Energy Musings - June 20, 2023

The Rhode Island show cause hearing for SouthCoast Wind highlighted the offshore wind market's turmoil from higher costs and inadequate power prices leaving developers to bail on their contracts.

Offshore Wind Confronts Deteriorating Market

Up and down the East Coast, offshore wind developers are waking up to find their power purchase agreements (PPA) underwater. Trying to avoid financial disasters, they are scrambling for solutions. Why the turmoil? Simple. Actual project costs are wildly off from the estimates when PPA prices were locked in. Penalties to get out of PPAs are a cheaper option, especially if you are not going to be penalized for terminating the contracts. Even the inflated renewable energy subsidies in the misnamed Inflation Reduction Act won’t save these bad deals.

The turmoil’s magnitude was at the center of a hearing before the Rhode Island Energy Facility Sitting Board (RI EFSB) last week. SouthCoast Wind, a 1,200 megawatt (MW) project in federal waters off Rhode Island to supply nine Massachusetts utilities with clean electricity, needs the RI EFSB’s approval to land its transmission cables and allow their passage across the state to connect with the regional power grid at Brayton Point in Somerset, Massachusetts.

The two-plus hour “show cause hearing” on June 12 had twice been rescheduled at the request of SouthCoast Wind – December 19, 2022, and February 27, 2023 – as the company’s assessment shifted from a viable project to an unfinanceable one. As the RI EFSB outlined in its show cause hearing notice, the need arose when it learned from the media on November 10, 2022, that SouthCoast Wind was requesting the Massachusetts Department of Public Utilities (MADPU) to suspend their review of the PPAs given the company’s realization the project was no longer financeable, i.e., unprofitable.

However, SouthCoast Wind wants the RI EFSB to continue its approval process without knowing if the offshore wind project will move forward. SouthCoast Wind is terminating its PPAs (paying penalties) and plans to bid in the new Massachusetts Request For Proposal (RFP) for more offshore wind. According to the company’s management, suspending the transmission cable application until SouthCoast Wind successfully demonstrates it has a viable project in 2024 would upset the development’s timing, making it harder to win PPAs and ultimately jeopardizing the company’s business model.

Francis Slingsby, the CEO of SouthCoast Wind Energy LLC, which is a joint venture of Shell New Energies US LLC and OW7 North America LLC (Ocean Winds) was the star witness. Ocean Winds, in turn, is a joint venture between EDP Renováveis, a global leader in the renewable energy sector, and ENGIE, a French multinational utility company. Mr. Slingsby was hired as SouthCoast Wind’s CEO last October after spending 11 years in various managerial roles for Ørsted, the Danish renewable energy firm, including his last two years as Chief Commercial Officer and Head of Business Development for its U.S. operations.

Before the hearing, Mr. Slingsby submitted written testimony. He also included a company-commissioned analysis of the U.S. offshore wind industry prepared by the energy consultant Wood Group. The report was submitted under seal as it contained confidential commercial information, so three-quarters of the pages were blacked out.

The hearing was a question and answer session with Slingsby and two other SouthCoast Wind officials. Almost all the questions were posed by the RI EFSB’s Chairman. A few questions were offered by another board member, and at the end by a lawyer representing two Rhode Island cities impacted by the landing of the transmission cable, the subject of the application, who are intervenors.

The Offshore Wind Dilemma

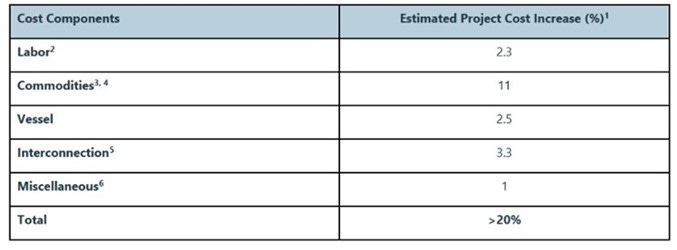

The RI EFSB’s Chairman started the questioning asking about offshore wind farm capital structures and the sources of their capital. He asked Mr. Slingsby about the returns earned by offshore wind farms after stating that typical utilities across the country seeking rate increases are targeting a return on equity (ROE) of 9%-11%. While Mr. Slingsby said SouthCoast Wind’s figure was “sensitive,” he acknowledged that the returns are “very significantly lower.” He attributed the low returns to inflation, commodity cost increases due to the Ukraine war, supply chain issues, and higher interest rates. To support his statement, he referenced the Wood Group report showing that since 2019 the project had experienced more than 20% cost increases for components and labor, as well as a 10% increase in financing costs. Therefore, SouthCoast Wind is facing a “greater than 30%” cost increase that has caused a “significant deterioration in project economics,” according to Mr. Slingsby. This is why SouthCoast Wind has moved to terminate its PPAs.

