Energy Musings - July 9, 2023

Decarbonizing the two hardest transportation sectors - aviation and shipping - is underway. It means new fuels and technologies and will disrupt the industries and add to global inflation.

Costly Decarbonization Of Aviation And Shipping

Heading into the Fourth of July holiday, the number of Americans flying exceeded 2019 pre-pandemic levels. June’s passengers increased 7% month over month and was 1% above 2019’s level. Passengers going through TSA checkpoints for the first half of 2023 slightly exceeded 2019’s traffic. In Europe, daily flights in June rose 9% month over month but remained 9% below 2019 levels. June’s global flights were 4% higher month over month and 14% above 2019’s flights. People are traveling, despite higher airfares. Airline executives are upbeat given record reservations for the rest of 2023.

Offsetting air traffic’s gains, cargo, and container shipping are experiencing slower demand after the consumption-driven Covid-recovery surge wanes. China’s economic reopening lags, which is depressing shipping volumes. Forecasts call for global shipping volumes to only grow about 2.2% annually for 2023-2027, down from the historical growth rate of 3+%.

Overhanging both industries is the push to decarbonize them in keeping with the world’s Net Zero emissions goal. Although most emissions reduction efforts within transportation target cars and trucks, the shipping and air transportation industries also plan to cut emissions by 2050. The challenge is how to do it.

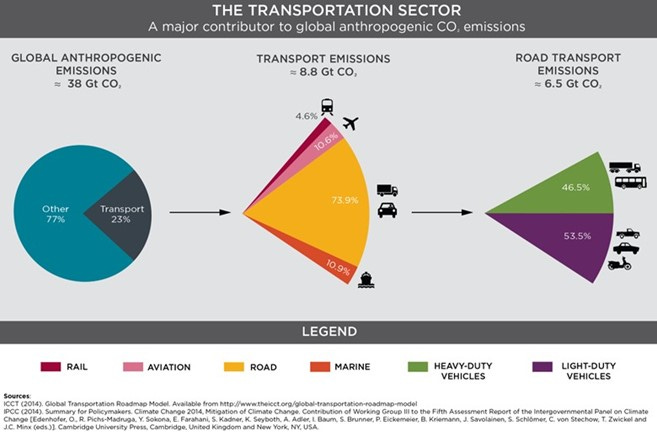

Transportation emissions account for roughly a quarter of global emissions. Of that share, road transportation emissions represent about three-quarters while aviation and shipping are each slightly over 10%. For those industries, whose assets are very long-lived and require them to transport their fuel, managing decarbonization will necessitate new fuels and new technologies.

Aviation and shipping emissions are two sectors within the transportation sector that will be very difficult to achieve.

For wheeled transportation assets, swapping fuel tanks for batteries, especially when the batteries are charged by clean electricity, seems an easy decision. Overcoming the logistical challenge of charging batteries in wheeled vehicles is multiple times easier than for planes and ships that are constantly detached from terra firma. Additionally, batteries lack the energy density to power huge, global-traveling ships and weight-restricted planes. A typical container ship would need the power of 10,000 Tesla S85 batteries every day. Battery power will likely be limited to harbor and short-haul travel where vessels can easily be recharged daily.

Shipping Emissions

“Ships bring 80–90% of most everything you want or need, or the raw materials used for making those things,” says Natasha Brown, a senior spokesperson for the United Nations 175-member nation International Maritime Organization (IMO). The IMO sets global rules for shipping safety and security. It is also responsible for preventing water and air pollution from ships. As a result, the IMO is charged with the task of cleaning up the shipping industry’s carbon emissions. Upwards of 90% of all shipping is powered by burning fuel oil, either heavy fuel oil (HFO) or low-sulfur fuel oil (LSFO).

Traditionally, the shipping industry relied on the cheapest fuel for its engines, which has meant HFO. Unfortunately, HFO is the repository of much of the sulfur refined from crude oil. The IMO was highly criticized in 2016 when it failed to endorse the decarbonization goals of the 2015 Paris Climate Agreement. Instead, the IMO said it would address sulfur first and carbon dioxide later. That later day is here.

Limiting the volume of sulfur allowed in marine bunker fuel was endorsed by IMO members and enshrined in IMO 2020 capped at 0.5%, down from 3.5%, the volume of sulfur allowed. Coastal areas are governed by stricter pollution limits, which set the sulfur content at 0.1%. When IMO 2020 came into effect, the volume of HFO fell from 81% in 2019 to 50% in 2020. Likewise, LSFO’s market share soared to 32% from 3%.

