Energy Musings - June 24, 2023

Banning private vehicle ownership is not the answer to emissions reduction. Government EV policies are misguided and will cost too much and be less effective than other strategies we discuss.

Don’t Outlaw Private Cars, Target EV Subsidies Better

We are in the Fourth Industrial Revolution claims Klaus Scwab, founder of the World Economic Forum (WEF). Therefore, we should “take dramatic technological change as an invitation to reflect about who we are and how we see the world.” Such a guiding principle is driving the green revolution, including banning internal combustion engine (ICE) vehicles because they dump tailpipe emissions into the atmosphere. We should only drive electric vehicles (EV), and they should be powered by the grid of the future fueled only by wind and solar.

A year ago, the WEF produced a paper about building a circular economy to reduce the need for a 500% increase in critical minerals to support the green energy revolution. Buried in the paper was the idea that people should cease owning vehicles and switch to vehicle-use services. Fewer vehicles being driven more miles might help speed up the emissions reduction effort. Some commentators jumped on the WEF’s idea as a justification for banning the private ownership of vehicles, a heavy-handed government intrusion into people’s lives, as if telling the people what kind of car they may buy isn’t. Support for this idea has split along political lines.

Subsidies Drive The EV Market

To promote the EV-only policy, governments are slathering subsidies across the automobile industry – from tax credits and point-of-sale benefits to cash for new manufacturing and battery plants. The problem is governments seem to have overlooked the scale of the critical minerals supply chains necessary for this redo of the automobile industry, and thus how quickly such supply chains can be built. If this redo aims to cut transportation emissions, could there be a better way?

The misnamed U.S. Inflation Reduction Act, signed into law in August 2022, created a plethora of subsidies and tax credits for individuals, states, and companies to foster renewable energy growth. The Congressional Budget Office’s initial estimate is that the bill would cost $391 billion from 2022 to 2031. Analyses by Goldman Sachs, Credit Suisse, the Mercatus Center, Americans for Tax Reform, and others have suggested that the cost will be more like $1.2-$1.4 billion over the decade, or more than three times the CBO estimate.

The tax credits for battery production for EVs were estimated by the CBO to cost $30.6 billion. The analyses project the subsidy will cost $196.5 billion, a 540% miss! Every subsidy and tax credit estimate is too low because the CBO underestimated the volume of projects that will be eligible. In some subsidies, the projects are eligible for 10 years of payments if the projects meet construction thresholds before 2031, thus ensuring subsidy money will be flowing until possibly 2041. Can we do better with the taxpayer’s money?

According to the U.S. Environmental Protection Agency (EPA), in 2021, transportation accounted for 29% of the nation’s greenhouse gas (GHG) emissions, making it the largest factor. Within transportation, the bulk of GHG emissions is accounted for by light-duty vehicles (58%), followed by medium and heavy-duty trucks (23%). The next largest transportation emissions share is aircraft (8%), with rail at 2%, and ships and boats accounting for 3%. Two of those three are the hardest transportation sectors to decarbonize, but not as impactful or the focus of this article.

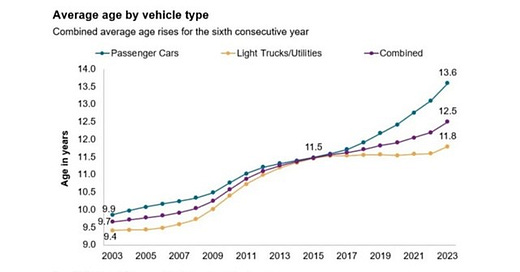

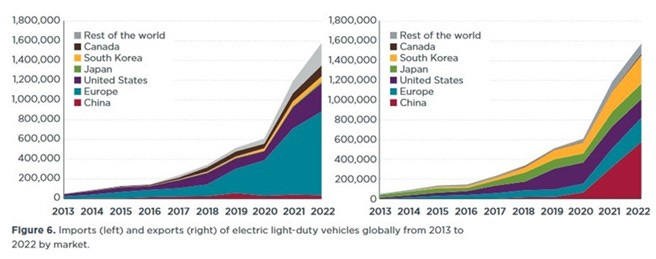

According to the latest Federal Highway Agency (FHWA) data, there were 276 million registered cars and trucks as of 2020, and roughly 58% were trucks, which include light-duty, heavy-duty, and sport utility vehicles (SUV). Today, we are probably nearing 300 million vehicles on America’s roads. They are aging, as various car reporting services estimate the vehicle fleet average age is 12.5 years, one year higher than in 2015. As the chart below shows, in 2003, the average age of the combined vehicle fleet was under 10 years. In 20 years, it has increased by nearly 30% due to better quality vehicles so it is likely the fleet’s average age will continue rising.

