Energy Musings - December 2, 2024

To decarbonize the transportation sector means finding technologies and solutions for heavy-duty trucking, ocean-going shipping, and airplanes. None of these sectors are close to solutions.

The Challenge To Decarbonize Transportation

When we talk about transportation and decarbonization in the same sentence, we automatically think about electric vehicles. However, personal vehicles and local delivery trucks are the easiest part of the transportation sector to change. Heavy-duty trucks, ocean-going ships, and airplanes are the more demanding transportation sectors. None of these sectors are readily adaptable to electrification. They are heavy vehicles carrying heavy loads, often traveling thousands of miles between refueling. Electrification is not a feasible way to power them.

The effort to decarbonize these transportation sectors has been ongoing for years, with little tangible progress made because of the hurdles the technologies must overcome. Let’s see where each industry stands in its goal to be decarbonized or reach net zero emissions by 2050.

Heavy-duty Trucks

The push to electrify heavy-duty trucks continues, but the economics for their owners are a stumbling block. The large batteries needed to power these trucks reduce their carrying capacity, as roads have load weight limits. Thus, transportation companies considering using electric trucks must factor into their economics the reduced loads that can be moved long distances besides the extra time needed for recharging batteries during journeys.

We previously wrote about California’s struggles with implementing its zero-emissions vehicle (ZEV) regulations and how regulators seek to modify the mandate. The American Truck Dealers reported that a typical electric Class 8 truck costs roughly $400,000, while the average price of a comparable diesel-powered truck is $180,000. That represents a huge premium and requires substantial operating cost savings immediately. The cost differential remains prohibitive even with the $40,000 federal tax credit.

Heavy-duty ZEVs have an average range of 150 miles compared to the 1,000-1,500 mile range of diesel trucks. Electric trucks require about 90 minutes to charge, adding time to their trips. Finding a working charger and one not occupied always remains a challenge, which can add further time to the recharging process.

Ryder System studied the total cost to transport (TCT) for ZEV trucks versus diesel trucks based on its dedicated fleet of more than 13,000 commercial vehicles and professional drivers. The study compared the TCT on a one-to-one basis for diesel and ZEV transit vans, straight trucks, and heavy-duty tractors, with California being one of the geographic markets studied. The following are the conclusions for California.

“A light-duty EV transit van (Class 4) shows an estimated annual increase in TCT of approximately 3% or nearly $5,000. While vehicle cost increased by 71% and labor increased by 19%, partially due to more time required for EV charging, fuel versus energy costs decreased by 71%, and maintenance costs decreased by 22%.

"For a medium-duty EV straight truck (Class 6), the annual TCT increases to approximately 22% or nearly $48,000. The vehicle cost increases by 216%, which is only partially offset by a 57% savings in fuel versus energy and 22% savings on maintenance.

“And, for a heavy-duty EV tractor (Class 8), the annual TCT increases by approximately 94% or $315,000. The equipment cost is the largest contributor, representing an increase of approximately 500%, followed by general and administrative costs, which increased by approximately 87%, and labor and other personnel costs, which increased by 76% and 74%, respectively. Fuel versus energy savings are approximately 52%. This assumes delivery times equivalent to a diesel vehicle and factors payload and range limitations as well as EV charging time – all of which require nearly two heavy-duty EV tractors (1.87) and more than two drivers (2.07) to equal the output of one heavy-duty diesel tractor (which requires 1.2 drivers on average).”

California’s problems were similar to those in the other regional markets Ryder studied. Trucking companies may save money using electricity compared to diesel fuel, but other operating costs and considerations destroy that economic advantage. The most damaging economic impact was the need for nearly two ZEV tractors and drivers to haul the same load as a diesel truck. Switching to ZEVs would cause even more problems for an industry that is facing staffing challenges.

Robert Sanchez, chairman and CEO of Ryder, summed up the industry’s dilemma: “For many of our customers, the business case for converting to EV technology just isn’t there yet, given the limitations of the technology and lack of sufficient charging infrastructure.”

Shipping Industry

The maritime industry’s latest emissions reduction effort is part of a 50-year program to minimize pollution of the oceans and seas, including dumping, oil spills, and air pollution. The International Convention for the Prevention of Pollution from Ships, 1973, began the effort modified by the Protocol of 1978. Referred to as MARPOL 73/78, this was one of the most important international maritime environmental conventions.

The agreement is divided into Annexes according to the various categories of pollutants related to particular ship emissions groups. The annexes included pollution by oil and oily water (1983), noxious liquid substances in bulk (1987), harmful substances carried in packaged form (1992), sewage from ships (2003), garbage from ships (1988), and air pollution from ships (2005).

In 2020, the International Maritime Organization instituted IMO 2020, which reduced the limit on sulfur in ship fuel from 3.5% by weight to 0.5%. The reduction is applicable for all areas outside of Sulfur Emission Control Areas, the four geographic regions already subject to reduced pollution standards restricting the fuels ships are allowed to use. The four areas are the Baltic Sea, the North Sea, the North American East Coast area including the U.S. and Canada, and the U.S. Caribbean.

