Energy Musings - June 29, 2023

Offshore wind industry in turmoil as economics are upended, suppliers announce technical and financial problems, the U.S. government starts an investigation, and dead whales and hurricanes appear.

Body Blows To Wind Energy And Net Zero

Recent weeks have not been kind to the offshore wind industry. The stretch of bad news was capped by the following Financial Times headline: “Siemens Energy shares plunge after wind turbine problems deepen.” Siemens Gamsea announced late last Thursday it was withdrawing its financial profit guidance for 2023. The move was in response to its need to reserve $1.1 billion for warranty claims and expenses arising from technical problems with many of its onshore wind turbines. The next day, Siemens Energy, owner of Siemens Gamsea, saw its share price drop 37%. The stock price slide continued Monday with the share price down 3%, bringing to $8 billion the market value wiped out. Analysts worry that all the bad news is not out.

Earlier, Ørsted, the Danish wind energy giant, told analysts at its annual capital day that it was scaling back its installed offshore wind goal for 2030 by redesigning, shrinking, and abandoning projects because they are uneconomic. Ørsted is terminating offshore wind project power purchase agreements in multiple U.S. states and pushing for higher subsidies in European wind markets. It presented a chart showing its U.S. offshore wind portfolio of projects will barely earn its weighted average cost of capital, an unacceptable financial return.

Economics is not the only challenge offshore wind faces. Two dead humpback whales washed ashore on Martha’s Vineyard only days after the first Vineyard Wind turbine foundation was hammered into the ocean floor. Are the two connected?

Because the whale carcasses remained in the surf, the National Oceanic and Atmospheric Administration (NOAA) announced it was abandoning plans to examine them in search of the cause of death. NOAA said such an investigation would be too difficult, despite NOAA being charged with protecting endangered marine mammals.

Three other dead whales washed ashore on Long Island bringing the total of known dead whales since last December to 46. Senior NOAA and Bureau of Ocean Energy Management (BOEM) officials have stated there is no connection between offshore wind construction activity and dead whales. Yet, their researchers acknowledge they do not have a full understanding of how underwater noise may impact the behavior of marine mammals, especially whales. They want to undertake more studies. Is that the science we are supposed to follow?

Another key concern about offshore wind turbines is their survivability in hurricanes. During a congressional hearing earlier this year, BOEM Director Liz Klein would not say whether offshore wind turbines targeted for installation along the East Coast could withstand a major hurricane. Research is underway to answer the question. Wind turbines are designed to lock their blades when windspeed exceeds certain limits to protect them from damage. The limits are hurricanes up to Category 3, which means wind speeds of up to 111 miles per hour (mph). Researchers are studying new wind turbine designs to withstand higher wind speeds, but those designs are not ready and will be the ones built.

GAO Starts Investigation

Historically, the East Coast has been the target of hurricanes with some years more active than others and some decades much more active than others. Category 3-4-5 hurricanes have sustained wind speeds above 111 mph. Category 3 (111-129 mph) hurricanes are associated with ‘devastating damage,’ while Category 4 (130-156 mph) and Category 5 (157 mph or above) will cause ‘catastrophic damage.’

The lack of solid conclusions about whale deaths and offshore wind, along with a host of other concerns has prompted protests over BOEM’s approval of more East Coast projects. A project slated for the New Jersey coast, which will be visible from the tourist-dependent beaches, has drawn intense outrage and protests.

In late March, the U.S. House of Representatives approved an amendment to the Lower Energy Costs Act (HR 1) calling for a government investigation of offshore wind issues. After passage, the bill was declared ‘dead on arrival’ by Senate Majority Leader Chuck Schumer. In response to the Senate rejection of the bill, Rep. Daniel Smith (R-NJ) wrote to the U.S. General Accountability Office (GAO), a congressional investigation body, in May requesting it investigates the multiple issues raised by the amendment. Earlier this month, the GAO agreed to undertake an investigation. According to reports, the GAO will investigate the issues raised by Rep. Smith and his colleagues in his May letter. These issues include:

Air and maritime safety, including the operation of radar systems.

Impacts on air traffic, including military training missions off the Atlantic Coast.

Commercial fishing activities, including fisheries-related surveys and associated management plans, fishing access in the Outer Continental Shelf and economic impacts to the fishing industry.

Marine environment and ecology, including whales and dolphins, and any endangered or threatened species.

