Energy Musings - January 11, 2024

A long discussion about the cost of renewable energy focused on Rhode Island where offshore wind is expected to be a key contributor to the state's 100% renewable energy by 2030 plan.

Summary

We are told that renewable energy is cheaper than fossil fuel-generated power so customer bills will decline as electricity grids transition to 100% renewable power. That pitch assumes that all fossil fuel plants will be shuttered, but we know that will not be the reality since renewable energy provides power only part-time. We examine the renewable energy cost issue for Rhode Island electricity customers and explain how and where the costs associated with renewable energy are hidden in the monthly bill. For Rhode Island, offshore wind is a key component of its 2030 100% clean energy plan. However, even its designers acknowledge there will always be fossil fuel plants operating, that these wind farms will have little impact on reducing carbon emissions, and their rates will boost customers’ monthly power bills.

The Mirage of Cheap Renewable Energy

The offshore wind is cheap “mirage” blew up last year. From the Meriam Webster dictionary, mirage synonyms include delusion (“an inability to distinguish between what is real and what only seems to be real”), illusion (“a false ascribing of reality based on what one sees or imagines”), and hallucination (“impressions that are the product of disordered senses”). Each synonym applied to offshore wind in 2023.

Mirage also means “hold on to your wallet.” Costs are going up. Your electricity is going to cost more. The Boston Globe highlighted that fact in a recent article.

“Going green won’t be easy, or cheap. But top Massachusetts utility regulators on Thursday launched an investigation into ways to reduce the financial burden of the state’s clean-energy transition — for lower-income residents, at least.”

Offshore Wind’s Problems

Last year, regulators in two states – New York and Rhode Island – and developers in three others – Connecticut, Massachusetts, and New Jersey – reacted to the latest offshore wind cost/profitability realities. In the first case, regulators protected customers from huge hits to their wallets by rejecting significant price hikes. In the other states, developers sidestepped bankruptcies by terminating their power purchase agreements.

The New York Public Service Commission rejected four offshore wind project rate hike requests that averaged 48%, with individual hike requests ranging from 30% to 61%. Although not endorsing the developers’ requests, New York’s energy research agency recommended a modest increase. It worried that future projects might cost more, and it didn’t want to impede the state’s clean energy efforts. The commissioners disagreed.

For about $150 million, offshore wind developers terminated power purchase agreements with utilities in Connecticut and Massachusetts. The moves followed state officials saying the projects could be rebid in the 2024 offshore wind solicitations. Developers hope for higher prices. Ratepayers will be hit with bigger electricity bills.

Last summer in Rhode Island, the state’s primary utility, Rhode Island Energy, rejected the sole bid it received for securing 600-1,000 megawatts of offshore wind power. The Ørsted/Eversource Revolution Wind 2 bid was judged too expensive for ratepayers as it would add over $3 billion in costs above the economic value the developers claimed to ratepayer bills. Details of the proposed power price and the contract length were redacted from the documents filed with the Rhode Island Public Utilities Commission. That information, along with pre-filed testimony of management involved in the analysis, was for a mandated hearing into Rhode Island Energy’s bid rejection analysis. Ørsted avoided the hearing by telling the PUC the bid expired before the hearing date, eliminating the need for a public airing. Importantly, the RI Office of Energy Resources and the PUC staff backed Rhode Island Energy’s judgment.

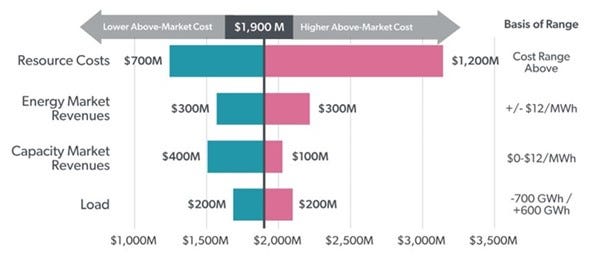

The Brattle Group’s December 2020 report, The Road to 100% Renewable Electricity by 2030 in Rhode Island, was used to justify Rhode Island’s push for 100% renewable energy by 2030 legislation. In the report, we discovered cost sensitivity analyses for attaining 100% of the state’s power needs from renewable energy by 2030 from four options – land-based wind, offshore wind, wholesale solar, and retail solar.

For offshore wind, the analysis shows a mid-point net present value cost of $1,900 million. The upper range was above $3,000 million. This analysis points up the issue Rhode Island Energy confronted when its analysis of the Revolution Wind 2 bid showed a cost to ratepayers above $3 billion, or already at the upper end of The Brattle Group’s analysis. The offshore wind capacity from Revolution Wind 2 would not satisfy the remaining offshore wind resources needed to meet the state’s clean energy goal. The chart of the analysis is below. The Revolution Wind 2 cost analysis highlights how different today’s construction costs are compared to the assumptions of those who masterminded the 100% clean energy plan.

