Energy Musings - March 31, 2025

The IEA has declared The Age of Electricity after consumption soared last year. The agency expects the growth to continue for the next two years. Natural gas is key to meeting this growth.

Natural Gas And The Energy Revolution

In a world with an increasingly urgent need for more energy, natural gas will play a crucial role. The International Energy Agency (IEA) just published its Global Energy Review 2025. The first two lines from the Key Findings of the report highlight the new era for energy. “Global energy demand grew by 2.2% in 2024 – faster than the average rate over the past decade. Demand for all fuels and technologies expanded in 2024.”

The key driver of increased energy demand was the explosive growth in electricity consumption. It rose by 4.3% last year, much more than the 2.3% increase in 2023. Moreover, it grew at a rate 33% faster than global GDP, which increased 3.2% in 2024. The IEA cited “record temperatures, electrification, and digitalization” as the principal reasons for electricity’s rapid growth. The trumpet that 2024 was the warmest year on record, driving the need for more air conditioning.

The agency explained that global electricity consumption increased by nearly 1,100 terawatt-hours (TWh), which was more than twice the average annual increase over the past decade. The increase exceeds Japan’s annual consumption. Moreover, 2024 marked the largest one-year increase ever, outside of recession rebound years for the global economy. The growth was widespread, encompassing China, emerging economies, and advanced economies. The chart below presents the IEA regional electricity growth data from its report but shown on a uniform scale as redrawn by Robert Pielke, Jr. We also note that no data is shown for Africa or South America.

China dominates the global growth in electricity.

The chart highlights China’s role in the growth of the global electricity market. It accounted for over half of the world’s electricity growth last year. China operates a command economy and is encouraging its people to adopt electric vehicles in furtherance of its goal to dominate the global market.

This dynamic of global electricity demand growth has been recognized and acknowledged by the IEA, which issued a report in February titled “The Age of Electricity.” It predicted that consumption would soar through 2027, driven by the electrification of buildings for cooling and data centers, as well as the increasing use of electricity for electric vehicles and industrial processes. While 2024’s increase was a record, the IEA expects growth to continue at nearly 4% per year for 2026 and 2027. That projection brings the 2024-2027 additional electricity consumption total to 3,500 TWh, equivalent to a Japan-sized increase each year. One wonders what the IEA thinks the growth rate beyond 2027 will be, as that is important for utility planning – not only in terms of the amount of generation needed but also in determining which fuels will be required.

The IEA continues to promote the idea that the world must transition away from burning hydrocarbon fuels and to renewable energy to save the planet from overheating. Consistent with this message, it noted that 80% of 2024’s electricity generation growth was satisfied by wind, solar, and nuclear power. Combined, these three power sources supplied 40% of the total power consumed, with nuclear accounting for 8% and wind and solar energy making up the balance.

While we can only speculate, the IEA probably assumes the growth in electricity demand will slow after 2027. Such a forecast would be similar to the agency’s repeated projections of a peak in global coal use. The announced plans by technology companies for new data centers globally, combined with the IEA’s optimistic forecasts for electrifying transportation, should serve as a warning that any slowing in the growth rate for electricity will be modest in the near term.

The surge in electricity is upending the narrative about energy and the energy transition. In a revealing February confession by Gregor Macdonald, an energy-transition promoter, he wrote, “China reflects the problem best, currently, in that despite very aggressive growth of wind and solar, total power systems demand growth keeps overwhelming the effort.” What? We thought China was leading the global push into renewable energy.

Macdonald wrestled with the reality of the energy transition as seen through the lens of global electricity. “So, what does it say that the easiest system [global electricity] to decarbonize continues to see fossil fuel growth?” he wondered. This is incredibly discouraging for an energy transitionist who now sees “the easiest system to decarbonize” suddenly experiencing surging growth after years of nominal increases, creating a dilemma for how to generate the needed electricity. Many electricity experts are projecting that this power surge will continue for years, well beyond the IEA’s 2027 horizon. If you can’t decarbonize the electricity system, what are your hopes for transitioning systems such as transportation?