Resiliency of offshore wind infrastructure to hurricanes and other extreme weather events off the Atlantic Coast.

All these issues are important to various constituencies who are concerned about the impacts of offshore wind industrialization on the coasts of the United States. Their answers will impact the efforts of the federal government and various state governments seeking to boost clean energy to cut the nation’s emissions in the fight against climate change. While it is unfortunate that we are so far down the road to offshore wind farms before we obtain answers to critical questions about its potential problems. As we paraphrased former Speaker of the House Nancy Pelosi, in our recent article about radar problems with offshore wind turbines: We must build these wind farms to find out how bad the radar problem is.

Further to the dissatisfaction with BOEM’s handling of its offshore wind approvals, a recent public hearing to address the Draft Environmental Impact Statement turned out to be more of a social function based on reporting about the session. The 200-turbine Atlantic Shores Offshore Wind farm is to be built nine miles off Atlantic City, New Jersey. It is a joint project of Shell plc and EDF. The first of two public hearings to solicit comments and address concerns was held at a New Jersey hotel on the evening of June 21st. The description of how the meeting would proceed and how the public could provide comments was addressed in BOEM’s notice. What was missing was how officials would answer concerns or provide additional details. BOEM wrote:

“The in-person meetings will follow an informal open house format with a series of Project information posters staffed by BOEM subject matter experts who can share information with individual attendees. Attendees can ask questions one-on-one of BOEM subject matter experts. Attendees can provide written comments using a provided comment form or provide oral comments by meeting individually with a court reporter for up to five minutes each. If additional accommodations are needed, please contact boempublicaffairs@boem.gov or calling 703-787-1520 7 days prior to the in-person meeting date.”

According to media reports, numerous concerned citizens, often representing organized groups protesting the wind farm, were upset about how BOEM was handling the public information hearing.

Offshore Wind Deals Underwater

The economic problems of offshore wind projects have suddenly exploded. Desperate to avoid financial disasters, offshore wind developers are electing to terminate power purchase agreements (PPA) because they no longer support the financing necessary to build the projects. Utilities who once thought they could plan their futures after signing PPAs suddenly wake up to find they are terminated. Developers will rebid their projects to get higher prices which utilities will have to absorb, hurting their customers. These PPA terminations have the offshore power market in turmoil.

Developers have few options – build a profit-losing project or pay a penalty to terminate the project. They depend on banks and private equity investors to fund their projects, which means they must demonstrate through financial projections that the money invested will be repaid, the interest on the loans paid, and dividends sent to the providers of equity capital. If you cannot present a financial model demonstrating (conservatively) that a project will meet those requirements, it is time for Plan B.

Plan B’s first step is figuring out how to get out of Plan A. Maybe developers can convince governments to provide larger subsidies because offshore wind projects are delivering on public policy initiatives – more clean power. Wrestling with uneconomic wind farms is not limited to the U.S. Developers in Europe are working hard to avoid financial disasters, and begging for more government aid is part of that plan.

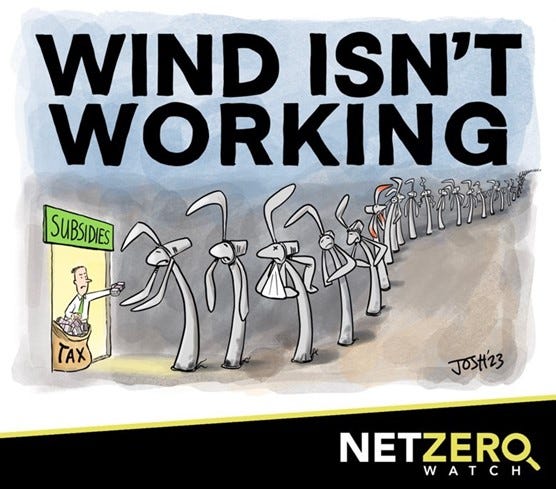

Offshore wind projects depend heavily on government subsidies to make money.

Developers will tell you and utility regulators that their financial problems were caused by the Russia-Ukraine war that sent commodity prices soaring. They will also list supply chain disruptions and sharply higher interest rates as causes for abandoning projects. None of these problems were or could have been foreseen they tell the regulators. But what is the role of management? When SouthCoast Wind CEO Francis Slingsby was questioned at a hearing about what would be different when rebidding its project in response to the 2024 Massachusetts request for offshore wind power, he extolled the work of his 75-member staff. But weren’t they the same people who failed to see the current problems? The real answer was that Massachusetts was inserting indexation features in the 2024 request that would relieve management from having to worry about future component and labor inflation and higher interest rates.

