Energy Musings - March 1, 2024

The world of electricity is changing with the advent of new technologies such as AI with its huge power demands. Utility executives are confronting demand growth rates multiples of recent years.

Accelerating Electricity Growth Is A Concern

Throughout history, inventions and evolutions have dramatically reshaped our world. It started 5,500 years ago with the domestication of the horse, and later the development of the printing press, the compass, paper currency, magnifying lenses, the steam engine, steel, the electric light bulb, and the automobile. More recently, our lives were reshaped by the development of antibiotics, transistors, the Internet, the personal computer, and the cell phone. Today, we are wrestling with an understanding of how crypto mining, data centers, and Artificial Intelligence will reshape our future.

One impact from the arrival of the triumvirate of new technologies is just beginning to be considered. How much electricity will they need? The magnitude of the power demands of AI, data centers, and crypto mining is just emerging and utilities are being forced to re-examine their prior demand forecasts. As they are being increased, utilities are also reassessing their capital spending needs.

A report from Grid Strategies late last year was titled “The Era of Flat Power Demand is Over.” It was an examination of how these new technologies are changing the growth trajectory of electricity demand. The report’s first page highlighted three bullet points:

“Over the past year, grid planners nearly doubled the 5-year load growth forecast.”

“The main drivers are investment in new manufacturing, industrial, and data center facilities.”

“The U.S. electric grid is not prepared for significant load growth.”

The conclusion of those bullet points was captured in the page’s heading: “$630 Billion in Near-Term Investment in ‘Large Loads’ is Increasing Expectations for Load Growth.”

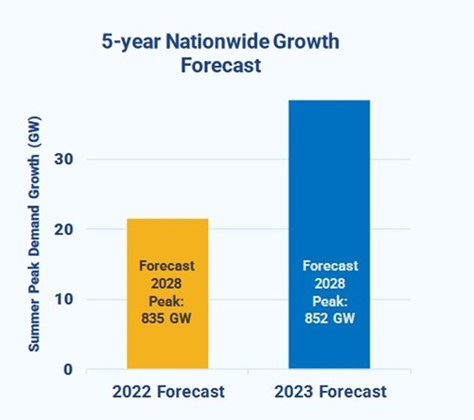

The future of the domestic electricity system was crystalized in the following graph showing just how much the demand forecast has grown in just one year.

Grid Strategies shows how dramatically new technologies are driving higher electricity growth.

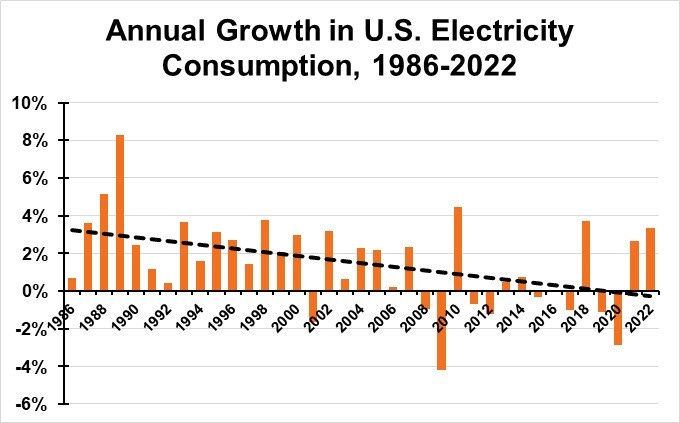

To appreciate the significance of this changed reality, we plotted the annual growth rate in U.S. electricity generation (consumption) from 1986 to 2022. We added a trendline to the chart to show how annual electricity growth has slowed dramatically over the past several decades.

Higher future electricity consumption rates demonstrate how different the power world will be compared to the past.

We remember when growing up how the job of the chief executive of an electric utility was explained to us. That explanation came back to us when in the early 2000s, the electricity industry was in turmoil as Enron led the charge to transition the system from a service to a commodity. Deregulation of electricity markets occurred in various states, but energy demand growth was flatlining and fuel choices for new power plants became politicized. This new electricity world created opportunities but also significant risks. Utility company CEOs were wishing they could be returned to the era of the 1950s. Then, a CEO plugged 5% growth into his company’s power consumption forecast model, determined how much new generating, transmission, and distribution capacity was needed, and then focused on the ‘care and feeding’ of regulators to ensure they would grant his company rate hikes sufficient to pay for all the investment needed.

A chart in the Grid Strategies report compiled data for the ten planning areas showing the greatest increase in 2028 summer peak demand forecasts. The chart shows what the respective planning area summer peaks were projected to be in 2028 when the forecast was made in 2022 and again in 2023. The increases often are of a scale not seen in years outside of snapback years after economic recessions.

The top ten electricity planning areas are now seeing future growth, unlike any years in the past decade.

