Energy Musings - July 14, 2025

The world of electricity is changing due to AI and data center growth. Utilities are relearning how to forecast demand, but they struggle on the supply side. Will SMRs be the answer?

How The Electricity World Is Changing

It is difficult to imagine anyone not aware of the dramatic changes underway in the electricity market. Whether it is Artificial Intelligence (AI), data centers, “electrify everything,” or merely population and economic growth, utilities are experiencing skyrocketing power demand growth at a rate faster than they have seen in years. Ratepayers are seeing this reflected in their electricity bills as they consume more power, which costs more, and the price of electricity rises.

Most utilities were unprepared and are scrambling to relearn how to forecast demand growth. More importantly, they are struggling to manage their electricity supply. That challenge is compounded by the shortages of critical equipment needed to build new natural gas generating capacity.

How the U.S. electricity market is changing.

The Energy Information Administration’s (EIA) Annual Energy Outlook 2025 Reference case shows how electricity consumption in the U.S. commercial sector by selected uses is expected to grow through 2050. The chart shows how computing power demand (AI and data centers) is projected to soar, especially after 2030. Computing power is expected to become the largest end-user of commercial electricity by 2050, far outpacing the growth in electricity consumption from increased use of air conditioning and ventilation.

The International Energy Agency (IEA) predicts that data center electricity consumption will double by 2030. It forecasts data power use to reach 945 terawatt-hours, surpassing the current power consumption of countries such as Japan, Ireland, and the Netherlands. The latter has restricted the development of new data centers due to concerns about their impact on the Netherlands’ grid.

Another development requiring utility attention, as they forecast power demand, is the volatility caused by training AI algorithms. Andreas Schierenbeck, Chief Executive Officer of Hitachi Energy, told the Financial Times in an interview that no other industry would be allowed to create such a volatile power demand as AI. “AI data centers are very, very different from these office data centers because they really spike up,” he said. “If you start your AI algorithm to learn and give them data to digest, they’re peaking in seconds and going up to 10 times what they have normally used.”

Schierenbeck noted that “[n]o user from an industry point of view would be allowed to have this kind of behavior….” He said that if you wanted to start up a smelter operation, you would have to call the utility ahead of time. He suggests that data centers should follow similar rules. We are not sure what that means. Would they need permission each time they are training the algorithm or every time it is used? We have been told that it can take days to train an algorithm.

A new report from the Department of Energy (DOE) studied the impact of data centers and AI on the nation’s power demand and grid reliability. The study was designed to examine the implications for grid reliability in 2030 under three power supply scenarios: the current planned retirements of operating power plants, no retirements of power plants, and current planned retirements with a replacement program to restore the grid to its current operating reliability standard.

The DOE report concludes that blackouts could increase by 100 times by 2030 if planned power plant closures remain on schedule without adding new units to replace them. The DOE said, “Staying on the present course would undermine U.S. economic growth, national security, and leadership in emerging technologies.” None of these outcomes is acceptable.

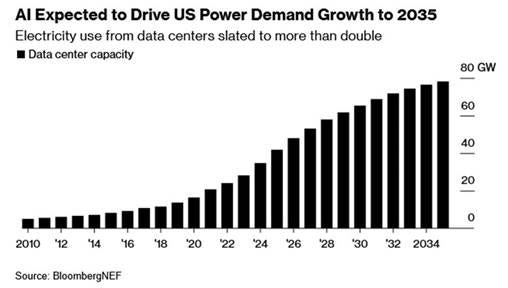

The DOE modeling exercise required making assumptions about data center and electricity demand growth. In a commentary on the report, BloombergNEF showed its forecast (chart below) for incremental data center capacity growth.

Data center growth will drive power demand.

BloombergNEF is projecting a near doubling in data center gigawatt (GW) capacity between 2025 and 2035 (41.8 GW to 78.2 GW). As the chart shows, from 2010 to 2020, data center capacity increased gradually. Starting in 2020, the growth rate accelerates before slowing to modest annual increases in the mid-2030s.