SouthCoast Wind commissioned Wood Group to study the U.S. offshore wind industry which showed how components and labor costs for its project have increased by over 20%

A crutch developers rely on is that the cost increases were unexpected, therefore they need significant price relief. It is easy to give developers a pass, but the reality is that their job is to anticipate the possibility of contingencies impacting their projects and prepare for them. For example, the need for Jones Act-compliant support and installation vessels, when none existed, should not have been a surprise. The cost of employing them was going to be expensive because they needed to be built and vessel owners are not about to risk their capital on building a vessel on speculation.

When asking essentially for a “do over,” the question “what will you do differently?” was asked by the Rhode Island cities’ attorney. Mr. Slingsby, in a Mad Magazine Alfred E. Newman, What Me Worry? imitation, responded that the pathway to the new PPAs as outlined in the draft Massachusetts RFP includes indexation for inflation and price increases in certain commodities. The sooner SouthCoast Wind can place orders for components and contract services will further help to keep costs in check. Implicit was an appeal for the RI EFSB to continue its application approval for the transmission cables as part of the cost-saving strategy.

But the core of Mr. Slingsby’s response was that the policy demands of the New England states for more clean energy – offshore wind ‒ to offset the capacity lost in shutting down fossil fuel power plants is what is shaping the market of the future. These clean energy policies, something being embraced around the world, will ensure that the market and the supply chain for new offshore wind projects will evolve. Saving the planet is too important for policymakers to allow the offshore wind industry to fail.

The SouthCoast Wind cost increase numbers suggested by the Wood Group analysis were accepted at face value. What we found interesting, however, was a 2019 European finance paper (behind the paywall of Nature Sustainability) that explains how higher interest rates will reverse the decline in renewables pricing. This is because of the nature of the cost and operations of renewable projects versus fossil fuel projects. The paper’s abstract stated:

“Increasing the use of renewable energy (RE) is a key enabler of sustainable energy transitions. While the costs of RE have substantially declined in the past, here we show that rising interest rates (IRs) can reverse the trend of decreasing RE costs, particularly in Europe with its historically low IRs. In Germany, IRs recovering to pre-financial crisis levels in 5 years could add 11% and 25% to the levelized cost of electricity for solar photovoltaics and onshore wind, respectively, with financing costs accounting for about one-third of total levelized cost of electricity. As fossil-fuel-based electricity costs are much less and potentially even negatively affected by rising IRs, the viability of RE investments would be markedly deteriorated. Based on these findings, we argue that rising IRs could jeopardize the sustainable energy transition and we propose a self-adjusting thermostatic policy strategy to safeguard against rising IRs.”

Renewable energy projects are highly capital intensive, making their financial returns susceptible to sharp declines as interest rates rise. Having failed to prepare for the possibility of the end of the zero interest rate environment is a management mistake. Now developers want ratepayers to bail them out. That may happen because public policies demand clean energy regardless of the cost. At the end of the hearing, the RI EFSB Chairman discussed how utility regulators face a Hobson’s Choice - do they blindly approve contract prices that are not economic or risk ensuring insufficient clean energy supplies as mandated by public policy? As the RI EFSB Chairman said, “There is no answer.”

The Changing Financial Landscape

Several days before the Rhode Island hearing, Ørsted held its annual Capital Markets Day 2023 for investors in London. Ørsted CEO Mads Nipper suggested:

“Ultimately, Ørsted may reconfigure or exit awarded projects where Ørsted has not yet taken FID (final investment decision), as of this date, if it finds the value creation in the projects to be insufficient.”

The company showed the following slide highlighting the poor current lifecycle internal rate of return (IRR) it is facing for its U.S. projects. The company targets 150-300 basis points above its weighted average cost of capital (WACC) for offshore wind projects. Currently, U.S. projects have a zero basis point spread, which is an unacceptable condition. For the non-financial readers, a company that fails to earn its WACC is on the road to failure – not a good long-term outcome.

Ørsted presented data at its Capital Markets Day 2023 showing it was only earning its WACC for current U.S. offshore wind projects

An example of the financial challenges facing offshore wind developers was Ørsted’s January announcement of a write-down in the value of its Sunrise Wind project in New York. Sunrise Wind is a 50/50 joint venture between Ørsted and New England utility company Eversource. Ørsted announced a DKK2.5 billion ($367.5 million) reduction in its value or a $735 million reduction in the total value of the offshore wind farm. Ørsted cited the rising cost of installation vessels and services as the cause for the reduced value of Sunrise Wind.

