Energy Musings - May 31, 2025

Our monthly review of the sector performance of the S&P 500 Index. Energy posted a positive 1% gain for the month, avoiding a consecutive landing in last place in the sector ranking.

Energy Posts Gain In May; Exits Last Place

The Energy sector of the Standard & Poor 500 Index tied with Real Estate in posting a 1.0% gain for May. Because E comes before R, Energy eased into ninth place in the sector ranking. Notably, after falling into last place in April, Energy avoided a repeat, as the sector experienced in August and September 2024.

Energy enjoys not being the worst performing sector in May.

S&P Global commented that “U.S. equities staged a remarkable recovery in May, thanks to optimism surrounding easing tariff tensions, with the S&P 500® up 6%, posting its best May since 1990.”

On Saturday, the Wall Street Journal noted that May was the best month for stock performance since 2023. Moreover, it pointed out how May's performance positioned the index relative to its all-time high in February, when the market was euphoric about Donald Trump’s administration's strong start. It summarized the reasons for the strong May performance.

“The S&P 500 rose more than 6% in May, putting it within 4% of a record closing high in mid-February. A hot tech sector, encouraging inflation data, and a growing consensus that the Trump administration won’t follow through on its most severe tariff threats helped power the gains.”

The performance at the end of the month was further supported by tame inflation data, which brought the annualized rate closer to the Federal Reserve’s 2% annual inflation target. The Commerce Department’s personal-consumption expenditures price index rose by 0.1% in April, raising the index’s 12-month increase to 2.1% through April, down from 2.3% through March. The core PCE index, which excludes volatile food and energy costs, also increased by 0.1%. The 12-month core inflation rate fell to 2.5% in April, down from 2.7% in March. These are the favorite measures followed by the Federal Reserve.

Equally significantly, personal income grew by 0.8% in April, nearly three times the increase economists expected. Personal consumption expenditures also experienced a slight rise of 0.2%, and the personal savings rate climbed to 4.9%. These figures presented a picture of a healthier consumer than many analysts had anticipated.

Consumers are benefiting from record-low gasoline pump prices at the start of summer. That is helping stretch family budgets. But what is the impact of low oil prices on energy companies?

May’s performance of oil prices was interesting. Between May 1 and May 30, the WTI price barely budged from just over $60 a barrel. Oil prices rose to $65 in the middle of the month, and fell below $60 for one day in early May. With oil prices remaining in the $60 a barrel range, energy companies are reassessing their spending and drilling plans. Slowing drilling activity, especially in the key Permian Basin, suggests that national production will not grow and will likely decline.

Oil no longer trades in the $70-$80 range but remains profitable.

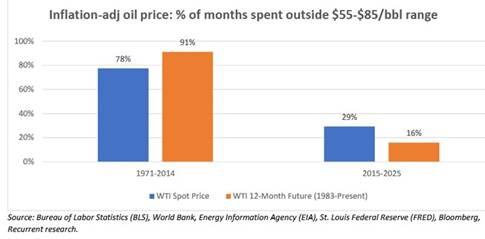

The interesting issue is whether slowing U.S. production growth will lead to higher future oil prices. If U.S. shale oil output begins to decline meaningfully, foreign producers will have increased market share opportunities. The world's low-oil price environment might fade depending on OPEC+’s policies toward price versus outcome. It is way too early to assess such an outcome. However, an interesting analysis of how U.S. shale oil has changed oil price volatility suggests that betting on extreme price moves might be a poor investment strategy.

Don’t pay too much attention to monthly oil price movements.

The chart shows that since oil shale production rose in prominence in the U.S., oil prices have remained within the $55-$85 per barrel range, either 71% or 84% of the months of 2015-2025. This confirms that oil prices are boring and forecasting them is an exercise in futility. Despite daily anxiety, the target price range for oil is acceptable for both consumers and producers. (We will revisit this analysis in a future Energy Musings.)

If oil prices remain in the $60 per barrel range, further progress on inflation and economic growth will follow. That will benefit all investment sectors, including energy, although monthly outcomes will vary depending on many factors.