Energy Musings - May 1, 2025

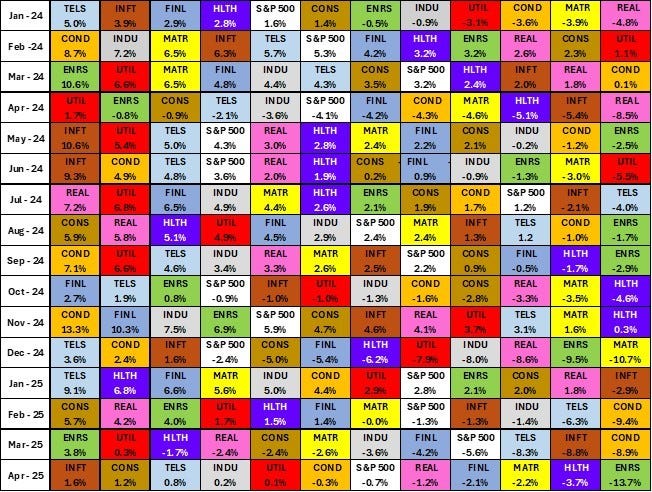

The S&P 500 Energy sector marked another first-to-last market performance for March and April. Oil stock performance was not surprising as oil prices posted their biggest monthly drop since 2021.

Energy Goes From First To Worst In April

Energy’s halcyon days of March, when the S&P 500 sector led all others, completely reversed in April, sending it into last place. The previous time Energy experienced a first-to-last monthly swing was in September/October 2023. The explanation for the rapid reversal is not a surprise: tariffs, OPEC+’s decision to begin adding back its production previously held off the market, and concerns about softening worldwide economic activity. All of these conditions contributed to a sharp decline in global oil prices.

The monthly change this time was much more dramatic than during the prior experience. In both situations, Energy outperformed the S&P 500 in the first month and trailed it in the second. In September 2023, Energy posted a +2.6% gain when the S&P was down 4.8%. In March 2025, the comparison was +3.8% versus -5.4%.

The relative monthly declines for the second month were much greater this time compared to 2023, and the changes compared to the performance gains for the S&P were also dramatic. This year, the March to April Energy swing was from +3.8% to -13.7%, a swing of a negative 16.5 percentage points. The comparable S&P changes were -5.4 % to -0.7 %, for a 4.9 percentage point gain. For 2023, the two-month Energy swing was -8.6% versus +2.7% change for the S&P.

Energy does a round trip.

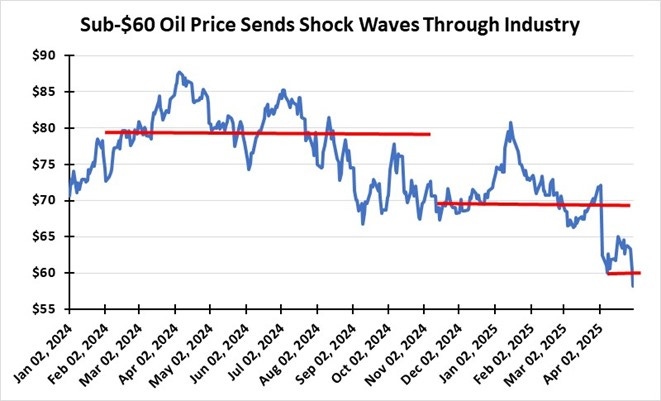

April saw the biggest monthly decline in oil prices since 2021. On April 1, domestic oil prices were around $72 a barrel, only to end the month at nearly $58, down $14 a barrel or a 20% decline. Commentary from oilfield service company executives on their first quarter earnings calls with analysts suggests they are preparing for lower activity for the second half of 2025 based on current economic conditions and expectations that weak oil prices will continue. They expect their oil and gas customers to slow drilling and production activity. A change in the Trump administration’s tariff policy, a settling down of the current financial chaos, as the U.S. and other countries negotiate a new global trade arrangement, or a reversal of OPEC+’s decision to add supply to the market could alter the outlook for global oil markets in the second half of 2025.

Central oil price values have stepped down from the 2024 high.

The past 16 months show a downward trend in oil prices. Many investors were lulled into thinking that the euphoria of Trump’s inauguration, which boosted oil prices from $70 to $80 a barrel, would continue. However, the vigor with which the Trump administration pursued its efforts to restructure its trade relationship with friends and foes shocked many investors. The uncertainty of how this trade war will be resolved is weighing heavily on economies, investor and consumer sentiment, and energy company actions.

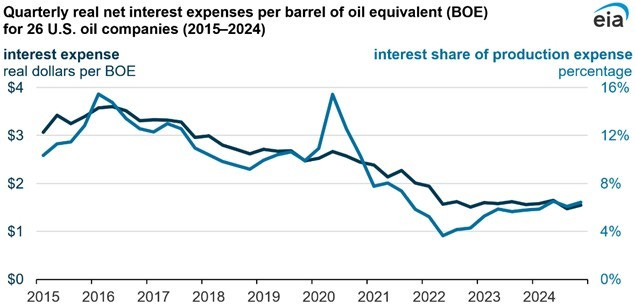

As April ended, the Energy Information Administration published a daily In-Brief Analysis showing that U.S. oil companies spent less on interest over the last decade despite higher interest rates. The article contained the two charts published below – one showing quarterly real net interest expenses per barrel of oil equivalent for 26 U.S. oil companies for 2015-2024, and monthly U.S. interest rate benchmarks for January 2015 to March 2025.

Other than a COVID-19 spike in interest’s share of production expense in 2020, the interest expense measures show a steady decline from their peak in 2016. This improvement contrasts sharply with what happened to all interest rates during 2023-2025.

Oil companies are managing their balance sheets better.

High interest rates have not hurt oil company profitability.

The EIA attributes the oil industry’s performance to relatively high oil prices, increased efficiency and cost reduction, and tempered investment growth and strategy. We would have listed the explanations in reverse order, as companies adopting “financial discipline” in managing their business and rewarding shareholders with higher returns were more critical in driving the performance than higher oil prices, in our opinion. This was/is a cultural change. The only time the industry demonstrated such restraint was in periods after oil price collapses and companies struggled to regain profitability. This discipline will put energy investors in good standing and could result in the sector posting a much better market performance in the future than people expect.

Allen, I hate being the only person who comments on your writing, b/c some will doubtlessly accuse me of being in your pocket or corner. I admit that I am in your corner, as I had the privilege of working with you on both for profit Boards, and as someone who travelled with you to visit energy investors. During our time together, I have gained an appreciation of your integrity and and your work ethic as well as your opinion and writing, and came to appreciate you as someone with a keen interest in what goes on behind the scenes to drive energy makers. I think you do a commendable job of researching your subject matter and have an admirable ability to evenhandedly approach situations full of vitriol and strong convictions on complicated subjects, often involving people with vigorous personalities. But I am not in your pocket and will pipe up strongly when I feel you are off base or the mark. Any of your readers who had the misfortune of knowing or dealing with me know that I am my own man with definite convictions of my own that I will share when I think appropriate.

In the meantime, Allen, keep up your good work, and be well and safe.