Energy Musings - July 14, 2023

The SouthCoast Wind project approval is paused by RI regulators over its shaky financial situation and not lies to the EFSB. Study shows the high cost of renewable mandates in NE. Whale deaths up.

SouthCoast Wind Paused But Not By Lies

Recently, it came to light that a staff member of Rhode Island’s Coastal Resources Management Council (CRMC) sent an email to the administrator for the Rhode Island Energy Facility Siting Board (EFSB) claiming that the testimony of representatives of SouthCoast Wind at its June 12 show-cause hearing included several lies. The nature of the claims and how they arrived required the EFSB to notify all parties involved and make the email public. At the end of the day, it wasn’t this controversy but rather the uncertain future for the project that sank its transmission cable permit application.

On Thursday, the EFSB voted unanimously to pause the cable application process until October 1, 2024, to give SouthCoast Wind time to secure new power purchase agreements (PPA) to finance the $5 billion, 804-megawatt (MW), 147 wind turbine project assuming it is selected in Massachusetts’ next offshore wind auction. It was this uncertain status that convinced the three EFSB members that it was inappropriate to use the agency’s limited resources to process the application only to have the project fail to secure new PPAs and be built.

This pause is a setback for the Biden administration’s goal of 30 gigawatts (GW) of offshore wind installed off the East Coast by 2030. It further highlights the impact the sharp increase in offshore wind construction costs is having on expensive green energy supply. A developing political battle over Massachusetts’ next request for proposals for offshore wind power could further set back Biden’s goal.

The claims controversy, however, highlights the attitude of offshore wind developers that since governments need, want, and even mandate this green power, they will be given some slack in the approval process. This outcome and the pushback from opponents of offshore wind may force developers to become less arrogant.

Let’s start by reviewing the claims over SouthCoast Wind lying to the EFSB.

CRMC has authority over permits for facilities built along the coast of Rhode Island, including those in state waters. The SouthCoast Wind project, while located in federal waters south of Martha’s Vineyard and Nantucket Island, requires Rhode Island permits to allow the transmission cable to enter state waters and then proceed up the Sakonnet River, making landfall and crossing Rhode Island at Common Fence Point in Portsmouth and connecting to the New England grid at a substation at the site of the former Brayton Point Power Station in Somerset, Massachusetts. There is opposition to the cable’s route from communities and residents located along the cable’s route.

At the June 12 show-cause hearing, SouthCoast officials testified about the status of the project’s financial viability. We wrote about the hearing in our June 20, 2023, edition of Energy Musings. The hearing was necessitated because the EFSB was not notified that SouthCoast Wind was going to terminate its power purchase agreements with its Massachusetts utility customers over the rates being inadequate to finance the project. The EFSB chairman learned of the development from news reports, which prompted him to call for the show-cause hearing. It was postponed several times before June 12 at the request of SouthCoast Wind.

Before the EFSB can approve, it must have input about and approval of the project from CRMC. At the hearing, SouthCoast Wind management was asked about the status of their CRMC application and the required meetings with the Fisherman’s Advisory Board (FAB). SouthCoast Wind officials assured the EFSB that the application had been submitted and discussions had been held with CRMC. They also said that there had been meetings with the FAB.

These statements prompted a CRMC staffer involved in the application review to send his email. He had attempted to reach the EFSB administrator to apprise her of what he considered to be lies in the SouthCoast Wind testimony. After failing to reach her by phone, he sent a detailed email with his observations. His email was not approved by the CRMC, which was partly why it had to be made public. It also necessitated the EFSB to send letters to CRMC for an official statement about the claims, as well as the legal representative about the status of negotiations with the FAB. SouthCoast Wind was asked to respond to the accusations.

The versions of the status of the CRMC application and the FAB meetings offered by SouthCoast Wind were disputed by both organizations. Although the CRMC application had been submitted, it was incomplete and thus not accepted. CRMC staff had met with SouthCoast Wind representatives and requested that they submit the missing information so the review could proceed. There was a similar response from the lawyer representing the FAB about the status of its dealings and negotiations with SouthCoast Wind.

The response from SouthCoast Wind’s lawyers was that the CRMC staffer’s claims were false and management had provided honest and correct answers at the hearing. A key issue in the approval process was the Gannt Chart submitted as part of the testimony at the show-cause hearing outlining the timeline for the CRMC permit approval process. The CRMC staffer said the timeline could never be achieved. SouthCoast Wind lawyers acknowledged that the timeline was an educated guess and could be wrong, but it was an honest appraisal by management.

At the heart of the show-cause hearing was the question of the economics of the SouthCoast Wind project and the decision to terminate its PPAs. There was discussion about the role that the next Massachusetts request for proposal of new wind projects, which is to contain cost indexation provisions that would insulate SouthCoast Wind from future cost inflation in its construction costs. Since PPAs provide two decades of revenue assurance, securing them is key to being able to obtain financing for the project.

