Energy Musings - February 11, 2025

The lack of EV ads during the Super Bowl upset Bloomberg reporters. Monday's Financial Times had three articles about EV companies highlighting the many problems they face.

Monday Was EV Day At The Financial Times

After so few auto and electric vehicle (EV) ads during Sunday’s Super Bowl telecast, a loss Bloomberg.com reporters lamented, we were overwhelmed Monday with EV articles in the Financial Times. The contrast is delivering an important message: EVs may no longer dominate the automobile news.

Bloomberg reporters suggest that auto executives and U.S. drivers are moving away from focusing on the “cleaner” technology of EVs. They noted seven of nine auto ads during the 2022 Super Bowl lauded EVs. On Sunday, only Ram trucks and Jeep hawked their vehicles. Harrison Ford pitched the electric version of the Jeep because people might like a quiet ride rather than the roar of the internal combustion engine model.

EVs are old news, and given the financial health of the automobile industry, judicious advertising spending is more critical than touting EVs that are well-established in today’s vehicle marketplace. It is also possible auto companies avoided advertising EVs because people don’t care about them. They have made up their mind – too expensive and too limiting or the vehicle of the future.

InsideEVs.com reported on Cox Automotive’s EV sales data for 2024 in January. “It's clear that 2024 was a big year for electric cars in this country,” it reported.

Here is InsideEVs message: “Americans bought a record 1.3 million electric cars in 2024, Cox Automotive's Kelley Blue Book estimates, while several companies sold more EVs than ever. Sales of battery-powered vehicles grew by 7.3%, while the auto market overall inched up just over 2%. EVs claimed 8.1% market share. And momentum is squarely on the side of batteries and charging cords: In the back half of 2024, 700,000 new EVs changed hands, representing 8.7% of car sales.”

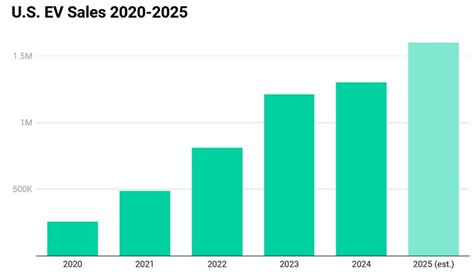

You can’t get more bullish on the EV market than in that paragraph. But if we believe EV forecasts from earlier years, there should be more on America’s roads. Why not, given the record of U.S. EV sales from 2020? Here is the Cox Automotive EV sales data for 2020-2025, graphically assembled by InsideEVs. The 2025 forecast was made late last year and does not reflect the expected outcome from Donald Trump’s election with new policies regarding “green” vehicles.

EV sales growth has slowed.

Unspoken by Bloomberg and InsideEVs was the slowing pace of EV sales. Sales rose by 89%, 66%, 48%, and 8% annually during 2020-2024. Cox Automotive’s forecast calls for an additional 300,000 EVs to be sold in 2025, a 23% increase from 2024’s sales.

The 2024 EV sales slowdown was partially due to the restrictive terms of the federal tax credit. However, since leased EVs are classified as commercial vehicles, all leases were eligible for the $7,500 tax credit, which reduced the monthly lease cost. According to Experian’s head of automotive financial insights, leases represented 45% of the EV market last year, up from 25% in 2023 and 9.5% in 2022. The federal tax credit and more budget-friendly EV models explained the surge in leasing. On average, Experian said EV lease payments were $198 lower per month than traditional auto loans.

Hopefully, the Bloomberg writers didn’t read Monday’s Financial Times. There were three EV articles:

BMW bets on petrol cars as it warns of US ‘rollercoaster’ EV transition.

Volkswagen’s EV dreams fade unleashing uncertainty among German workers.

Chinese EV leader BYD to offer ‘God’s Eye’ self-driving system on all models.

BMW has been cautious about the pace of the global EV shift. It developed a range of products long before EV sales began slowing. BMW Board member Jochen Goller told the FT, “This is why we are investing in our combustion engines. We are investing in modern plug-in hybrids. And we will continue rolling out electric cars.”

Like virtually every other manufacturer, the Chinese auto market is a problem. Numerous challenges exist, such as local favoritism, cheaper input costs, and higher levels of electronic sophistication in vehicles. BMW has not been immune to these challenges in the Chinese market. Goller said China was unlikely to regenerate the explosive economic growth that attracted Western auto manufacturers. Despite this prospect, Goller said about BMW’s plan, “…we still see a growing market…and therefore, our ambition is clearly that we want to participate in a growing market.”

BMW’s success and strategy contrast with the problems befalling Germany’s largest auto manufacturer, Volkswagen. Between 2019 and 2024, VW’s vehicle deliveries in Europe fell by nearly one million units because buyers were only lukewarm about the company’s EV lineup.

To address its weak performance, VW management announced plans last fall to shut plants, lay off workers, and reduce the salaries of the remaining workers. VW has never done what it was proposing in its history. The shocking proposal fired up its unionized employees, who threatened to strike unless the plans were changed. The result was a deal eliminating the threat of layoffs until 2030 and factory closures in Germany. However, VW will halve its production capacity to 750,000 units from 1.5 million, leaving certain factories to compete for future investments.

VW’s production target is below the 900,000 units it produced last year, suggesting a long-term pessimistic view of the global auto market’s health. “[In Europe] we have a market that is no longer growing and probably, in the future, will stagnate,” David Powels, CFO at VW’s flagship brand, told the FT.

Two VW plants in Saxony have been earmarked for “alternative use” as car output winds down. They must cut costs by 20% to remain contenders for producing future VW models. This reality is helping spark the region’s political tilt to the far right. The growing frustration over Germany’s economic decline has driven a surge in support for the Alternative for Germany (AfD) party. It has dismissed the EV transition as a “fairy tale.”

The AfD party is currently polling five percentage points ahead of Chancellor Olaf Scholz’s SPD party. I will likely team up with the Christian Democrat party to form a coalition government after the February 23 election.

Powels pointed out the challenges faced by VW and other European auto manufacturers. “It’s not just new players with new technologies, these new players have a lower cost base and much higher efficiency and productivity,” Powels said about the Chinese auto manufacturers entering the European market.

The global market is unsettled by BYD, China’s largest EV manufacturer, who unveiled an advanced self-driving system that it plans to install in its entire model lineup, including its $9,600 Seagull budget hatchback. The system, called ‘God’s Eye,’ was developed in-house by BYD. It will deliver features usually only found on upscale EVs, including remote parking via smartphones and autonomous overtaking on roads.

According to financial analysts, installing the God’s Eye system fills a critical void in the self-driving market for lower-cost EVs. It may be a game-changer in the Chinese automobile market as Chinese consumers are more willing to pay extra for sophisticated in-car technology than in other parts of the world. A 2024 EY survey of consumers reported that only 39% of Chinese EV owners rated “expensive services” primarily consisting of in-car connectivity as a “challenge.” It was highlighted by 45% of European and 47% of U.S. respondents as a primary concern.

BYD is the largest EV manufacturer in China, the world’s largest automobile market. Its success comes from providing a wide range of affordable EVs supported by the company’s vertically integrated supply chain. The absence of self-driving capabilities was seen as one of BYD’s most significant shortcomings.

The Financial Times likely had no idea how depressing its articles about EV companies and their challenges would be for the Bloomberg reporters. Tariffs. EV mandates. Subsidies. Critical minerals. Energy transition. These topics will roil the 2025 global automotive market. Do not put much weight on current forecasts. Be ready to zig when the market zags.