deals to be had, the team expects further growth in the months ahead – a 10% share is well within reach.” That contrasts with the EV sales share in Q3 hitting 8.9%, the highest level recorded and an increase from 7.8% in Q3 2023. However, reaching a 10% share seems a stretch.

The fallout from the slowdown in EV sales and the continuing lack of buyer interest is roiling the automobile industry. Not only are automakers experiencing EV market headwinds, but the overall auto market is also struggling. Both Ford and GM have been forced to lay off workers, both at EV plants and conventional vehicle assembly plants. In Europe, Ford recently announced the layoff of 4,000 European workers due to weak EV sales and general economic pressures.

Volkswagen, the leading auto company in Germany, announced plans to shutter three plants and lay off thousands of workers from its 295,000 workforce. This would be the first plant shutdown in the company’s 87-year history. Management plans to slash the pay of remaining workers by 10%. The company is in a protracted negotiation with its workers’ union, which opposed the move and is prepared to strike on December 1 if no agreement is reached.

Volkswagen’s problems stem from the combination of weak EV sales, competition from Chinese imports into Europe, and a more competitive global auto market. The company is suffering from shifts in the Chinese auto market where its partner company has lost share to domestic auto manufacturers such as BYD. GM has experienced a similar problem. During 2014-2018, GM earned an average of $2 billion annually from its Chinese joint ventures. GM’s market share in China peaked at around 15% in the middle of the 2010s. Its most recent quarter’s market share fell to 6.5%. Ford has experienced a similar problem.

GM and Ford have generated huge EV losses — $3.7 billion for the first nine months of 2024 for Ford and an undisclosed number for GM. The latter company projects selling one million EVs by 2025 and stopping burning cash. GM executives believe American interest in purchasing EVs is greater than “experts” suggest. However, a J.D. Power survey in May showed a drop in consumer interest in buying an EV. Only 24% of shoppers say they are “very likely” to consider purchasing an EV, down from 26% the year before.

An EY Mobility Consumer Index survey early this fall found that of the U.S. consumers planning on purchasing a new vehicle in the next 24 months, only 34% intend to purchase an EV, down 14 percentage points from the 48% in the 2023 survey. Given the results of the J.D. Power and EY surveys, one suspects the automaker executives’ optimism about latent U.S. customer interest in buying EVs is more a function of the upcoming ban on selling new ICE vehicles in California and those other states that following the Sunshine state’s environmental edicts.

Such bans are not working well in the U.K., where vehicle sales are being allocated to meet the buying restrictions. The result has been a crumbling of the nation’s automobile industry. Ford is laying off workers at its U.K. plants in response. Government officials say they will not waver from their policy, but they are open to introducing “flexibility” into the mandate. The government is also reducing the fines on auto companies that fail to meet the sales mix goals.

California is also adjusting its electric vehicle mandate, at least for trucks servicing the state’s ports. This policy had the earliest date of the EV sales mandates. We will watch for further market adjustments.

The latest disruption in the EV market was the bankruptcy of Swedish battery manufacturer Northvolt. With only about $30 million in cash, sufficient to fund operations for about a week, and $5.8 billion in debt, Northvolt was forced to move for a financial restructuring. After raising an initial $15 billion in capital, the company has burned through $20 billion while still losing money. Leading Northvolt investor Goldman Sachs took a $900 million hit to its fund.

The company, which operates and has agreements to supply EV batteries to U.S. and European car companies, has been hurt by slowing EV sales and investments. It also faces fierce competition from Chinese EV battery companies, which control 85% of the global market.

While trumpeting its 2024 forecast accuracy, BloombergNEF took a new look at the future through the lens of a Donald Trump presidency. That likely means changes to the EV tax credit and a revision to the Environmental Protection Agency’s vehicle emissions mandate that requires 58% of new vehicle sales to be electric by 2032, along with 13% plug-in hybrids or other partially electric cars.

According to Liam Denning, BloombergNEF has just reduced its long-held 2030 U.S. forecast of EVs accounting for 48% of new car sales to only 33%. He says that means nine million “missing” EVs in the second half of this decade. So, is BloombergNEF late to the forecasting party or leading the parade of reduced EV forecasts? We assume BloombergNEF is adjusting its forecast to reflect its expectations for Trump policy changes.

A Yahoo Finance report, citing the work of researchers Joseph Shapiro, Hunt Allcott, and Felix Tintelnot in a report titled “The Effects of ‘Buy American’: Electric Vehicles and the Inflation Reduction Act,” said that repealing the $7,500 EV tax credit would slash sales by 27%. They said it would reduce annual EV registrations to 867,000 vehicles, 317,000 fewer units. Interestingly, Shapiro and Tintelnot said that there would only be an increase of 155 million gallons of gasoline consumed in the first year after the repeal of the tax credit. Over a decade, this would translate into seven billion gallons of additional gasoline use or about 5% of the 136 billion gallons consumed annually in a typical year.

At the root of the EV market problems lies the challenge from China. Its impact on Ford CEO Jim Farley's thinking was laid out in a Wall Street Journal interview last September. Farley is a “hands-on” and challenging CEO who came from the marketing ranks at Toyota and was noted for spending a year on the road doing intense market research for a new Camry sedan, which involved chatting with car owners in store parking lots.

On trips to China after the pandemic, Farley was impressed with the nation’s auto manufacturers’ progress in designing and building new cars. These cars, unlike American vehicles, use artificial intelligence and other technology to enhance the driving experience. Through a combination of power prices, high-tech interiors, and rapid vehicle updates, Chinese car makers have wrestled market share away from the traditional auto company Chinese joint ventures.

Remembering how Japanese car makers carved out market share in the U.S., Farley understands that tariffs will not prevent Chinese EVs from eventually entering the domestic market. Based on his experiences test-driving Chinese EVs, he has altered Ford’s strategy in China to emphasize commercial vehicles and not compete with local EV manufacturers in the car market.

Farley has Ford executives seeking ways to contract some of the same low-cost parts providers to Chinese EV companies. He is also shifting toward smaller EVs because the large batteries for pickups and SUVs are too costly. This shift led to the shocking announcement of the cancellation of the planned Ford Explorer-size electric SUV.

It is possible to view the EV slowdown, and a shift away from subsidies may lead to better EV products down the road. As the old EV market unravels, a new EV market may be born, which would be in keeping with the history of many technological products.