Energy Musings - March 2, 2025

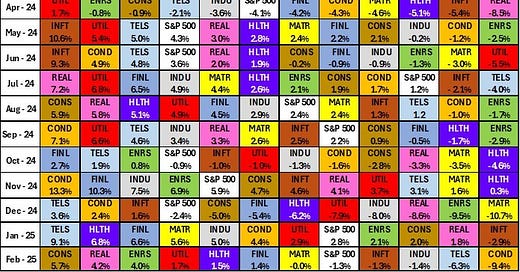

February was a good month for energy stocks as the S&P 500 Index sector posted a 4.0% gain. This was nearly twice the gain of January. Energy is now in the top of the sector rankings.

Energy Stocks Perform Well In February

The Standard & Poor’s 500 Index declined 1.3% in February as technology and consumer discretionary stocks were slammed by valuation and economic concerns. For January, the S&P 500 Index posted a 2.8% gain. Economic concerns continued pressuring crude oil prices, but the pressure only became significant in the final days of February. As a result, energy stocks still managed to post a 4.0% gain for the month. This followed the sector’s 2.1% gain in January. Year-to-date, the energy sector is in third place, only one-hundredth percent behind real estate.

The most interesting observation about the sector performance for the first two months of 2025 is that the three sectors – consumer staples, real estate, and energy – finished in the 8-10 places out of 11 in January but were the top three in February. This performance reversal suggests that investors are shifting their focus to defensive and undervalued sectors and away from high-growth and highly valued ones. We call this market rotation.

Energy stocks are back in rarified air.

By examining the changes in the energy sector ranking since May, we find it crashing but recovering to the middle of the rankings by July. It then drops to last place for two months before snapping back to a top-tier ranking. Once more, energy crashes but starts rebounding in the first months of 2025.

One wonders whether we will experience more sharp cyclical performance months given the uncertainty of the economy given potential tariffs and deteriorating business and consumer sentiment. These concerns are global; therefore, companies operating internationally might suffer from reduced revenues and higher costs, impacting their per-share earnings and stock market valuations.

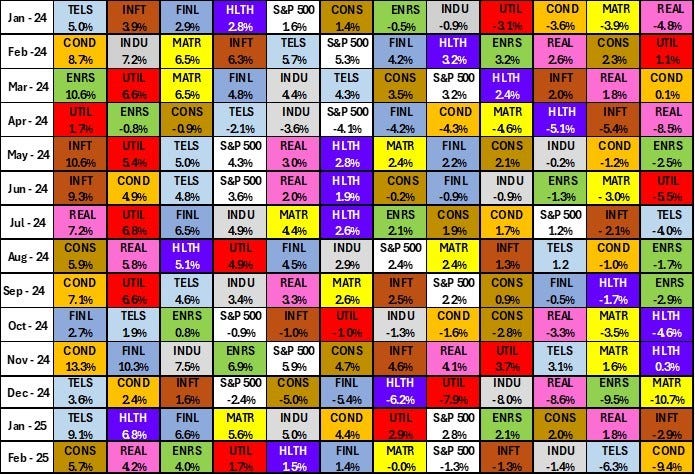

Torsten Slok, the lead economist at money manager Apollo Global Management, Inc., published a note Saturday highlighting the potential impact of tariffs and government efficiency actions on GDP, inflation, and capital spending. Five of his charts are below. He concludes that these actions will produce a modest economic stagnation shock but no recession.

Using an economic model similar to the Federal Reserve’s, the first two charts show the impact of tariffs and the Department of Government Efficiency (DOGE) cuts on the U.S. economy and inflation. Over the coming quarters, inflation will be 0.2% higher, and GDP will be 0.5% lower. Such impacts will not derail but will become a drag on the economy.

Tariffs and DOGE cuts have a modest economic impact.

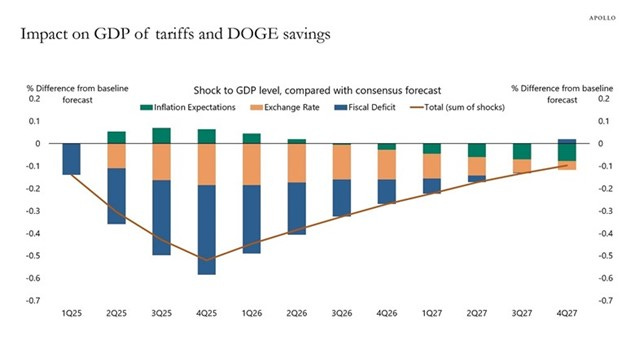

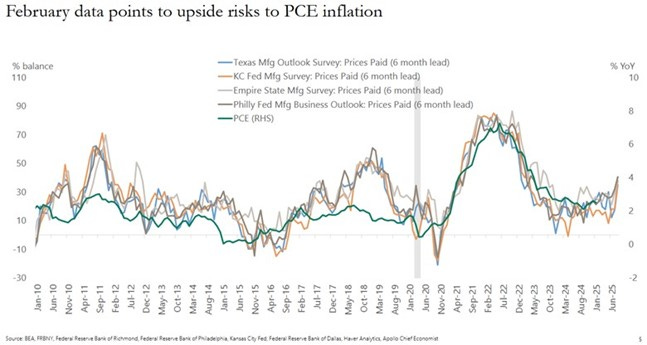

The following three charts show current data on corporate capital spending plans, business expectations for inflation, and consumer inflation expectations. Capital spending plans are being reduced, reflecting businesses becoming more cautious about the pace of future economic growth. Various surveys of manufacturer pricing expectations show an upturn, which will flow into an increase in the Federal Reserve’s favorite inflation measure, Personal Consumption Expenditures (PCE). Lastly, the consumer sentiment survey for the next 12 months shows an upturn in expectations for the inflation rate.

Each economic series shows deterioration in the most recent (February) data. Slok views the deteriorations as indicators of consumers and businesses starting to factor into their economic outlooks the impact of tariffs and DOGE cuts. Because the models of the tariffs and DOGE cuts show a modest impact and are primarily felt in the next several quarters, he is sanguine about the longer-term harm to the economy. What may not be as modest is the impact on investor expectations and the valuations of high-growth, high-tech stocks. Thus, the stock market could suffer more than the economy.

February economic expectations data shows deterioration.

While tariffs’ projected impact on the economy and inflation appears modest, their effects on energy may be more significant. Global oil prices are affected not only by economic activity and expectations but also by geopolitical developments and the policy actions of oil producers and consumers. It is impossible to forecast these actions now. Absent a collapse in oil prices, 2025 will likely be a muddle-through for energy companies.