Energy Musings - January 19, 2024

Germany has made great progress in building its renewable energy generation capacity, but it has come at a cost - high electricity bills. Emissions are down but its economy is failing.

Germany: An Energy Beacon Or Disaster?

Germany is the largest economy in Europe and the fourth largest in the world. It trails only the United States, China, and Japan. Importantly, Germany is the world’s third-largest export nation. How Germany goes often tells us about how Europe will perform.

Importantly, Germany is a leader in the energy transition to a renewables-only energy system. Energiewende – the country’s energy transition program – unfortunately, has led to soaring energy costs, declining economic activity, and the scene of the latest European farmers’ protest over fuel tax hikes, even though the country’s carbon emissions have fallen to a seven-decade low.

German farmers with their tractors rally in central Berlin to protest government plans to raise diesel fuel taxes.

Agriculture is one of the most sensitive sectors to fuel cost volatility. Whenever politicians decide to adjust fuel taxes and/or subsidies, they are surprised by how quickly and powerful farmer protests become. The picture shows German farmers on a Berlin street with the Brandenburg Gate in the background after they mobilized and drove into most major German cities in protest. They were reacting to the government’s latest energy policy shifts. For the farmers, the government backed down from its diesel fuel tax hike.

Over the past several years, we have seen farmers protest government actions in Ecuador, Sweden, France, and now Germany. Farming is not a hugely profitable undertaking. With fuel a major cost in operating a farm, whenever governments act to lift fuel prices, farmers become angry.

Germany’s Economy

While upset German farmers are the latest problem, the German government is struggling with a sick economy impacted by still-elevated energy costs and weak exports. Germany’s fourth-quarter GDP estimate showed a 0.3% contraction. However, the economy avoided falling into a technical recession (two consecutive quarters of negative GDP growth) because the third-quarter GDP was revised up from a negative 0.1% to zero change as the fourth-quarter GDP fell 0.3%. For the full year, Germany’s GDP contracted by 0.3% confirming the International Monetary Fund’s projection for negative growth in 2023.

Germany’s economy is expected to grow in 2024. The IMF sees it growing by 0.9%, while the European Union projects it to grow by 0.8%. Other forecasts range between -0.5% and +1.3%. Estimates for Germany’s economy in 2025 call for growth of 1.0%-1.3%. These projections assume inflation continues to decline, while employment and exports grow.

The critical assumption is lower inflation. December’s inflation data showed it 3.7% higher than in December 2022, but the higher than-forecasted inflation rate was attributed to higher energy prices. The monthly increase was driven partly by the ending of the federal government’s support for household energy bills in December. As a consequence, natural gas was 34.0% more costly than a year ago, while district heating costs soared 58.4%. Electricity prices were flat year-on-year, while light heating oil was 11.0% lower and motor fuel prices fell by 1.1%.

As usual, we were told that excluding food and fuel, inflation in December would have been only 3.5%. Of course, those are two of the most significant components of family budgets, and the ones they purchase most frequently, making them sensitive to current prices. Moreover, while inflation may be down, it only means prices are rising at a slower pace, not declining. Until prices across the board fall, consumers are going to continue to consider current prices in the context of past expenses and that they are too high.

Germany’s Energy Market

Environmentalists are praising the progress Germany has made in growing its renewable electricity generating capacity and output. However, electricity only represents 16% of Germany’s primary energy consumption. The progress in growing the renewable share of electricity capacity and output is not to be dismissed. However, the energy transition, known as Energiewende which means “energy turnaround,” grew out of the country’s anti-nuclear movement of the early 1970s. It gained steam after nations agreed to the Kyoto Protocol mandating cutting greenhouse gas emissions starting in 2005.

Kyoto required Germany, the world’s sixth largest emitter, to cut its carbon emissions. In 2000, legislation was enacted to enable feed-in tariffs and grid priority for renewable energy. In 2007, the European Union established 2020 climate change targets – 20% of electricity to come from renewables, a 20% cut in greenhouse gas emissions, and 20% greater energy efficiency.

In 2010, Germany’s conservative government reversed its “nuclear consensus” to end nuclear power by canceling the phase-out. However, the following year, a tsunami off Japan caused a nuclear reactor at the Fukushima plant to fail, releasing some radiation. Germany’s Chancellor Angela Merkel seized on the fear of a possible nuclear accident to reverse the nuclear policy and order a complete phase-out by 2022. She had wide parliamentary support and was comfortable with Germany’s reliance on Russian natural gas supplies and began pushing for its expansion.