LSFO is much more expensive than HFO, heavily impacting the profitability of ships. Ships, at least initially, struggled with the lack of universal availability of LSFO. Ships need to be able to go anywhere which means appropriate fuel supplies must be available everywhere. Concern about the universal availability of LSFO and the cost differential between LSFO and HFO prompted some ship owners to install smokestack scrubbers to strip the sulfur from the exhaust gas. The scrubber decision was based on economic analyses of the all-in installation cost versus the savings from burning cheaper HFO and increased vessel geographic flexibility.

In 2018, the IMO voted to cut shipping carbon emissions by at least 40% by 2030 relative to 2008 levels. Many leading shipping companies targeted cutting their emissions by 50% by 2050 and eliminating them as soon as feasible this century. However, that is no longer sufficient for the UN and the U.S. government. The Biden administration is pushing the IMO to cut global shipping emissions more aggressively, and UN leadership is supportive.

The following comes from April 20, 2023, White House FACT SHEET: President Biden to Catalyze Global Climate Action through the Major Economies Forum on Energy and Climate.

“In July, the International Maritime Organization (IMO) will adopt a Revised IMO Greenhouse Gas Strategy to accelerate efforts to decarbonize shipping. Today, President Biden will ask leaders to join the United States in supporting the IMO’s adoption of 1.5 °C-aligned goals for the sector, including a goal of zero emissions from international shipping no later than 2050.”

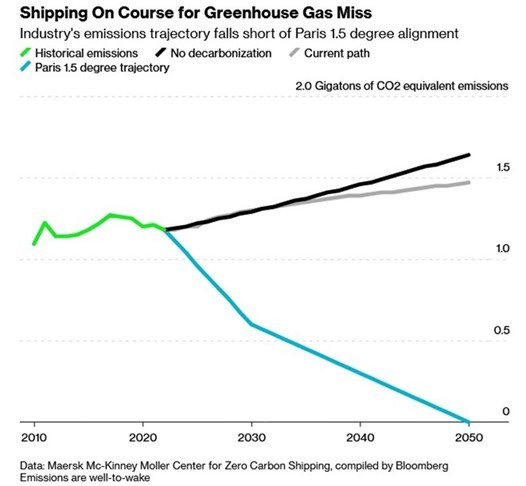

Climate activists claim shipping will fail to meet the Paris 1.5-C degree cap on global temperatures by 2050. They point to scenarios such as this Bloomberg chart.

Without any actions, shipping will not reduce its carbon emissions by 2050. Doing so requires significant actions and costs.

In the first week of July, the IMO convened its Maritime Environment Protection Committee’s 80th session. It was reported that the committee decided to impose a financial penalty on companies that fail to cut their greenhouse gas emissions, or possibly a carbon tax on fuel. Details about the amount of the penalty, how it would be assessed, and how it would be distributed to support those adversely impacted while adopting a carbon-neutral goal remain to be worked out by the IMO. According to Kitack Lim, the IMO’s Secretary-General, “We will have to use this fund in R&D to incentivize shipping companies and also to financially support the island nations and developing countries.”

He went on to say that the IMO would do an impact assessment in its member states and hoped it could be started by 2025. The direct impact on shipping companies and the indirect impact on every country in the world would be analyzed. “We may not be able to support every country. Some countries will have to absorb some of the impacts,” said Mr. Lim. The global socialization of the cost of solving climate change would take a huge step forward under this IMO plan. Get ready for the political jockeying.

For shipping, net zero emissions in 27 years requires immediate action. New ships will operate for 25-30 years or longer. That would take them to or beyond 2050. Thus, new ships must be capable of operating in a world embarking on cutting emissions sharply or face early retirement at a financial cost for their owner. Presently, shipping has not settled on the right technology or fuel to meet these enhanced emissions goals.

Companies are exploring many options including liquefied natural gas (LNG), liquefied petroleum gas (LPG), liquefied ethylene gas (LEG), methanol, hydrogen, ammonia, fuel cells, nuclear, and even batteries and solar. Surprisingly, sails are appearing as a potential solution, roughly 150 years after the sailing era ended. Companies are building experimental ships to test these fuel options, but always lurking in the background is ship owners’ need for experience with the test vessels before settling on a particular fuel or technology. Then begins the race to build new vessels and establish the global supply chains necessary for the global shipping industry to operate.