The challenging offshore wind economic environment has Ørsted cutting back on its offshore wind ambitions. The company is now targeting to have 28 gigawatts (GW) of offshore wind installed by 2030 rather than its prior target of 30 GW. That is just over a third of its current pipeline. According to Mr. Nipper, this is a “direct result of taking a very high priority to value creation.” He pointed to reconfigurations of projects in the US and Poland. While Ørsted raised its overall profits and growth outlook, Mr. Nipper also was clear that to maintain high returns, it must increase stricter financial scrutiny of projects. Profitability is becoming more important than building everything, so expect even fewer projects in the future.

Interestingly, Ørsted’s chart of U.S project returns in its Capital Day presentation mentions the positive contribution from the Inflation Reduction Act’s (IRA) tax credits that offset some of the cost inflation. The IRA’s tax benefits were also cited by Ørsted in explaining why it purchased New Jersey utility PSEG’s share of their jointly owned Ocean Wind project. Ørsted said its total ownership of the project would allow it to take better advantage of incentives and tax provisions for developing renewable energy projects. Another example of how important government subsidies are for the renewable energy business.

Wanting A New Regulatory Process

The offshore wind market’s turmoil was further highlighted by recent filings with the New York State Public Service Commission by Sunrise Wind, the 924-MW wind project, as well as three wind farms - Empire Wind I, Empire Wind II, and Beacon Wind I with a total of 3,300 MW of power – proposed to be developed by a joint venture of Equinor, a Norwegian energy company, and bp plc, the international major oil company. The New York filings were motivated by the state allowing price adjustments to PPA prices in its latest RFP for offshore wind power.

The companies are asking state regulators to allow the inclusion of retroactive price adjustments in PPAs negotiated in the first two offshore wind procurements. What we wonder is how this would work given the long-standing “filed rate doctrine”? That regulatory doctrine holds that retroactive adjustments to utility rates cannot be implemented. Maybe state regulators will allow adjustments under the guise that since the projects have yet to be built, adjusting the prices for the power that hasn’t been delivered is ok. However, violating the filed rate doctrine puts regulators in the difficult position of approving higher prices and blindsiding the ratepayers they are supposed to be protecting. The defense would likely be that regulators must do whatever it takes to get these projects built because they are fulfilling public policies – the Hobson’s Choice issue.

The New York move is interesting given the Massachusetts situation. When offshore wind developers’ requests for the MADPU to pause its approval process for the PPAs, while the developers and the utilities negotiated alternative solutions, were rejected, it forced the developers to find another path. The path opened when Massachusetts announced its next offshore wind RFP which included rate indexation for inflation and commodity prices. Developers would be protected against rising costs destroying project economics during the time between negotiating PPAs and building offshore wind projects.

Developers are terminating their PPAs while planning to bid in the 2024 RFP where they could earn higher prices. Further aiding the developers’ decisions was that they would not be penalized in the bid evaluation process for their prior PPA terminations. We assume this is like New York’s provision that has developers hoping to make it retroactive.

As Bruce Mohl, writing in Commonwealth about the New York and Massachusetts offshore wind market, put it:

“The precise size of the price adjustments being sought was blacked out in the public filings, but it would appear to be substantial. In the Sunrise Wind filing, a calculation using the inflation adjuster formula contained in the third-round procurement indicated a price increase of 23 percent would be warranted.”

According to Mr. Slingsby’s testimony, SouthCoast Wind’s PPAs were priced in the range of $75 to $77 per MW, or $0.075 to $0.077 per kilowatt-hour (kWh). Applying the 23% increase factor, the price range would increase to $92.25 to $94.71/MW or $0.0925 to $0.09471/kWh. These are healthy price increases and ratepayers will notice.

With the inclusion of indexation measures in future PPAs, the claims of ever-declining offshore wind costs will no longer be valid. The reason becomes clear when we consider the reports of the consultants in the New York and Rhode Island filings. In New York, in support of its request to receive higher prices in prior PPAs, Equinor/bp cited the following:

“Wood MacKenzie estimates that $25 billion of investment is required in the supply chain in the next few years for the industry to meet demand peaks in the second half of the decade. The need for investment is particularly acute for vessels, where 80 percent of the capacity required to meet demand in 2030 does not exist today, and for foundations, where investments in new fabrication facilities need to be made five years or more ahead of facility completion. The shortage of supply creates significant investment opportunities, but it also means that offshore wind supply chains will remain strained for the foreseeable future, and that a strategy to pause projects to wait out current supply chain constraints is not likely to lead to reduced costs.”