The heart of the financial problem is that offshore wind projects, like all other renewable energy projects, earn low returns on investment. They earn a fraction of the returns earned by traditional oil and gas investments – usually only one-third to 40%. The low returns are supplemented by government subsidies for producing clean energy that government policymakers want to meet their net zero goals.

At the height of the “go green” hysteria in Europe, major international oil companies Shell plc, bp plc, and TotalEnergies SE all embraced investing more in renewable energy projects while cutting back investment and production of oil and gas. At that time, bp’s CEO Bernard Looney warned his shareholders and pensioners that such a strategy risked the company’s future dividend trajectory. Seldom acknowledged by these CEOs was that the historical returns earned by renewable energy projects came primarily from the steady decline in component costs and interest rates below what was assumed in the original investment proposals. Once those declines ended and costs and interest rates rose, the business was in trouble.

If a developer could convince his lenders that their returns were assured for the next 20 years, they would be happy. Risk-taking investors expected improving returns as project debt was paid off. When construction costs were below the assumed expense, expanded profit margins accrued to the investor. However, as several oil and gas investors described to us, they invested in projects expecting future construction costs to decline below what was projected in the financial model. They were willing to gamble that the declining cost trend would continue, providing them a reasonable return, while also collecting brownie points for investing in renewable energy projects.

That world existed until Covid upset the global economic order. The post-pandemic recovery and then Russia’s invasion of Ukraine highlighted the need for more energy. The market turned to fossil fuels to fulfill this need because renewable energy failed to deliver the amount of clean energy when it was needed. The rush to build more renewable energy capacity drove up the cost of raw materials necessary to build these projects. With component costs soaring 40% over the past two years and interest rates up 500+%, the economics of renewable projects, especially for expensive offshore wind projects, were devastated, putting the industry in its present condition.

Siemens’ Wind Problems

What is the significance of the Siemens profit warning for the offshore wind industry? Some would say there will be little impact since Siemens’ problems primarily relate to its onshore wind turbines. In the profits warning release, Siemens suggested that the technical review was prompted by a “substantial increase in failure rates of wind turbine components.” As management explained during its conference call with analysts the following day, the quality of components (blades and bearings) problem speaks to both internal manufacturing issues and vendor operations. But there was a mention of vibration issues with certain platforms [turbines], which can be caused by deficient components but also possible design issues. There was no elaboration of this comment because, as management cautioned, the technical review was in its early stage, so the full scope of the problem is uncertain. The technical review includes both onshore and offshore wind turbines. What management knows is that the outcome will result in higher costs for warranty claims. The magnitude of those claims depends on the age of the turbines. The warranty expense will be increased by the cost of preemptive steps taken to avoid problems with turbines that have not yet demonstrated operational issues, but which statistically are likely to suffer from them during their operating lives which can extend for 25 years.

Importantly, this is not the first time Siemens has experienced unusual costs associated with the performance of its offshore wind turbines. In early 2018, Ørsted acknowledged that it was needing to repair over 600 offshore wind turbines supplied by Siemens. The turbines were in wind farms in British, Danish, and German waters.

Dr John Constable of GWPF, along with reporters with the newsletter Recharge, and Danish newspaper Jyllands-Posten, outlined the scope of Ørsted’s problems. Jyllands-Posten wrote, “The turbines’ blades are so worn down already that they have to be brought to land and repaired.” Anholt, the Danish offshore wind farm, began operation in 2013, but as the newspaper wrote, “almost 300 blades at its offshore wind farm at Anholt have to be taken down after just a few years of operation, sailed ashore and transported to Siemens Gamesa’s factory in Aalborg.” Once repaired, the blades had to be returned to the coast and then reinstalled offshore. At the time of this event, Siemens Gamsea offered a five-year warranty, but the newspaper reported that Ørsted and the company were in a dispute over whether these repairs were normal wear and tear or a quality deficiency.

Ørsted said the cost of the repair would be nominal, suggesting that Siemens Gamsea would cover the expense under its warranty. Shortly before the news of the repairs broke, Siemens Gamsea “provided 4.5 billion Danish Krone ($750 million) or 16% of its revenue to guarantee its commitments.” That figure, based on the assumed 600 offshore wind turbines requiring repairs, suggests this episode may have cost Siemens Gamsea at least $1 million per turbine to repair the blades.

