Energy Musings - June 18, 2024

We were traveling at the end of May so missed our normal monthly wrap-up of stock market sector performance and commentary on the Energy sector outlook.

May Stock Market Performance Wrap-Up

We were out of the country when the stock market closed in May. Therefore, we were unable to provide our monthly update. Here is our May Standard & Poor’s 500 Index sector performance report. Once again, after several months of outstanding performance, the Energy sector in May fell to last place. Why?

Energy goes from best to worst once again as market sentiment favors sectors helped by lower inflation and interest rates.

It possibly was because oil prices weakened during the last half of May. The weakening was attributable to cooling inflation data and growing investor optimism that interest rates would soon be cut. That view triggered investors to seek “growth” sector investments and to move money away from “value” investments. The latter category includes Energy.

From March to May, Energy was the #1 and #2 performing sector for the first two months but fell to #11 in May. Conversely, Information Tech, a high-growth industry, went from #9 and #10 in March and April to first place in May.

We saw a similar pattern last summer and fall. Energy was the top performer for July, August, and September while Information Tech was in the middle for the first two months but next to last for the final month. However, when inflation declined, oil prices weakened, and investors sensed multiple Federal Reserve interest rate cuts on the horizon in 2024, sector performances flipped. For October and November, Information Tech finished second and first, respectively, while Energy finished last in both months.

Without a significant directional move in global oil prices, it is likely Energy’s performance will be influenced more by geopolitical events that could add to or subtract from the risk premium for oil prices. Likewise, Energy’s performance will be impacted by economic and monetary developments. Inflation reports, interest rate movements both officially and in the bond market, employment reports, and consumer confidence about the economy will be the data to monitor. In other words, there are few trends strong enough to drive investors one way or another, but that could change quickly. Thus, more market turmoil awaits events and news until investors gain greater confidence about future trends.

We see the impact of a trendless and news-sensitive oil price pattern in the chart below. If we focus on 2023 and 2024 price action, we see times when people were bullish that economic growth would drive oil demand growth rates higher and when OPEC+ moves limiting supply growth boosted oil prices. Likewise, when economic events proved disappointing, oil prices fell. What is evident from the nearly 18-month oil price record is how they remained within the channel of $70-$84 a barrel. Within that range, economies continue to perform reasonably well and oil producers make acceptable profits, which feeds their spending needs and hefty returns for shareholders.

Oil prices continue being range-bound seeking confirmation of improving supply/demand fundamentals.

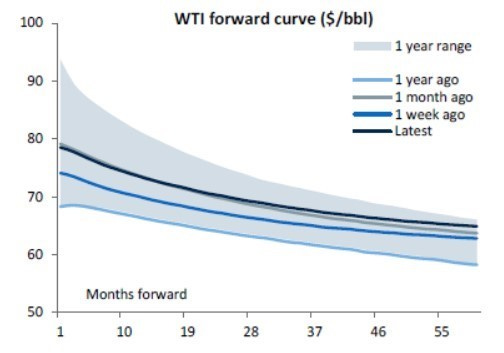

Importantly for the Energy sector, the forward oil price curve suggests price expectations now are factoring in slightly greater optimism for demand growth. That is supported by the recent demand forecast revisions of the Energy Information Administration (EIA) and OPEC+. The chart below from the commodity research group at RBC Capital Markets shows the most recent forward price curve for WTI compared with a year ago, a month ago, and a week ago. The most recent curve shows the highest current price but importantly the highest price estimate five years in the future. The latest price curve supports the view of greater investor confidence about stronger oil demand leading to higher future oil prices.

The latest WTI forward price curve shows the highest 5-year out price reflecting expectations for higher future demand.

It is dangerous to forecast the movement of stock prices. The volatility of the past 18 months, which has seen sectors soar to the top in performance only to suddenly drop to the bottom, is likely to continue through the summer. For many investors, this lack of direction will be frustrating. For others, patience is just another chance to search for green shoots giving early signs of future market trends. Stock markets, like Mother Nature, can often fool you.