Energy Musings - June 2, 2023

Crude oil prices are battered by headwinds but the future looks better; May was disastrous month for Energy stocks as oil prices fall; East Coast offshore wind challenges continue to emerge.

Oil Prices Are Crashing As Headwinds Grow Stronger

When the oil market opened following the Memorial Day holiday, oil prices dropped by more than 4%. From around $73 a barrel, oil prices fell to the $69 level before falling again on Wednesday. There are numerous reasons for oil price weakness including disappointing economic data from China, continued strength in the U.S. dollar’s value, concerns over the U.S. debt ceiling saga, persistent inflation, and the risk of further central bank interest rate hikes, capped off by uncertainty about the upcoming OPEC+ meeting. The prospect of an in-person gathering of OPEC+ officials has some oil watchers speculating that this meeting could lead to a further cut in production quotas or another period of market-share battles between Russia and Saudi Arabia. The banning of several media outlets from covering the gathering has further added to the mystery of what may happen this weekend in Vienna.

Given the uncertainty about these issues, the commodity futures market remains susceptible to increased volatile moves reflecting trader sentiment shifts. For the past several years – essentially since the start of the pandemic in 2020 – oil trading has experienced a shrinking market as traders have retreated from participation or have reduced the amount of their commitment. In fact, according to the commitment of traders’ data, the net bullish positions are the lowest they have been since 2011.

Bob McNally, the founder and president of Rapidan Energy Group, a Washington-based oil market, policy, and geopolitical consulting firm and the author of Crude Volatility: The History and the Future of Boom-Bust Oil Prices, explained the oil market landscape in an interview with Gulf Intelligence. His thoughts are based on a talk entitled “Oil Market at the Foothills of a Multi-year Boom Price Cycle!” How can this be, given there seems to be too much oil supply and not enough demand?

McNally doesn’t disagree, as he told the interviewer that “it is hard to be bullish in the next 3-6 months because of macro-economic risks.” These revolve around the uncertainty of a global recession, albeit some countries are already mired in recessions, in particular Germany. McNally pointed out that U.S. gasoline consumption has been growing at a rate above what was expected. European gasoline inventories are low. He acknowledged that gasoil/diesel demand is off, but it is being impacted by recession issues and the tempering of consumer spending on material goods. Demand for all other categories of oil is stronger than expected. However, we only see demand data with a lag, which adds to the price volatility since people are extrapolating current demand from contemporary economic data and weekly changes in inventory data.

The biggest challenge in understanding oil market dynamics is Russia. As one of the three largest oil producers and exporters in the world, what is happening with its output and how it interacts with the other OPEC members is key. As McNally highlighted, during 2014-2016, Saudi Arabia and OPEC worked to convince Russia of the need to join with them to manage global oil supplies. Thus, OPEC+ was formed. This new alignment did not always work smoothly, as we saw in 2020 when the pandemic upset global oil demand and Russia continued to pump out supply not needed by the market.

The Russian oil enigma has been compounded by its invasion of Ukraine and the West’s financial sanctions, the ban on purchases of Russian oil, and instituting a price cap on Russian oil sold and transported. Oil markets soared on the prospect that these sanctions and restrictions would leave the world’s oil market short of supply. However, we learned how fungible crude oil is, and when its price cap was set well below the going market price, Russian oil was being snapped up by countries needing cheaper oil and who were unafraid to reject the West’s moral stand on hurting Russia’s economy and its war effort. A ghost fleet of old tankers that would never be able to trade in the world oil market after carrying sanctioned Russian oil continued to move more oil than traders expected. India and China stepped up their purchases of cheap Russian oil. Other markets were supplied by sanctioned oil either being transshipped via ship-to-ship transfers or refined with the product supplied to Western economies.

It is the uncertainty of how much Russian oil is reaching or will continue to reach the global market that is pressuring oil prices. In a recent article, Michael Tran of RBC Capital Markets showed Russia’s monthly oil production compared to its OPEC quota. Through 2022 production matched the quota. So far in 2023, production has fallen short.

Russia Helped OPEC Manage Global Oil Supply From 2017-2020; Now With Sanctions And Production Challenges, It Is Falling Below Its OPEC Quota

Oil industry experts have warned that Russia’s oil production has likely peaked and will soon be in decline as it lacks access to western oilfield technology as sanctions forced the leading oilfield service companies to leave. Recognizing the importance of oil and gas production to Russia’s economy and the government’s revenues, the Russian government has classified the data making it impossible for outsiders to know the exact volumes. It has also shifted its pricing mechanism from Urals oil to Brent which helps its revenues. Russian oil output now must be estimated by outside sources such as Petro-Logistics which is used in the RBC chart.

