Energy Musings - June 23, 2025

Headlines point to problems with the green energy narrative. Moreover, the decarbonization of the U.S. economy has continued without consideration of energy policies.

The Green Energy Narrative’s Troubles Grow

A weekly Carbon Brief newsletter headline screamed, “Three Years to 1.5C.” It cited research by 60 climate scientists that shows that the world is “doomed to breach the symbolic 1.5°C warming limit” in as little as three years.

“Carbon Brief climate science contributor Dr Zeke Hausfather told the Washington Post: ‘Some reports, there’s a silver lining. I don’t think there really is one in this one.’” Start the countdown to the climate apocalypse.

While Carbon Brief was clamoring for more climate change action, a series of headlines suggests the narrative about green energy’s success in revamping our economy is faltering.

Green hydrogen and SAF

The first headline was about Germany's steel company ArcelorMittal, which is ditching plans to convert its Bremen and Eisenhűttenstadt plants to use hydrogen rather than coal in its furnaces. It is even turning down €1.3 ($1.5) billion in public subsidies. The company said it was “just not competitive” to proceed with the conversions given Germany’s high energy costs and uncertain future energy mix.

“Frederik Van der Velde, chief executive of ArcelorMittal Belgium, told the Financial Times that there had been excessive focus on hydrogen in Europe, which would take ‘many more years to become economically viable.’” That verdict on hydrogen’s promise versus its profitability is becoming a familiar story throughout Europe.

Because of European Union regulations, ArcelorMittal also warned that it could shut its flagship green ethanol plant in Ghent, Belgium. The EU said the plant’s output did not qualify as “green,” preventing the company from charging a premium for the product to cover its higher cost. Therefore, the production would have to be sold at a loss, which the company is unprepared to do.

This announcement highlights the new German government's challenge in boosting its economy. New German Chancellor Friedrich Merz has pledged to increase Germany’s competitiveness. He envisions policies to reduce high energy costs for businesses, slashing red tape for new and upgraded plants, and pumping money into infrastructure will do the trick. However, these policies risk Germany’s pledge to become carbon neutral by 2045.

In another green energy matter, Reuters reported that the EU has offered to subsidize airline purchases of expensive Sustainable Aviation Fuel (SAF) required for intra-Europe flights. The EU will use the revenue from the sale of 20 million carbon emissions permits to help cover the gap between the cost of conventional kerosene (jet fuel) and SAF fuels. Reuters calculated that the subsidies would cover purchases of 216 million liters of SAF or 2.6 billion liters of biofuels. The EU subsidies would cover up to €6 ($6.90) per liter of the cost of SAF or €0.5 ($0.58) per liter for biofuels.

The 216 million liters of SAF would represent about 15% of global SAF production. However, the need for subsidies highlights a problem with decarbonizing the airline industry. The International Air Transport Association (IATA) expects SAF production to reach two million tons (2.5 billion liters) or 0.7% of airlines’ total fuel consumption in 2025. Such a small amount of decarbonization is costly. IATA says SAF purchases will add $4.4 billion to the industry’s global fuel bill.

The bigger problem is that most SAF production is heading to Europe because of the UK and EU mandates on its use. This has resulted in refiners adding compliance fees to the fuel bill. IATA estimates that the European SAF mandates will require airlines to purchase one million tons (1.25 billion liters), which at current market prices is $1.2 billion. Additionally, compliance fees are estimated to add $1.7 billion. The result is that the mandate has made SAF five times more expensive than conventional jet fuel. This will force airlines to increase their ticket prices.

The bigger challenge is that even with the subsidies, the market for SAF and biofuels faces a profitability challenge. That is why Shell plc stopped constructing its Rotterdam refinery to produce 820,000 tons of SAF and biofuels annually. The company explained when it announced the pause last summer that it would focus its capital spending on its most profitable ventures, primarily those in oil and gas. We suspect Shell management is waiting to see how the SAF and biofuel markets develop and whether these fuels can become profitable or always require subsidies before restarting its construction. As Shell has found out, any business dependent on mandates and subsidies is problematic.

Electric vehicles

In the U.S., the headlines dealt with the electric vehicle (EV) market. S&P Global Mobility reported that EV registrations fell in April for the first time in 14 months. That was partly due to Tesla’s registrations falling by 16%.

Another EV headline was that more customers chose to lease EVs, rather than buy them in the first quarter of 2025. The story was based on data from Experian. The data showed nearly 60% of customers leased their EV purchase, up from 36% in 2024’s first quarter. This is not surprising as the $7,500 subsidy for EV purchases has been curtailed for many buyers by income thresholds and EV eligibility. To sustain the market, the Biden IRS ruled that all EV leases would be considered commercial vehicles, which were still eligible for the credit. The credit reduces the cost of the EV being financed via the lease, helping to lower monthly payments and make it more affordable.

