Energy Musings - December 26, 2023

Last week was a tough week for the electric vehicle industry. It was tough for automakers and consumers who face an uncertain but expensive future if EV mandates go forward in the US and Canada.

EV Struggles – Real or Imaginary?

“The math doesn’t work,” Mark Fields, former Ford Motor CEO, told Joe Kernen of CNBC early last week. Until the industry solves charging and cost issues, EV sales will continue to underperform. The bottom line for Fields is that “the government [Biden administration] will have to back off” its policies mandating two-thirds of new vehicle sales being EVs by 2030. Absent such an adjustment, emissions will worsen, and the EV transition will lag.

Kernan questioned Fields about the EV sales slowdown, while acknowledging they are not falling, but rather growing more slowly than predicted. Policymakers are ignoring the evidence, but automakers are not, and they are acting by scaling back EV investment.

Fields noted that the 2021 Infrastructure Act committed the U.S. to spending $7.5 billion to build out a nationwide network of 500,000 EV chargers. But by December 5, no new charging stations had been commissioned. Fields also noted that an EV charging study estimated the U.S. needs between 1.2 and 1.4 million chargers by 2030. There are about 180,000 chargers in place today. Using the low estimate of 1.2 million chargers, Fields calculated that the nation must add 465 chargers every single day from now until 2030, a feat he doubts will happen.

EVs also have a cost problem. In the third quarter, Fields noted, 25% of luxury vehicle sales were EVs, yet they were only 3% of non-luxury car sales. The problem: the average cost of EVs is 25% above the average cost of internal combustion engine (ICE) vehicle sales, he said. And that premium is down 20% due to EV price cuts earlier this year. Fields put the cost difference into perspective by citing that elevated interest rates translate into an additional $275 per month in loan payments.

Charging and vehicle cost is the math Fields says doesn’t work. The automobile industry understands it. The reality, according to Fields, is that the industry will transition to EVs because fossil fuels are finite, but not on the original timetable. As automakers adjust their spending plans to match a slower transition, there will be unintended consequences.

Unintended Consequences of the EV Transition

The Biden administration is driving the EV transition by proposing higher vehicle fuel-efficiency standards. As a result, automakers stopped working on the next generation of ICE power trains last year. This means fleet fuel economy improvement will slow and eventually stop.

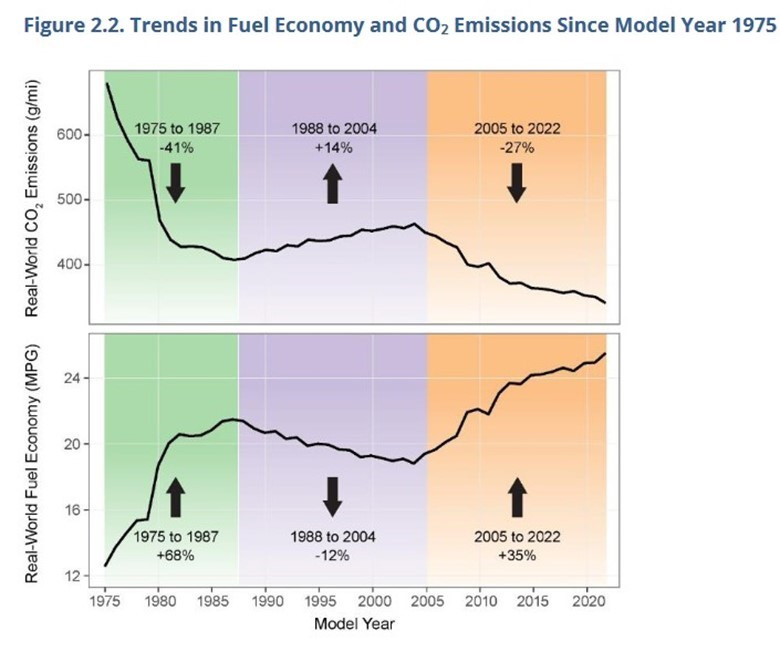

History offers us a lesson in what happens to emissions when fuel-efficiency improvements are ignored. The following chart from The 2023 EPA Automotive Trends Report - Greenhouse Gas Emissions, Fuel Economy, and Technology since 1975 shows that during 1988-2004 vehicle fuel efficiency declined 12%, coinciding with emissions rising 14%. The years before and after showed positive and strong correlations between rising vehicle fuel efficiency and reduced emissions.

History shows falling fuel-efficiency will increase vehicle emissions.