Siemens Energy management also used the profits warning announcement to express concerns about assumptions undergirding its financial projections. They pointed specifically to the failure to achieve the magnitude of productivity improvements in the business and the continued challenges in ramping up its offshore turbine business. These warnings came barely a month after management had issued its second-quarter financial results and presented an upbeat outlook for the company’s future. It was probably the sharp reversal in outlook and tone that unnerved investors.

In the conference call, Siemens Energy CEO Bruch acknowledged the need to fix Siemens Gamesa's corporate culture. He said that too many things had been swept under the rug in the past. The current Siemens Gamsea CEO Jochen Eickholt is the third head of the company since its 2017 merger with Siemens Energy. After a year and a half on the job, he has suffered through several profit warnings and other organizational challenges. Given this history, Mr. Bruch’s comments that the merger never fully worked and that major management mistakes were made should not have been a surprise. This even invoked an analyst’s question about whether Mr. Bruch would entertain selling the business. The question was deftly avoided with the statement that he viewed the business as an opportunity.

Offshore Wind’s New Era

Management’s caution about the challenges in building an offshore business is a sober warning that the economic headwinds impacting the industry should not be thought of as ‘in the rearview mirror.’ Mr. Eickholt implied that margins were too thin, i.e., prices need to be higher, and that Siemens Gamsea would be more selective in the contracts it enters, along with tightening their terms. But the company earning a profit will not happen anytime soon.

In researching the Siemens Gamsea news, we uncovered the company’s U.S. website page from 2019 when it was about to install the first two wind turbines for the pilot project for the Coastal Virginia Offshore Wind (CVOW) to be built by Dominion Energy. It will be the first offshore wind farm built by a utility company as opposed to a wind developer. The web page was headlined: “Offshore wind in the U.S.: No longer a matter of if but when.”

It talked about how 10 years earlier the idea of U.S. offshore wind was only a dream. But by 2024, the company expects to have provided turbines for 1,700 megawatts (MW) of offshore wind power from three projects – Sunrise Wind (880 MW), Revolution Wind (704 MW), and South Fork (130 MW). Now we must wonder whether those turbines might have component and/or design issues that could put those wind farms’ performance at risk. That could be a huge surprise for the New York Public Service Commission which shut down the Indian Point nuclear power plant that supplied New York City with 25% of its electricity. That loss was immediately replaced with power from two gas-fired power plants but produced more carbon emissions that upset environmentalists. The government plans to replace the shuttered output with offshore wind from the Sunrise and South Fork projects. Could these projects wind up being delayed? If so, what happens to the offshore wind supply chains and installation vessel scheduling? More delays?

The offshore wind industry has taken the first step on its road to installing thousands of turbines off the East Coast to produce clean energy. What was thought to be an easy journey marked by cheering supporters, finds wind developers scrambling for routes that avoid serious potholes while being jeered by protesters. The developers, largely European, are unfamiliar with some of the conditions they are confronting, despite years of study. From whales to lawsuits, from uncooperative regulators to aggressive protesters, offshore wind developers are dealing with a growing list of challenges. Those challenges pale in comparison to the new economic world of soaring construction costs and sharply higher interest rates. After years of economic tailwinds – low inflation, zero interest rates, favorable regulatory structures, lucrative subsidies – developers are facing serious headwinds. Wind’s yellow brick road has some tarnish.

There is no true answer for the IRR question because these projects are all in LLCs so the data is opaque. In the RI hearing, SouthCoast Wind's CEO said the IRR was well below the 9% most regulated utilities are seeking in their rate increase filings. BP's Mooney told shareholders that returns were more in the 5-8%, well below the oil and gas traditional returns of 15-20%.

When I have researched UK power projects that file audited returns, the offshore wind ones do not make money without subsidies. Orsted's CEO told analysts that their US offshore wind portfolio was only earning its WACC when they are well above that elsewhere and they always shoot for 150-300 bp above WACC.

What is the IRRs in these projects? The PR always reads as fluff. Always sounds like the same nothing.

What is needed is to embrace the industry in the USA as a strategic asset. No mas dissing it by media for drama and politicos for votes and each of use to embrace it. Without the USA the world would be upended.

The world needs a strong USA. Strong leadership matters.