The DOE’s report, which was mandated by President Donald Trump’s Executive Order “Strengthening the Reliability and Security of the United States Electric Grid,” required modeling of the nation’s power demand and supply growth dynamics. The DOE reported that it examined all the available forecasts for data center capacity and found wide-ranging estimates. For 2030, it cited a range of 33 GW to 109 GW. The DOE elected a midpoint of 52 GW for its modeling exercise. That compares with BloombergNEF’s projection of 65.3 GW, which is roughly 30% greater than the DOE’s estimate. If data center capacity is closer to BloombergNEF’s projection, there would be greater power demand than the DOE modeled, suggesting the blackout rate could be higher.

Returning to the EIA’s commercial electricity consumption forecast, it is important to note that residential electricity consumption currently exceeds commercial use by about 5%. By 2037, commercial consumption surpasses residential use, and is 10% greater by 2050, showing the dramatic impact of technology-driven computing power usage. This growth may bring multiple challenges for our nation’s electricity grids. Besides fueling the electricity generators, there is the emerging problem of voltage spikes due to the training of AI algorithms. These spikes increase the volatility of power grids, and at the same time, they are becoming more volatile due to the increased use of intermittent renewable energy.

The intermittency issue came to the forefront in April when the Spanish and Portuguese power grids experienced blackouts. Much was made of the high penetration of solar power on the Spanish grid, which raised the question of whether a glitch with this power triggered the collapse. The issue was voltage volatility caused by a lack of generation. A 2020 report by the National Renewable Energy Laboratory addressed this issue. As they said in their introduction:

“Historically, in the U.S. power grid, inertia from conventional fossil, nuclear, and hydropower generators was abundant—and thus taken for granted in the planning and operations of the system. But as the grid evolves with increasing penetrations of inverter-based resources—e.g., wind, solar photovoltaics, and battery storage—that do not inherently provide inertia, questions have emerged about the need for inertia and its role in the future grid.”

Grids are designed to manage the balance between electricity supply and demand on a second-by-second basis, every day. There is tolerance for only brief imbalances before the grid develops problems. This balance is referred to as grid frequency. It can drop if a large power plant or transmission line fails. Inertia resists the drop in frequency, giving the grid time to rebalance supply and demand.

The NREL defines inertia as the tendency of an object in motion to remain in motion, which historically provides an essential source of electric grid reliability. The inertia from rotating electrical generators employed in fossil fuel-fired, nuclear, and hydroelectric power plants is vital to the operation of the grid. Their inertia represents a source of stored energy that can be tapped for a few seconds, providing the grid with time to respond to power plant and transmission failures.

The availability of inertia from these power plants has been taken for granted in the planning and operation of grids. However, the introduction of intermittent energy sources that do not use conventional generators reduces the available grid inertia. The embrace of intermittent power — specifically wind and solar — displaces generators that produce inertia, forcing grids to plan and operate differently to maintain reliability.

The increased penetration of intermittent power is one issue, but so is the size of the grid and the make-up of its traditional generating sources. If these conventional generators are slower, the grid is at greater risk of disruption than if the population of generators is newer and has faster response times.

In explaining the cause of the Spanish grid blackout, Spain’s Ecological Transition Minister Sara Aagesen stated that a voltage surge led to a small grid failure that cascaded into a larger one, bringing down much of the system. Spain lost 15 GW, approximately 60% of the system’s supply. “All of this happened in 12 seconds, with most of the power loss happening in just five seconds,” she told reporters. The speed with which the Spanish grid collapsed highlights the importance of a grid having sufficient inertia or finding alternative ways to offset the loss of small power supplies.

The solution for a lack of inertia created by the switch away from fossil fuel-generated power to cleaner sources may be nuclear power, rather than wind and solar. Nuclear advocates have swelled in recent months. Data center and AI developers recognize the significant increase in electricity volume their operations will generate. Moreover, this power requires 24/7/365 performance — no intermittent power is allowed.

