Energy Musings - March 10, 2025

Politicians come up with a wide range of "solutions" for high electricity prices. Unfortunately, many of them haven't been investigated to know if they will work as hoped.

Everyone Is Reacting To Higher Electricity Bills

No one likes higher bills, especially critical ones like electricity. On both sides of the Atlantic, governments are working to reduce residents’ electricity bills. Each action is designed to lower future costs as well. Most actions are cosmetic since addressing the underlying cost drivers requires profoundly rethinking environmental, energy, and taxation policies. Few politicians or regulators are willing to do that. However, it is often easier to attack the companies providing the energy.

The European Scene

In the United Kingdom, the Keir Starmer Labor government, in its campaign manifesto, pledged, "We will save families hundreds of pounds on their bills, not just in the short term, but for good." It further quantified the savings, saying that bills would decline by "up to £300 ($382) by 2030." The Labor government made the fatal mistake of giving but a number and a date.

UK Energy Secretary Ed Miliband blamed high electricity bills on "our reliance on the fossil fuel markets." He said the ticket to lower monthly electricity bills was to add more renewable power, even though it receives subsidies when producers' wholesale power prices fall below the government’s guaranteed contract price. Producers are paid the difference through a Contract for Difference (CFD) arrangement, and the public pays the bill.

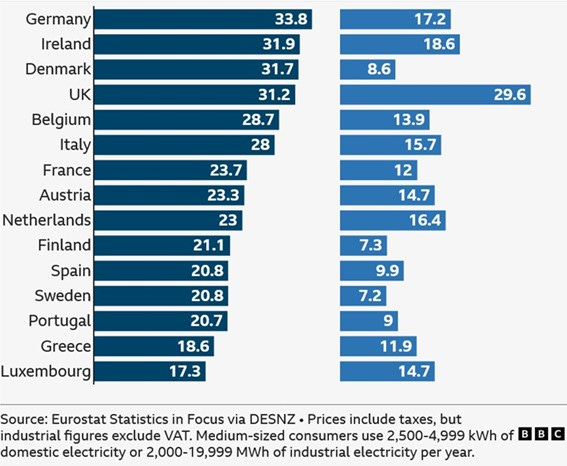

The BBC published the chart below while discussing the high cost of UK electricity. It noted that taxes were included in the residential prices on the left but not for the industrial prices on the right. They used the chart to illustrate that the UK had Europe's fourth most expensive residential electricity prices. More destructive for its economy is that its industrial electricity prices exceed Denmark, Finland, Spain, and Sweden. The UK’s high-priced industrial electricity is hollowing out its manufacturing sector.

The debilitating cost of UK electricity, in pence per kWh.

On the continent, the European Union (EU) is dealing with an unhappy public that suffers from high residential electricity prices. Those high prices are spurring growing consumer discontent with EU energy and climate policies. High industrial electricity prices are at the core of the economic problems that are befalling Germany, Belgium, Italy, and the Netherlands. Closed plants, lost jobs, and non-competitive companies further aggravate the public.

The EU announced the Affordable Energy Action Plan, which proposes short-term measures to lower energy bills for citizens, businesses, industry, and communities. These measures are in addition to connecting local electricity grids throughout the EU and better preparing them for potential energy crises. The plan addresses the three price components of electricity bills – supply, networks, and taxes.

The EU says the plan, as envisioned, will generate €45 ($47) billion in annual cost savings in 2025. Savings will increase to €130 ($137) billion annually by 2030 and €260 ($274) billion annually by 2040. Only time will tell if these savings materialize. More importantly, what happens if the savings do not happen?

In America

In the U.S., Connecticut Governor Ned Lamont (D), in his State of the State speech in January, called for the federal government to “rethink the Jones Act.” He wants changes in the law to allow foreign-built, -owned, and -crewed LNG carriers to bring cheap domestic natural gas from the Gulf of America to the East Coast. Because no U.S.-flag LNG carriers are operating, all supplemental natural gas brought to New England during the winter to fuel power generation must come from international markets. International LNG is roughly three times more expensive than domestic gas. Ouch!

New England’s Independent System Operator (ISO-NE) of the region’s electricity grid reports that natural gas supplied over 50% of the fuel to generate the region’s electricity in 2024. The share is often 75-85% during summer because supply is plentiful. In winter, many homes in New England use natural gas for heat, so that demand forces electric utilities to find other fuels to offset the loss of natural gas-generated power. They turn to coal, oil, and LNG to offset the lost pipelined natural gas supply. Many residents do not like coal and oil because they are dirty fuels. However, they hate expensive LNG more.

We will not be surprised to see a discussion about modifying or junking the Jones Act this year. It is a subject we have written about and continue to follow closely. Expensive LNG is only one Jones Act-related issue. There are national security issues, too. The challenge is determining whether the act should be revised (we do) and, if so, how.

Interestingly, we are reading a volume covering the history of U.S. maritime regulation from its founding to the enactment of the Jones Act in 1920. The history offers a perspective on maritime regulation that may eventually shape any changes to the Jones Act. We will have more to say once we finish the book.