Average age of our vehicle fleet is rising because of better quality vehicles.

Currently, the U.S. consumes roughly 20.4 million barrels per day (b/d) of petroleum products. Gasoline and diesel represent nearly two-thirds of the total. Since 2002, total petroleum consumption grew by about 600,000 b/d. However, since those early years, the share accounted for by gasoline and diesel slipped from about 64% to slightly under 63% due to the improved fuel efficiency of newer vehicles. As these more fuel-efficient vehicles account for a larger share of the vehicle fleet, the rate of growth of gasoline and diesel consumption slowed. Given government fuel-efficiency mandates, continued improvement will likely further erode gasoline and diesel’s share of total petroleum consumption.

Growth in SUVs has caused the share of light-vehicle trucks share of the total fleet to soar.

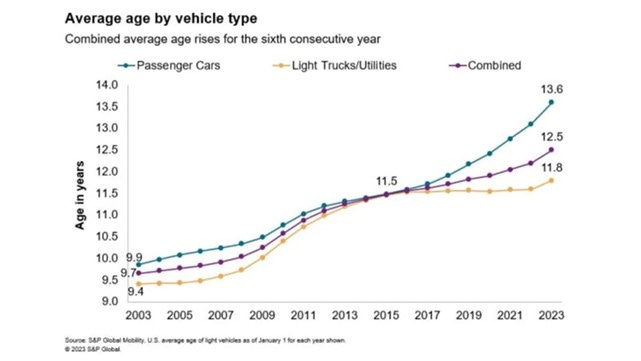

Since the introduction of EVs, and given their accelerating sales growth, spurred by government mandates and subsidies, the share of petroleum use represented by gasoline and diesel fuel is projected to fall over the next decade. The following chart shows how EVs are growing as a share of new vehicle sales in the U.S.

EV share of vehicle fleet has grown significantly and it has been driven by BEV purchases.

First quarter 2023 vehicle registration data shows battery electric vehicles (BEV) grew by 63% compared to a year ago and reached 6.9% of the total market, up from 4.6% in last year’s first quarter. Plug-in hybrid electric vehicles (PHEV) sold reached 1.4% of sales, up slightly from last year. Despite the rapid increase in EV sales, they still represent a minuscule share of the U.S. vehicle fleet. Today, the U.S. vehicle fleet is likely approaching 300 million cars and trucks. Given the popularity of SUVs, we would suggest that the fleet split, rather than 115 million passenger cars, and 185 million trucks, is maybe 205 million cars and SUVs, with an additional 95 million trucks.

Slow EV Penetration Of Vehicle Fleet

Despite the rapid growth in EV sales, they still represent only about 1.5% of our estimated fleet of cars and SUVs. What is disturbing for EVs is the fact they are not staying in the vehicle fleet as long as ICE vehicles. Green Car Reports recently noted that S&P Global Mobility estimates that “of the nearly 2.3 million EVs registered in the U.S. between 2013 and 2022, about 6.6% have left the fleet, while about 5.2% of other vehicle types have left the fleet over the same time frame.” The study had no explanation for why the higher scrappage rate for EVs, but the article said it “isn’t due to battery degradation or durability.” It cites “a recent study by Recurrent, which sells battery health reports for used EVs, found that only 1.5% of 15,000 EVs needed pack replacements due to degradation.”

Green Car Reports suggests that insurance companies may be the cause. They believe the insurance companies are “far too eager to completely write off EVs rather than fix them—especially when the battery pack is involved, or when there's even light flood damage.” Flood damage is a problem for all vehicles, but especially for EVs because lithium-ion batteries and water do not mix well. As to the repair issue, there are some EV models with no repair plans when damage is done to the battery that is integrated with the vehicle’s frame. In other cases, the cost of parts boosts the expense to 70% or more of the value of the vehicle, which triggers the “write-off” decision. Insurance companies are also concerned that heavier and more powerful EVs are susceptible to higher accident rates, especially if operated by inexperienced drivers. Combined, these issues contribute to higher insurance and scrappage rates for EVs that will slow the transition to a complete EV fleet.