Each planning area is determining how it is going to secure sufficient generating capacity to meet these higher-generation needs. An example of planning is Duke Energy, which is now expecting a 2-gigawatt increase in its 2028 peak summer consumption. In 2023, Duke spent $12.57 billion on capital improvements. In its current five-year plan, Duke plans to spend $73 billion on new capital projects with 50% going to grid investments. The company has also announced plans to replace two coal-fired power plants – one in North Carolina with the other not yet identified – with Small Modular Reactors. The North Carolina plant is scheduled to come into service in 2034, a decade away.

We put Grid Strategies’ conclusions in the category of how the future world for utilities will be markedly different from the business and financial world they have lived in for the past twenty years. We worry about whether current utility CEOs are up to the tasks they may be facing. If not, then we will be looking at major economic disruptions as the risk of missteps in executing business strategies increases. The problem is these missteps, while costly, will not only be impactful for electricity utility, but they may be deadly, besides being disruptive and costly for regional economies.

Last year, the North American Electric Reliability Council issued its annual report on the reliability of the electricity grid. The report provided an early warning about growing risks to the nation’s power system. NERC commented on electricity demand trends which highlight the multitude of challenges facing the electricity utility industry and grid operators. The report stated:

“Electricity peak demand and energy growth forecasts over the 10-year assessment period are higher than at any point in the past decade. Electrification and projections for growth in electric vehicles (EV) over this assessment period are a component of the demand and energy estimates provided by each assessment area. Since the 2022 LTRA, peak season CAGR has risen in nearly all assessment areas, contributing to an overall trend to lower reserve margins. Some of the sharpest peak demand forecast increases and growth rates can be seen in winter seasons as heating system and transportation electrification influence forecasts. Dual-peaking or changing from summer to winter peaking is anticipated in several areas, requiring resource and system planners to shift the focus of planning. Concentrated growth and the emergence of new types of loads are occurring in many areas. These growth trends bring additional challenges for resource and transmission adequacy. Planners and operators can prepare by considering robust demand and energy scenarios, carefully monitoring and refining demand forecasts, and developing operational tools for peak load management.”

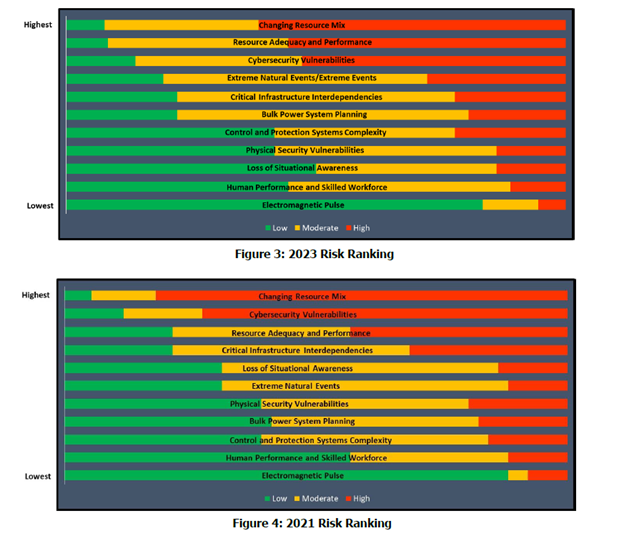

Taking those demand trends into account, the officials participating in the latest risk assessment were asked if each of the 11 identified risks from their 2021 survey was still relevant. Each risk was classified as to its potential impact - Low, Moderate, or High. The outcome of the process led to the latest ordering of the 11 risks and changes to the potential impact of each risk. The process produced the chart below with the 2021 rankings contained in the subsequent chart.

The latest NERC survey on grid reliability puts energy resource concerns at the top of the list.

We noted that the top three risks from 2021 were also at the top in 2023. What was different was that Resource Adequacy and Performance moved to second from third place in the risk survey. Additionally, the high impact of that risk improved, but the low risk declined and the moderate risk expanded by more than twice its weighting in the 2021 survey.

The top risk in both 2021 and 2023 – Changing Resource Mix – saw its low and moderate impact assessments increase thereby reducing the high assessment impact. But the important point is that the top two risks now involve the resources powering the grids. That is significant because it highlights the growing importance of renewable (non-dispatchable) energy in meeting the growing power needs as well as providing for the stability of grid operations.

Electric utilities have entered a new world with greater operational challenges – keeping supply and demand in balance – as dispatchable power plants age into retirement or are forced to retire because of new emission rules. This is shrinking the reserve power margins available for grids which can be called upon when demand spikes or supply drops. As a result, more grids are warning about the increased risk of blackouts or periods when people will have their unrestricted use of electricity suppressed.

As a result of the electrify-everything push, demand will grow at a faster rate than at any time in the past decade pressuring grids and utility managers. This electrification push is also causing shifts in grid seasonal peaks from summer to winter, adding even more operational challenges. How these challenges will be met is uncertain. What we do know is that the solutions will add to customers’ electricity bills. We doubt they are aware of the financial pain they are about to suffer. We will be watching and analyzing future developments.