Similar challenges are emerging in our neighbor to the north. Canada’s Environmental Minister Steven Guilbeault told CBC’s Power and Politics host, “What we are proposing is that, by 2035, we progressively make it easier and easier to buy electric vehicles.” That benign comment was followed by Guilbeault stating, “So, 12 years from now, 100 percent of new vehicles sold would have to be electric vehicles.” The reason for the EV mandate was outlined in the agency’s press release announcing the policy.

“These vehicles account for about half of Canada’s greenhouse gas emissions from the transportation sector, while the transportation sector overall accounts for about 25 percent of Canada’s overall greenhouse gas emissions.”

Guilbeault acknowledged that people could continue to use their ICE vehicles after 2035, but there would be no new ones sold in Canada. The Canadian mandate applies to light-duty vehicles: cars, trucks, and SUVs, excluding police, fire, or ambulance services. Hybrids will continue to be sold after 2035 as long as they have an all-electric range of at least 80 kilometers (50 miles). Hybrids may become a popular alternative to battery-only EVs (BEVs) given the charging and cold weather conditions in Canada.

Just like the U.S., Canada needs many more charging stations, especially given its large remote geography. A Natural Resources Canada report estimates that by 2035 the country needs between 442,000 and 469,000 charging ports. As of December 1, 2023, Canada had 10,425 charging stations with 25,256 charging ports. To reach the low-end estimate of 442,000 charging ports, Canada must install 104 charging ports every single day from now to 2035. While only needing to install a quarter of charging ports as in the U.S., Canada’s population is an eighth the size of the U.S., and its economy is 8% of that of the U.S. Coupled with more remote areas, Canada faces a huge challenge building out a nationwide charging system.

A major problem for Canadians facing the EV mandate is their performance in cold weather. Earlier this year, Seattle-based Recurrent measured the EV range loss at temperatures of -7C (19F) to -1C (30F). It found that 18 popular EV models lost 30% of their range in freezing conditions. SaskPower says that in extreme cold (-40C/-40F), the battery range can be cut in half. Equipping EVs with heat pumps may help minimize range loss, but that boosts the EV’s cost. A study by MoveElectric showed that EVs equipped with a heat pump only lost 25% of their maximum charge compared to ones without heat pumps that lost nearly 34% of their range.

Auto Industry Problems With Slowing EV Transition

Last week, news releases from General Motors and Ford saw dealerships bailing out of selling EVs as the transition slows. GM bought out about half its Buick dealerships who opted not to sell EVs as the company moves to only offer electric vehicles in 2030. GM had asked Buick dealers to invest $300,000-$400,000 to prepare their stores to sell and service EVs. In 2020, GM’s Cadillac division lost 20% of its dealers who opted for buyouts rather than investing $300,000-$700,000 for tools, training, equipment, and charging stations to sell and service EVs.

The Ford EV dealer experience is similar. In 2022, Ford CEO Jim Farley had “secured commitments” from two of every three dealers to go all-in on selling EVs. At the time, Ford said it had 1,920 dealers in the voluntary Model e Program for its initial 2024-2026 period. Now, half of Ford dealers, or 1,550, have decided to stay with selling hybrid and ICE vehicles only in 2024, waiting before having to decide whether to make the investments necessary to sell and service EVs.

These announcements follow a November letter to President Joe Biden signed by 4,000 auto dealers calling the EV mandate “unrealistic,” as their lots filled with unsold EVs. They asked for time for EV technology to improve and become less costly.

GM and Ford began scaling back their EV investments and production targets in the fall. GM said it was slowing North American EV production due to lower-than-forecast demand. It pushed its earlier output target for building 400,000 EVs by mid-2024 into 2025, which will save the company $1.5 billion. The company also pushed back the opening of an EV truck factory in Detroit by a year. It is also working to build greater flexibility in its manufacturing operations to allow for fluctuations in EV demand. However, given the company’s championing the Biden administration’s EV push, GM reiterated its plan to only build EVs by 2035.

In July, Ford pushed back its EV output target by one year, and in October it announced a postponement of $12 billion in EV investments citing them as being “too expensive.” Through the first nine months of 2023, Ford’s EV business lost about $3.1 billion. In the third quarter, Ford lost $36,000 per EV sold, up from the $32,000 per unit sold lost in the second quarter. The company postponed the construction of a Kentucky battery plant and later scaled back production at its Michigan battery plant in response to weaker EV demand. Some of its production cutbacks reflect the company adjusting to the higher labor costs following the settlement of the UAW strike. The higher costs and weakening demand have not caused the company to back off from its EV 8% pre-tax profitability goal in 2026, but we will not be surprised to see the target revised when Ford reports year-end results in early 2024.