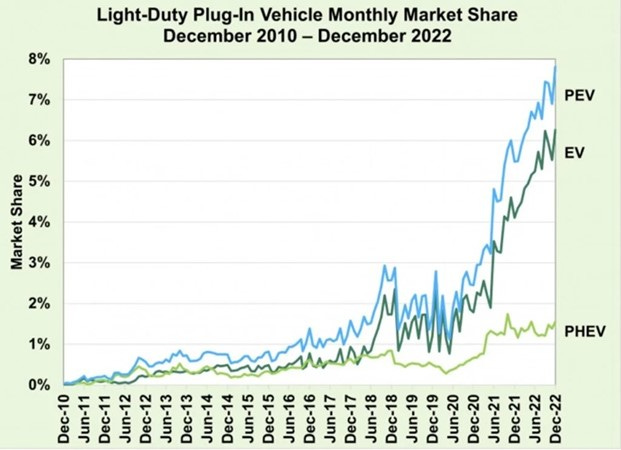

A major question for future EV sales is the impact of ICE vehicle sales bans in numerous U.S. states and European countries and cities. Despite accelerating the vehicle fleet transition to fully electric, China remains the world’s largest EV market, and it has become the world’s largest EV exporter. The Chinese government’s focus is on building EV exports by improving their quality and reducing their cost. This strategy will challenge the European automobile industry which is struggling with high inflation, expensive energy, aging workforces, and a lack of critical mineral supplies. China will remain a disruptive force for European and American automobile manufacturers.

China has become the leading EV market and now it is the leading EV exporter.

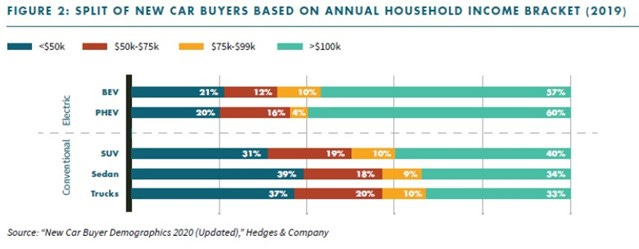

An interesting dynamic is who is buying EVs in the U.S. This plays into the interaction of the tax subsidies and the cost of EVs for buyers, especially against cheaper ICE vehicles, and how these dynamics will impact market growth. Although the data is slightly dated, the chart below shows that high-income (>$100,000) buyers dominate the U.S. EV market. Until EV prices become more competitive with comparable ICE models, it will be hard for EVs to dominate the fleet without even greater government assistance. Banning ICE vehicle sales will likely slow the fleet transition as buyers priced out of the EV market will retain their older ICE vehicles or purchase used-ICE vehicles.

So far, EV purchases have been dominated by high-income households.

Such market challenges call into question whether government policies toward EVs (subsidies and bans) and their role in reducing transportation carbon emissions should be reassessed. Two groups whose reports we have reviewed are striving to find more cost-effective ways to reduce vehicle emissions than current government policies. They are searching for ways to accelerate the shift to a cleaner automotive sector. One group is the Transportation Energy Institute (TEI), and the other is the Breakthrough Institute. Let’s explore their arguments.

EVs Are Not The Answer To Emissions

While acknowledging the rapid growth of EVs, TEI shows in the chart below, based on a set of assumptions, the challenge of revamping the fleet’s composition fast enough to cut emissions significantly. Using the Energy Information Administration’s Annual Energy Outlook for 2022 for vehicle fleet growth which calls for 16.2 million new vehicles sold annually, an annual increase in EV sales of 31% through 2032, and an average fleet scrappage rate of 5%, EVs will account for only 9.8% of the total fleet in 2032. Such a model supports the arguments of major oil company CEOs that oil will be needed for decades. It also suggests that there will be little impact on transportation carbon emissions.

Models show that even with healthy growth in EV sales, after a decade of growth, they will still represent less than 10% of the U.S. vehicle fleet limiting emissions reduction efforts.

