Energy Musings - March 27, 2024

The slowdown in global EV sales and China's EV companies with surplus manufacturing capacity has ignited a battle over tariffs. Battle lines are drawn. Legacy automakers are at risk.

EVs and China’s Global Ambitions

The automobile industry must figure out how to get Americans to buy their electric vehicles (EV). It is either that or face huge fines for failing to meet the Environmental Protection Agency’s new tailpipe emissions rules. The new rule for light-duty vehicle emissions starts in 2027 and the details were laid out last week.

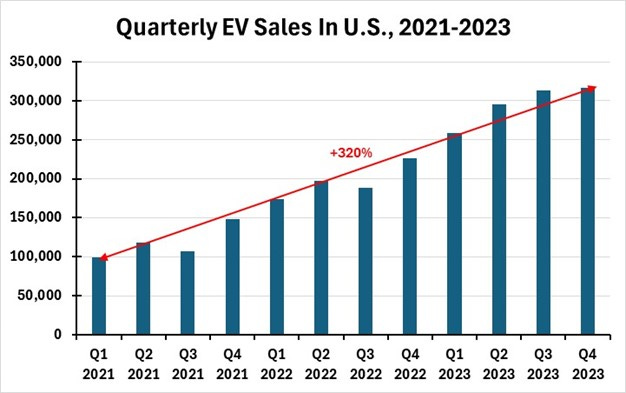

When initially proposed, the EPA rule sparked pushback from the automobile industry and others associated with the industry for being too harsh and unrealistic. The EPA noted, at the time, that to comply 67% of new vehicle sales by 2032 would have to be EVs. That is a gargantuan market share increase. For 4Q2023, according to data from Cox Automotive, EVs represented 8.1% of new car sales. For all of 2023, EVs averaged a 7.6% market share, which was a meaningful increase from the 5.9% share in 2022. However, the increase dictated by the EPA rule means a roughly 600 basis point increase over nine years. If the industry just sustained the 2.2 percentage point increase it experienced in 2022-2023, by 2032 the EV market share would reach only 27.9%, less than half the required increase.

Quarterly EV sales showed slowing growth as we moved through 2023.

What does attaining the EPA’s target mean in industry terms? As annual domestic auto sales average about 17 million units, meeting the EPA’s goal requires a 10-fold output increase from last year’s sales. It will require huge auto industry investments in new assembly plants, building battery plants, and training workers. For batteries, the challenges include discovering deposits of the critical minerals used in their manufacture. These minerals include cobalt, graphite, lithium, manganese, nickel, and copper. Most of these resources are found outside of North America. But even if they are found here, gaining access to them is difficult, if not impossible. Environmental activists cheered when the Department of the Interior revoked the licenses for a planned copper-nickel mine in Minnesota.

Not only will finding new critical EV minerals be difficult, but new processing facilities will need to be constructed along with developing new supply chains. None of these actions will be easy, quick, or cheap. The challenges will further hobble EV growth.

The United States is late to the global EV party and its efforts to catch up are running into resistance to the chagrin of politicians pushing the green revolution. In the U.S., EV sales have been targeting the luxury car market where the wealthy can afford expensive vehicles and more people motivated to be known as “first movers” reside. Not only does this population segment have the financial wherewithal to purchase EVs, but they also have a home or homes where private charging systems can be installed.

However, nationally the U.S. has a woefully underdeveloped public EV charging network. That forces potential EV buyers to rely on limited and more costly recharging options, making them question buying EVs. Moreover, EVs are expensive and have a limited driving range, which often necessitates greater planning of trips and dealing with the frustration of out-of-service, broken, and balky public charging stations.

More recently, we have learned how costly EVs are to insure and that they are expensive to repair compared to internal combustion engine vehicles. There have been many articles highlighting how much more EVs cost to insure, but some of the observations were based on anecdotal evidence and averages that included the costliest vehicles – Teslas. A recent article and study by MoneyGeek.com said the following about the insurance cost issue:

“Insuring electric vehicles now costs roughly the same as conventional gas-powered cars, with annual premiums for each averaging $1,607 and $1,606, respectively. This is a significant change from just two years ago when EVs were 15% more expensive to insure.”

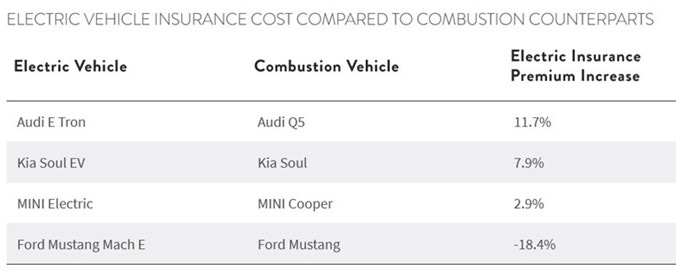

The study also noted that where there were comparable EV and ECE models, the EV model cost more to insure. The range was 3% to 12%. They did note that the Ford Mustang Mach E was 18% less costly to insure than the regular Mustang model.

Comparable EV and ICE models show EVs to be somewhat more expensive to insure.

Keep reading with a 7-day free trial

Subscribe to Energy Musings to keep reading this post and get 7 days of free access to the full post archives.