Energy Musings - May 5, 2025

California is facing losing 20% of its refining capacity that will result in it having to import more gasoline to meet the state's needs. The refinery shutdowns will likely boost gasoline prices.

California And Newsom’s Growing Oil Problem

California Governor Gavin Newsom is crusading to change the public’s perception of him. He aspires to a higher office after his term is over. To lead America will require a major image shift from his radical economic, political, and social views. Given today’s modern communications world, everything stays on the Internet, and videotape lasts forever. Opposition research will find every contrary statement and document all your past policies that you are trying to keep hidden.

For Newsom, major image problems are California’s budget problems and his war against oil. These two issues are linked. Taxes on oil companies and energy consumption are sources of revenue for the state. After economic problems due to the COVID-19 pandemic, California’s economy rebounded sharply. The state has some of the highest marginal tax rates for high-income taxpayers. Hence, rising incomes and rising stock market wealth created significant income tax payments. California was rewarded with billions in capital gains taxes.

California saw its revenues for FY21-22 jump by 55%, a $70 billion windfall, boosting the state’s budget surplus to $98 billion. This revenue surge spurred the Newsom administration to randomly hand out $50,000 bonuses to selected individuals for a COVID-19 vaccine shot. To put the windfall into perspective, only New York State had a larger budget than California’s one-year revenue increase.

The problem for Californians was that Newsom’s advisors created the subsequent two annual state budgets based on the assumption that the windfall of capital gains revenues would continue. This was despite the state’s long history of revenues going through stock market cycles. These budget assumptions were made despite the stock market falling 23% from the end of 2021 to mid-June 2022, which was when the 2022-23 budget was signed into law.

As the state budget swung into a huge deficit, Newsom began looking for new sources of revenue to fund his $320 billion budget rather than cut spending. The Hoover Institute showed how much California’s spending problems have contributed to its budgetary problems. During the 1960s, California’s population grew by 25%. The 1964-65 budget was $2.35 billion in the decade's mid-point. Had the budget grown commensurate with population growth and inflation, the Hoover Institute estimated it would be $38.6 billion. Furthermore, if you were generous and tripled the amount to allow for higher cost and improved public goods and services, the budget would still be only $116 billion. Newsom’s willingness to spend lavishly despite growing budget deficits will be a tough record to hide.

Newsom’s anti-oil doctrine is also quickly turning from a positive election talking point into a serious negative with no easy solution. The governor had been a major booster of electric vehicles (EV) and championed legislation to ban the state's sale of internal combustion engine (ICE) vehicles by 2035. California has the largest EV fleet in the U.S. and the most significant number of EV chargers. The latter is needed if the EV fleet continues to grow.

In his search for additional state revenues, oil companies became a target. This is on top of the state’s campaign to end its crude oil production and eliminate the oil company’s market. Oil companies have always been a favorite target of politicians seeking tax revenue, because they are so profitable! However, they are significant employers and local taxpayers. The City of Richmond has been wrestling with what to do economically if Chevron’s refinery closes. While it is the largest polluter in the city and region, it is the largest employer with 3,000 employees and contractors. It is also the largest taxpayer, and the city and state are benefiting from payments by Chevron for past pollution issues and for gaining approvals to modernize and expand the refinery. The city has no answers about what comes next if and when the refinery closes.

A refinery fire in 2023 sparked a jump in gasoline prices, which resulted in a political backlash. California politicians responded with an anti-price-gouging law, establishing a new division that oversees oil company pricing. This followed previous laws adding new reporting requirements for oil refiners and restricting oil drilling near neighborhoods and schools. Last October, during a special session, the state legislature enacted ABx2-1, a bill giving the California Energy Commission (CEC) the ability to set constraints on storage levels for each refiner, fuel, and blending component. It also allows the CEC to adjust refiner inventory minimums and establish conditions under which they can reduce or rebuild inventories.

Oil companies and unions pushed back on the legislation. They warned that this micro-managing of refinery operations could lead to more price spikes. Additionally, they warned that the mandate for higher inventory levels would cost the oil companies, who would need to acquire additional land, construct more storage tanks, and finance the greater inventories. Unions argued that the law could impact refinery worker safety. While the law required the CEC to create these rules, they have yet to offer any proposed rules after six months.

With the bill’s signing, Phillips 66 announced plans to shut its 147,000 barrels per day (b/d) Los Angeles refinery by the end of 2025. That was recently updated to October 17, 2025. Some 900 workers will lose their jobs. Newsom and other politicians accused Phillips 66 of timing its announcement to react to the law’s enactment. Still, the reality is that the refinery’s profitability had been under review by management for a while, and the recent update of the closing date reflects the long-term planning the company had underway.

Valero Energy Corp. has just announced its plan to shutter its 170,000 b/d refinery in Benicia. It notified the CEC that it will “idle, restructure or cease refining operations” by the end of April 2026. The company “continues to evaluate strategic alternatives for its remaining operations in California.” The moves led Valero to take a pre-tax impairment charge of $1.1 billion related to the Benicia and Wilmington (85,000 b/d) refineries in its first quarter 2025 earnings.