A proposed solution for high electricity bills in neighboring Rhode Island is to cap the rate of return on equity the primary utility company, Rhode Island Energy, can earn. A new solution is to create a publicly-owned utility.

We previously wrote about the proposal to cap the allowed return on equity (ROE) to 4%, down from the 9.275% rate currently allowed by the Rhode Island Public Utilities Commission. The commissioners selected that rate as a compromise of two proposed rates – 10.1% by the local utility and 8.5% by the commission’s staff charged with representing the interest of ratepayers.

Rhode Island Energy has noted that the allowed rate is below the national average of 9.3% and in line with the rate allowed in neighboring states. In response to a request from ecoRI.com about the proposed legislation to limit the return on equity, a spokesperson for the utility emailed, “Utility ROE is not driving costs in Rhode Island; it is a small portion of an overall bill. On an average electric bill, only about $3 is utility profit while $36 covers public policy costs and taxes.” Rhode Island Energy’s tax rate is 4.1667%, almost precisely the same as the proposed cap on ROE.

As a prelude to the email, ecoRI.com researched Rhode Island’s high-cost residential electricity compared to Nebraska. They used the Energy Information Administration’s electricity database to learn that the average Rhode Island price was 28.7 cents per kilowatt-hour (kWh), while Nebraska residents paid only 12.3 cents/kWh. The Rhode Island Energy spokesperson noted that the two states have remarkably different electricity environments. Nebraska relies on coal, natural gas, and state ownership of power plants. New Englanders disdain coal power except during energy shortages in winter. They also have no experience with municipally-owned electric utilities.

The ecoRI.com reporter failed to note, likely because he knows little about electric utility regulation, that Nebraska does not have a renewable portfolio standard (RPS) like Rhode Island and the other five New England states. The RPS is part of the state’s clean energy mandate. The cost of the RPS mandate is the $36 monthly charge the Rhode Island spokesperson referenced. That cost explains a quarter of the difference between the Nebraska and Rhode Island power prices.

State Representative Megan Cotter is proposing a commission to study local ownership of power plants. Her legislative proposal would establish a commission to study microgrids and report its findings by April 16, 2026. The bill was assigned to the House Corporations Committee, but no hearing date was designated as of last week.

Cotter told ecoRI.com that she did not favor seizing existing utility assets by eminent domain. She favors building microgrids, investing in renewables, and creating a new electricity infrastructure. Seizing utility assets by eminent domain would set off an interesting legal battle. The other option is for the state or municipalities to buy Rhode Island Energy’s assets. As a public company responsible to shareholders, Rhode Island Energy would demand full value for the assets.

In 2023, 70% of Maine residents rejected a ballot initiative for the state to create Pine Tree Power to buy the assets of the state’s two electricity companies, Central Maine Power and Versant. Customers ranked Central Maine Power as the worst electricity company in New England for the previous four years. Despite that poor image, voters rejected the effort.

The privatization effort began after the companies objected to a plan to build new transmission lines through Maine forests to bring Canadian power directly to Massachusetts residents. The plan did not offer to pay Maine residents for sacrificing their forest but expected them to tolerate the new infrastructure.

Independent assessments showed that buying the assets would cost Mainers $6-13 billion, or $44,000 to $95,400 per resident. That would have meant higher power prices to finance the purchase before the non-profit aspect of Pine Tree Power would lower rates, if ever.

Between 2000 and 2019, 60 U.S. communities considered “municipalizing” utilities, buying the assets and making them locally owned. According to a study by Concentric Electricity Advisors, only nine did it.

Rhode Island and other New England states are building a new electricity grid with the backup power required to support increased renewable energy generation. This is a reality the public does not understand because they have not been told about how electric utilities work to ensure power when it is needed. When the wind doesn’t blow, or the sun doesn’t shine, residents needing power must rely on alternative power sources. The generators supplying that backup power must be built, maintained, and fueled so they are ready to deliver electricity in seconds when renewable energy fails to deliver. That backup power expense is helping drive up electricity costs. This is a critical aspect of electricity grids and renewable power the public does not understand, nor is it informed of the cost.

Rep. Cotter envisions building microgrids and investing in the green economy (renewables) to create a new utility infrastructure. Last year, the Rhode Island Office of Energy Resources (OER) commissioned a study on microgrids and their feasibility for the state’s critical infrastructure. In December, the OER announced a microgrid program: Phase 1 will focus on microgrid feasibility studies, while Phase 2 will support several projects through the construction phase.

Communities and organizations were asked to submit proposals for microgrids addressing critical infrastructure to be protected. A visit to OER’s website last week revealed that Phase 1 of the plan was on hold. There was no explanation for why or how long the hold would last. Is it due to the proposed legislation for a commission to study the concept, is it a financial issue, or was there no interest?