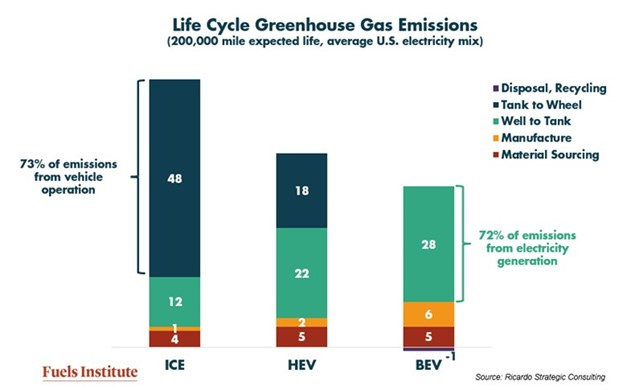

TEI shows data on the life cycle greenhouse gas emissions for ICE vehicles, hybrid (HEV), and BEVs based on a 200,000-mile expected life and charging based on the average U.S. electricity supply mix. Understand that the 200,000-mile figure, based on the U.S. Department of Transportation Federal Highway Administration’s most recent data for 2021 showing the average driver traveled 13,489 miles, means an operating life of vehicles of 14.8 years. There are other data sources, primarily automobile insurance companies, that use an average of 10,000-12,500 miles driven per year. Such lower numbers would extend the vehicles’ operating lives by up to 5.2 years.

Over 200,000 miles of vehicle operations, BEVs generated the least amount of emissions.

As the chart shows, ICE vehicles generate the most emissions over their life, while BEVs generate the least. What many people do not realize is the legacy emissions of a BEV versus an ICE vehicle. The chart shows BEVs generate 25% more material sourcing emissions, and six times manufacturing emissions. Combined, EVs generate 2.2 times the total emissions created than manufacturing an ICE vehicle.

A study by Volvo, comparing the emissions generated by building similar model crossover vehicles, a BEV versus an ICE vehicle, manufactured at the company’s South Carolina plant, found the BEV had generated 70% more emissions than the ICE vehicle when it rolled off the assembly line. The study concluded that charging the BEV on a 100% clean energy grid meant it would only need to be driven for 3-4 years to overcome its legacy emissions. Using an average-powered grid would require 7-8 years of driving to erase the gap, and a dirty grid would take even longer.

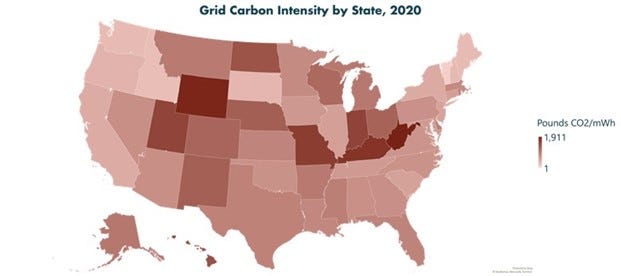

The carbon intensity of state electricity grids will have a meaningful impact on the volume of emissions from EVs.

TEI showed the grid carbon intensity of states in 2020. As the next chart shows, TEI reached a similar conclusion to the Volvo study. In fact, in their dirty grid scenario, the BEV creates more emissions than an ICE vehicle or HEV.

Surprisingly, in states with extremely high carbon intensity grids, EVs can generate more emissions than internal combustion engine vehicles.

TEI’s study highlights how a government policy of cleaning up dirty grids may achieve greater carbon emission reductions than pushing for a nationwide transition to an all-EV fleet, something that will not be achieved for several decades despite bans on selling ICE vehicles.

The Breakthrough Institute study was led by Ashley Nunes, the institute’s Director of Federal Policy, Climate, and Energy. In testimony to Congress in April, Mr. Nunes discussed the miles an EV must travel to realize an emissions advantage over a similar ICE vehicle. They estimate distances between 28,069 and 68,160 miles. Using a 10,000 annual miles per year metric, the emissions saving can be achieved in as little as three years, or it may require nearly seven years. Those findings are consistent with other studies.

Government EV Policy Should Change

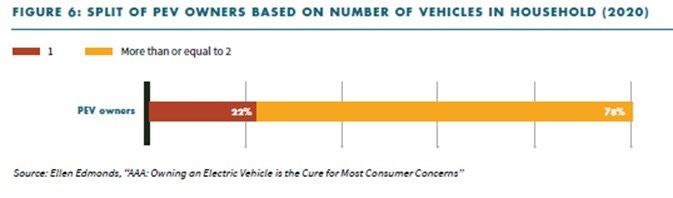

The challenge for government policy is that incentivizing the purchase of EVs may be misdirected. The Breakthrough Institute’s work suggests that the majority of EVs are purchased and used as secondary or tertiary vehicles, rather than the primary household vehicle. This conclusion was supported by the Fuels Institute. Its data showed that 78% of EV owners had two or more vehicles in their households, and only 22% it is their primary vehicle. This ownership split impacts emissions reduction success as the second and third household vehicles are driven less than primary vehicles. Therefore, subsidizing EV purchases as second and third vehicles will be less impactful for reducing emissions than if the incentives were directed at replacing higher-mileage primary vehicles.

