Energy Musings - June 6, 2025

Here are items we found interesting in today's news. EV interest is falling among American car buyers. Long-term interest rates may be entering a new higher range. Natural gas stocks get hyped.

News Items That Caught Our Attention Today

Buyers Are Less Interested In EVs

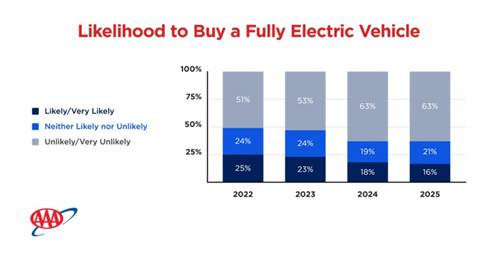

Earlier this week, the American Automobile Association (AAA) released its annual survey of Americans interested in purchasing electric vehicles (EVs). The chart shows that the percentage of buyers likely/very likely to buy a fully electric vehicle fell to 16%, down from 25% in 2022, and the lowest interest level since the 2019 survey. Equally disturbing for EV proponents was that those buyers who were unlikely/very unlikely to purchase an EV climbed from 51% in 2022 to 63%.

More people are interested in buying traditional vehicles.

The headline of an article reporting on the AAA survey on Carscoops.com read: “EV Support In America Is Falling Faster Than Anyone Predicted.” Oops! Multiple tech-oriented websites tried to put a positive spin on the survey’s results. However, the AAA survey contained the following quote from one of its engineering officials.

“’ Since we began tracking interest in fully electric vehicles, we’ve seen some variability,’ said Greg Brannon, director of automotive engineering. ‘While the automotive industry is committed to long-term electrification and providing a diverse range of models, underlying consumer hesitation remains.’

That hesitation was supported by other data from AAA showing how EVs are losing support. “Only 23% of US drivers now believe most cars will be electric within the next decade, down from 40% in 2022.” In 2019, the expectation was for a majority of cars to be electric in 10 years. Low gasoline prices, high EV costs, the prospective loss of EV tax credits, and higher insurance costs, besides the normal range anxiety and lack of access to home charging, which increases EV operating costs, contribute to the declining interest. The EV revolution has shifted into a lower gear.

Is The Decline In Interest Rates Over?

We believe that the 40-year decline in interest rates has ended and that we are moving back into a world of higher rates. Interest rates play a significant role in the investment landscape and the global economy. One industry that has thrived on falling and low interest rates is renewable energy. It faces substantial challenges from rising interest rates that disrupt the renewable energy business model.

The chart of U.S. interest rates for the 10-year Treasury bond shows the 40+-year bond bull market driven by falling rates. The history shows how rates rose from the post-World War II era until they peaked during the inflationary spike in the 1970s, driven partially by the Oil Embargo and the resulting economic shocks and fallouts. Since then, interest rates have been continually lower.

Is the 40-year bond bull market dead?

A world where interest rates are in the 5% range has significant implications for project financing and investor returns. Higher interest rates make fixed income (bonds) more attractive to investors than assuming the risk, albeit potentially higher returns from stock investing will impact stock valuations. Investors may start putting more money into bonds than stocks, limiting the upward push for stock markets.

This is a significant sea change in financial markets with implications for investments worldwide. Ignoring it and assuming the future will be like the recent past could be economic suicide.

The Wall Street Journal Hypes Natural Gas

Today’s Wall Street Journal contains an article in its Heard on the Street column headlined, “Natural Gas Stands to Heat Up Energy Stocks.” It was based on this week’s data on the increase in natural gas in storage caverns throughout the United States, as reported Thursday by the Energy Information Administration (EIA). The article focused on how the deficit between the current storage volumes and the year-ago volumes was nearly 80% two months ago. It is now less than 50%, suggesting that producers have injected more gas into storage for sale next winter. That suggests producers anticipate higher prices this winter than they can get by selling gas today, even after they factor in the storage cost.

Two things will drive natural gas demand: air conditioning loads requiring more electricity from gas-fired generators and increased liquefied natural gas exports. The EIA expects LNG export volumes to be 26% higher this summer than last. The key points about the natural gas market are its sensitivity to higher temperatures (more air conditioning) and increased electricity demand from the growing number of data centers, and increased use of AI.

Here are the two paragraphs addressing these issues from the WSJ column.

“The National Oceanic and Atmospheric Administration recently estimated decent chances of above-average temperatures in much of the country this summer. The Federal Energy Regulatory Commission said that if NOAA’s assessment is right, ‘the electric grid will likely be challenged throughout the continental United States.’”

“A wild card is rapidly growing power demand from data centers. In January, analysts at Bernstein Research laid out the scenario for a natural gas ‘super cycle’ as AI and LNG export growth coincide with supply constraints. This could push natural-gas prices to $5 per million British thermal units this year and next. Futures prices peaked around $4.50/MMBtu in March and settled at $3.68 Thursday.”

The Heard on the Street writer is bullish on natural gas producer stocks. This is a positive case, but savvy investors will note that all the attention on natural gas stocks means people are ignoring global oil market trends.