On Valero’s recent earnings call with analysts, CEO Lane Riggs described the California regulatory ecosystem as “the most stringent and difficult of anywhere else in North America.” According to Reuters, Newsom responded by sending a letter to the CEC, directing it to guarantee reliable fuel supplies. He wants the CEC to “redouble the state’s efforts to work closely with refiners.” He wants the CEC to offer changes to the state’s fuel management strategies by July 1. Additionally, Newsom asked the agency to substantiate the state’s belief that refineries can function profitably. Of course, he also blamed President Trump for the general market instability.

Severin Borenstein, an economist at the University of California, Berkeley, told The Hill, “We know that California gasoline consumption is going to decline over time.” California is leading the energy transition, according to Borenstein. While acknowledging that gasoline pump prices aren’t coming down soon, he is less worried about them being high in the first place. “I’m perfectly comfortable with the part that is due to higher taxes, which are going towards various government policies,” he said.

While Borenstein acknowledged California’s gas taxes are more regressive — they hurt lower-income families more — compared to other taxes in the state, he said the revenue finances government action. He worries about the “mystery gasoline surcharge,” a term he coined that refers to the difference between fuel prices in California and those of other states, even after accounting for taxes. Contrary to his belief that this surcharge is likely “going towards profits of some company,” he might want to examine the impact of the state’s special fuel blending requirement and its environmental programs costs.

Sanjay Varshney, a finance professor at California State University, Sacramento, cited the state’s higher gas taxes, stricter fuel blend requirements, and lack of transportation pipelines as the cause of higher pump prices. He believes California’s climate-oriented policies are well-intentioned but may be “overly aggressive.” Varshney wondered, “If you are leading, but nobody is following, can you basically change the world on your own?”

Varshney said Newsom has historically “used the oil industry as a punching bag” and told “them that they are basically rogues and scoundrels,” which makes operating in California difficult. “The companies are fed up, so they leave,” he added.

The combined loss of the Phillips 66 and Valero refineries equals 20% of the state’s existing refining capacity. California has a growing refined oil market problem. The CEC says the state’s total refining capacity is 1.6 million b/d, yet the Energy Information Administration estimates California consumes 1.85 million b/d of product. The current 250,000 b/d shortage will grow to nearly 600,000 b/d by next spring. It is hard to image there will not be an issue for gasoline consumers.

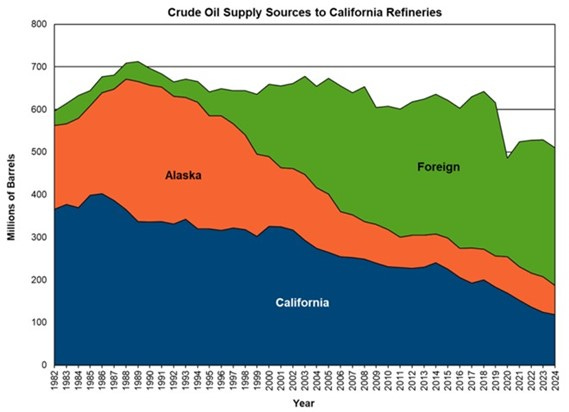

Foreign oil supplies are key for the California market.

In the late 1980s, California met its refinery oil supply needs from state output, Alaska crude, and a small amount of imports. As the chart shows, as Alaskan oil volumes declined and then California production, foreign supplies have grown dramatically. In 2024, California relied on foreign oil supplies for 63.5% of its refinery fuel needs. That dependency will only increase in the fourth quarter of this year and even more in the second quarter of 2026.

Crude oil pipeline capacity into California is full, and building new pipelines is not a near-term solution, if ever. There are no surplus U.S.-flag crude oil carriers that could move supplies from the Gulf Coast to California. Therefore, importing more foreign oil is the only alternative to increase refinery supply. The additional transportation costs and environmental impacts from increasing foreign oil supplies will harm California residents.

The following chart shows the countries that supplied fuel to California refineries. Brazil and Iraq represented nearly 42% of the supply. Guyana provided almost 16% of California’s supply last year, and with that country’s output growing rapidly, it may become a more critical future supplier to the state.

Two countries are key suppliers of oil to California’s refineries.

The CEC acknowledges the refinery market situation in California as a reason for high gasoline prices. They typically average $1 a gallon higher than the average for the nation. This is a condition that the state’s politicians are making worse for residents. The CEC lists six reasons for expensive gasoline. The state can do little about the first two: the global oil market and geopolitics. However, politicians play a role in the remaining four factors: isolated refinery market, cleaner fuel blends, environmental program costs, and taxes. Making the state more dependent on imported gasoline supplies may lead to more price spikes harming residents.

California has the largest ICE vehicle fleet in the nation, with 31 million vehicles. Despite the push for residents to buy EVs, this fleet will not shrink as fast as the state’s refinery capacity will decline. If refineries continue to shut down, Californians will experience even higher gasoline prices, a cost-of-living driver pushing more residents to leave the state. They will also suffer from higher pollution from more oil tankers traveling to the state to deliver the higher gasoline imports less refining capacity can deliver. This will be the conundrum facing the next governor of California. It will likely be a prime campaign issue, making Newsom’s efforts to explain it away more difficult.