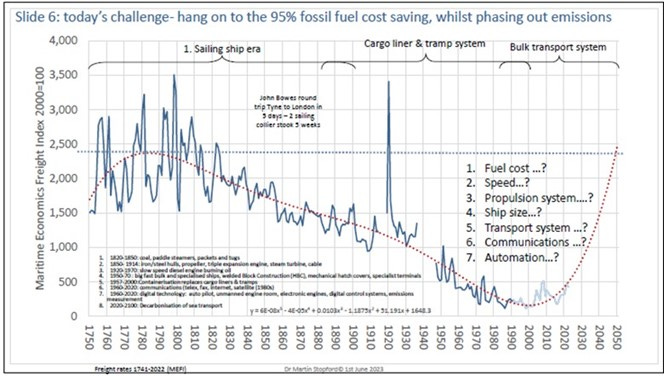

Dr. Martin Stopford of Clarkson Research is considered an expert in shipping industry history, vessel operations, and marine business strategy. In a recent series of webinars about shipping’s future examining how innovation shaped its history, he explored the innovations needed for shipping to dramatically cut its carbon emissions. He concludes that new business models may prove more important for reducing emissions than new propulsion systems and fuels. He examined how the transition from sail (100% green) to power (steam and then diesel) led to significant shipping innovations that drove a 95% reduction in freight cost over 270 years from 1750-2020.

Dr. Stopford listed the seven innovations that drove the 95% fall in freight cost.

1. Fuel: wind, coal, cheap oil, expensive oil

2. Speed: 3-6 knots average, 8-30 knots, 16-23 knots, 13-22 knots

3. Propulsion systems: sail, steam engine, triple expansion steam, slow-speed diesel engine

4. Ship size: 150GT, 1,400GT (10x), 36,000GT (240x)

5. Logistics system: trade networks & ad hoc voyages, tramp shipping, cargo liner & passenger liner services, bulk shipping, specialized (vehicles, chemicals, etc.), containerization

6. Information systems: letter and seafarer local knowledge, cable, 1927 telephone, GPS, Satellite

7. Automation: automated shipping functions

The economic and social gains from these innovations are impressive. But what now?

In a chart of the maritime economics freight index for 1750 to 1990, updated by Dr. Stopford through 2021, fuels to meet net zero emissions will drive, in his estimation, the index to levels last seen in the second half of the 18th Century by 2050. In other words, the 95% freight cost reduction will be wiped out with significant economic ramifications.

Shipping freights costs have come down 95% but will go back up based on the cost of green fuel choices for the global shipping industry.

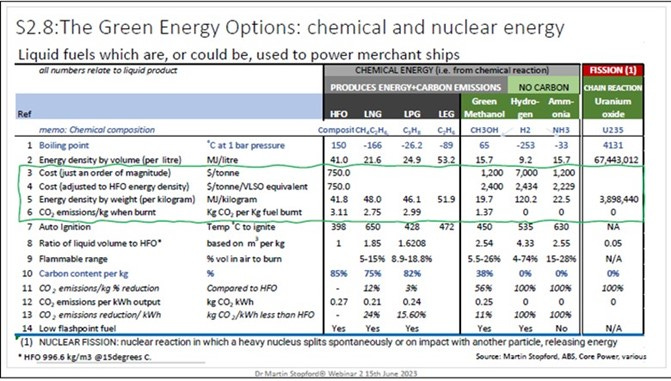

Why does Dr. Stopford foresee higher freight costs? Because he sees the fuel choices mandated for reaching the IMO’s net-zero goal as being much more expensive than HFO. He presented the following data on fuel costs. As the energy density by weight is similar for all the petroleum-based fuels ‒ HFO, LNG, LPG, and LEG ‒ Dr. Stopford uses the HFO price as the standard measure. The chart shows that the energy density by volume for “green” fuels is a fraction of that of HFO. Therefore, when he calculates the fuel price, they are roughly three times the HFO price. This is an important reality, but not the only one.

The Green fuel choices are all very expensive and will raise shipping costs.