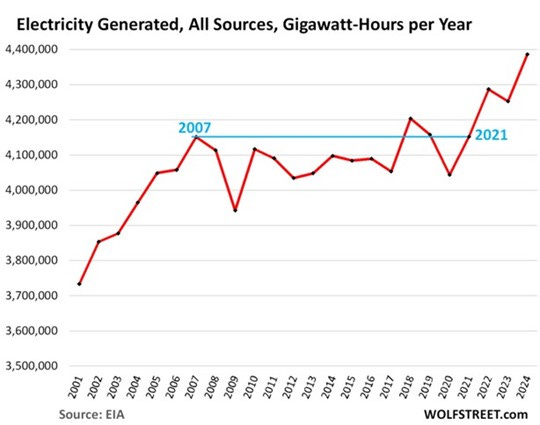

Two charts of the U.S. electricity market highlight the new era of electricity and its associated challenges. For 14 years, electricity generated was essentially flat, only to surge in 2022 and 2024. The recent growth is similar to the surge in electricity generated between 2001 and 2007, an era of surging economic growth.

The U.S. electricity market has experienced a sudden surge.

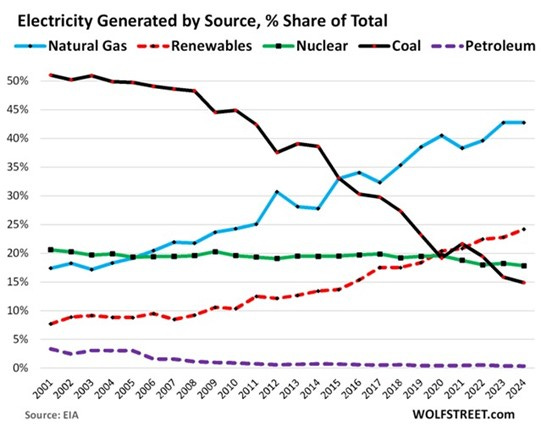

At the same time, while renewables have experienced sharp growth in recent years, natural gas has grown at an even faster pace. The primary loser has been coal, which explains why the U.S. continues to make progress in reducing its carbon emissions.

Coal’s share of U.S. electricity continues to decline.

Due to the dependency of renewable energy on fickle Mother Nature, dispatchable natural gas is likely to continue holding—and potentially increase—its share of electricity generated. Temporarily, cheaper coal is gaining market share from natural gas, as gas prices recently have doubled. That will be temporary.

Fortunately, the United States is endowed with vast natural gas resources. Exploiting those resources enabled us to meet the growing domestic demand for gas while becoming the world’s largest exporter of liquefied natural gas, all while sending gas prices to historically low levels. Higher gas prices, with less governmental hindrance, will spur more output, thereby dampening any extended rise in gas prices.

U.S. LNG exports have grown from 2016 to 2024.

That reality was withheld from the American public by the previous Secretary of Energy, Jennifer Granholm. Trump administration officials discovered that Granholm, in support of the Biden administration’s promotion of renewable energy over fossil fuels, buried the LNG report until an “updated” version with the “correct” conclusion could be written. Biden paused the approval of any new LNG export terminals pending the completion of the updated study on the potential harm increased LNG exports would bring to domestic gas consumers. This entire effort was a charade because the study had already been written. However, it had the wrong conclusion.

Fortunately, we have Shell’s recent global LNG outlook report, which provides a realistic view of the industry’s supply and demand dynamics, to set the record straight. The industry’s dynamics can be summarized in two key conclusions from the study.

“LNG enables lower emissions in hard-to-electrify sectors and paves the way for net-zero emissions.”

“With rising global demand, LNG is a fuel of choice to ensure energy system resilience.”

LNG is increasingly being used for maritime and road transportation because it can reduce emissions. It is also being counted on by technology companies that are increasing their use of artificial intelligence and power-hungry data centers. In the long term, the existing global LNG infrastructure may facilitate the importation of bio-LNG or synthetic LNG and potentially be repurposed for handling green hydrogen.

Growth plans in China, India, and other Southeast Asia nations drive Shell’s confidence in rising global demand. Europe and Japan will need to import LNG to close the widening gap between their plans for energy diversification and investment levels. Given these industry dynamics, Shell foresees 170 million tons of new LNG supply coming to market by 2030, helping to meet growing long-term global gas demand. The challenge is the uncertainty of project start-up timings.

Starting up LNG export terminals adds supply in large discrete amounts. Therefore, it is highly likely that there will be periods of supply shortages and surpluses as the ability to precisely time project start-ups is limited. Such an outlook can lead to volatile periods in LNG prices, which, in turn will impact supply and demand. Although such periods may be challenging for the industry, the long-term dynamics driving the global gas market will ultimately prevail.

More gas will enhance electric grid resiliency and ultimately lead to a reduction in coal use, which will help lower carbon emissions. In other words, more natural gas is good for the economy and the environment.