The Revolution Wind 2 bid proved too expensive for Rhode Island electricity customers because it alone almost reached the full cost of meeting the state’s 100% clean energy goal with offshore wind.

What is the significance of the new realities of renewables for the future of electricity rates? Rhode Island has the toughest clean energy mandate in the United States. It requires utilities to use 100% renewable energy by 2030 – six years from now. Through the first 10 months of 2023, only 10% of the state’s electricity came from renewables. That share needs to grow by 15 percentage points a year!

Rhode Island Energy Bills Explained

Most ratepayers have no idea what they pay for electricity – only what their monthly bill is. They have no clue about future electricity bills given the push for 100% renewable power. They also don’t realize they could experience more blackouts due to the intermittency of renewable power.

Let’s look at our Rhode Island summer home’s November electricity bill to gain an understanding of what might happen to future bills. It has three charges - Delivery Services ($49.61), Supply Services ($56.59), and Other Charges/Adjustments ($4.43), for a total of $110.63.

The $4.43 charge reflects our share of the company’s Gross Earnings Tax which is levied at a rate of 4.2% of our Delivery Services and Supply Services expense, or $106.20. In effect, this is a pass-through expense and will vary with the total amount of your power bill.

The Supply Services charge reflects the authorized (PUC approved) rate Rhode Island Energy charges for the electricity it supplied to our house. The utility cannot earn a profit on the supply cost, so it reflects what the company pays for its electricity supply.

Under the state’s electricity rate structure, the supply cost is established for six-month periods. The summer rate covers from April 1 to September 30, with the winter period spanning from October 1 to March 30. Depending on your billing cycle (ours is a mid-month to mid-month measurement period), you may have one or more months with an average summer/winter rate, rather than the authorized seasonal rate. The current winter rate is $0.17741 per kilowatt-hour of power used (last summer’s rate was $0.10342/kWh). Our November usage was 391 kWh, making the cost of our electricity $56.59.

The confusing part of the bill is Delivery Services since it captures the expenses of eight programs. Their charges are based on Rhode Island’s Basic Residential Rate A-16. Here is how our November bill broke down.

Understanding your power bill will help you estimate what the changes from more renewable power will cost you.

1. The Customer Charge is for being a customer.

2. LIHEAP is the state’s program to aid low-income customers in dealing with large electricity bills. (About 30,000 families, or roughly 6.5% of the state’s families participate in this fund.)

3. The Distribution Energy Charge is for maintaining the system’s infrastructure, such as transformers, substations, and utility wires and poles.

4. The Energy Efficiency Programs are state programs to weatherize and make other home improvements to reduce electricity consumption.

5. The Renewable Energy Distribution Charge is for bringing renewable energy into the distribution system – think of wires to connect commercial-scale renewable energy projects.

6. The Transmission Charge covers the cost of moving the power from where it is generated to the utilities’ distribution network.

7. The Transition Charge reflects the cost of shifting Rhode Island’s electricity system from its current fuel mix (84% from natural gas) to 100% renewable energy.

8. The RE Growth Program allows Rhode Island Energy to pay participants for their renewable energy supply and then recover the cost from all customers (we participate in this program – more later).

Excluding the 4.2% for the Gross Earnings Tax, the cost of our Supply Services (energy) represented 53% of our bill, while 47% was for its Delivery Services. We are told that the shift to renewable energy will reduce our electricity bill because cheaper renewable power will replace expensive and harmful fossil fuels, thereby reducing our Supply Services expense.

However, making this energy shift will boost transmission costs, along with other components of Delivery Services. It is expensive to build new transmission wires to bring renewable energy from more remote locations where it is generated – think of the ocean cables needed to bring offshore wind power to the New England grid – to the distribution system. For example, when the $350 million Block Island Wind farm was constructed in 2016, the $114 million expense for the cable to bring the surplus power to the mainland was paid for by ratepayers, adding to the total cost of the electricity consumed. When the cable had to be reburied, the $31 million National Grid (now Rhode Island Energy) spent was also charged to its customers.

Renewable Energy

Let’s examine the cost of the RE Growth Program. In 2017, we took advantage of a community-negotiated deal with a solar installer for discounts to encourage homeowners to install solar systems. National Grid allowed us to install a 7.2 kilowatt peak generating system. We are paid $0.3475 per kilowatt-hour for the solar power we generate which goes to Rhode Island Energy. At the same time, we pay for the power we use. We are not using our solar power to be “off the grid.”

We received a community discount on the installation, and a 30% federal tax credit, and the power we sell offsets much of our monthly bill and provides us with a cash payment for any difference. Not all expenses can be offset. Our 15-year contract is renewable and transferable. The renewal price will be determined before commencing a new contract.