We dealt with this line of questioning and the economics of offshore wind, especially given the changed business strategy for renewables by SouthCoast Wind’s 50% owner Shell plc in our Energy Musings article. At the time of the hearing, SouthCoast Wind’s CEO expressed confidence it could successfully compete in the Massachusetts bid. However, a dispute about the size of that request has emerged between the governor and attorney general of Massachusetts. The governor would like to expand the bidding to 3,200 MW, rather than the 1,600 MW previously discussed. The attorney general is opposed because she worries that given the uncertain and high-cost offshore wind market, bidding for all that power would lock ratepayers into decades-long, high-priced electricity contracts that would be a disservice to the residents of Massachusetts. This controversy has yet to be resolved, based on media reports, but the state’s offshore wind request will not occur until early in 2024. A smaller sale might leave several offshore wind developers, including SouthCoast Wind, on the outside of contracts to supply Massachusetts utilities with clean power.

It was this uncertainty, and the fact, as acknowledged by SouthCoast Wind executives, that without PPAs, their project would not go forward and the need for the transmission cable permit would be moot. This economic landscape made it easy for the EFSB to vote to pause SouthCoast Wind’s cable application until it knows the company has secured PPAs enabling it to finance the wind farm. Sanity and logic prevailed.

Renewables Make New England Electricity Expensive

The six states composing New England have been aggressively adopting green energy mandates for their state electricity systems. A report by Lisa Linowes of The WindAction Group for the Fiscal Alliance Foundation analyzed the impact these aggressive green mandates are having on Massachusetts and New England electricity prices.

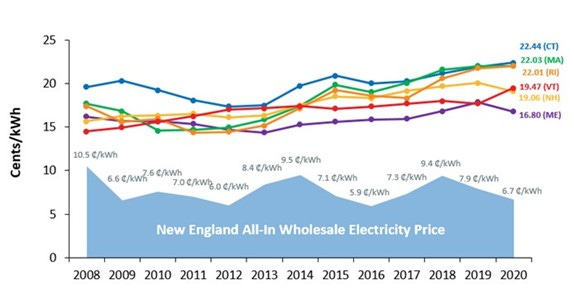

Ms. Linowes’ report began with the following chart from the independent system operator for New England (ISO-NE). It shows residential electricity prices for the New England states and the all-in wholesale electricity price for operating the region’s grid for 2008-2020. The spread between retail prices and the wholesale cost for the grid, roughly 70% of the retail price, reflects the cost for utilities to administer and comply with the individual state green energy mandates. This is a hidden expense for ratepayers, and we wonder if asked whether they would agree that this cost is acceptable.

The spread between New England retail electricity prices and the wholesale price reflects the expense of meeting the green energy mandates of the region’s six states.

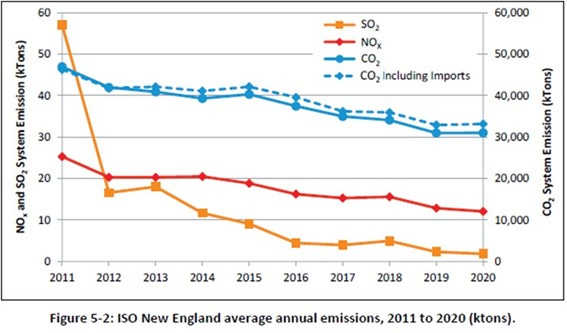

The goal of New England states in pushing more renewable power into its grid output while shutting fossil fuel-based power plants is to reduce the emissions of ISO-NE’s electricity. The following chart from the 2020 ISO New England Electric Generator Air Emissions Report shows the progress the region has made in cutting its grid’s emissions. Between 2011 and 2020, aggregate annual native generation NOX, SO2, and CO2 air emissions 2011 through 2020 declined. NOX emissions fell by 52%, and SO2 by 97%, while CO2 has decreased by 34%. Unfortunately, emissions in 2021 rose reducing some of the region’s gains. Interestingly, based on 2021’s emissions, CO2 emissions in the region have been flat since 2018.

Switching to cleaner fuels has enabled New England to sharply lower is NOX, SO2 and CO2 emissions.

New England’s efforts to improve its air quality have resulted in a significant shift in ISO-NE’s fuel mix. The following chart shows that shift over 2000-2019, as natural gas and imported power shares gained and coal and oil shares declined. In 2022, the share of electricity generation from natural gas was six percentage points higher at 46%, while nuclear was 23%, down two points. Net imports declined five points to 14%, but renewables increased by two points to 11%. Hydropower fell by one point, while oil increased by one point and coal remained flat at three-tenths of one percent.

As the chart demonstrates, the region’s huge emissions reductions came from minimizing its burning of coal and oil. That was accomplished by stepping up its use of natural gas, plus increasing clean power imports, primarily hydropower from Canada. Growing the region’s use of renewable power has also helped. Going forward, emission reduction gains depend on adding more renewables – wind and solar - as several nuclear plants have been shut down. The region is also planning to boost its imports of clean power from Canada once transmission lines are built.