Since late last year, the outlook for oil markets in 2023 called for a sloppy first half of the year to be followed by continued tightening throughout the second half and into 2024. That view was somewhat predicated on a shallow recession in the first half and recovery during the second. Now the recession questions are when, how deep, and will it be global or limited to Western economies? It seems, from the action of oil futures prices that traders are targeting 4Q2023 as the likely start of a recession although some suggest it may not emerge until 2024’s first quarter. The latest labor market data and comments from Federal Reserve officials that maybe it will pause in hiking short-term rates at its upcoming June 14 meeting have clouded the debate about a recession.

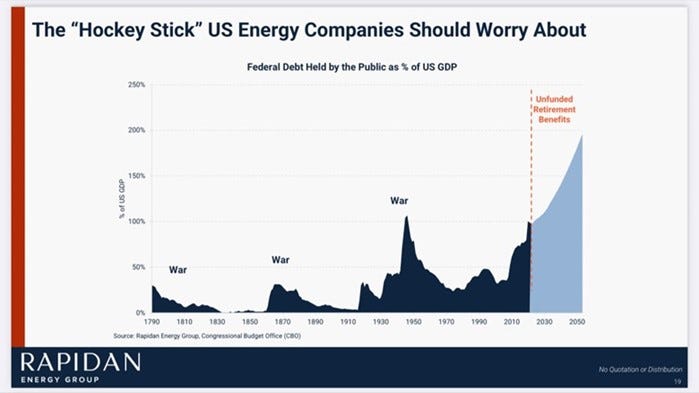

McNally and the interviewer discussed the impact of climate change on oil markets and oil companies. Although he acknowledged the possibility that oil demand will peak in the future, McNally said there was another issue that was of greater concern. Government debt, which is now over 100% of U.S. GDP. The only previous time it was this high was during World War II. McNally then shifted the discussion to entitlements – Social Security, Medicare, and pensions – as long-term liabilities that are not factored into our debt totals but are a threat to oil companies. To finance these entitlements and support existing government expenditures and pay the interest on the rising government debt, McNally believes the government will target profitable industries for increased taxation. The oil and gas industry is a prime target, as we have heard President Joe Biden talk about the industry’s profits, low taxes, and high CEO compensation. To McNally, this is a greater risk to the oil industry’s future than climate change and stranded assets!

McNally And Rapidan Believe The Debt Load, Entitlements, And Pensions Will Force The Government To Look For More Revenues Exposing The Oil Industry To Higher Taxes

We do not disagree with McNally’s assessment of the oil industry’s risk of more government actions that will harm not only the business but its profitability. Stay tuned.

Energy Suffers In May As Oil Prices Fall After Rally

The Energy sector of the Standard & Poor’s 500 Index fell 10% in May, putting the sector at the bottom of performance for the 11 sectors. The performance was not surprising given what happened to oil and gas prices during the month. Our chart of monthly sector performance for 2022-2023 shows how Energy’s (green) performance has changed dramatically from last year to this year. One only has to look at the chart and see that the green squares were mostly on the left during 2022 and now mostly on the right so far in 2023.

Energy Was The Top Performing Sector In 2022 But It Is The Worse Performer So Far In 2023 - Down 11% YTD

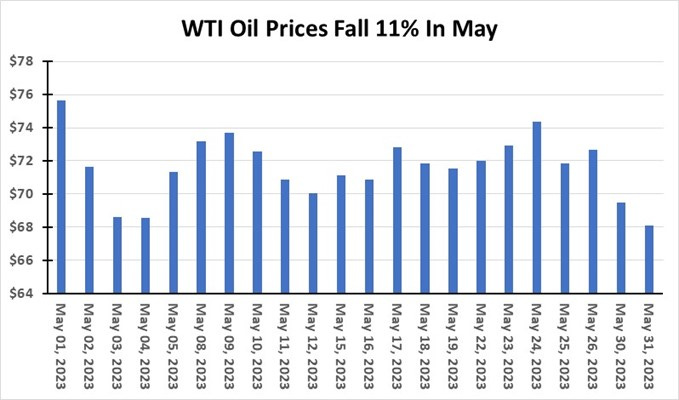

WTI oil prices fell 11% in May but as the chart below shows, they experienced several sharp declines and rallies. The choppy economic news and the debt ceiling negotiations saga had financial markets on a knife’s edge. The collapse of oil futures prices at the end of May coincided with the emotional peak over the debt ceiling negotiations and the legislation’s outcome. Lower oil and natural gas prices translate into lower revenues and earnings for Energy companies, especially when current results are compared to prior quarters with higher commodity prices. That is a ticket to lower Energy stock prices and thus the S&P 500 sector’s poor performance for May.

It Was No Surprise Energy Stocks Performed As Poorly As They Did In May Given The 11% Decline In Oil Prices

Commodity prices are volatile and will remain so until the recession question is answered, and economic growth resumes an upward trajectory. Traders have little confidence about when those conditions will be met, although it seems that the fourth quarter may be the suspect quarter. If a recession develops in 4Q2023, expect the Biden administration to begin instituting policies to accelerate an economic recovery as it heads into its 2024 re-election campaign. Economic stimulus and lower interest rates (a likely policy measure) will be good for oil demand and oil prices. Waiting is frustrating, but oil’s fundamentals are improving, albeit not manifesting in oil futures prices yet.

