Energy Musings - March 20, 2024

An anti-fossil fuel op-ed as CERAWeek opened called for the Greater Houston Partnership to abandon hydrogen and CCSU as failed technologies. It is responding to the subsidies being paid.

Contrary To Doomsayers, Houston Energy Has A Future

An op-ed in Monday’s Houston Chronicle as CERAWeek opened attacks oil company CEOs and Houston business leaders for defending a “declining industry.” Climate activists’ favorite attack line was in the opening paragraph: “Big Oil’s decline is an existential crisis for our region.” Op-ed author, Randall Morton, worries that the region’s “economic development leaders at the Greater Houston Partnership are doubling down on this declining industry.”

The risky GHP strategy is its focus on two technologies in its Energy Transition Initiative – hydrogen and carbon capture. Morton says these are failed technologies. However, he misses a critical point. These technologies are less about betting on “fading fossil fuels” than they are decisions to suck on the federal teat – subsidies. That reality was acknowledged by Energy Secretary Jenifer Granholm in her CERAWeek talk when she told the audience, “Many of you are taking advantage of those irresistible tax credits. Good!”

Changing human behavior, which is what subsidies are designed to accomplish, apparently doesn’t sway Morton. Maybe he wants even more government money for his favorite technologies but he never tells us what those might be.

There seemed to be no shortage of taxpayer money being thrown at green energy technologies based on the legislation passed in 2021 and 2022. First, there was the Infrastructure Investment and Jobs Act of 2021, then it was the Inflation Reduction Act of 2022. The former included a laundry list of favorite climate investments to help localities deal with the clean energy transition including $7.5 billion for electric vehicle charging stations, $5 billion for zero-emission and clean buses, $2.5 billion for clean ferries, and $65 billion for clean energy transmission.

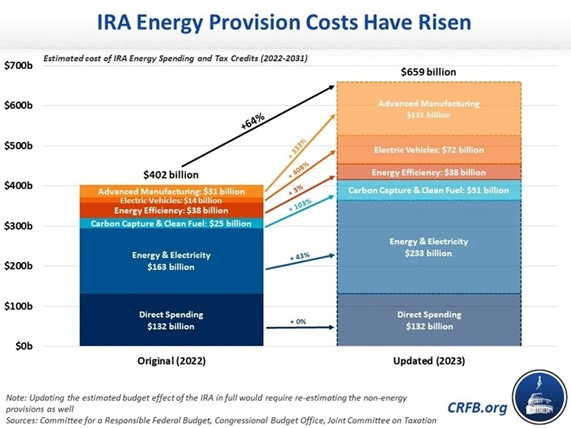

The most irresponsibly named IRA bill was a trove of subsidies and tax credits for clean energy. The Congressional Budget Office at the time of its passage estimated the bill to cost $391 billion between 2022 and 2031. An analysis by investment firm Goldman Sachs put the cost at $1.2 trillion while a money manager estimated it at $1.4 trillion. Even the CBO has upped its initial cost estimate to $660 billion through 2031 and increased it to $786 billion for 2024-2033. Many of these subsidies, which originally had time limits, have had them removed allowing subsidies for the life of projects further bloating the cost of the bill.

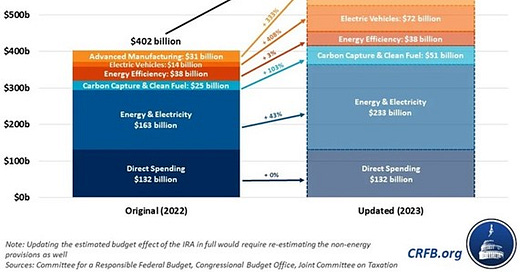

The Committee for a Responsible Federal Budget wrote about the CBO’s revised estimates. They included two charts that dramatically show how much the various categories of spending are projected to increase and how those spending categories will spread over the forecast periods.

The Inflation Reduction Act conservatively has increased by nearly two-thirds since it was enacted in 2022.

You will note the magnitude of the spending increases. They will be even greater according to Goldman Sachs. For categories of green energy spending like electric vehicles, energy efficiency, and carbon capture & clean fuel, they will be much greater in 2031 and 2033.

Many of the subsidies in the IRA will continue for well after the 10-year cost assessment period inflating the overall cost of the bill.

In the world of industrial policy, which the Biden administration is engaged in, the question becomes should one reject the government’s free money? For Morton, no one should succumb to the siren song of subsidies, even if they were enacted to prompt these specific investments. Shunning the subsidies would open companies and CEOs to attacks from activists and politicians for not being patriotic and supporting the government’s effort to solve the existential climate crisis. And they could be slammed by shareholders for accelerating their company sunsets.

Do we need a clean energy industry? How about one that depends on government handouts forever? Yes, if you ascribe to the climate disaster mantra. How many years do we have before the world ends? This fear is what is driving the shoveling of taxpayer money into corporate coffers as long as they make the “correct” investments. Does anyone consider letting market forces drive technology development?

