Energy Musings - March 4, 2024

The S&P 500 Energy sector posted positive returns in February breaking a four-month string of losses. The performance was helped by high oil prices and an improving sentiment toward the industry.

Energy Produces Positive Results In February

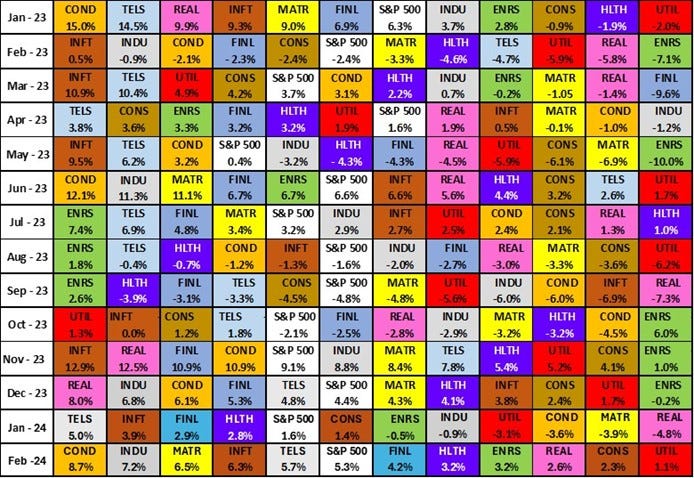

After four consecutive months of negative performance, the Energy sector of the Standard & Poor’s 500 Index posted a 3.2% gain for February. Although the positive month was a break with the recent trend, it still put the sector in the bottom third of the index’s 11 sectors and slightly over two percentage points behind the performance of the S&P 500.

Energy’s positive results in February broke four months of poor performance.

The overall stock market continues to be driven by the performance of the Magnificent 7 technology stocks, especially those most closely aligned with Artificial Intelligence. The Information Technology sector’s gain in February nearly doubled Energy’s performance. What contributed to Energy’s performance was high oil prices during the month partially elevated by continued Middle East geopolitical tensions. Continued strong economic performance to the consternation of market forecasters predicting multiple interest rate cuts by the Federal Reserve, seems to have it on hold.

In the final days of January, the slide in West Texas Intermediate prices contributed to Energy posting a loss of 0.5 percent performance for the month. Oil prices continued sliding for the first two days of February before beginning to rise. The balance of the month saw a see-saw of WTI prices but within the extremely narrow range of $76 to $79 a barrel after recovering from the February 2 low of $72.28.

On February 29, however, optimism about OPEC+ extending its voluntary production cuts helped lift oil prices to a high for the month near $80 per barrel. In the recent past, the market, in response to continued solid economic data and growing optimism that the Federal Reserve will cut interest rates, just not as many or as early as thought at the end of 2023, began focusing on oil’s long-term supply/demand balance. As Occidental Petroleum CEO Vicki Hollub told CNBC, “We’re in a situation now where in a couple of years’ time we’re going to be very short on supply.” Her view is based on the lack of robust reserve replacement during the past decade.

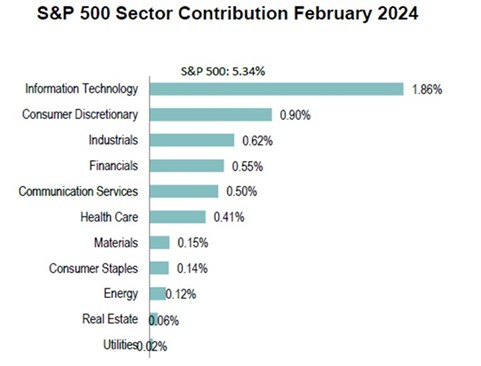

While it is possible that the long-term case for oil is improving, shifting stock market forces are limiting the impact rising energy stock prices are having. A chart in the S&P Global Index Dashboard for the U.S. market showed just how little impact energy had on February’s performance of the S&P 500 Index.

The February sector contribution highlights how little energy plays in the stock market but it is critical for economic performance.

The 0.12% contribution from Energy to the S&P 500 Index monthly performance makes it nearly immaterial as a contributor. The lack of impact is due to the weighting of Energy in the S&P 500. It has been shrinking after having risen with the 2022 oil price and energy industry mini boom. Then, the global economy was rebounding from the Covid-19 economic shutdown and oil and natural gas consumption was growing rapidly along with soaring oil prices. The Russian invasion of Ukraine was also helping drive the commodity cycle talk.

Energy’s long-term weighting decline in the S&P 500 Index makes it nearly immaterial for helping or hurting the market’s performance.

The chart above shows the weighting of Energy in the S&P 500 Index quarterly from 1979 to 2023, with the last data point being February’s weighting. We have listed the respective spikes in weighting reflecting periodic energy booms that drove investment activity. What the chart demonstrates is how the energy sector has seen its weighting fall from the 20 percent range in the 1970s and 1980s to low single-digits now. There was a revival in the early 2000s when China’s oil consumption outstripped its production and imports soared. China was undertaking a significant industrial expansion along with infrastructure modernization in preparation for the upcoming 2008 Summer Olympics.

The decision to award the Olympics to China was made on July 13, 2001, which marked the start of this growth spurt and oil consumption lift-off. At the time of the announcement, WTI was $26.59 a barrel. Prices continued to slide throughout 2001 reaching the low-$20s. A year later, WTI finally returned to the 2001 price, but the price horse was about to run. Almost exactly seven years after the Olympics announcement (2008) WTI peaked at slightly above $145 a barrel. That was just as the Global Financial Crisis emerged sending economies and financial institutions into tailspins that ended with a global recession and massive government rescue efforts.

You will notice in the chart that Energy’s weighting had recovered from its low in 2004 driven by rising oil prices and global oil consumption growth. The sector established an interim peak in June 2008 but soon began what turned out to be a long-term decline. The financial crisis and subsequent recession cut oil demand. During the ensuing economic recovery, oil demand recovered which pushed oil prices up as weak oil prices and unprofitable exploitation of U.S. shale basins challenged production growth. The rise in oil prices drove a brief Energy sector recovery which collapsed at the end of 2014 when Saudi Arabia abandoned its policy of supporting the OPEC marker price.

Beginning in the first half of 2022, Energy’s weighting increased. It peaked at the end of the year. The weighting declined somewhat but then oil prices began to retreat in the face of the continued absence of Chinese consumption. Today’s Energy weighting is higher than the 2020-2021 average, but it remains about half of the 2016 weighting.

Energy’s weighting dilemma may reflect the dominance of the stock market by technology stocks. It is reminiscent of the one-decision Nifty 50 stocks in the 1960s. Energy is also suffering from the lingering fear that managements will soon begin spending wildly to grow production only to cause oil prices to drop and profitability to evaporate.

More time to demonstrate financial discipline coupled with a shock to the stock market that knocks down technology stock valuations could improve Energy’s stock market position. A potential uptick in inflation could drive a serious investor reassessment of Energy’s value. Energy companies have become strong cash flow generators. Having de-levered balance sheets, they are becoming excellent sources of dividends and return of capital vehicles by buying back their shares. We doubt all these conditions will emerge anytime soon, but they are the ingredients that would lead to a higher sector weight in the S&P 500, which would further help propel energy stock prices up. Did February’s performance mark the start of Energy’s investment renaissance?