Energy Musings - February 1, 2025

January's improved oil prices contributed to better energy stock performance. We show readers how this relationship has played out since January 2020. Many other cross-currents to consider.

January Was Better For Energy Stocks

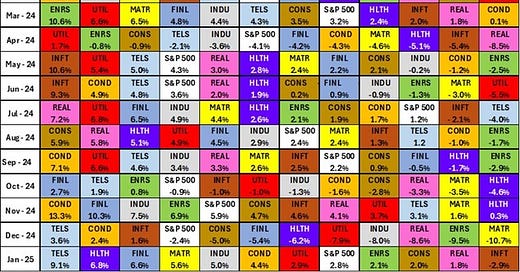

The Energy sector of the Standard & Poor’s 500 Index finished in eighth place after posting a 2.1% increase for January. While falling short of matching the S&P’s 2.8% monthly gain, Energy did move up two spots in the sector ranking. Better oil prices helped boost the performance. It is early for any boom due to President Donald J. Trump’s pledge to unleash “Drill, Baby, Drill,” and we would not hold our breath expecting such a reaction.

Energy improved its sector ranking with a positive performance in January.

What helped the Energy sector was Trump’s pledge to roll back the Biden administration’s rules that shackled energy companies, limiting their efforts to boost output and new resource developments. The new administration ended the Biden pause in building new liquefied natural gas (LNG) export terminals on day one in office. Trump also pledged that within his first executive orders, he would include one rolling back support for renewable energy developments, especially offshore wind farms. He delivered on this promise.

Fewer headwinds for the Energy sector were greeted with investor enthusiasm. However, there was uncertainty about the legal attacks expected to be launched by Democrats and whether the world was ready for a flood of new U.S. oil and gas output. Energy industry leaders cautioned that capital spending plans were unlikely to be ramped up from the year-end forecasts calling for spending to be flat to slightly negative. Given the uncertainty about the legal landscape for energy, and the current global oversupply of oil, oil and gas executives remain hesitant to boost spending. However, they are likely reassessing their portfolio of projects in planning for when they might increase spending.

Energy executives are watching geopolitical developments worldwide in response to Trump’s entrance into office. Key regions’ developments could boost hydrocarbon supplies but significantly increase economic growth. The first days of the Middle East cease-fire are encouraging as one change has been the Yemen Houthis declaring they will stop shooting at ships transiting the Red Sea. The first ships have passed through the former war zone without problems. If the attacks end permanently, shipping costs will fall as vessels taking additional days to transit around the tip of Africa, adding costs to cargoes, will take the shorter route through the Red Sea and Suez Canal. That would be a positive for global inflation, which would help boost growth.

The European Union (EU) struggles to deal with Trump’s return to the White House. His tariff threats, calls for European countries to boost their military support for NATO, and calls to end their renewable energy transition have unsettled the EU’s political world. The fallout of Trump’s election victory contributed to the collapse of the German government coalition and new elections this month. The Norwegian government just collapsed in dealing with the EU’s energy policy, calling for an energy transition.

A growing debate is underway within the EU over whether restarting its members’ purchases of Russian pipelined natural gas could be a bargaining chip in peace negotiations for the Russia-Ukraine war. This debate comes as the EU members must deal with the current policy to end the community’s use of any Russian energy supplies by 2027.

The EU debate is being framed within the context of the economic cost of high energy prices driven by the ban on using Russian natural gas and the relentless push for more renewable electricity. The colder winter and increased wind stillness are depleting continental natural gas storage supplies faster than anticipated, forcing countries to purchase more expensive imported LNG. Higher energy prices have led to a sharp cut in Germany’s 2025 forecast for economic growth. After two years of economic contraction, 2025 forecasts predict a minimal increase of 0.3%.

How these significant political and economic issues play out will impact energy consumption and commodity prices. Forecasting the outcomes and impacts is currently impossible, creating a level of uncertainty about future energy markets. Assuming they do not collapse, lower energy prices will boost global economic growth and future energy consumption. Greater energy use will support commodity prices. Such a scenario should be good for the stock market and energy investments.

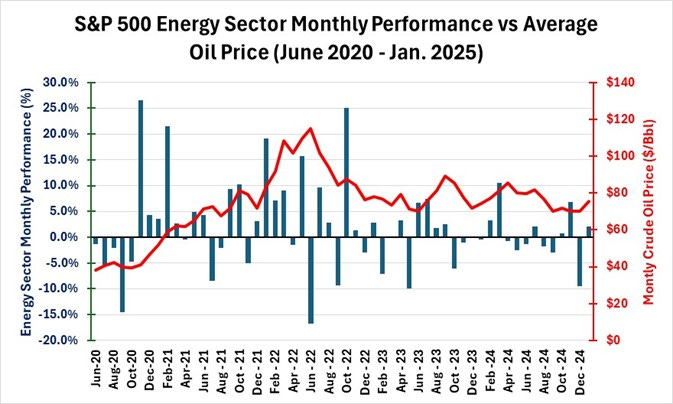

Rising oil prices boost energy stock performance.

When Energy stocks and oil prices over 2020-2025 are examined, it is clear that periods of rising oil prices boost Energy stock performance. Likewise, when oil prices decline, so does Energy stock performance. When oil prices are relatively stable, Energy stock performance is more influenced by speculation over future price trends. The significant difference between now and the past is that energy company management has embraced financial discipline and remains dedicated to keeping solid balance sheets with lower debt levels while returning surplus cash flow to shareholders.

Pay attention to the trend in global crude oil prices. But also remain aware of what is happening geopolitically. There will be plenty of cross-currents in the latter, which will cause crude oil prices to fluctuate. For example, key OPEC leaders are discussing how the group should respond to Trump’s call for lower crude oil prices. There is no easy answer, but speculation over possible actions will impact commodity and stock prices. Stay tuned and stay alert.