New England’s electricity fuel mix has changed materially that had helped the region cut its emissions sharply.

Significant help in cutting ISO-NE’s emissions has come from the decline in electricity usage. Reasons for this decline have been warmer winters, reduced manufacturing activity in the region, increased energy efficiency, and behind-the-meter solar power growth. There is the possibility that the region’s high electricity prices have caused ratepayers to be more diligent about their power use.

For 2008-2020, New England’s electricity consumption, according to state data reported by the Energy Information Administration (EIA), declined by 9%. This was while total U.S. electricity consumption (excluding the New England states) rose 7.5%.

The average New England retail power price during 2008-2020 rose 21%, while nationally, excluding the New England states, it increased only 18%. If we extend the time to 2022, there is an even greater spread between the rate of increase in retail electricity rates for New England and nationally. From 2008 through 2022, New England retail electricity prices rose 41% while the U.S. average retail price, excluding New England, increased 34%. Furthermore, New England retail electricity prices were 156% of the adjusted U.S. price in 2008, which increased to 159% in 2020 and 161% last year. New England electricity ratepayers are not only paying premium prices for their electricity, but the price has also risen faster than national retail electricity prices. Moreover, New England ratepayers are consuming less electricity.

Ms. Linowes has discovered the culprit for the region’s high retail prices – renewable energy mandates. In New England, she has identified 26 separate programs across the six states. That is approximately four programs per state. Each program applies to a different technology and carries a different compliance requirement and cost. These expenses come in addition to the tax credits and subsidies that boost the cost of wind and solar power. Renewable project developers also benefit from state mandates for utilities to sign long-term power purchase agreements at above-market rates to meet the green energy mandates.

According to Ms. Linowes’ report, “The annual cost of Massachusetts renewable energy policies has quadrupled in 10 years from $250 million in 2011 to $1 billion in 2020. Cumulatively, this has cost Massachusetts ratepayers $6 billion in increased electricity prices in that period.”

Her report also showed that the Regional Greenhouse Gas Initiative has cost ratepayers in the states participating in the program an estimated $3.8 million due to higher electricity prices. This money is to fund state energy efficiency projects, but limited data about them raises questions about whether they have successfully reduced costs and avoided emissions. Ms. Linowes provides data for some energy efficiency projects showing that the cost per carbon ton avoided is significantly higher than the value of the allowances sold. If true, it means the program is using its resources inefficiently.

Virginia, an RGGI member, has begun the process of exiting the program. While climate activists point to the many low-income and coastal environmental projects funded by the money collected from the state’s two utilities and the need to continue the spending. Virginia Governor Glenn Youngkin’s administration points to the $2.39 average monthly increase in Dominion Electric’s customers’ bills since Virginia joined RGGI in 2020 as proof the program has been “detrimental to customers.” That statement is true for all the green mandates.

Ms. Linowes’ report calculates that the annual cost of renewable energy policies over 2011-2020 has cost Massachusetts ratepayers $6 billion in increased electricity prices. The annual cost to ratepayers has climbed from $250 million in 2011 to $1 billion in 2020. Unfortunately, the cost of these mandates is hidden from the ratepayers, and things could get worse given the push to reach net zero emissions. That is because of the cost and impacts of growing the necessary installed generating capacity of wind and solar to meet Massachusetts and New England’s power needs. The hidden renewables mandate costs will only grow, but in addition, there will be growing conflicts over the land needed to hold these generating assets.

The report on what the renewable mandates have cost Massachusetts ratepayers should get wider reading in New England and across the United States. While ratepayers have few options in dealing with escalating electricity costs, the regulators who oversee utilities need to be educated on these costs as they are the protectors of ratepayers. The key message from this report is that renewable energy is not cheap, despite what its proponents claim. An honest assessment of the cost is long overdue.

Tale Of Whale Deaths Not Pleasant Reading

North American Right Whales were included in the latest NOAA totals of whale deaths since December through mid-July.

Source: worldanimalnews.com

Dead whales have prompted an outrage directed at the offshore wind industry and those in government who are facilitating their building. The latest whale death data from the National Oceanic and Atmospheric Administration (NOAA) covers from December 1, 2022, to July 12, 2023. Below are the latest counts within specific areas of the entire East Coast.

· 34 humpback whales between Massachusetts and North Carolina

· 4 sperm whales between New York and Florida

· 2 North Atlantic right whales in North Carolina and Virginia

· 1 sei whale in North Carolina

· 14 minke whales between Maine and Virginia

· 1 fin whale in Virginia

Total large whale deaths: 56

Off New York coast: 11

Off New Jersey coast: 10

These whale deaths have occurred during a time when surveying, transmission cable installation, and starting to pound the foundations for wind turbines and substation platforms for wind farms. To dismiss any possible association between increased offshore wind construction activity and rising whale deaths is unconscionable.