Therefore, we have seen multiple technology companies announce deals with utility companies to reactivate closed nuclear power plants, which have significant operating lives remaining. Building new nuclear plants is an idea that is gaining increased acceptance. Surprisingly, New York State announced plans to construct a new nuclear plant, most likely in the Lake Erie region of the state, where its two operating plants are located. This comes only a few years after the state prematurely closed its Indian Point nuclear plant that supplied 25% of New York City’s power.

The governor of Massachusetts has also spoken about the need for her state to adjust its clean energy strategy and possibly embrace nuclear power, as offshore wind appears to have only a limited impact on the region’s electricity supply. Furthermore, offshore wind has become more expensive than originally advertised, making the long-term, steady, fixed-price power of nuclear plants look increasingly appealing.

The problem with large nuclear power plants is the time required to construct them, given that the U.S. has lost much of its institutional knowledge and expertise. Permitting and construction regulations add to the challenge of building new nuclear plants.

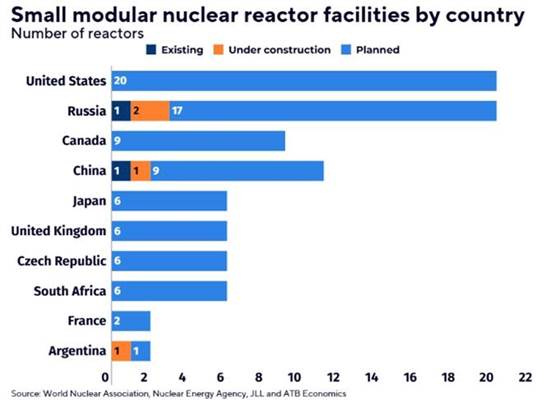

Small modular reactors (SMR) may fill the power supply void. The U.S. is now the top country planning to build SMRs, but it has yet to break ground on its first one. Our neighbor to the north has embraced SMRs, and the first plant in Ontario has received construction approval. Currently, the SMR market appears aspirational, as indicated by the countries listed below, which show operating, under-construction, and planned units. Only two SMRs are operating.

The U.S. leads the world in small modular nuclear reactor plans.

While SMRs are limited in the amount of power they can generate, they offer the potential for faster construction. Additionally, because they are smaller, SMRs can be located alongside other power plants that already have the infrastructure for connecting to the grid. This can reduce their costs and speed up the time they can begin delivering power.

SMRs are cheaper to build than onsite power plants, since they are constructed inside buildings in modules that are transported to the final location and then assembled. Enclosed modular unit manufacturing sites enable a faster construction process and a stable labor force. The latter is essential since it allows workers to have a career and not be forced to relocate from one remote work site to another.

Hardly a day passes without us learning of new developments in the electric utility world due to the projected growth in AI and data centers. Initially, the buzz was about the dramatic increase in power consumption that grid operators needed to plan for. That demand shock then stimulated debate over where the electricity supply would come from, especially as utilities have been forced to schedule the decommissioning of their existing fossil fuel power plants. The belief that cheap, quick-to-build renewable energy would solve the supply problem evaporated when tech companies began making deals with utilities to reactivate closed nuclear power plants and to agree to build large natural gas-fired power plants. These tech companies recognized the necessity of stable power supplies for their businesses to operate. For that assurance, they were willing to undertake expensive solutions that often entailed long development times.

The votes of technology companies in the future power supply market were a rude shock to renewable energy proponents. They discovered that reliability trumped cost when selecting clean energy supplies. The renewable solution suffered a massive setback when the Iberian Peninsula grid was blacked out. The reluctance to identify or the lack of understanding of the cause of that grid blackout further raised concerns among businesses that require power 100% of the time.

The electric utility industry is in a watershed moment. Power consumption is exploding, and customers are demanding reliability and cleanliness in their electricity over supposedly “cheap” intermittent power. The sudden embrace of nuclear energy is opening a new era on the supply front of electricity. The utility industry is rapidly evolving into an exciting industry due to these fundamental changes. It is no longer the dull, sleepy industry of the past. It will be interesting to see if the young tech and skilled workers begin to seek jobs in the industry. Their skills will be needed.