With the various credits, the electricity bill offsets, and cash payments, we recovered the full cost of our system in 60 months (five years) on a pre-tax basis and 72 months (six years) on an after-tax basis. The latter is key as the cash payments are taxable income for us. Either way, this is an outstanding return on our investment. The fast recovery of our system cost is due to the high price we are paid for our solar power. We entered the program in year three of its existence. In its first year, the utility was paying $0.41/kWh, which dropped to $0.375/kWh in year two, and then to our $0.3475 rate in year three. The rate paid has continued to decline and customers now earn about the same rate the utility charges for power.

Let’s see how the various Delivery Services charges have changed over time. We examined our 2016 and 2020 November bills. Here are those costs.

Rhode Island electricity costs have been increasing since the clean energy mandate was enacted.

Since 2016, the monthly customer charge has increased by $1, which is not unreasonable given inflation. Over 2016-2023, the cost of the Energy Efficiency Programs fell by $0.00121/kWh. Does that suggest less is being done, or are there fewer opportunities compared to earlier years?

The Transition Charge increased by $0.00079/kWh, which is surprising because of the push to transition the state’s power system. The big increases were the Transmission Charge, up 23.5%, the Distribution Energy Charge which is 52.5% higher, and the Renewable Energy Distribution Charge which soared by 374%.

As mentioned above, we participate in the RE Growth Program via our solar system. What we didn’t realize was how much that program costs. Over 2016-2023, the monthly cost has soared 18-fold from $0.22 to $4.02 today. The annual cost for a customer has increased from $2.64 to $48.24!

We noticed that on January 2nd, a Rhode Island resident asked Alison Bologna, one of the morning anchors at Channel 10 News, about this charge on their electricity bill. She explained its purpose and wrote that the rate had previously been $1.58. However, we noted it was $2.16 a month back in 2020. Did it dip at some point?

At over $4 a month, is this charge on bills getting ratepayer attention? As more people are encouraged to install solar panels on their roofs or battery backups for their homes which are subsidized under this program, the monthly cost for ratepayers is destined to rise. The Brattle Group report shows it increasing slowly up to 2030. We remain in contact with our contractor who tells us the solar installation business is so strong the company struggles to hire enough new workers.

Expensive Power Now And In The Future

Rhode Island residential electricity is expensive. According to the latest Energy Information Administration state electricity data, the residential price is 27.5 cents per kilowatt-hour compared to the U.S. average of 16 cents/kWh, a 72% premium. However, the average amount of power used by Rhode Islanders is only 64% of the U.S. average, which puts the state’s average monthly bill just 10% above the U.S. average.

So far, we have identified several areas where the energy transition from Rhode Island’s heavy dependence on natural gas to 100% renewable energy will add costs to residential power bills. Interestingly, the annual natural gas spot price in 2023 (Henry Hub) was only a penny higher than in 2016 ($2.53 per thousand cubic feet vs. $2.52). And in 2020, the average spot gas price fell to $2.03/Mcf. Yet during this period, the Supply Services charge on my bill went from 8.2 cents/kWh to 10.4 cents/kWh, and finally to 17.7 cents/kWh. That charge reflects the full cost of the power being supplied. But why so high when spot gas barely moved?

The Supply Services cost is a function of the purchasing strategies of National Grid and now Rhode Island Energy, which are different. National Grid used to purchase all its gas supplies at one time, rather than Rhode Island Energy’s strategy of purchasing supplies for future deliveries at different times. The changed strategy enables them to take advantage of market dips. However, the natural gas cost in winter is also impacted by the need to purchase expensive liquefied natural gas (LNG) supplies from abroad, as well as costly petroleum and coal supplies to meet the region’s power needs. Winter temperatures force natural gas supplies to shift to home heating instead of being used to generate electricity.

A study last year for The Fiscal Alliance Organization showed that the cost of wholesale power on the ISO-NE grid is only about a third of New England state average utility rates. A conclusion from the report stated:

“The delta between residential rates and the all-in wholesale price is directly related to energy policies that state governments have implemented, including renewable energy mandates and incentives, energy efficiency, and climate programs.”

The study, HIGH IMPACT: How Massachusetts Energy Policy is Raising Electricity Rates, examined the myriad of renewable energy programs and mandates for the state. The report concluded:

“The annual cost of Massachusetts renewable energy policies has quadrupled in 10 years from $250 million in 2011 to $1 billion in 2020. Cumulatively, this has cost Massachusetts ratepayers $6 billion in increased electricity prices in that period.”

