Energy Musings - May 9, 2024

As we head north from Houston, gasoline pump prices climb. One reason for the increase is higher state gasoline taxes. Higher taxes are something gasoline buyers seldom consider.

Gasoline Prices And Regional Costs Of Living

Our recent trip from Houston to Rhode Island reminds us of how gasoline pump prices rise as we move away from the Gulf Coast and closer to New England. There are many reasons for different pump prices in the various states, with taxes being just one. The eastern U.S. has few refineries, so fuel supplies tend to be shipped longer distances into the region. In some cases, the supplies are imported. Thus, higher transportation costs become part of the pricing puzzle. State taxes and transportation costs are independent of seasonal refiner profit margin fluctuations.

The price of gasoline’s raw material – crude oil – plays a role in pump prices. Daily crude oil price fluctuations are reported like daily stock market moves. Both have an emotional impact on the public. Moreover, gasoline is a frequent consumer purchase, so they are sensitive to pump price fluctuations. What we don’t have, as happened in the 1970s, is fear over availability.

During the 1970s supply shortages, consumers kept more gas than normal in their vehicle tanks. Their consumption patterns shifted from waiting until they had less than half a tank before filling up to going to the service station before hitting the half-full level. That consumption pattern shift resulted in domestic gasoline inventories moving from company storage tanks to individual vehicle tanks. That distorted the gasoline supply data and inflated consumption figures.

To explain the intricacies of setting gasoline pump prices beyond following the price of the raw material – crude oil – would be mind-numbing, so we won’t try to do it. We know gasoline pump prices are a politician’s third rail. If prices are rising in an election year, incumbent politicians clamor for actions to cap the increase or, better yet, drive them down.

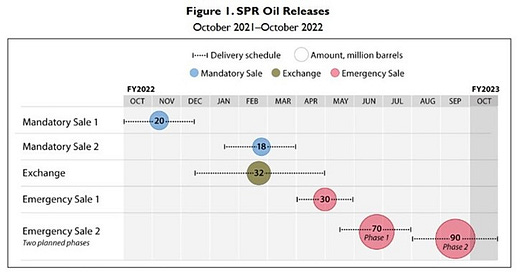

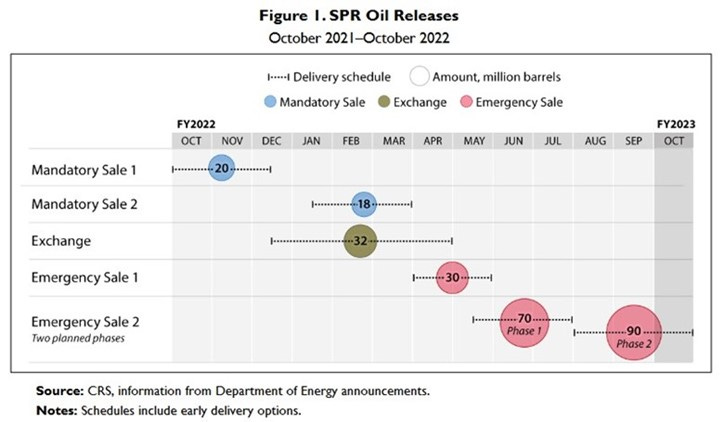

President Joe Biden aggressively used the Strategic Petroleum Reserve’s oil supplies to tame sharply rising gasoline prices in the run-up to the 2022 general election. A report from the Congressional Research Service detailed SPR withdrawals between October 2021 and October 2022. Then, 260 million barrels were withdrawn and made available to the domestic oil industry. The withdrawals included two mandatory sales, one exchange, and two emergency sales, with the second having two phases. The withdrawal represented 42% of the 618 million barrels in the SPR in September 2021.

Until Biden, the federal government had only made three emergency withdrawals from the Strategic Petroleum Reserve

The SPR was created in 1975 following the 1973 Arab oil embargo. Withdrawals from the SPR are strictly limited. Congress sometimes mandates sales from the SPR to pay for other legislative priorities or to pay for the modernization of the SPR. The two mandatory sales in the above chart were in furtherance of complying with Congressional legislation.

Statues authorize unlimited SPR drawdowns following either a presidential finding of a severe energy supply interruption or to carry out U.S. obligations under an international energy program. According to the CRS, “Prior to 2022, there had been three emergency SPR releases: (1) Operation Desert Storm in 1991, (2) Hurricane Katrina in 2005, and (3) Libya oil supply disruptions in 2011. These emergency SPR drawdowns resulted in sales ranging from 11 million barrels to 30.6 million barrels.” Research showed the three emergency withdrawals totaled 58.9 million barrels. Biden’s three emergency withdrawals represented more than three times the crude oil supplies needed when supply disruptions occurred.

The chart below shows the weekly price of regular gasoline as reported by the Energy Information Administration during Joe Biden’s presidency. So far, gasoline prices are 53% higher than when Biden entered office. Fortunately, the current national pump price is below $4 a gallon, the panic point for politicians.

