Energy Musings - November 17, 2023

As offshore wind potholes emerge, politicians are racing to hill them. They have so much political capital as risk, they cannot accept the narrative of every cheaper offshore wind ending.

Offshore Wind Push Continues Despite Financial Turmoil

After delivering a devastating blow to the offshore wind and renewable energy industries in October, the New York State Public Utilities Commission has accelerated its efforts to repair the damage. By having their huge rate increase requests rejected (on average offshore +48% and onshore +71%), developers were forced to rethink their plans for moving forward. The latest move by the regulators offers a lifeline to those developers who can terminate their current deals and bid in the upcoming solicitation. The time to act is short, however. The latest announcement quickly followed a recent award of three offshore wind and 30 onshore renewable projects totaling 6.4 gigawatts of capacity.

The announcement by New York Governor Kathy Hochul about plans for new renewable energy solicitations was intended to mitigate the fallout from the rejection that she agreed. She is worried about the economic and political fallout of the decision. We suspect she is also worried because of the recent offshore wind project terminations in neighboring New Jersey by Danish developer Ørsted taking 2.3 GWs of offshore wind power out of the state’s pipeline. One of the four New York offshore wind projects asking for a rate increase that was rejected was Ørsted’s Sunrise Wind, which the company says is being evaluated and considered for rebid or cancelation.

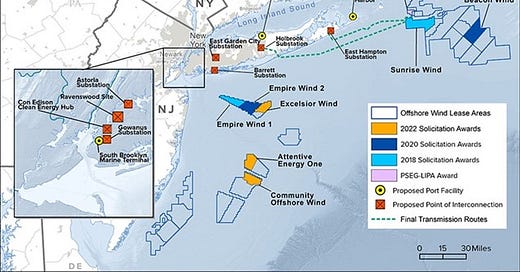

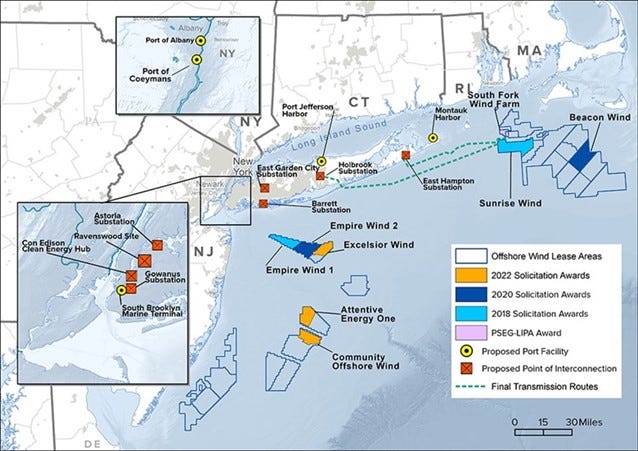

Hochel commented, “For New York to continue to be a climate leader, we must be proactive in addressing the near-term challenges affecting the clean energy industry.” She added that the accelerated solicitations demonstrate New York State’s commitment to remaining “the place for the renewable energy industry to do business.” Unsaid is that the governor is worried about meeting the state’s clean energy mandate. It calls for getting 70% of the state’s electricity from renewable energy by 2030 and to have 9 GW of offshore wind generating capacity online by 2035. The latter goal requires the state to build on average 818 megawatts of new offshore wind capacity per year starting next year. Only the 132-MW South Fork Wind Farm is under construction, which will deliver power to Long Island at the end of 2023 or in early 2024. Several projects are in the approval process. However, New York is way behind in meeting its 2035 target.

New York is working hard to become the center of the East Coast offshore wind industry, but at what cost?

New York’s plan for the renewable power solicitation calls for its issuance on November 30, 2023. Is there any coincidence that the date is when the UN’s COP 28 climate change conference opens in the United Arab Emirates? Final offshore wind proposals are due by January 25, 2024, with winners anticipated to be announced at the end of February. The onshore projects have a two-stage process. Developers must meet eligibility requirements by December 21, 2023, with final proposals submitted by January 31, 2024. Awards are anticipated to be announced by the end of April 2024.

Governor Hochel was one of the six East Coast governors who submitted a plea to the Biden administration to do more to help offshore wind developers. Industry events have overtaken that plea and conditions appear to be worsening. That would include the huge financial impairments on offshore wind projects taken by developers. There are also the New Jersey project cancelations and concerns about the viability of others.

A leading offshore wind equipment supplier – Siemens Energy – has asked for and just received $16 billion in financial guarantees and support from the German government, its parent company, and various banks. Without that support, the company was heading toward bankruptcy. The German government cited the company’s 26,000 German workers as part of the justification for providing support and its need to sustain the industry’s supply chain.

In the U.S., a $280-plus million wind turbine manufacturing facility targeted for Portsmouth, Virginia was canceled by Siemens Gamesa costing more than 300 potential jobs. This is a sign of the diminished outlook for wind turbine demand, as well as the precarious financial position the company’s parent, Siemens Energy, finds itself in. Losing this plant is just another government promise that is evaporating.

More infrastructure projects spawned by the offshore wind boom are at risk. For example, the New York rate hike rejection has put numerous wind farms at risk of cancelation, or certainly facing long delays. That is why the turbine plants and assembly facilities planned for the Port of Albany and Port of Coeymans are being abandoned. The Port of Albany was the planned location for a wind tower factory that would create 300 jobs. Between 2021, when the plant was announced, and today, the plant’s $350 million cost has escalated to $604 million. This cost increase pushed the owner, the Canadian-based Marmen Welcon partnership, to seek additional financial support from the state government. Gov. Hochel turned down the request. Subsidy pockets are only so deep.

The turbine towers were targeted to supply Equinor’s Empire Wind project which is now in jeopardy of cancelation following the rate hike increase rejection. The Port of Albany plant will need new projects quickly, which probably explains the accelerated offshore wind approvals and new solicitation. Without them, the Port of Albany development will likely not advance. But even then, without additional financial support, the plant may be “unfinanceable” just like offshore wind farms. Given the uncertain pace of offshore wind projects and the timing of future ones, the justification for plants to supply wind turbine components will be questioned. Who wants to build a plant that isn’t used or not used for years?

One has the sense that the political pressure is high for New York, and likely other East Coast states, to come to the aid of offshore wind and other renewable energy projects. We are sure the governors were counting on the federal government to come to the rescue, but that was not realistic. The narrative that offshore wind would always become cheaper has been destroyed. In a world of higher interest rates, and likely a higher sustained level of inflation, businesses depending on high financial leverage to be profitable will not work. That is the realization that developers fail to understand, and counting on more subsidies is not a sound strategy.