Hydrogen fuel, which is a favorite of climate activists and politicians, has issues with the amount of energy created by the process. Moreover, the energy loss in the conversion process plus the expense of transporting it to ports for consumption makes it very expensive. The physical properties of hydrogen (small molecule size) contribute to steel pipeline and storage tank embrittlement, possibly causing them to leak or rupture. Shifting to a hydrogen-based energy system may require significant new infrastructure to be built, and from more expensive materials, further inflating the transition cost. Will these considerations hold back the push for hydrogen fuel for shipping use?

One tactic being promoted is that a carbon fee be assessed on petroleum-based fuels to close the gap with expensive hydrogen. Another form of subsidy for an uneconomic fuel. In the U.S., the Biden administration is proposing spending $1 billion to promote hydrogen demand to help support up to $7 billion in spending for building 6-10 regional hydrogen hubs.

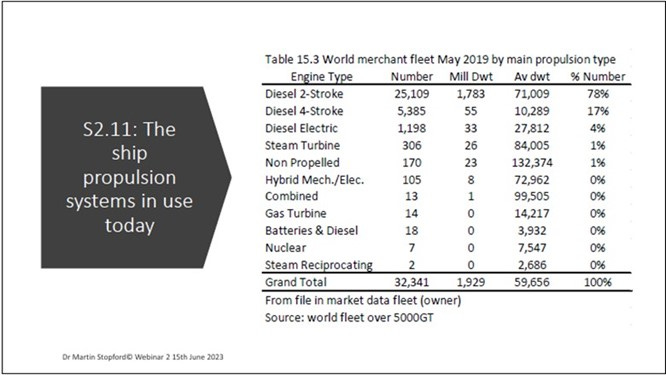

A major impediment to a rapid decarbonization of shipping is the 98% of the global fleet being powered by fossil fuels.

The final challenge in selecting shipping’s next primary fuel is the current fleet’s propulsion system mix. The chart above shows the global fleet of 5,000 GT vessels being dominated by 2-stroke diesel engines. When all categories of diesel engines are included, they represent 98% of the world’s fleet.

Recently, alternative fuel vessels have been added to the fleet. Last year, according to Clarksons, most of the new tonnage ordered will be capable of using alternative fuels, primarily LNG. Maersk has ordered 25 ships that can burn methanol as an experiment.

Much like the global mandate to switch the vehicle fleet from internal combustion engine (ICE) vehicles to electric-powered vehicles (EV), switching the world’s shipping fleet to 100% “green” fuels in 27 years appears unrealistic. We are not aware of anyone analyzing global economic growth, inflation, and social stability when 90% of the raw materials and finished goods that move around the world on ships suddenly cost 95% more as shown by Dr. Stopford.

Aviation Emissions

Cutting aviation emissions will be as challenging or maybe more difficult than reducing shipping emissions. Sustainable aviation fuel (SAF) made from agricultural products and wastes is the preferred solution. But alternatives include Sun-to-liquid and Power-to-liquid (using hydrogen) fuels. Another aviation option is electric. Impediments to these options are the lower energy density of batteries, and the extremely complex storage of hydrogen, especially in large volumes. Interestingly, hydrogen as a fuel has a high energy density, but as shown by data from Toyota’s 2014 Mirai fuel cell car, a full tank of fuel contains only 5.7% by weight of hydrogen with the rest of its mass being that of the tank.

The reality is that it will take a combination of tools to cut aviation emissions. Since 2008, the aviation industry has made commitments and has been supporting strategies to reduce its emissions. As set forth by the International Air Transportation Association (IATA), achieving the industry’s net zero emissions will take a combination of four actions. These include (contribution percent) using sustainable aviation fuel (65%); developing new technology, electric, and hydrogen (13%) propulsion systems; improving infrastructure and operational efficiencies (3%); and utilizing offsets and carbon capture (19%).

A significant challenge in executing this transition is that air traffic is expected to grow meaningfully by 2050. In 2022, the International Council on Clean Transportation reported on updates to various airline traffic to 2050 forecasts. The International Civil Aviation Organization (ICAO) now predicts the annual growth of revenue passenger kilometers flown will be 3.6% between 2018 and 2050, down from its prior 4.2% per year forecast. The lower growth rate reflects a 4-year lag in travel growth due to the pandemic. The organization’s range for growth is from 4.2% to 2.9% depending on the speed with which global economic activity recovers from the Covid era.

