Energy Musings - December 31, 2023

Happy New Year! Here is hoping 2024 will be kinder to Energy stocks than the year we are closing out. Oil prices in 2023 didn't help the stocks, falling nearly 19% and fighting to stay above $70.

Energy Stocks Close Out A Dismal 2023

The stock market generated an outstanding return for investors, ending 2023 with a 24.3% gain for the S&P 500 index. Much of that gain came in the fourth quarter when the index rose 11.2%, with December alone posting a 4.4% gain.

For Energy, 2023 was not as much fun. For the quarter, the Energy sector of the S&P 500 index posted a loss of 7.8%. Energy was barely negative in December (-0.2%). For these two periods, Energy was the only S&P 500 sector to post negative results. The fourth quarter’s results ensured that Energy posted a negative year (-4.8%), but it was not the worst-performing sector. Energy fell between Consumer Staples (-2.2%) and Utilities (-10.2%).

Energy ended 2023 by being the worst-performing S&P 500 sector every month in the fourth quarter.

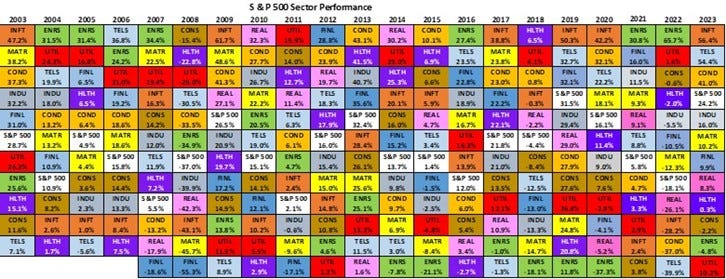

As our 2023 monthly sector performance chart above shows, Energy was the worst-performing sector for all three months of the fourth quarter. Such a performance record was not seen going back to 2020. Of course, with the WTI oil price falling by 19% in the quarter, dropping from $88.82 a barrel to $71.65 and spending brief periods under $70, weak stock performance was not a surprise. In the quarter, traders abandoned any hope of a price rally and sold their long holdings and purchased short positions, betting for lower prices in the future. So far, they have been rewarded.

Oil prices were range-bound in 2023 but successfully held off a worse decline in the fourth quarter.

The WTI roller coaster ride in 2023 is evident from the chart above. What is also amazing is how oil prices stayed largely within the $70-$85 range, with only brief periods outside it. We won’t speculate on the trend for oil prices in 2024 but rather save that for another article. What was interesting was seeing how Energy faired in 2023 compared to the past two decades.

Energy stock performance in 2023 has the sector back where it spent 2014-2020 during its last cyclical down period.

Energy generated the second-worst stock sector performance in 2023. What is clear from the chart (only look at the green boxes) is that Energy’s performance puts the sector back in the area where it resided from 2014-2020. For some oil price bears, this is confirmation that oil is entering another cyclical down period. However, some investment strategists suggest that absent a total oil price collapse in 2024, energy stocks have attractive valuations, especially given their high dividend yields supported by strong balance sheets, healthy cash flows, and management’s commitment to financial discipline. They opine Energy may be a fertile area in the market to prospect for undervalued stocks that could deliver healthy returns in 2024.