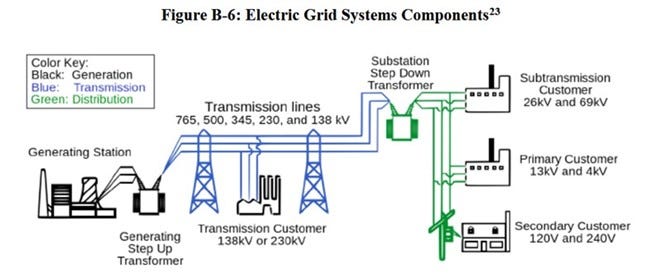

Most people are familiar with how electricity works in a traditional utility. The following schematic shows how electricity is generated from a significant, centralized power source and then goes through wires that eventually end at your home or business. During its journey, power is stepped up and stepped down to improve its transmission and usefulness.

How an electricity grid works.

What are microgrids? According to the U.S. Department of Energy Microgrid Exchange Group, “A microgrid is a group of interconnected loads and distributed energy resources within clearly defined electrical boundaries that acts as a single controllable entity concerning the grid. A microgrid can connect and disconnect from the grid, enabling it to operate in both grid-connected or island-mode.”

Microgrids are isolated power systems that work with or without a traditional grid. They are mainly proposed to ensure the continuous operation of critical infrastructure. A days-long power loss due to a storm energized Rhode Island officials to request the microgrid study. A backup generator with on-site or readily available fuel can become a microgrid for many homes and businesses. The following microgrid schematic, which discusses the plan, came from the OER website.

A variety of microgrids.

The OER study considered the following types of microgrids. The descriptions highlight how they might work.

• Remote microgrids: Islands, remote communities, and commercial installations (e.g., mines).

• Level 1 microgrids: Single- or multiple-DER (Distributed Energy Resources), single facility, single owner, BTM (Behind The Meter) installations.

• Level 2 campus microgrids: Single- or multiple-DER, multiple facilities, single-owner installations.

• Utility owned/operated microgrid.

• Utility distribution microgrids—Hybrid ownership model.

• Virtual microgrids.

• Level 3 Multi-user community microgrid.

The list highlights the varied nature and structure of microgrids. Each has plusses and minuses, and their structure may depend on utility regulations on access to rights-of-ways and the ability to cross a regulated utility’s assets. The proposed commission will explore these issues regarding the feasibility and types of microgrid operations that make sense in Rhode Island.

While the report talks about microgrids providing power when the grid is down due to storms or other events, it also suggests that the cost of the power can be lower. By removing some of the grid’s load, it is believed that the traditional utility’s electricity cost can be reduced. We would question that assumption because removing customers and power load means fewer people are available to finance the existing system’s operations, which do not shrink with the loss of customers. As a result, the remaining customers will experience much higher bills.

The commission will have substantial work to do because the OER report highlights potentially serious issues. The report noted: “State-supported microgrids are a means to an end— energy assurance for critical infrastructure mission assurance—and they can support multiple policy objectives simultaneously, but microgrids are not an end in themselves.” Microgrids may have limited and specific critical infrastructure applications, which is not a general solution to reducing ratepayer costs.

The report also discussed the issues microgrids present for electricity regulation. The report warned: “A single-issue foray into tinkering with fundamental issues risks undesired unintended consequences.” Our long history of researching energy and utility industries confirms that regulatory bodies almost always address problems created by strict regulations that cannot anticipate different market environments. Their actions resolve the past problem but usually make the next one.

The final warning should be heeded when thinking that microgrids provide universal solutions to high electricity prices. “Although microgrids can greatly increase the probability that power will be available during outages, in most cases, the EPS (Electric Power System) provides more reliable service daily. Microgrids are complex and have fewer resources and less redundancy to maintain operation than the vastly larger EPS.”

In other words, microgrids have limited power sources and the flexibility to adjust supply to meet demand. EPSs can access more generating sources and move power around their system to reach customers who need it.

Solving Rhode Island’s high electricity prices should begin with assessing the economic success versus the cost to ratepayers of the state’s clean energy mandate and renewable energy program. We have benefited from the latter program, but only because we could afford the cost of a solar installation, and Rhode Island forced the utility to pay us three times the price of the power we bought from it.

Through the discounts on our monthly bills and the supplemental payments for our power sales, we repaid our total investment in 60 months. We are 15 months beyond that point and continue to earn monthly profits. We have 108 more months left on our initial contract, with a mandatory renewal feature but no guaranteed price. The cost of the state’s renewal energy program has increased 13-fold since our solar system was installed in the summer of 2017. Is that cost worth it?

Rhode Island is only the latest state to wrestle with high electricity bills. Solving this problem is critical from both an economic and health perspective. Customers experience financial stress from high electricity bills. Their jobs are at risk if high power costs impact businesses. Lastly, low-income families must be subsidized by taxpayers and are at risk of losing their power during winter months when more deaths occur due to cold temperatures. There are many reasons for politicians to learn how their electric systems work and the most cost-effective ways of delivering power to their constituents. These are only some of the reasons. Somehow, we feel politicians will take the easy way out and merely grab a nice-sounding solution without understanding the plusses or minuses. The public will suffer the consequences.