The International Energy Agency (IEA) developed aviation forecasts as part of preparing its global average temperature alignment scenarios. Under it Sustainable Development Scenario (SDS), global aviation activity grows by 2.9% per year between 2019 and 2050. Its Net Zero Emissions (NZE) scenario has traffic growth at only 1.8% per year.

The Air Transport Action Group (ATAG), which represents the commercial aviation industry, projects a range of 2.3% to 3.3% per year growth in air traffic for 2019-2050 in its latest Waypoint 2050 report. Its central value is 3.1%. The first edition of Waypoint 2050 issued in 2020 had a higher range of 2.7% to 3.5% but a central value of 3.0%, like its more recent forecast.

The most optimistic aviation activity projections come from airplane manufacturers. Airbus produces a Global Market Forecast (GMF) while Boeing has its Commercial Market Outlook (CMO). The latest GMF forecast predicts air traffic returning to 2019 levels by 2023-2024, which appears on track. It foresees an average annual growth rate of 3.9% for 2019-2040. The CMO forecast is similar with a 4.0% annual growth rate for the same period.

These growth rates suggest air traffic will see roughly a doubling of passenger miles flown by 2050, which means more planes and more flights. That will increase the pressure on airlines and airframe manufacturers to find ways to cut emissions. The favored solution is burning SAF, which has a smaller carbon footprint than jet fuel. Governments are rushing to provide subsidies or institute mandates and penalties to drive the build-out of this supply chain. SAF is the preferred solution because it is a liquid and can be blended with conventional jet fuel to lower carbon emissions. This means SAF can be integrated into the aviation fuel supply chain with a minimum of disruption.

Shell plc is a major player in the SAF market. It recently prepared a report “Decarbonizing Aviation: Cleared For Take-Off” that examined the outlook for the aviation industry to 2050. Shell foresees passenger miles doubling by 2050, consistent with the other forecasts. As the table shows, SAF is the leading solution with increased efficiency and carbon offsets playing significant but lesser roles. Hydrogen and battery alternatives are likely to be smaller players in the emissions-cutting efforts to 2050.

There are a limited number of options for decarbonizing aviation.

The following chart shows how Shell foresees the industry meeting its net zero goals and how this scenario differs from other aviation industry forecasts. It also shows how important each action is for reducing aviation’s current emissions trajectory. The chart also points to the key challenge for SAF, which is available feedstocks. The SAF contribution is split between biofuel feedstocks and synthetic feedstocks, with the latter lagging in becoming commercial.

Shell’s scenario for decarbonizing aviation focuses on SAF to achieve the bulk of the emissions reductions.

Presently, SAF is produced by refineries configured to process used fats, oils, and greases, as well as agricultural wastes. The list of SAF feedstocks is growing. The U.S. Department of Energy (DOE) lists the following feedstocks for producing SAF.

· Corn grain

· Oil seeds

· Algae

· Other fats, oils, and greases

· Agricultural residues

· Forestry residues

· Wood mill waste

· Municipal solid waste streams

· Wet wastes (manures, wastewater treatment sludge)

· Dedicated energy crops

The DOE also states that an estimated one billion dry tons of biomass can be collected sustainably each year in the U.S., which would yield 50–60 billion gallons of SAF. In 2022, the refining industry produced 15.8 million gallons of SAF or well under 1% of the suggested potential output. In 2022, the DOE launched the Sustainable Aviation Fuel Grand Challenge, targeting the use of SAF to reach at least three billion barrels a year in 2030, or 126 billion gallons. The DOE goal is for SAF to eventually replace all traditional jet fuel by 2050.

In the European Union (EU), a SAF blending mandate was imposed on suppliers. It starts in 2025 with a minimum of 2% SAF blended into jet fuel at all EU member airports. That share rises to 5% in 2030. The blending percentage increases to 20% in 2035, 32% in 2040, and reaches 63% by 2050. EU jet fuel consumption is projected to grow from 12 billion gallons to 13.5 billion between 2025 and 2030, meaning that SAF demand would increase from 240 to 675 million gallons.

