Energy Musings - November 1, 2024

Our monthly wrap-up of the stock market performance for the Energy sector shows a surprising positive monthly outcome. That performance came despite negative oil prices and sentiment.

October: A Tale of Two Monthly Halves

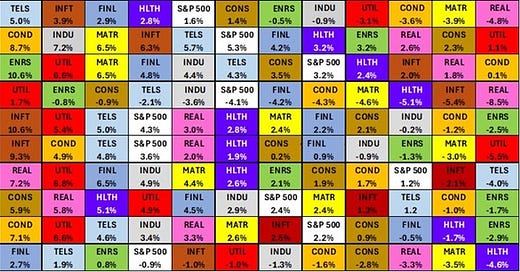

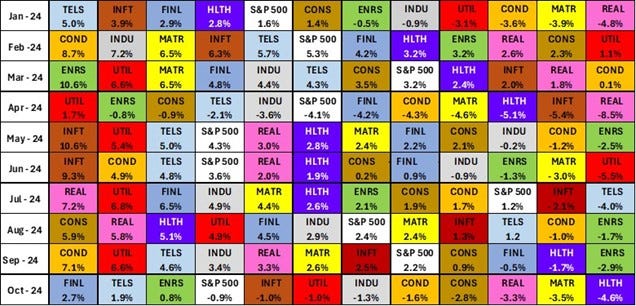

October’s stock market ended with a surprise. Energy wasn’t the worst performing sector in the Standard & Poor’s 500 Index as it had been for the prior two months. Amazingly, Energy ended up in the rarified atmosphere the sector last experienced in March and April. Energy ended October in third place among the 11 industry sectors of the Index.

Energy returns to rarified performance territory.

This market performance was surprising, given the collapse of oil prices during the second half of October. Anxiety over the plight of oil prices weighed on energy stocks. The chart below of October oil prices demonstrates that this anxiety was well warranted.

Energy stocks did better than suggested by oil’s price trend in October.

When Israel launched its long-anticipated retaliatory strike against Iran for launching 200 missiles against the Middle East nation at the beginning of October, fears were it would target Iran’s oil infrastructure. It was a rational expectation given Iran’s ability to sustain a high level of oil exports provided it with the cash to maintain its aggression against Israel. After warnings from the U.S. and U.K. not to strike Iran’s oil facilities, the October 25 strikes excluded any attempt to damage Iran’s cash flow pipeline. That failure to attack Iran’s oil infrastructure caused the largest one-day decline (-6%) in oil prices in over two years. Investors dumped energy stocks that day.

Although oil prices dropped into the $67 a barrel range, they were considered to be vulnerable to a further decline. OPEC is nearing the time it plans to begin restoring oil output it has held off the market to support oil prices. China’s economic activity continues to sputter resulting in weaker oil demand. Europe’s economy continues to underperform. This mosaic fostered further negative demand revisions by the International Energy Agency and OPEC. These forecast revisions reflected three consecutive monthly cuts. Then there was the expectation that energy company third-quarter earnings would be weaker than anticipated.

When we consider the landscape today, we find that WTI crude oil prices are back to $71 a barrel. That is above what had been considered the price floor for a long time. Was the drop into the $60s a temporary event that doesn’t disturb the long-term trading range of $70 - $80? Only time will answer that question.

Weaker U.S. economic data suggests the Federal Reserve will need to cut interest rates further to support a weakening labor market and consumer spending. It should be positive for oil demand.

Energy’s October performance produced another anomaly. Through September, Energy’s performance put it in last place, trailing Health Care (+8.36% versus +14.35%). October was dismal for Health Care, as it finished last with a -4.62% performance for the month. So, Energy’s +0.79% monthly gain helped its relative performance.

Year-to-date through October, Energy’s market performance exceeded that of Health Care. Energy has produced a +9.22% return this year while Health Care’s earned only +9.07%. Some people will say that is not much of an outperformance. However, Energy was in 5th place at the end of April with a +13.04% return. Dropping 4.68 percentage points over the subsequent five months before rallying to only be down by 3.82 percentage points at the end of October is impressive given the volatility of oil prices and the negative investor sentiment towards Energy. We have no idea what the rest of 2024 holds for the overall stock market or Energy, but we are sure it will be interesting to see.