The green energy revolution bloomed in Germany between 2011 and 2022. That was before Russia invaded Ukraine and international efforts to punish Russia turned the European energy market upside down. Russia cut natural gas supplies, as European and other countries stepped up sanctions aimed to cripple the aggressor’s economy and presumably its military effort. For Germany, which received 55% of its gas supply from Russia, it struggled to find alternative energy supplies in a world marked by soaring crude oil and liquefied natural gas prices. The push for more renewable energy was stepped up. Without Russian gas, Germany wrestled with opening LNG import terminals to bring in supplies from America and elsewhere. Amazingly, Germany continued with closing its three remaining nuclear power plants. Two were closed in 2022, with the final plant shuttered last year. The closure was over the cries of many voices that these plants were needed to help residents deal with the ongoing energy crisis.

Without the dispatchable nuclear power, Germany was forced to restart closed coal-fired power plants, including some fueled with low-grade lignite. Germany also restarted some mining operations. The most upsetting experience for environmentalists was the dismantling of a wind farm so the coal below could be mined.

Germany’s power generation is rapidly shifting from fossil fuels to renewable energy.

The chart above from Clean Energy Wire shows the history of Germany’s installed electricity generation capacity by fuel since 2002. While the clean energy push had begun, it was primarily focused on onshore wind. After Merkel reversed Germany’s nuclear phase-out ban in 2011, renewable energy capacity began growing rapidly. By the end of 2023, renewable energy (biomass, hydropower, solar, wind offshore, and wind onshore) capacity totaled 162.1 gigawatts compared to fossil fuels with only 73.0 GW of capacity. Renewables represent 69.0% of total electricity generating capacity and their capacity and share of electricity generation will continue to grow based on planned industry spending.

Renewable energy generated more than half Germany’s electricity last year.

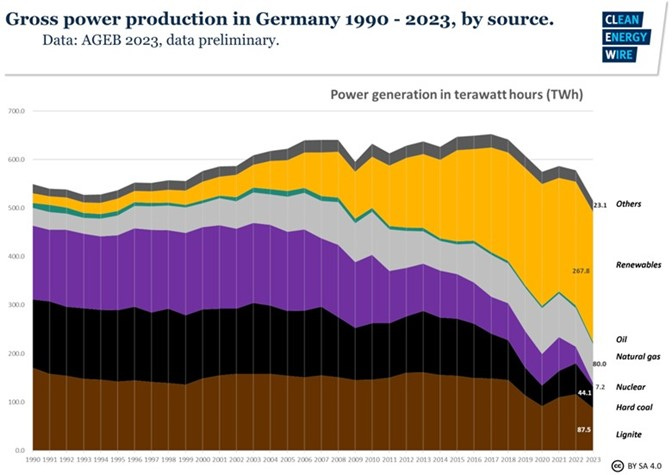

When we look at the history of Germany’s power generation by fuel, we see that renewables’ share grew beginning in 2005. The colorful chart above highlights how power output from fossil fuels has declined since the early 2000s. The initial decline was centered on nuclear output, but by about 2013, hard coal-generated power began falling which then was joined by lignite in 2018. However, when a cold winter arrived in 2021, followed the next year by the Russia/Ukraine-generated European energy crisis, coal and lignite consumption rose as natural gas supplies were limited.

Renewables And High Power Bills

The problem Germany faces is that renewable power generation is not as efficient as output from fossil fuel sources while often being more expensive. In 2023, renewables generated 267.8 terawatt hours of Germany’s electricity output. That represented 52.5% of power generated for the year, with the remainder coming from fossil fuels. Germany’s challenge is that its renewable power output came from nearly two-thirds of its generating capacity. Renewables represented 64.3% of total electricity generation capacity at the start of 2023, but that share grew to 69.0% by the end of the year. The capacity-to-generation mismatch is costly for the German economy and its residents.

Germany’s push for a net zero energy market has resulted and will continue to result in higher electric bills. As of February 2023, Germany’s residential electricity price was the second highest in the European Union at 49.5 Euro cents per kilowatt-hour, trailing Ireland by 0.4 € cents/kWh. For comparison, Germany’s power price is over three times the average cost of electricity in the United States. Such a high power cost puts Germany’s industries at a competitive disadvantage compared to the U.S.

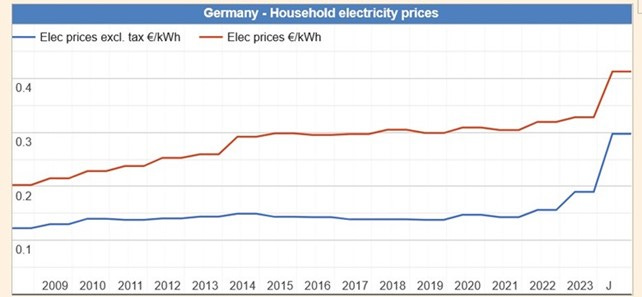

Germany’s household electricity prices have more than doubled since 2008.