EV optimists point to rising EV market share in 2023. EVs sold in the third quarter represented about 9% of total new vehicle sales. According to Argonne National Laboratory data, 112,421 plug-in vehicles (PEV), of which 89,082 were battery electric vehicles (BEV) and 23,339 plug-in hybrid vehicles (PHEVs), were sold in November 2023, up 30.6% from November 2022 sales. PEV market share reached 9.23% of total light-duty vehicle sales.

These figures demonstrate the challenge of commenting on the EV market. Most people, including policymakers setting EV mandates, think in terms of BEVs. Plug-in hybrid EVs (PHEV) and hybrid electric vehicles (HEV) use gasoline depending on driving distances. These vehicles upset the tailpipe emissions narrative of EVs.

November HEV sales show 110,362 units sold including 27,803 cars and 82,559 light-duty trucks. Total HEV sales increased 93.3% from November 2022. Total HEV sales almost equaled PEV sales, but were more than BEV sales. The huge year-over-year HEV sales gain is explained by Americans opting for more environmentally friendly vehicles that overcome EV range fears while also being considerably cheaper than BEVs. Toyota sold 50% of the HEVs in November! These trends have not been lost on Ford, which plans to step up its HEV lineup.

Yes, PEV sales exceeded one million units through 11 months of 2023. At 9+% of total new vehicle sales, the PEV fleet continues to grow. However, to meet the Biden administration’s target of 68% of new vehicle sales being PEVs in 2030, the industry has a monumental hill to climb in six years. The industry is being asked to raise its market share from under 10% to nearly 70% in that span. With U.S. annual new vehicle sales between 15-17 million units, by 2030 the industry must be selling 10.2-11.6 million PEVs, nearly a tenfold increase. Is that realistic?

Besides inadequate charging networks, EV owners are learning about extremely high insurance rates because of expensive EVs and the high cost of repairing them. That is why EVs are leaving the fleet at a 50% higher attrition rate than ICE vehicles. A recent news story from Vancouver’s Times Colonist told of a major Canadian insurance company scraping a 2022 EV because minor battery damage was going to cost $60,000 to repair, or more than the vehicle was worth.

The bulk of EVs are being sold in the luxury market to people who can afford them as well as pay their high insurance costs. High loan and insurance costs are impediments to sales to lower-income buyers who will be forced to buy EVs under government mandates.

The other bad news for EVs last week was a battery fire. A spontaneous lithium-ion battery fire broke out near the loading dock at GM’s Factory ZERO in Detroit. It grew into a three-alarm fire and led to the cancellation of the second shift and the shutting down of production at the plant.

Another potential problem for GM could be the recent stop-sale order for its Chevrolet Blazer EV. The order came following a week of reports of problems with the vehicle, including from automotive media. One episode involved a breakdown during a road trip experienced by an InsideEVs reporter. Then there was the scathing report from car-buying service Edmunds. As InsideEVs wrote:

“The stop-sale order also comes after car-buying website Edmunds issued a scathing report about the Blazer EV the staff purchased for evaluation two months ago. The publication reported window switches that refused to work, the infotainment display getting stuck in a shutdown loop, a number of error messages and the failure of various driving functions. ‘What we got back from the dealer was alarming: the single longest list of major faults we at Edmunds have ever seen on a new car,’ the publication said.”

An auto manufacturer doesn’t want to upset the automotive media since they influence consumers. The stop-sale order was issued late last Friday. It reportedly affects only “a limited number” of Blazer EVs. GM did not tell Automotive News how many vehicles were impacted, but according to Cars.com, there are about 1,000 Blazer EVs currently for sale.

A curious issue arose from the input from Blazer EV owners who contacted InsideEVs. They confirmed “similar problems, as well as other issues with GM’s Ultium-branded cars.” Ultium is GM’s new software and battery platform that underlies its future EV models and is considered key to the company’s future and its plan to produce only EVs by 2035. If there is a design problem here, GM’s EV production goals might be pushed further into the future jeopardizing its 2035 EVs-only goal. This is an issue to watch.

Despite the optimists telling us how well EVs are selling and that the charging and cost issues will be quickly resolved, the industry struggles. Having bought into the EV vision, the reality is unsettling. The math doesn’t work, and consumers are concluding HEVs better meet their driving needs. Auto executives are wondering whether their betting on the EV transition, even with mandates, is putting them on the road to bankruptcy.