Energy Musings - May 1, 2024

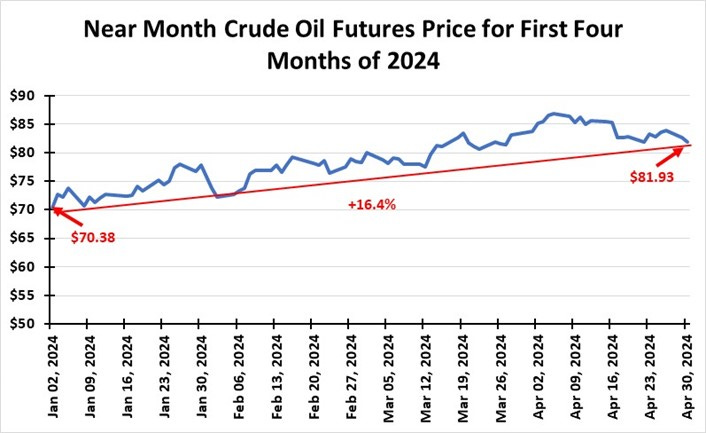

Our monthly review of stock market sector performance for April show a good month for Energy. That was despite oil prices ticking lower at month-end. Oil prices are up 16.4% since January.

April Was Good For Energy

The Energy sector of the Standard & Poor’s 500 Index recorded a small loss in April. However, it finished second behind Utilities, the only sector posting positive results for the month. The S&P 500 declined by 4.1% in April. For the first four months of 2024, Energy has become a top-performing sector after its dismal results for 2023.

According to S&P Dow Jones, for the year-to-date through April 30, the S&P 500 gained 6.04%, while Energy posted a gain of 12.82%. That put Energy in second place behind Communication Services with its 13.42% increase.

April was the second good month for Energy stocks helped by higher oil prices.

For energy investors, it is nice to see the sector at the top of the performance rankings after last year’s fourth quarter where it finished last during each month. So far, 2024 is turning out to be a very different year from 2023, however, many professional investors either refuse to acknowledge that fact or believe the first third of the year is just an aberration and the market will return to the pattern of 2024.

Market technician JC Parets of All Star Charts sent an email this morning to subscribers summing up market trends and the challenge for investors.

THIS YEAR IS NOT ANYTHING LIKE LAST YEAR.

The strategies that worked so well throughout 2023 are not the ones working this year.

Last year's leaders are some of the worst stocks in 2024.

The leaders in 2024, in many cases, were some of the worst sectors in 2023.

It's not bad or good. Better or worse. It's just different.

The better you get at adapting to the current environment, the fewer headaches you're going to have.

Current sector performance is due to higher-than-expected interest rates. Higher rates are sustained because the Federal Reserve is still fighting the higher-than-acceptable inflation. In today’s statement, the Fed said: “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” A factor impacting inflation is the cost of energy.

So far this year, oil prices have been on an upswing that has supported better Energy sector performance.

While negative economic data on the final days of April and May 1st, oil prices weakened. Why not? The data shows a slowing economy which is bad for energy demand. However, over April, oil prices declined slightly. Since the start of 2024, crude oil futures prices are 16.4% higher. That means gasoline and diesel prices are higher, which impacts family and company budgets. Those costs will be passed along in higher prices or weaker profit margins. Neither option is good for the economy.

A weakening economy will force the Fed to react by cutting interest rates. They will cut regardless of the rate of inflation. Jobs take precedence over inflation in government policy and monetary policy. More growth will support and boost oil prices. Higher oil prices will help the performance of Energy. It is a marathon and not a sprint.