Energy Musings - July 2, 2025

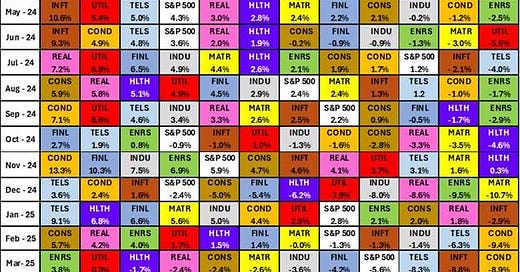

June was a positive month for energy stocks. However, the positive performance was insufficient for overcoming the disastrous decline in April, leaving the sector in last place for the quarter.

Record Close In June For S&P 500 And NASDAQ

As June ended, the geopolitical turmoil of the month passed into history and no longer upset investors. The result was a record close for the Standard & Poor’s 500 Stock Index and the technology-heavy NASDAQ stock market. Only the Dow Jones Industrial Index (DJIA) failed to join the party, although it posted a 5% gain for the month. The DJIA is about a thousand points below its all-time high, but on the first trading day of July, the index cut 40% of that shortfall.

Energy experienced a good month in June, rising 4.85%. Despite that gain, the sector was the worst performer for the second quarter, registering a negative 8.59% performance. The quarter’s final two months’ performance was torpedoed by its 13.7% loss in April. ‘

Energy’s ranking rebounded from the depths of the prior two months.

Investors seem to be shrugging off worries about inflation from Trump’s tariffs. They appear to be ignoring the chaos of the trade negotiations, such as the reaction to Canada's proposed digital services tax, which cratered trade talks with the U.S. and was subsequently abandoned to restart the negotiations.

Middle East tensions exploded with Israel’s attack on Iran. Fears of the start of World War III ended suddenly after the shocking U.S. bombing of three key Iranian nuclear facilities that spurred a ceasefire in the war. Trump’s shocking moves and ability to force the warring parties into a ceasefire were followed by his amazing win at NATO, where the members agreed to ramp up their defense spending under his urging and amid growing concerns about the ongoing Ukraine/Russia war.

The month’s drama then shifted to Capitol Hill, where Republicans entered the final stages of negotiating the One Big Beautiful Bill, which includes spending cuts, extension of the 2017 income tax cuts, and the potential dismantling of renewable energy subsidies. The Senate finally passed its version of the OBBB, which had many cost-cutting provisions stricken by the Senate Parliamentarian, leaving these actions for future recission legislation. The bill was tossed to the House for its vote.

S&P posted a 5.1% gain in June. Its researchers wrote in the monthly S&P Dow Jones Indices report commentary that the stock market in June abandoned its defensive narrative and re-embraced risk, which was reflected in significant increases for the information technology and communication services sectors. The rally also saw market breadth expanding as small- and mid-cap stock indices advanced by 5% and 7%, respectively.

Energy is inexorably tied to crude oil price movements.

Energy benefited from the Middle East tensions that lifted global oil prices by over $10 a barrel before crashing when oil traders saw Iran’s rocket attack on a U.S. military base in the United Arab Emirates as symbolic, and the evaporation of the potential that Iran would close the Strait of Hormuz and block 20% of the world’s oil flow. The oil price round-trip cut some of the energy gains in June, but it still resulted in the best monthly performance of the quarter and the first half of the year.

The five-year chart of monthly energy sector stock performance and average oil prices highlights the significant importance of oil prices for stock performance. What is not always captured in such a chart is the shifting narrative surrounding future oil market supply and demand dynamics, as well as oil price trends. The stock market is a discounting mechanism; thus, it constantly reacts to current news and how that news affects views about the future.

For the first six months of 2025, energy posted slightly less than a 1% gain. While barely positive, energy’s performance beat two sectors – consumer discretionary and healthcare, which posted losses for the period.

Investors remain optimistic, although that view depends on positive answers to several critical questions. Will the Federal Reserve cut interest rates by the end of the summer? That could propel stocks higher. Will the tariff war drive the economy into a pothole? It is unlikely, although they could contribute to a slowing in economic growth. Trump’s many economic, political, and foreign policy wins have been shocking to Democrats. Will the winning streak continue? Are there that many critical issues left to be resolved? What the third quarter and balance of 2025 hold is unknown, but we will be watching closely.