Energy Musings - March 24, 2025

Two analyses of wind power highlight fundamental and overlooked issues that impact its competitiveness. At the same time, the IEA has announced it is reversing its anti-oil and gas policy.

Wind Power To The Rescue?

Wind energy is among the darlings in the great push for net zero emissions to fight climate change. Wind and solar are seen as the best options for low-carbon fuels to replace hydrocarbon energy. Their problem is that they depend on a fickle Mother Nature who often teases us with more and less of these fuels and frequently none when humans need power the most – at night. That necessitates using batteries as backup power sources, even though they are environmentally destructive and typically can only provide power for four hours, which is insufficient for a whole night of power.

Given the wind and solar intermittency, grid operators, who ensure electricity for customers every minute of every hour of every day, turn to fossil fuel power to carry the load when renewables fail to deliver. This solution is costly for ratepayers who bear the financial burden of a second power system, which also tends to be less clean. With the backup power system, ratepayers are more assured of reliable power, which they value more highly than clean power. To ensure reliable power, ratepayers must compromise over the third demand of their power system - affordability.

After years of pushing for net zero and renewables as the answer for power systems, the International Energy Agency (IEA) has suddenly discovered the need to prioritize reliable power over all other concerns. At the CERAWeek energy conference, IEA head Fatih Borel told the energy executives, “I want to make it clear…there would be a need for investment, especially to address the decline in existing fields.” He was more emphatic when he stated, “There is a need for oil and gas upstream investments, full stop.”

Wow! Birol has suddenly gained religion about the importance of oil and gas. This view contrasts sharply with his organization’s claim in 2021 that oil and gas companies should not invest in new coal, oil, and gas projects if the world wants to reach net zero emissions by mid-century to fight climate change. Having cajoled the world into believing it was necessary to abandon hydrocarbon energy to combat climate change, suddenly, the IEA is reversing its policy. From climate dictating our power supply, the reliability of power systems is now of supreme importance.

Governments worldwide adhered to the IEA’s direction and closed their electricity plants powered by hydrocarbons. They loaded up on renewable energy sources, even amid intermittency challenges. Now, they must consider restarting some retired plants, especially nuclear-powered ones, as a short-term solution to the reliability issue.

The social backlash from rising electricity costs as expensive renewable energy solutions were foisted on their grids has alarmed politicians. A less reliable electricity grid is not what the public wants. Nor do they want a costly power system. More importantly, they do not want to be directed as to which forms of energy they have to use to enhance their everyday lives. Outlawing natural gas-fired stoves, oil and gas furnaces to heat their homes, and internal combustion vehicles for transportation has raised the cost of living and often denigrated the quality of their daily lives. The public is not happy.

Along with the sudden “new religion” of the IEA, we found two interesting items that deal directly with problems of the renewable transition. The first issue was laid out by Rob West, analyst and CEO of Thunder Said Energy. West’s data-driven energy analysis and consulting firm is based in Tallinn, Estonia. He produces a daily energy analysis email promoting his firm’s research studies. Even without purchasing the studies, he provides enough information and charts to give a reader a broad understanding of the issue being analyzed.

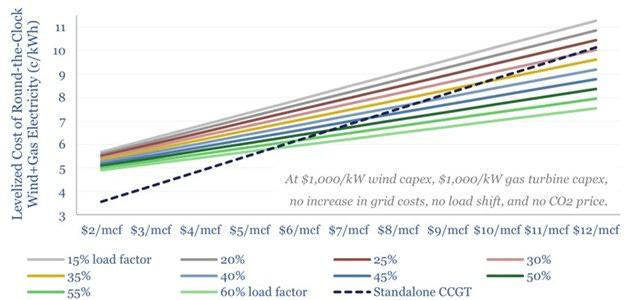

A recent email posed the following question: “Which is more economical for powering a new 100MW load, such as an AI data center: 100MW of onshore wind with a 100MW backup gas turbine for non-windy moments; or a standalone CCGT running at 80% utilization?”