We need to consider the impact of this reality on Rhode Island electricity customer bills with the startup of new offshore wind farms. The levelized cost of energy estimate for Revolution Wind 1 is $98.73 per megawatt. That measure is an estimate of what the cost of power will average over the 20-year life of the offshore wind farm’s contract. The LCOE translates into $0.09873/kWh for customers. Then there will be another 1-2 cents/kWh added for maintenance of the wind turbines. So, we are now talking about the total cost of the power generated by the turbines costing $0.11-$0.12/kWh. One might say: “Gee, that’s cheaper than the $0.17741/kWh we are currently paying. It must be a good deal.”

That is the message offshore wind developers want you to believe, but that is not necessarily the reality. For example, the Ørsted/Eversource team developing the 90-megawatt South Fork Wind project off the tip of Long Island says that “the power from South Fork Wind … will cost the average ratepayer between $1.39 and $1.54 per month when it starts operating.” The EIA 2023 electricity data for New York residential customers shows an average monthly bill of $105.80. South Fork Wind’s monthly cost increase is only 1.3%-1.5% of the bill. However, the cost escalates at 2% per year.

What we found interesting comes from a 2019 report by the National Renewable Energy Laboratory. It says South Fork Wind’s PPA, filed with the Long Island Power Authority, shows $160/MWh. That would have been for power produced in 2018 and translates into $0.16/kWh. With the guaranteed annual escalation, the $160/kWh rate is now $180/MWh. Not cheap!

There are ways of structuring offshore wind power purchase agreements that obscure the full cost for customers. Vineyard Wind 1 has a PPA of $74/MWh in 2018$. The rate escalates by 2.5% per year plus it will include the estimated market value of ISO-NE capacity payments. The capacity market is a new program where auctions are held for renewable power to be supplied in three years and is designed to attract new projects. A developer receives a fee per kilowatt-month of the capacity of the project, which is the project’s nameplate capacity multiplied by its estimated capacity factor. For offshore wind, many developers use a 43%-45% utilization factor. Based on recent capacity auction results, we estimate this payment may add 2.6 cents/kWh to the price of the Vineyard Wind’s electricity at the turbine.

We also do not know what the cost to transport the power from the offshore turbines to the ISO-NE grid will be. Of course, that cost will become part of our Delivery Services expense. What is disturbing about the offshore wind LCOE estimate is that it represents only part of the total cost customers will pay because of the clean energy program costs highlighted by the Massachusetts study. If the power cost is only 30% of the wholesale power cost, then Revolution Wind 1’s $0.10/kWh cost becomes $0.33/kWh or nearly twice the current Supply Services expense. Even blended with the existing fuel cost, the 20-year cost of offshore wind guarantees higher electricity bills.

Although neither we nor the author of the earlier study have conducted a similar examination into the full cost of Rhode Island’s renewable energy policies, we suspect it would reach a similar conclusion to that of Massachusetts, although the financial magnitude would be smaller given Rhode Island’s smaller population.

Clean Energy And Emissions

Importantly, these clean energy mandates come at a significant cost, but they may have little impact on reducing greenhouse gas emissions. A statement by the Bureau of Ocean Energy Management (BOEM) in its Vineyard Wind 1 Offshore Wind Energy Supplement to the Draft Environmental Impact Statement noted this point.

“Offshore wind projects will by themselves probably have little impact on climate change but they may be significant and beneficial as a component of many actions addressing climate change.”

BOEM is hopeful that offshore wind energy can be used to eliminate some fossil fuel-generated power, but it fails to acknowledge that the intermittency of wind, as well as for other renewable energy sources, requires utilities to continue to operate dispatchable power plants to immediately provide power when renewable energy fails to deliver. Even the economic consultants who advised Rhode Island on its 100% renewable energy goal noted the power system would require some fossil fuel plants in the state to continue to operate. How is that possible with 100% renewable power? Because a portion of the 100% goal will be met with renewable energy certificates (REC). That is a piece of paper representing a credit earned by a renewable energy project for each kilowatt-hour of power it generates. These RECs are purchased by utilities, including Rhode Island ones, and are considered equal to a kilowatt-hour of power from a renewable energy plant in the state. In other words, the clean energy output from a project in New England or any other state counts as clean energy in Rhode Island. Crazy? Of course.

A conclusion from The Brattle Group report sums up the outlook for Rhode Island ratepayers wondering what their future electricity bills will be.

“Achieving 100% renewable electricity by 2030 will not be costless. Ratepayers will need to support investments driving long-term energy, economic, and environmental benefits. In the near term, renewable electricity will cost more than fossil-fired generation, and utility bills will be higher regardless of the composition of the ultimate portfolio of renewable resources. But net economic and energy benefits and costs will be determined by how that portfolio is shaped over time.”

We know the trajectory of future electricity bills is up. What we don’t know is how high or how quickly they will rise. The answer will depend on which renewable energy is selected and the trajectory of its cost. Given the current cost trends for renewable energy sources, we are not optimistic that future Rhode Island electricity bills will experience any relief in the foreseeable future. Hang on to your wallets.