Energy Musings - June 25, 2025

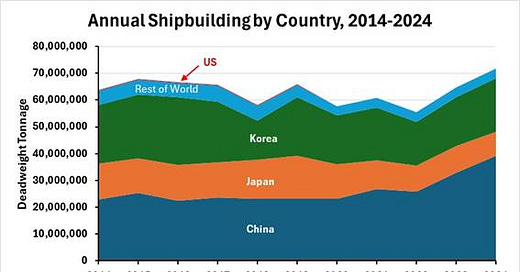

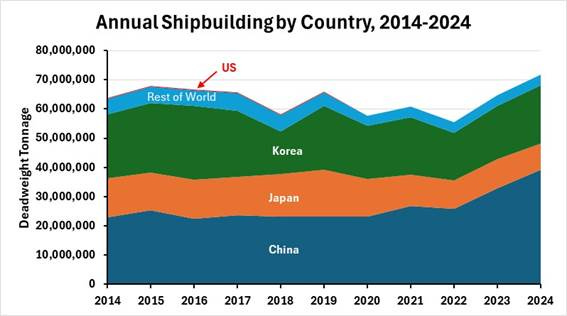

The latest UN data on shipbuilding showcases the sorry state of the U.S. maritime industry. We delivered four hundredths of a percent of the world's new ship tonnage in 2024!

UN Data Highlights US Maritime Challenge

President Donald Trump has prioritized reviving our maritime industry for national security and avoiding the potential of commercial blackmail from foreign actors. The latest United Nations Trade and Development agency (UNCTAD) data shows our maritime weakness.

UNCTAD reports that for 2024, global shipbuilding delivered 71.7 million tons of new ships. That tonnage includes the 30,782 tons built in the United States. That represented four hundredths of a percent of the total tonnage built by the world’s shipyards. It was not four percent, or even four-tenths of a percent. It was just four hundredths of a percent! As the chart shows, our shipbuilding prowess is virtually non-existent globally.

U.S. shipbuilding tonnage barely registers in the global data.

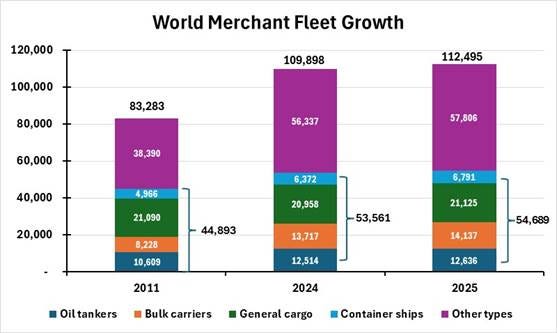

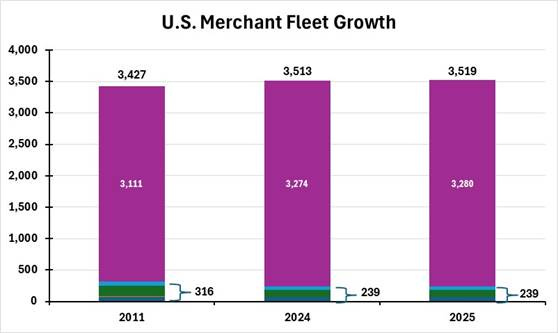

The new global ship tonnage was responsible for the world’s merchant fleet growing by 1,469 vessels during 2024. According to the UNCTAD data, the U.S. merchant fleet increased by only six ships. The global fleet increased by 1,128 ships if we exclude the Other Types. Similarly, that share of the U.S. fleet was unchanged.

The following charts show the global fleet, which includes the U.S. fleet. We also show the U.S. fleet separately. We have presented the data for the world and U.S. fleets for 2011, 2024, and 2025, divided by class of vessel. We have also provided the respective fleet totals, excluding the Other Type vessels.

Over 2011-2025, the global fleet grew 35%. The U.S. fleet expanded by only 2.7%. This further proves the sad state of U.S. shipbuilding and our maritime industry.

The world merchant fleet continues to grow steadily.

The U.S. merchant fleet remains stagnant.

The UNCTAD data supports the president’s efforts to revive our shipbuilding and merchant marine industries. During World War II, the U.S. created a powerful industry that delivered ships in months, not years, and enabled the U.S. and its allies to secure victory in the European and Pacific theaters. Over time, however, we have allowed our shipbuilding and maritime industries to atrophy. The downsizing of our defense industry contributed to the atrophy. Moreover, military officials recommended to defense supplier executives that spending would continue to decline. Therefore, it made sense for the industry to contract, which it did through mergers and company acquisitions.