EVs are primarily owned in households with two or more vehicles, which will impact the number of miles they drive and their impact on reducing carbon emissions.

Mr. Nunes testified that this ownership split suggests EVs must be owned and driven for longer than if they were displacing primary vehicles. He said the Breakthrough Institute estimates these EVs would need to stay on the road for 10 years and there is little evidence that is happening, as suggested by the higher EV scrappage rate than for ICE vehicles.

Both research groups focused on other issues such as the shortage of critical minerals necessary for building EVs and the relative cost disadvantage EVs have versus ICE vehicles. These are not issues for us to explore here.

Mr. Nunes testified, “Even when [carbon] reductions are realized, EVs may not be the most cost-effective emissions reduction pathway, at least from the vantage point of public spending.” He made two recommendations for Congress for revising public policy. “First, EV subsidies should be reserved solely for vehicle replacement purposes.” He said the policy goal should be to transform the ‘propulsion profile’ of the vehicle fleet, which means prioritizing the subsidies to encourage the replacement of household vehicles and not an addition to the number. In that regard, he said, “Replacement of primary vehicles in a household should be prioritized.”

His second recommendation would be to “consider alternative vehicle powertrains that also offer emissions reduction potential.” This would mean the increased use of and maybe incentivizing HEVs. Mr. Nunes testified:

“Breakthrough’s work finds HEVs are a more climate friendly alternative to an EV if the EV covers less than approximately 96,000 miles across its lifetime and an HEV covers 180,000 miles. Furthermore, we note that because HEVs cost significantly less than EVs, the magnitude of EV cost penalties relative to their GHG emission reduction benefits makes HEVs a more promising near-term emissions reduction pathway.”

If the smarter government policy for cutting transportation emissions is to replace high-mileage ICE vehicles rather than merely promoting EVs, we should consider a more targeted subsidy effort. We should be reexamining electrifying taxis, utility service vehicles, delivery vans, etc. that are driven daily and for hours at a time and which return to a base location each night. Such a policy shift may not only be more successful in cutting automobile emissions faster, but it may also be less costly for taxpayers.

Embracing such a policy shift would be to acknowledge that Toyota Motor Corporation President Akio Toyoda is right that HEVs are more effective decarbonization tools than BEVs. As he stated earlier this year, BEVs “are not the only way to achieve the world’s carbon neutrality goals.” He explained the overall emissions advantages of HEVs when he stated, “The amount of raw materials in one long-range battery electric vehicle could instead be used to make 6 plug-in hybrid electric vehicles or 90 hybrid electric vehicles.” He went on to point out that “The overall carbon reduction of those 90 hybrids over their lifetimes is 37 times as much as a single battery electric vehicle.” That is a very powerful fact that should be given greater weight to how to create government policy for cutting emissions.

Over the years, Toyota management’s market insights have enabled it to become the world’s largest automobile manufacturer, 25% larger than the second-place company. They know about successfully building and selling popular vehicles. Their success should be considered when we think about how best to transition to a cleaner global vehicle fleet. Rather than vilify Mr. Toyoda, as various public pension funds did at the company’s latest annual meeting, we should acknowledge that his plan could save the world from having to build hundreds of new lithium, cobalt, nickel, and graphite mines and processing plants with their huge emissions and societal impacts. Politicians need to recognize that one-size-fits-all policies are seldom successful, and there are plenty of smart people capable of developing better plans.

Dean, you are absolutely right. Proof reading twice and two grammar software results didn’t catch my mistake.

Good article, Allen, with excellent data. Very well done. I think you meant to write "Analyses by Goldman Sachs, Credit Suisse, the Mercatus Center, Americans for Tax Reform, and others have suggested that the cost will be more like $1.2-$1.4 TRILLION (instead of billion) over the decade, or more than three times the CBO estimate" in the second paragraph of the section entitled "Subsidies Drive The EV Market."