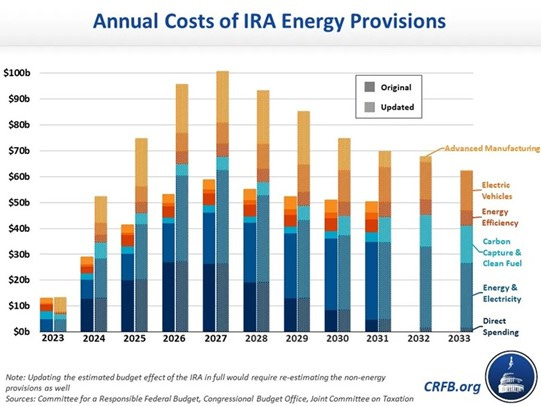

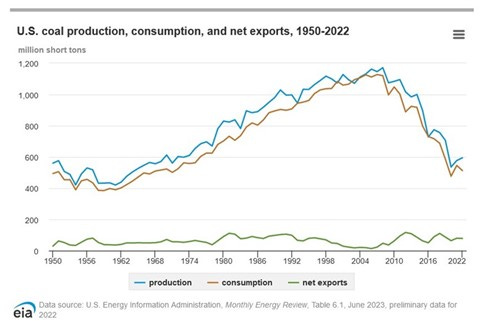

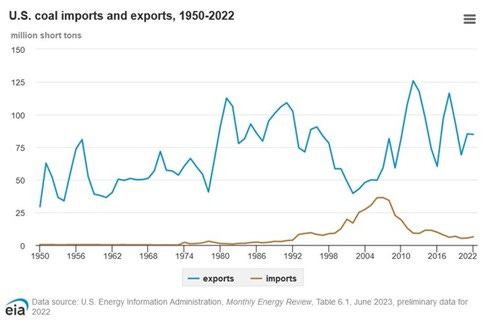

We were surprised at some of the claims Morton made. He tried to link Big Oil to King Coal. He was using the decline in U.S. coal production and the reduction in coal employment as the lesson for oil’s future. Our coal production has declined as shown in the chart below, but as you can see in the second chart, our coal exports are up and we continue to import coal at about the same level as we did in the late 1990s. Coal’s decline was because we are blessed with huge natural gas resources that create less pollution.

Our coal use is down due to soaring natural gas production and lower cost to generate electricity.

Coal exports continue growing and our imports are up as global coal markets are posting annual records with no end in sight.

Coal production and consumption peaked when natural gas became cheaper for generating electricity. That came from the oil and gas industry’s ability to exploit our shale gas resources. This resulted from the application of technology perfected by the oil and gas industry. Without the surge in gas output, we would be using substantially more coal, and our emissions would be higher rather than lower. Moreover, we would not have created the jobs associated with natural gas drilling and the LNG export industry. Amazingly, in 2022, 20% of our electricity still came from coal-fired power plants. This is after a nearly 325-year history of U.S. coal usage.

While our coal industry has declined, the world coal industry is posting output records. It is projected to continue as China, India, and other Asian countries continue expanding their fleets of coal-fired power plants. Their use of coal, even as they invest heavily in clean energy technologies, is because it is the cheapest energy to power their economies, it creates jobs, and it ensures electricity capacity is available when needed.

Morton claims the oil industry is trapped in a death spiral like the coal industry. For him, electric vehicles and renewable power are driving the death spiral. He quotes The Rocky Mountain Institute saying that EV sales put “at risk nearly half of oil demand” by 2030. That sounds ominous. However, neither of the two major climate alarmist organizations – BloombergNEF and the International Energy Agency – see such an outcome.

BloombergNEF optimistically sees road transportation use peaking in 2027 (left-hand chart), but as the right-hand chart shows the plateau lasts a few years before slowly declining. It is still at 20 million barrels a day in 2050 under its Economic Transition Scenario, nearly 50% of 2021’s consumption.

BloombergNEF sees oil demand peaking by 2030 but the road fuel decline doesn’t become meaningful until the mid-2030s.

It is interesting that the U.S. Energy Information Administration’s March 2024 Short-Term Energy Outlook projects gasoline consumption growing in 2024 and barely declining in 2025. Vehicle miles traveled will continue growing in both years, but vehicle efficiency (average miles per gallon) is growing rapidly limiting consumption growth.

Yes, EVs play a role, but they only represent a small share of the U.S. vehicle fleet. Full-electric vehicles (BEV) represent three million of the 289 million vehicle fleet. Hard to see that share growing to 50% by 2030.

The latest EV statistics suggest they are having a minimal impact on U.S. gasoline demand as the ICE vehicle fleet is growing faster.