Gasoline prices soared to $5 a gallon shortly before the summer driving season started in 2022. The jump in gasoline prices early in 2022 prompted Biden, worried about the impact high gasoline pump prices would have on Democrat candidates in the November election, to order the emergency withdrawals. On the chart, we marked the first withdrawal announcement, the start of the emergency withdrawals, and the completion of the entire withdrawal program.

The record of gasoline pump prices shows why the emergency withdrawals grew from 30 to 70 to 90 million barrels as prices barely reacted to the initial supply injections. Larger withdrawals were needed to slow and then stop the price increases. Adding more supply broke the upward trajectory of pump prices, putting them on a trend to below $4 a gallon before the election.

The 2022 emergency withdrawals from the SPR helped to lower gasoline prices in runup to the election.

There is talk of the need for another Biden-directed SPR withdrawal to help consumers confront higher gasoline prices heading into the upcoming presidential election. Higher crude oil prices have already forced Biden to cancel plans to begin refilling the SPR, something he promised when announcing withdrawals in 2021. This time, the Department of Energy capped at $79 per barrel the price it was willing to pay for replacement barrels. The cancellation decision occurred with WTI trading at $85. With the oil price below $80 a barrel, buying oil to refill the SPR might restart. Lower oil prices may halt and even reverse the rise in gasoline pump prices.

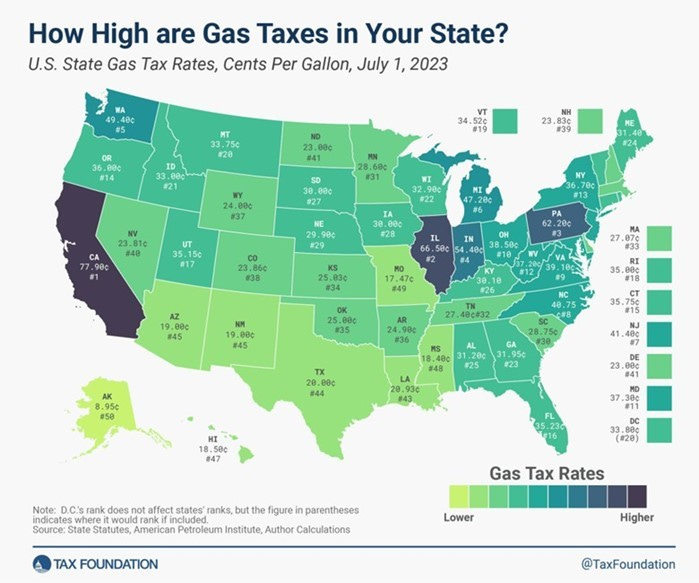

The oil market dynamics – over which no one has control – will impact regional gasoline pump prices, but state taxes also play a role. The following map shows state gasoline taxes and the ranking of each state. The states are grouped by tax levels, shown by different colors.

State gasoline taxes vary widely.

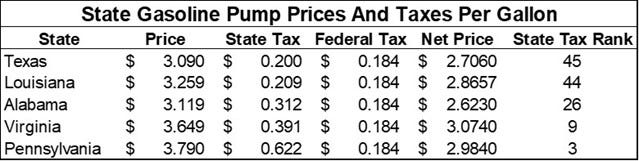

Our drive goes from Texas through Louisiana to Mississippi where we head north. From Mississippi, we travel through parts of Alabama, Georgia, and then across Tennessee to Virginia. We travel up the Shenandoah Valley and briefly through West Virginia before reaching Maryland. Then up to Harrisburg, Pennsylvania, and a right turn to New Jersey, New York, Connecticut, and finally to Rhode Island.

The map shows the southern border states from Arizona to Mississippi have the lowest gasoline tax rates. Alabama and Tennessee have higher rates. Of the remaining states we pass through, all have higher state taxes, and Pennsylvania’s is the highest at 62.2 cents a gallon. Even higher state taxes are found in Illinois at 66.5 cents and California at 77.9 cents a gallon.

Our record of gasoline prices on our trip and how they rise as we get closer to New England.

On our annual drive from Houston to Rhode Island, we always pay attention to gasoline pump prices (what energy analysts wouldn’t?). On this trip, we purchased gasoline in five states. Our spreadsheet shows how gasoline prices varied by region. The spreadsheet lists the pump price we paid, the state and federal taxes, and a pre-tax calculation. We also list each state’s national gasoline tax ranking. Notice how the state gasoline tax ranking rises as we move north.

In Rhode Island, every gasoline station near us has the same pump price – similar to what we paid in Pennsylvania. Rhode Island ranks 18th in gas taxes at 35 cents per gallon. It will be another grin and bear it summer.

Good useful data, Allen. Thanks for the effort you put into making your Musings factual and interesting!