While they argue that price relief is needed and pauses will not help, the question becomes whether supply chains will receive the necessary investment to expand in the timeframe required. Earlier this year, the CEOs of two of the largest U.S. offshore supply vessel companies said they would be interested in investing in wind support vessels if they could earn adequate day rates. How much higher must they be? We do not know, but if we look at the commentary about the state of the inland shipping industry, leading barge company CEOs said rates must increase by at least 30% before they would consider investing in new vessels. They remain cautious because the key components – steel, engines, electronics – are all subject to mandates making them more expensive, assuming the technology exists to meet the new requirements. This is especially true for marine engines needing to burn environmentally friendly fuels. These fuels are still being developed but the engines to burn them have yet to be designed and built. There is no timeline, so a company building a new inland barge either gambles the new engines will exist at the time the vessel is built or risk a shorter vessel lifespan at a significant financial cost due to mandated technology obsolescence.

In the Executive Summary of the Wood Group’s report for SouthCoast Wind, it stated:

“The overall conclusion of the report is that the costs of building and operating offshore wind farms have likely increased well above 20% since 2019, in addition to the significant increase in financing costs. The economics and ability to fund offshore wind in the US have been adversely impacted. It will take several years and significant investment to overcome some of these challenges.

“Recent quarterly losses announced by the two leading original equipment manufacturers (OEMs), Siemens and Vestas, also supports the view that this is not an industry that is in a healthy and mature state.” (emphasis added)

The emphasized text was the focus of Mr. Slingsby’s questioning by the lawyer representing the Rhode Island intervening cities. Implicit in the questions was the risk to the project from further inflation and/or the lack of availability of components and required equipment to construct the offshore wind project. What might these risks mean for the viability of the SouthCoast Wind (and other offshore wind projects) and the cost to the cities impacted by the construction related to the landing of the transmission cables? There seemed to be no answer other than trust me that government mandates for clean energy will ensure the market will develop in time.

SouthCoast Wind’s Regulatory Problem

The RI EFSB Chairman spent time attempting to understand the timing of SouthCoast Wind’s filings and when it knew about the changed economics of the project. Mr. Slingsby suggested that when he joined the company last October, it was evident the project’s economics had deteriorated significantly. However, when SouthCoast Wind supported Commonwealth Wind’s request last November with its request that the MADPU pause its PPA approval process to provide time for the parties to explore ways to address the deteriorating financial condition of their project, it neglected to notify the RI EFSB of the filing.

This lack of notification led to a series of questions about when the SouthCoast Wind project became unfinanceable. The RI EFSB Chairman wanted to know if the financial challenge was from a projected negative profit leading potentially to bankruptcy or merely an insufficient return for the project’s shareholders. Mr. Slingsby said he thought it was the latter. The Chairman also wanted to understand why all the uncertainty about the financial health of the project in October, November, and December, but in testimony on January 27, 2023, before the RI EFSB the project was said to be financially viable.

The answer seemed to be that once the draft of the third Massachusetts RFP for offshore wind was released and inflation and commodity price indexation was included the decision to terminate SouthCoast Wind’s PPAs was made. It also helped that past performance problems such as prior PPA terminations would not be used to penalize a bidder. The draft RFP was released on May 2, 2023, after which SouthCoast Wind moved forward to terminate their existing PPAs.

New Shell CEO’s Impact On SouthCoast Wind

We wondered how much the change in the CEO of Shell plc, the parent of Shell New Energies US LLC., played in SouthCoast Wind’s decision to terminate their PPAs and move forward with rebidding their project. We assume the RI EFSB Chairman was not aware of the impact of Wael Sawan’s appointment as Shell’s new CEO. Mr. Sawan, a 25-year veteran of Shell, was noted for heading up the company’s global LNG business, which is one of the company’s most successful and profitable businesses. His final two years before being elevated to the CEO role had him leading the company’s renewables business.

Upon assuming the CEO role, Mr. Sawan commenced a complete top-to-bottom strategic review of Shell’s businesses to improve profitability and boost returns to shareholders. He discussed in a March interview with The Wall Street Journal the company’s core strategic policies. Like fellow British-based oil company, bp plc, and France-headquartered Total, Shell will not pour money into renewables unless it can earn profits comparable to its core oil and gas business. With renewable returns traditionally in the 5%-8% range versus oil and gas returns of 15%-20%, significantly higher prices or lower costs for renewables are necessary to improve returns. Mr. Sawan also said Shell would no longer subsidize low-return renewable projects with its healthy oil and gas profits. He unveiled the company’s new strategy last week at a New York Stock Exchange meeting with analysts and investors that followed through on his March interview points.

