Energy Musings - January 2, 2025

Energy posted a dismal performance for December, but it was not the worst performing market sector. It surprisingly posted a positive performance for the year based on its first four month gains.

Wrapping Up Energy Performance For 2024

Last year ended on a down note for investors. On Tuesday, the last trading day of 2024, the Dow Jones Industrial Average was down 29.51 points, or -0.07%, to close at 41,544.22. The Standard & Poor’s 500 Index fell 0.4% to 5,881, while the Nasdaq closed at 19,310, down 0.9%.

For the S&P 500, this was the first time since 1966 that the index ended trading for the year with four consecutive down days. According to FactSet, December was the worst month for the S&P 500 since April. Despite the dismal ending to 2024, the year saw the S&P 500 rise 23% for the second 20%+ gain year. The 2023-2024 return for the index was a gain of 53%. To find a similar performance, one must go back to 1997-1998, when the S&P 500 rose nearly 66%.

The quarter of a decade space between such outstanding stock market returns should warn investors not to expect another 20%+ performance for 2025. Is it possible 2025 could be a down year for investors? Yes, because bullish sentiment overwhelmingly dominates investor outlooks, which is always dangerous. Whenever bullish or bearish sentiment is overwhelming, the opposite often happens. This is not a forecast or prediction for 2025, merely a warning based on history and personal experience.

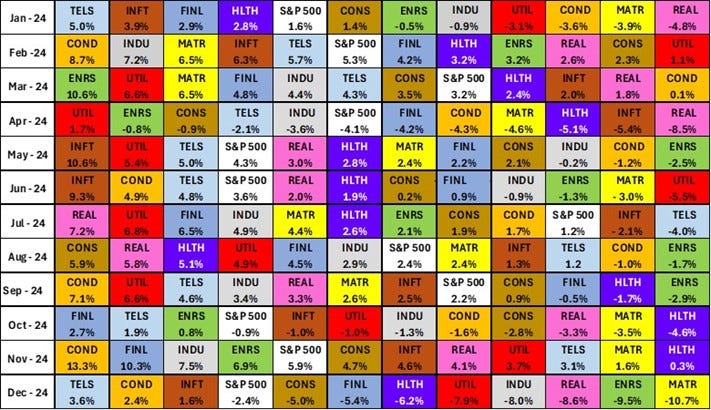

December was not a good month for the stock market, with the pattern of the last four trading days indicative of the market’s lousy monthly performance. The S&P 500 Index posted a loss of 2.4% for the month. The energy sector of the S&P 500 Index finished in 10th place in December. It posted a loss of 9.5% for the month, or nearly four times the 2.4% loss for the S&P 500 Index.

December was the fifth month that Energy’s performance put it in last (3), second from last (1), or third from last (1) place. Energy posted weak performance for five of the 12 months of 2024. Importantly, Energy’s poor monthly performance began in May, so the sector was at or near the bottom of the sector rankings for five out of eight months.

Energy avoided the cellar in December.

Energy’s poor stock market performance reflected the industry’s changed environment. Crude oil prices were strong during the first four months of 2024, which coincided with the Energy sector’s strong stock market performance. Energy was up 12.8% year-to-date through April, trailing Communications Services (TELS), rising by 13.4%. These two sectors were well ahead of the pack, as no other sector experienced an 8% gain. The S&P 500 was up 6.04% for the four months, so Energy and TELS delivered more than twice the stock market’s gain. Investors were very happy to own Energy and TELS stocks.

Because of the strong performance of Energy during the first third of 2024, the sector was able to post a 5.72% gain for all of 2024. That put the sector in eighth place; however, it is still at the bottom of the 11 sectors.