The issue for the aviation industry with these targets and mandates is their cost. According to Argus Media, on July 7, 2023, the price for a gallon of jet fuel was $2.44, based on an average of prices in Chicago, Houston, Los Angeles, and New York. IATA says that SAF can cost two to four times the price of traditional jet fuel. Based on various recent quotes, we found SAF prices that fit within that range. Last year, an Air France official said their SAF spread was more like four to eight times the price of kerosene (jet fuel). We are not sure whether Air France just made some bad deals or was purchasing SAF in markets with very limited supplies. However, as a result, the airline has considered adding a SAF surcharge to ticket prices, as is Lufthansa.

In the U.S., there are aggressive renewable fuel subsidy programs in place at both the federal and state levels. Under the Inflation Reduction Act of last year, each gallon of SAF will receive a credit of $1.25 a gallon with a premium of one cent for each additional percentage point reduction in CO2 up to 50%. At its maximum, a gallon of SAF would receive a credit of $1.75 for 2023 and 2024 before a new tax credit program goes into effect for the following two years which provides for a credit of up to $1.75 a gallon. SAF also receives a 1.6 renewable identification number (RIN) for each gallon produced that can be sold. Reportedly, recent sale prices were about $1.66 a gallon, meaning each RIN would earn $2.66. For SAF producers, several state tax credit certificates can be earned and then sold. These certificates have recently traded at $66 a ton, which based on roughly 315 gallons per ton, would translate into roughly $0.21 a gallon of SAF.

Airlines purchasing SAF in Illinois and Washington will receive an additional tax credit of $1.50 a gallon for use against their state taxes. In Illinois, the credit is in place for the next decade, but it is only available to airlines purchasing and using SAF in the state. International flights from Illinois do not pay any fuel tax. Washington just enacted a credit of $1 a gallon of SAF that can increase to as much as $2 depending on the fuel reaching an additional 50% reduction in greenhouse gas emissions. For each additional percentage point reduction, it earns two cents a gallon. These state incentive plans are designed to promote the refining of SAF volumes within the respective states.

In the EU, there is a system of penalties starting in 2024 that is based on the difference between kerosene and SAF prices and the volume of SAF missing from the government’s mandated blending percentage. Penalties are assessed on both SAF suppliers and the airlines who use SAF and are to be finalized late this year.

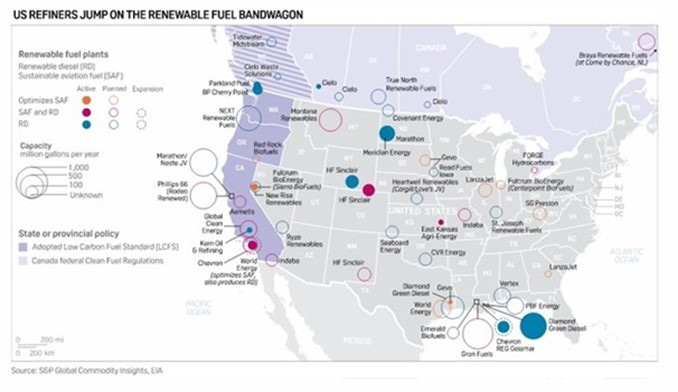

With the agreement of the airlines and the support of the U.S. and EU governments, there will be plenty of incentives provided to ensure adequate SAF fuel is available and consumed. This government support is encouraging financial institutions such as Bank of America to develop lending programs to help finance the necessary investment in new SAF production plants, something that will be required if the projected volumes of SAF needed are to be available. All these incentives and financial support appear to be working when we consider the following map showing all the existing, under construction, and planned renewable refining plants.

Spurred by U.S. government subsidies and mandates, the refining industry is responding to the need to build more SAF-producing plants.

No question that decarbonizing the aviation and shipping industries is underway. We find it interesting that the shipping industry, which is dominated by European companies within the UN’s IMO and the EU’s approach to aviation’s SAF use are structured on mandates and financial penalties. In the U.S., the approach to boosting SAF is via subsidies and tax credits. At some point, the cost of these decarbonization efforts will become an issue, especially if the cost of SAF remains two to six times that of jet fuel.

If the entire 95% freight cost reduction earned by shipping over the past 150 years disappears, all our raw materials and goods will cost substantially more, which will become a serious inflationary problem. Correcting that inflation will be virtually impossible for years. For aviation, expensive SAF and other decarbonization options will work their way into aviation’s cost structure. Will those costs push ticket prices and air cargo charges to levels that cripple travel growth and cause activity to decline? Has anyone spent time assessing such outcomes? How will the public react to a more expensive world?