Latest Developments In The U.S. Offshore Wind Market

As the start of offshore wind farm construction begins, there are numerous developments that may reshape the current projected trajectory. We will only touch on a few of the issues as we anticipate developments will necessitate more in-depth discussions. Here is a brief list of the issues.

1. A labor strike involving crane operators in New Bedford harbor has halted the unloading of the first shipment of wind turbines destined for installation in the Vineyard Wind project. The crane operators were never offered a contract from the wind farm developer as promised a year ago when it trumpeted agreements for hiring workers at the port that is the staging point for the construction project.

2. In New London, Connecticut, the port authority just announced that the projected cost for the revamping of the State Pier to support the construction of Revolution Wind has jumped by $47 million. The project that began with an estimated cost of $93 million has soared to $300 million. To finance the latest project cost increase, the port authority is asking the state to borrow $23 million and getting Ørsted and Eversource, the two project developers, to pay the balance. Reportedly, the port agreed that rentals of State Pier to other wind developers will go 90% to Revolution Wind’s developers until their $23 million payment is fully recovered. At that point, 100% of the rentals would go to the port authority. The cost overrun was supposed to have been made public in early April, but it was not disclosed until the end of May. No one is confident the cost of the State Pier project will ever be fully recouped.

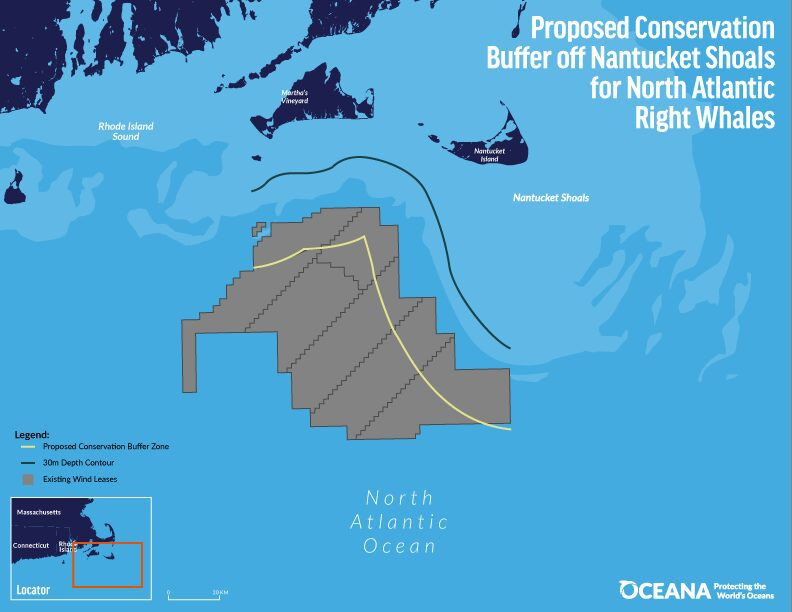

3. Oceana, an international organization initially founded by The Pew Charitable Trusts, Oak Foundation, Marisla Foundation (formerly Homeland Foundation), Sandler Foundation, and the Rockefeller Brothers Fund, is working to protect and restore the oceans on a global scale. The organization is “dedicated to achieving measurable change by conducting specific, science-based policy campaigns with fixed deadlines and articulated goals.” It has just proposed a Conservation Buffer off Nantucket Island for North Atlantic Right Whales. On Oceana’s website, it claims it “has won more than 225 victories and protected nearly 4 million square miles of ocean.” As the map below of the proposed buffer shows, it would disrupt some offshore wind development, especially Vineyard Wind. Will the U.S. government oppose such a prestigious environmental organization? Has Oceana had any discussions with the Biden administration before its announcement?

Oceana’s Proposed Conservation Buffer Impacts One Set Of Offshore Wind Leases And The Location Of Vineyard Wind’s Proposed Project

4. Another wind project, SouthCoast Wind, is struggling, and its developers are in trouble for not notifying Rhode Island regulators of their asking the Massachusetts Department of Public Utilities to pause its review of the utility power purchase agreement. The following paragraph from a public meeting notice (we are planning to attend) explains the issue best.

“On November 10, 2022, after learning about SouthCoast Wind’s suspension request to the MA DPU and its concerns, the Board Chairman issued Order No. 160 ordering SouthCoast Wind to show cause why the Board should not stay its proceedings regarding the Rhode Island-jurisdictional transmission facilities until the MA DPU approves the contract and until SouthCoast Wind can demonstrate the economic and financial viability of its proposed project. SouthCoast Wind will respond to the Board’s show cause order at the hearing on June 12, 2023.”

We will be following these developments and reporting on them.