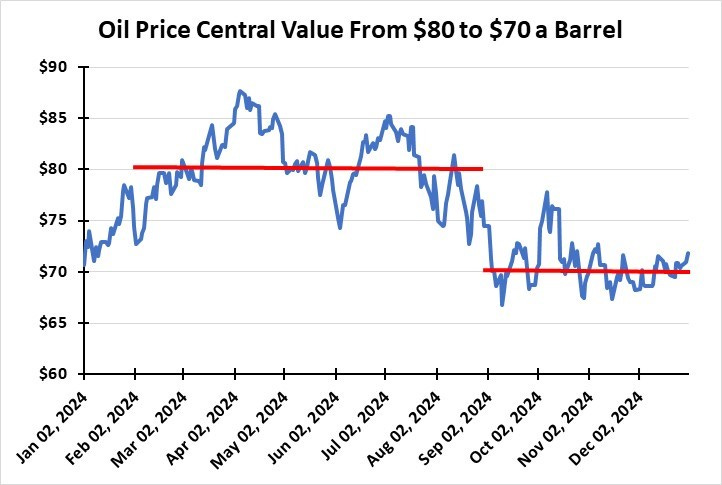

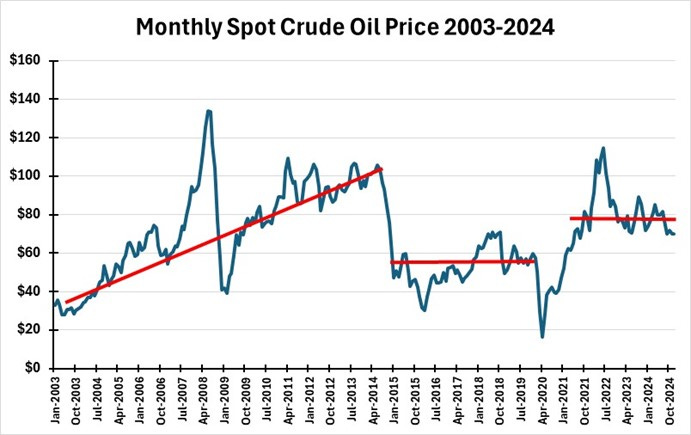

Energy stocks performed well because crude oil prices climbed from $70.62 at the start of 2024 to nearly $88 a barrel in early April. From the peak, oil prices corrected – falling to about $74 at the beginning of June. As the chart shows, oil prices rallied back to about $85 before entering a slide that saw prices fall below $70 a barrel in early September, bottoming at slightly under $67 on September 10. Since then, except for a brief rally pushing oil prices back into the upper $70s, they have fluctuated around $70 for the fourth quarter.

The global oil market has been impacted by China’s lack of oil demand and the continued growth in U.S. output contributing to the worldwide oil glut. The glut has been well managed by OPEC members with the help of Russia, but the roughly two million barrels of output being held off the market to support oil prices is weighing on the oil price outlook. For most of the second half of 2024, the conventional view was that oil prices were being artificially supported and would fall unless demand suddenly rebounded or U.S. shale producers cut back their drilling and production activity. Oil price forecasters have repeatedly reduced their projected prices for 2024 and 2025.

Without higher oil prices, industry capital spending is being reduced, leading to lower drilling and completion activity. Lower commodity prices mean lower earnings for producers. Reduced oilfield activity is impacting the revenues and profits of oilfield service companies. Given these dynamics, it is unsurprising that Energy performed poorly during the past eight months.

The 2024 performance of oil prices explains Energy’s market results.

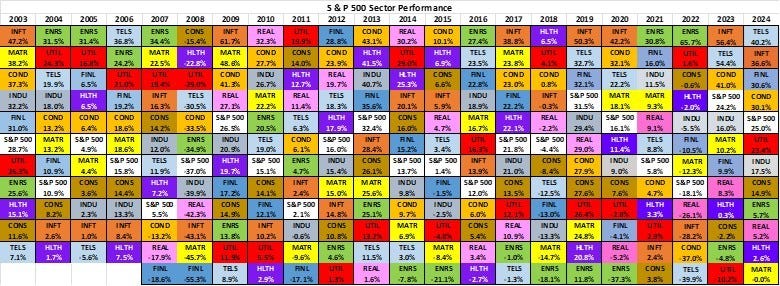

When we examine the performance of Energy over 2003-2024, we see periods when the sector was topping the performance results and other times when it was at the bottom. When looking at the following chart, one needs only to look at the green cells, which show the annual energy performance each year, to see how the sector was faring.

Energy performed well in 2003-2013 but poorly during 2014-2024.

The key to the outstanding and poor performance years for Energy can be explained by examining the chart of monthly crude oil prices for 2003-2024. Despite exhibiting volatility, oil prices showed a rising trend from 2003 to 2014. Oil prices collapsed when the market-share war between Saudi Arabia and other OPEC producers broke out in 2014.

Since 2015, oil prices have experienced two periods of relatively stable prices. From 2015 to 2020, oil prices fluctuated around the high $50s. However, from close to $60 a barrel, oil prices collapsed in 2020 due to the global economic shutdown due to Covid. Prices began recovering in the second half of 2020 with the gradual reopening of economies. When the Russia-Ukraine war erupted in early 2022, oil prices soared above $100 a barrel but quickly fell as energy demand suffered. Since then, prices have vacillated around the upper $70s until recently.

Oil price history explains energy stock performance.

With the year-end rebound in oil prices, we will be watching closely to see how investor sentiment towards oil shifts with the arrival of the Trump administration and new U.S. energy policies. The geopolitical turmoil and questions about economic growth will also weigh on oil price sentiment. We will have more to say about future energy market scenarios in upcoming posts.