West concludes that the answer depends on natural gas prices and wind turbine load factors. These variables are also impacted by where the analysis is done worldwide. In the U.S., standalone natural gas power plants are more economical because of the low fuel price. In Europe, a combination of wind and natural gas starts to become more economical than a standalone combined cycle gas turbine (CCGT) plant when long-term natural gas prices are above $9 per thousand cubic feet (mcf) and the wind turbine’s capacity factor is in the 35% to 40% range. The capacity factor, load, measures how much power a wind turbine produces compared to its theoretical 100% output.

Gas prices and wind turbine capacities dictate the winner.

The competitive sensitivity is shown in West’s chart, which plots natural gas prices from $2/mcf to $12/mcf along the horizontal axis. The colored lines reflect the various wind turbine capacity factors ranging from 15% to 60%. Where these lines cross the black dotted line shows the point at which both technologies – gas plus wind and CCGT - are equally cost-efficient.

What is interesting is learning that wind turbine capacity factors in Europe have averaged 25% in recent years. Such a low capacity factor means the wind plus gas combination can only be competitive at $12/mcf. In West’s opinion, “on average, it is hard to argue that wind is deflationary.” This is a serious knock on the renewable energy movement.

West offered several qualifiers to his analysis. First, adding a $50/ton CO2 price to natural gas improves the crossover point for the wind and gas combination. It outcompetes the standalone gas plant by about eight percentage points of capacity factor. Still, the tax shifts all the lines in the chart up by 1-2 cents per kilowatt-hour (the vertical axis), which is also inflationary.

His second qualification is that there are selected geographies where wind turbine capacity factors are consistently higher than experienced throughout the rest of Europe. He cites locations such as parts of Scotland, Norway, Portugal, and Australia, where capacity factors average 35%-40%. Parts of Brazil have 50% capacity factors. This regionalism is seldom considered when analysts create models to tell the world how renewable energy can displace hydrocarbon energy.

Our second item of interest came from a monthly webinar by Norway’s energy consulting firm, Esgian's offshore wind research team. They have hourly data on the power output of the 83 operating offshore wind farms. This allows them to track the capacity factors of each wind farm over time.

One issue the Esgian researchers were interested in studying was the common belief that larger offshore wind turbines lead to higher capacity factors. What they have found is that as the industry moved from wind turbines of 4 megawatts (MW) to 6 MW, the capacity factors rose. However, going from 6 MW to 8 MW turbines has seen a stagnant capacity factor in the 40% range. The industry now has a handful of 9.5 MW wind turbines, but the performance of the wind farms has seen capacity factors plummet to 31%. This data prompted Esgian to look deeper into the issues of each of the three wind farms using these larger wind turbines. Only one has performed in line with the 40% capacity factor. Another wind farm is experiencing problems with its export cable, while the last was subject to significant curtailment issues. That is when wind farms produce too much power for the grid to take, forcing it to shut down the wind turbines. In Europe, these wind farms are paid for their power output when curtailed, helping them meet their financial commitments.

Based on what the analysts learned about the problems of these large wind turbine farms, they researched their database and discovered one-third of offshore wind farms have export cable issues. This suggests a potentially significant performance risk that is not adequately understood or addressed when offshore wind projects are proposed.

To demonstrate the significance of the export cable problem, Esgian calculated that a six-month outage for a wind farm could reduce its lifetime power output by one percent. That becomes a significant financial consideration since wind farms are paid for the power they deliver. In many locations, that price is supplemented by subsidy payments for each kilowatt-hour of power delivered. For projects that are financed with substantial debt to boost the traditionally low return on investment of wind farms, losing such an amount of lifetime output could be financially crippling.

The analysts were asked a series of questions about their data and conclusions. One question was whether the capacity factor stagnation when wind turbines increased from 6 MW to 8 MW was due to export cable issues. They answered that the lack of improvement was not always due to export cable issues, but it did play a role. It appears, however, that despite the physics of larger turbines, 8 MW turbines haven’t performed as projected. They cautioned that these larger turbines have not been operating as long as the smaller ones, so that capacity factors may improve over time.

With changing sentiment about the energy transition exemplified by the shift in the IEA’s policies, the issues highlighted in these two analyses point to economics and performance reality becoming more critical in influencing the use of renewables. We have spent the past few years discussing how renewable generating capacity dominates the grid’s installations. Those days may end with the discussion shifting to whether we are installing enough hydrocarbon (dispatchable) power. That would usher a more favorable view of the oil and gas industry.