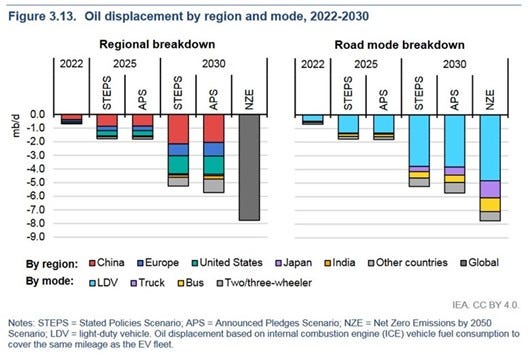

The most recent International Energy Agency report on EVs and their impact on global oil use offers no support for RMI’s claim. Under the IEA’s various climate scenarios, the Net Zero Emissions by 2050 model shows only a 7.5% reduction in global oil consumption in 2030.

The IEA sees at most a 7.5% reduction in oil use with EV fleet growth in the most extreme Net Zero Emissions scenario.

How many years have we listened to the climate activists predict the demise of the internal combustion engine vehicle? More than we care to count. In Chicago last January, we saw the problem with BEVs in cold weather – they don’t hold their charge and often cannot be recharged if the temperatures are too low. It’s great to have a vehicle, but it is of little use if it can’t drive it.

When talking about natural gas, Morton embraced the BloombergNEF claim that wind and solar are now “the cheapest new-build technologies to produce electricity in countries covering 82% of global electricity generation.” These claims are based on the levelized cost of electricity (LCOE) measure that is ripe with distortions in its calculations. Pick the right set of assumptions about capital cost, capacity output, repair and maintenance costs, and ignore their short service lives, the need for increased transmission investment, and maintaining backup power for wind and solar part-time output and you make these renewables look cheap.

The capital cost for distributed solar power is 50% greater than for a combined-cycle gas turbine generator. Onshore wind needs twice as much capital as gas. Both wind and solar require substantially more land mass than a gas plant. These are real issues that result in wind and solar generating extremely low returns on energy investment compared to natural gas plants. Their low capacity output and non-dispatchable power results in having to overbuild the nameplate capacity of projects, upping their cost to electricity consumers. Morton ignores all these issues but buys into the BloombergNEF conclusion.

There is no question, Houston’s economy suffered during the 1980s oil industry bust. However, it wasn’t all due to oil prices. Soaring interest rates that crushed home values and people’s adjustable-rate mortgages also played a role ignored by Morton. He wants Houston to diversify away from energy, but he is worried about the outsized role energy plays in the Houston economy.

According to Dallas Federal Reserve Bank research, energy’s direct share of the Houston area’s GDP has averaged 7% over the past decade. Nondurable goods manufacturing, mostly refining and petrochemical output, accounted for 13% of GDP. Durable goods manufacturing tied to energy accounted for 3-4%, bringing total energy impact to about 25% of Houston’s GDP. There are also indirect impacts on construction, engineering, legal services, and the spending of energy employees.

As the Dallas Fed points out, the energy industry is capital-intensive. It means employment is relatively low but wages are high. They pointed out that during 2011-2020, energy accounted for about 16% of Houston’s employment but 29% of wages paid.

At a quarter of the Houston economy’s GDP, energy is certainly important but maybe not as dominant as Morton believes. There would be a hole if energy disappeared. However, while refining might be at risk in the long term, it is difficult to see it or the petrochemical industries going away because they supply much more than gasoline. A reason the region has such a huge presence is the Port of Houston which is an export hub for petroleum and petrochemical output that likely would still be needed globally.

Houston has the largest medical complex in the world and hosts numerous top-ranked medical research and educational institutions. We may no longer be the technology center of Texas, but there remains a large technology focus. The city is home to several outstanding universities. Many industries in Houston could pick up the slack if energy were to shrink.

We would also note that Houston is the fourth most populous city in the nation and is on track to becoming the third during this decade. The Greater Houston metropolitan area is the most ethnically diverse in the country. At least 145 languages are spoken by city residents and 90 nations have consular representation in the city. Some other facts include that Houston covers 655 square miles while the Houston-The Woodlands-Sugar Land Metropolitan Statistical Area spans 9,444 square miles, an area slightly smaller than Massachusetts but larger than New Jersey. Harris County’s population was the second-fastest growing in the nation in the past year.

Houston has a long and distinguished history as a driver of Texas’ growth and the globe’s most important industry. While energy may be considered the most important industry, one cannot overlook the educational, technological, and skill levels of the city’s population. Like all industries, energy will undergo a transition as the fuels to power the world shift. Contrary to the fears expressed by Randall Morton in his op-ed, I have faith that our future industry leaders will manage the transition, and the industry with all its talent will remain an important driver of the region’s economy and well-being. There will be hurdles to overcome, just as there have been throughout the region’s history. Don’t bet against Houston and energy.

Well done, Allen. My thoughts echo Kit’s. I don’t know how you come up with so much good data, but it’s worth the effort. Thanks for your work.

One look as to who BloombergNEF caters to tells you all you need to know

https://about.bnef.com/

They are part of the problem. People still believe the press offers facts… that train departed long ago.