With Mr. Sawan heading Shell’s renewables business when it was announced last September that he would succeed Ben van Beurden, the prospect for changes in the company’s renewable energy business strategy increased. He had plenty of time to understand the cost and pricing of renewable energy projects and why they earn low returns. The Shell CEO selection was made before Mr. Slingsby’s October arrival at SouthCoast Wind. However, Mr. Slingsby was hired in January 2022 and spent the intervening months on “garden leave,” a euphemism for the duration of the non-compete clause in his Ørsted contract.

We suspect Shell’s new strategy caused its SouthCoast Wind co-owners EDP and Engie to agree. While we can only speculate, we believe Mr. Sawan’s elevation forced SouthCoast Wind to examine how to boost the project’s returns, even if it meant terminating the PPAs and paying a penalty. Although Mr. Slingsby would not reveal what the PPA termination penalty would be, a media story says it will cost $60 million. In the scheme of a multi-billion dollar project, such a penalty payment is a rounding error, especially because it avoids a disastrous financial deal. We would have loved to know if our assessment was accurate.

SouthCoast Wind And New Projects

We also watched with interest as Mr. Slingsby attempted to explain why SouthCoast Wind did not bid in the recent Rhode Island RFP for 1,000 MW of offshore wind power. Once again, we are not sure what the RI EFSB Chairman knows about the agreement between Deepwater Wind, the developer of the five-turbine, 30-MW Block Island Wind farm, and the then governor of Rhode Island. Mr. Slingsby went through a tortuous answer about why SouthCoast Wind could not agree to sell 1,000 MW when it plans to build a second 1,200 MW project. If 1,000 MWs is not optimal, how did it justify breaking its first wind project into two transactions of 800 MW and 400 MW?

As we have written before, Deepwater Wind had an agreement that ensured only it could build new offshore wind until it had developed 385 MW. When Ørsted purchased Deepwater Wind in 2018 for $510 million, it gained this exclusive supplier role, which likely explains why it was the only bidder in the recent RFP. The JOINT DEVELOPMENT AGREEMENT [JDA] BETWEEN THE STATE OF RHODE ISLAND AND DEEPWATER WIND RHODE ISLAND, LLC contained the following information.

“T. Phase I of the Project (“Phase I”) – A wind power project to be located in state waters having approximately twenty (20) MWs of nameplate capacity and interconnected to both the electric power systems of BIPCO [Block Island Power Company] and mainland Rhode Island.

“U. Phase II of the Project (“Phase II”) – A wind power project to be located within the SAMP [Special Area Management Plan] area in United States waters off of the coast of Rhode Island having approximately three hundred eighty-five (385) MWs of nameplate capacity and interconnected to the electric power systems of mainland Rhode Island, and which, in the event Phase I is Discontinued, is also interconnected to the electric power system of BIPCO.”

With Rhode Island seeking 1,000 MW of offshore wind and Ørsted having a preferred position for 385 MW of that total, it made sense for SouthCoast Wind, as well as other developers, to decline to bid on a roughly 600 MW project. That would leave SouthCoast Wind trying to sell another 600 MW of power to someone else if it were successful in the Rhode Island bid. Possibly SouthCoast concluded it would not be able to sell such a small amount of power output, therefore upsetting the timing and economics of its next project. That might have been a straighter answer to the RI EFSB Chairman’s question about not bidding on the Rhode Island RFP, but it might have raised questions about bidding collusion and potential price-fixing charges.

The East Coast offshore wind market is in turmoil with projects in Massachusetts, Rhode Island, Connecticut, and New York seeking to terminate their PPAs and rebidding at higher prices. Off New Jersey, a recent development is the opening of a federal investigation into the deaths of 39 whales (reportedly 46 whales now) and their possible link to offshore wind developments. On the West Coast, the governor of Oregon has asked the Bureau of Ocean Energy Management (BOEM) to stop its work on offshore wind development. And as the Wood Group and Wood Mackenzie have laid out in their reports, the health of the industry is not good. It will also need billions of dollars invested in the supply chain over the balance of this decade to reach a healthy state, and even then, there is no assurance it will be healthy. Exploding offshore wind costs, plus higher interest rates that seriously hurt returns from renewable projects are forcing offshore wind developers to examine their projects and likely cull them. Even Germany is allowing developers to cancel approved projects over poor economic returns. How the offshore wind industry evolves from here will be fascinating to watch, but probably costly for ratepayers.

I'm grateful to Allen for doing the drudge work of digging up all of the underlying machinations involved in trying to make the uneconomic economic. This is a sh__ show funded in the name of climate change that should be laughed out of town. One of thousands.