What will be interesting to watch is what happens to lease profits when they end, given the accelerating depreciation in used EV prices. If the leasing company recovers less residual value in its leased EVs, we could see a problem for some auto lending companies.

Climate versus energy policy

We will add another blow to the green energy narrative. Last week, Roger A. Pielke, Jr., who writes at The Honest Broker on Substack, published “The Most Amazing Climate Policy Figure.” Pielke, Jr. was an academic with his last position at the University of Colorado Boulder. He was a political science professor specializing in public policy and science, environment-society interactions, and sports policies. He began his career researching climate because his father, Roger A. Pielke, is an atmospheric scientist and a leading climate change researcher.

The subject of Pielke’s article was the following chart. It shows the remarkable history from 1992 through projected data for 2025 of the relationship between U.S. carbon emissions and the nation’s gross domestic product (GDP). Decarbonizing the U.S. economy has seen a steady progression irrespective of which political party controlled the government’s energy and environmental levers.

The U.S. economy has steadily decarbonized.

“Sources: OMB and EI. Note that 2024 and 2025 U.S. carbon dioxide emissions from FF are based on projections from the 10 June 2025 EIA STEO.”

Pielke followed up with this chart plotting the annual coordinates of U.S. GDP and carbon emissions from fossil fuels. As GDP grew from the early 1990s to the mid-2000s, carbon emissions increased. That relationship reversed after 2005 and has declined steadily since.

GDP and carbon emissions annual data points.

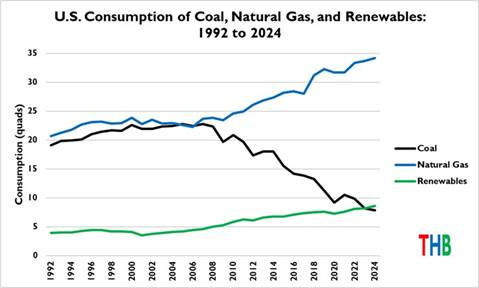

Using two fuel consumption charts, Pielke highlighted the historical pattern above and the dramatic energy consumption shift since 2005.

Coal use was the driver of carbon emissions.

The chart shows how coal consumption grew slightly between 1992 and 2005 but began a slow, steady decline. The pace of the decline accelerated as the nation exited the 2000s. At the same time, coal use peaked, and natural gas consumption steadily rose. Likewise, renewable energy fell to its lowest level in 2001, but its use rose slowly through the remainder of the period.

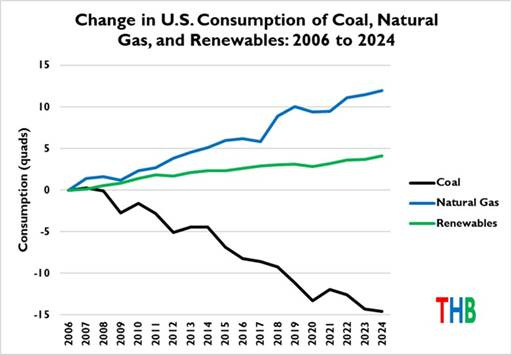

Fuel use in recent times reflects coal’s displacement.

The history of fuel consumption since 2006 is shown in the chart Pielke prepared to dramatize the impact of coal’s decline and the rise in natural gas use. Renewable energy steadily increased during this period, but natural gas use appeared to be more critical in decarbonizing the U.S. economy.

Given Pielke’s four charts, he offered some thoughts about the implications of his findings. He noted that what has driven the linear decarbonization trend is not understood. In his view, the government should focus on keeping the decarbonization trend on its linear-decline trend rather than concentrating on energy policies. That means working on technological advancements that have and will further contribute to decarbonization. If that trend can be sustained, Pielke believes the U.S. could reach net-zero emissions by the middle of the second half of this century, consistent with the Paris agreement’s 2ºC scenario.

Pielke further believes that as long as coal is on the grid, natural gas will remain the bridge fuel to a decarbonized future. It is required to bridge fuel needs while nuclear power plants are built, accelerating decarbonization. Most importantly, Pielke asked a question.

“A question that should be asked: Has U.S. climate policy since 1992 even mattered for decarbonization? Or have steps that result in maintaining historical rates of decarbonization been recharacterized as climate policy?”

In other words, have we mischaracterized industrial policy as climate policy? If so, then maybe we should be rethinking how we impact our economy to continue the decarbonization trend rather than focusing on how to control which energy sources will be allowed to power the economy. Have people had their attention diverted while the magician works his sleight of hand? The climate narrative may be nothing more than “sound and fury, signifying nothing.”

"The climate narrative may be nothing more than 'sound and fury, signifying nothing.'"

Precisely.