For German households, electricity costs have more than doubled over 2008-2023 regardless of whether the price excludes taxes or not. Taxes add nearly 40% to the cost of electricity. That component offers the government room for adjustments to help segments of its population and economy, but some of it currently subsidizes renewables.

After months of wrangling, the government last fall agreed to a subsidy program for manufacturers. Electricity prices will be cut from €15.37 to €0.50 per megawatt-hour. There are provisions for particularly energy-intensive businesses that could lower their electricity price to €0.06. This program has been put in place for 2024-2027 at an estimated cost of €28 billion, with €12 billion allocated for 2024 alone. If Germany sticks to the total figure, it implies either relief will be reduced or fewer companies will be eligible for relief in 2025-2027. The assumption underlying reduced support in those years is the expectation that Germany will see a significant increase in offshore wind power, which the government anticipates being less costly, helping to bring down the cost of power.

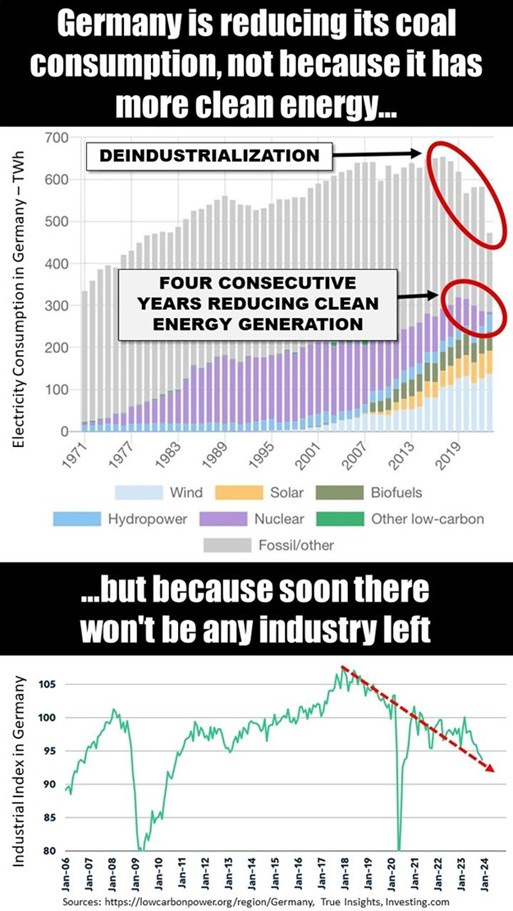

Germany’s economy and energy market needs to be considered in the context of the country’s carbon emissions. The Agora Energiewende think tank said Germany emitted 673 million metric tons of CO2 last year, down 73 million metric tons from 2022. CO2 emissions were at the lowest level since the 1950s, and 46% below Germany’s 1990 emissions.

According to Agora, some 44 metric tons of CO2 reduction last year was because coal-fired electricity output fell to its lowest level since the 1960s. That reduction was possible because electricity demand fell and electricity imports from neighboring countries increased. About half of the imported electricity came from renewable energy sources.

The decline in emissions from industry (20 million tons) came as energy-intensive companies reduced production due to economic weakness and high natural gas prices, Agora said. Agora director Simon Műller said, "The consequences of the fossil energy crisis and the slowdown in the economy are particularly evident in the CO2 emissions of energy-intensive industries." But the think tank calculated that only about 15% of last year’s CO2 reduction constituted “permanent emissions reductions resulting from additional renewable energy capacity, efficiency gains and the switch to fuels that produce less CO2 or other climate friendly alternatives.” Agora also said, “most of the emissions cuts in 2023 are not sustainable from an industrial or climate policy perspective.”

One of the trends underway in Germany’s economy is how high energy prices have driven manufacturers to shift production to foreign locations. This is a problem for the strength of the economy and what it may mean for its recovery and long-term growth prospects. "The crisis-related slump in production weakens the German economy. If emissions are subsequently relocated abroad, then nothing has been achieved for the climate," said Agora’s Műller.

Reducing Germany’s emissions is possible because the country’s economy is being hollowed out by the country’s high electricity bills.

According to Agora’s Műller, to hit its climate targets, Germany needs a "barrage of investments" to modernize industry and reduce the carbon footprint from heating. He failed to quantify the magnitude of investment needed, but we suspect it will be huge. Will Germany be able to finance such an economic modernization?

We remain convinced that Germany’s embrace of the Kyoto Protocol and its push for a green energy transition for the world was motivated by attempting to level the global economic playing field. Germany lacked hydrocarbon resources – it only had coal. Therefore, by forcing all other countries to match Germany’s higher electricity costs, it would be better able to compete in global trade. What we are seeing is Germany’s economy is being hollowed out by its high electricity cost and it is rapidly becoming uncompetitive, which will hurt its economic growth for years to come. This is a playbook other countries should be leery of following.