A shrinking industry, facing reduced revenues (government defense spending), focused on cutting costs and eliminating inefficient businesses. That meant targeting the closing of shipyards. Furthermore, there was little incentive to invest in operating shipyards because they faced a shrinking market.

That tide may be changing. Earlier this month, Canada’s Davie Shipbuilding announced that it aims to acquire shipyard assets in Galveston and Port Arthur, Texas, from Gulf Copper & Manufacturing. Davie’s goal is to enter the market to build icebreakers that the president has ordered. As Davie’s CEO, James Davie, said, the company’s goal is “to make Texas a world-class hub for American icebreaker and complex ship production.”

Davie’s involvement in building U.S. icebreakers would expand with the acquisition, given its ownership of Helsinki Shipyard in Finland, one of the world’s leading builders of icebreakers. It also owns a Canadian shipyard in Quebec that specializes in building icebreakers.

Last July, the Biden administration negotiated a deal with Canada and Finland called the Icebreaker Collaboration Effort Pact for the parties to share their expertise. The Trump administration reaffirmed that collaboration in March.

Davie hopes to complete the acquisition later this summer. U.K.-based marine industrial group Inocea owns Davie. It plans to invest $1 billion to modernize and expand the Texas shipyards.

The move by Davie follows the December 2024 purchase of the Philly Shipyard, controlled by Aker Capital, by Hanwha Systems and Hanwha Ocean Co. of South Korea. The Committee on Foreign Investment in the United States (CFIUS) approved the transaction in September.

Hanwha Ocean was formerly known as Daewoo Shipbuilding & Marine Engineering Company. It is the only company that has built submarines for the Korean Navy. It has also built five Tide-class fleet oilers for the U.K. Royal Fleet Auxiliary. Hanwha is one of Korea’s top three shipbuilders.

Last spring, the company completed a six-month refurbishment of a U.S. Navy vessel at its shipyard in Geoje, Korea, and returned it to the U.S. The need for the U.S. Navy to utilize a foreign shipyard to refurbish a vessel is a sign of the woeful state of the domestic shipbuilding and repair industries.

David Kim, Hanwha Philly Shipyard’s new CEO, said, “Hanwha Philly Shipyard begins an exciting new chapter today. We plan to grow and build on a long tradition of success, by expanding production using advanced technologies, and supporting the national revitalization of U.S. shipyards.” He went on to further explain the company’s plan. “We intend to do that by pushing the boundaries of shipbuilding by combining people with technology to build best-in-class vessels.”

Established in 1997 following the closure of the U.S. Navy's Philadelphia Naval Shipyard, Philly Shipyard has delivered around 50% of all large ocean-going U.S. Jones Act-compliant commercial ships since 2000. These ships have primarily been tankers and container ships. It recently completed a second National Security Multi-Mission Vessel (NSMV) for the U.S. Maritime Administration, establishing the shipyard’s credentials as a prime maritime supplier.

NSMVs are used as training ships for U.S. maritime schools. The first vessel was delivered to the State University of New York Maritime College last year. The second ship is being completed and will go to the Massachusetts Maritime Academy.

Hanwha Group acquired a 9.9% stake in Australian shipbuilder Austal Ltd. for 183.3 million Australian dollars ($117 million) in March. This purchase came after an offer to buy Austral USA’s shipyard in Mobile, Alabama, for $662 million, which was scuttled, partly due to national security concerns over Korean ownership of the yard becoming more involved in U.S. submarine construction.

Austral specializes in building both commercial and naval vessels as a global defense prime contractor. It is one of four major suppliers to the U.S. Navy. It has built a surface warfare combatant ship, the Independence-class Littoral Combat Ship (LCS).

While headquartered in Australia, Austral operates shipyards in Alabama and Western Australia. It will be interesting to see the Hanwha Group’s next moves in light of its Philly Shipyard purchase. It will be fascinating following the arrival of the Trump administration, which is focused on reviving the U.S. maritime industry and plans to encourage greater investment in domestic shipyards by foreign shipbuilders.

The actions of Hanwha and Davie signal that maritime capital understands the serious condition of the U.S. shipbuilding and repair industries and the commitment of the Trump administration to revive our domestic maritime industry. The maritime sector offers profit opportunities for foreign shipbuilders, but navigating the foreign policy and national security issues raises questions about the speed of the revival. The UNCTAD data confirms the challenge facing policymakers and companies seeking to revive the industry.