Energy Musings - March 20, 2025

We are updating our last Energy Musings for additional information we learned about the Chinese involvement in the offshore wind industry. This just adds some additional color to the discussion.

Update On Offshore Wind National Security Risk

Readers know our most recent Energy Musings article, “New Offshore Wind National Defense Risk” (March 17, 2025), discussed a security warning from the German Institute for Defense and Strategic Studies (GIDS). The think-tank was responding to a request from the German defense ministry about possible risks posed by using Chinese offshore wind turbines in German wind farms, which are currently planned. The report was viewed by POLITICO, which reported the report’s conclusions.

The risks GIDS identified were the ability of Chinese wind turbines to be controlled remotely and shut down, depriving Germany of electricity. It was also noted that these turbines could have radar monitoring, allowing the Chinese to track the movement of naval ships. Both issues put Germany’s national security at risk. It could also risk the European Union’s security and compromise NATO’s capabilities.

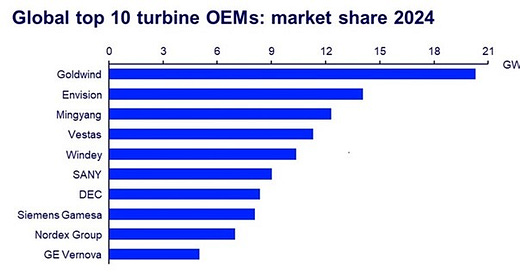

Since publishing our article, we have learned two other interesting points about China’s involvement in wind energy. First, consultant Wood Mackenzie released a report showing the global market shares of the top 10 wind turbine manufacturers. The report covers both onshore and offshore wind turbine markets.

The report shows that Chinese wind turbine manufacturers are among the top three suppliers in the market share, with about 46 gigawatts of capacity installed. That is roughly 44% of the market share of the top ten manufacturers and 34% of the global market. You will note in the chart below that in China’s home market and that of neighboring Vietnam, Wood Mackenzie uses a different measure than in the rest of the world. The capacity installed is measured based on Wood Mackenzie’s analysis of grid-connected capacity.

The Chinese manufacturers' dominance was helped by a local market that grew 12% last year. China installed 80 GW of capacity in 2024, representing 60% of the world market. The international wind turbine installation market declined 9% last year.

China dominates the global wind turbine market.

Image: Wood Mackenzie. Note: Wood Mackenzie bases its analysis on grid-connected capacity in all wind markets except China and Vietnam.

The first three companies in the list are Chinese, as are numbers five through seven. European companies are the fourth, eighth, and ninth. GE Vernova, as number 10, is the only American wind turbine manufacturer in the top 10. Given its performance and financial problems, plus its rapidly growing turbine business, GE Vernova has signaled it might exit the offshore wind turbine manufacturing business, leaving it to compete only in the onshore wind market.

For people who forgot, GE Vernova supplied the wind turbines and blades for the Vineyard Wind farm. In July, one of the blades broke with debris falling into the ocean. For days, the blade debris washed up on the beaches of nearby Nantucket and then the other islands and the coasts of Massachusetts, Rhode Island, Connecticut, and New York. An investigation showed that GE Vernova’s blade was never properly tested because it was too large for the testing facility. Furthermore, the plant covered up the defects in the blades. All the blades from that plant were ordered to be removed and replaced by ones from the company’s French plant. The accident led to an extended delay in the construction of Vineyard Wind, adding to its cost and losses for GE Vernova. The company eventually shut down the Canadian plant and laid off workers at the French plant.

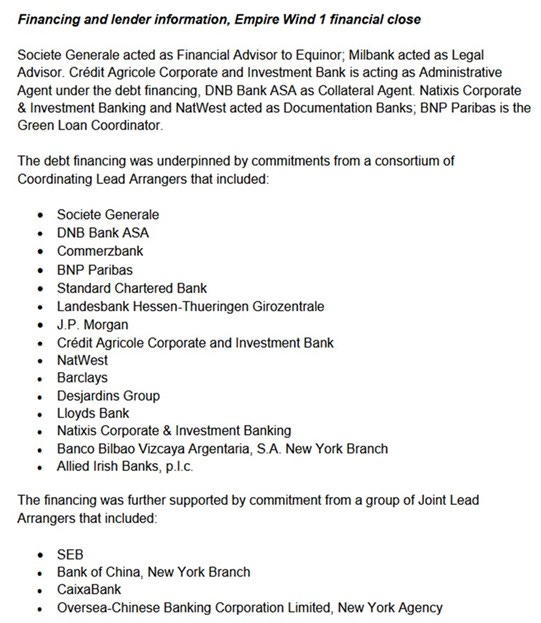

The second thing we learned about was the involvement of Chinese lenders in the Empire Wind 1 project.

In June 2024, Norwegian developer Equinor signed a power purchase agreement (PPA) for the Empire Wind 1 power with the New York State Energy Research and Development Authority (NYSERDA) for $155.00/MW for 25 years. Empire Wind 1 was one of four offshore wind projects that had previously signed lower-priced PPAs that requested increases because they needed more income to secure project financing.

Empire Wind 1 had agreed to a PPA price of $118.38/MW. It requested an increase to $159.64/MW, 35% higher. The NYSERDA agreed to the slightly lower PPA, meaning only a 31% rate hike.

Empire Wind 1’s electricity cost will be 15.5 cents per kilowatt-hour (kWh). At the time of the revised PPA, the NYSERDA stated the higher price translated into a doubling of the monthly cost for New York electricity customers. The agency suggested New York customer average monthly bills would increase by $2 compared to their previous estimate of 73 cents.

The Energy Information Administration database shows the average December 2024 New York retail electricity price was 19.82 cents/kWh, while the average residential price was 24.70 cents/kWh. Those are the delivered prices, for which the actual power cost is about 30% of the customer price. This rule-of-thumb estimate makes the Empire Wind 1 delivered cost 22.14 cents/kWh.

However, offshore wind projects have the additional cost of transmitting the power from the offshore turbines to a substation onshore. The underwater cables used are expensive and costly to install. They cost substantially more than traditional overhead transmission lines. Therefore, the 30% rule may be inaccurate, making the power cost a smaller share of a higher final delivered cost. That is why the NYSERDA suggested such a high increase in the cost to customers.

We also learned of the institutions financing the 810 megawatt (MW), 54-turbine Empire Wind 1 project located in the New York Bight waters, 15-30 miles south of Long Island and directly in the navigation lanes for ships entering New York Harbor. The power will be cabled to Brooklyn for use in the New York City grid.

In early January, when Equinor announced the closing of its financing for Empire Wind 1, the list on its website shows two Chinese institutions involved. Most of the institutions are from Europe, which is home to Equinor. We wonder whether having Chinese institutions engaged in such projects is wise.

Two Chinese lenders helped finance Empire Wind 1.

Empire Wind 1 is using 15-MW turbines from Danish manufacturer Vestas. This removes the risk of Chinese turbines creating a national security risk. Because the Chinese institutions played a small part in Empire Wind 1’s financing, we suspect they had no leverage to push Equinor into purchasing Chinese turbines. But we continue to wonder about using Chinese lenders who might influence purchasing decisions.