Ships had to switch the fuel they used or install onboard exhaust gas emissions cleaners to comply with IMO 2020. In 2019, the year before IMO 2020, heavy-fuel oil provided 81% of the maritime industry’s fuel. For 2022, the latest available data shows that the share is down to 55%.

In 2023, IMO adopted the 2023 IMO Greenhouse Gas Strategy, replacing and strengthening the 2018 Initial Strategy. The strategy calls for reaching net-zero greenhouse gas emissions from international shipping by around 2050, with interim checkpoints of a 20% reduction from 2008 volumes by 2030 and 70% by 2040.

Which new ship-powering systems and fuels will meet the emission reduction targets is unclear as the organization works through details and studies the data from many experiments. This uncertainty impacts new vessel orders as shipowners fear choosing the wrong powering system. No owner wants to build a vessel with equipment that may be outlawed or restricted, as it would shorten the ship’s working life, impacting the earnings and returns on the huge capital investment. The uncertainty also causes shipowners to continue operating older vessels with higher operating and maintenance expenses and an increased risk of catastrophic events such as the ship taking down the bridge across Baltimore’s harbor.

Decarbonized power systems for shipping include electrification, clean fuels such as hydrogen, onboard carbon capture systems, and nuclear power. Onboard carbon capture is gaining interest because it would delay the need for carbon-neutral fuels by removing carbon dioxide from conventional fuels. The mechanics and costs remain challenges.

Ships are estimated to use 7% of their energy consumption in port. Therefore, the industry can cut emissions by plugging ships into onshore electricity. However, that assumes the electricity used is generated from cleaner fuels than the emissions generated by ship fuels.

A study says 900 ships are operating with batteries for hybrid power systems, which can be charged by power from shore. The study modeled that 4,000 ships using 80% of their voyage energy consumption on trips shorter than 24 hours would consume 6 million tons of oil-equivalent fuel per year when sailing on these short trips, or 2.4% of the world fleet energy use. If the battery usage time could be extended from 24 to 72 hours, then 8,000 vessels could capitalize on battery power, saving the equivalent of 6.2% of the world fleet energy use. While a nice improvement, the world fleet still faces addressing the remaining 94% of energy use.

Air Transportation

While heavy-duty trucking and the global shipping industries are working on finding solutions to their emissions problems, the solution for the air transportation industry already exists. Sustainable Aviation Fuel (SAF) is being mandated for air transportation because electricity can only address a minuscule share of the world’s airplanes. Batteries are heavy, and airplanes need substantial power to fly with heavy loads. Batteries may work for small planes and those traveling short distances and likely not carry heavy loads.

The U.S. Department of Energy has just published a report titled Pathways to Commercial Liftoff: Sustainable Aviation Fuel. It notes that U.S. aviation currently represents 3% of total greenhouse gas emissions, and fossil jet fuel consumption is projected to grow 2-3% annually through 2050. In 2019, the domestic fossil jet fuel market was 26 billion gallons, representing a little more than a quarter of the 106 billion gallons of global demand. Global demand is projected to grow to 230 billion gallons in 2050. If the U.S. is to achieve its net zero carbon emissions by 2050, low-carbon or no-carbon transportation fuel must be used at scale. The DoE says that SAF is the only viable solution.

The use of SAF was embraced in 2021 with the SAF Grand Challenge. Government agencies are committed to supporting the research, development, demonstration, and deployment necessary to produce 35 billion gallons of SAF annually by 2050. A 2030 near-term goal of three billion gallons of domestic SAF production, estimated to cover 10% of jet fuel demand, was established. So far, domestic projects announced represent over three billion gallons of annual SAF production capacity with an investment of $44 billion.

At present, SAF is produced via the Hydroprocessed Esters and Fatty Acids (HEFA) pathway. HEFA primarily uses fats, oils, and greases as its feedstock. This is the only technology proven at commercial scale, and it could represent up to 70% of total SAF production by 2030. As production scales up, feedstock supply may become constrained without changes, such as the development of purpose-grown crops that do not compromise food security or have adverse environmental outcomes.

Only four SAF production facilities with a total nameplate capacity of 64 million gallons per year (MGPY) of fuel are operating. As of August, these facilities had produced 16.5 million gallons, exceeding the 15 million gallons produced for all of 2023. Unfortunately, this volume represents just 0.6% of total fossil jet fuel consumption and the SAF Grand Challenge 2030 target. To reach the SAF target, 8-12 commercial-scale (averaging 100 MGPY capacity each) production plants must be operating by 2030.

Jet fuels consist of n-alkanes, iso-alkanes, cycloalkanes, and aromatics. Aromatics do not burn as cleanly as alkanes, thus producing more particulate emissions. They also have a lower specific energy. The n-alkanes have limited blending potential because they do not have the highest fluidity and handling properties. The iso-alkanes have high specific energy, good thermal stability, and low freezing points. Cycloalkanes bring the same functional benefits as aromatics. Thus, combining iso-alkanes and cycloalkanes can add value to jet fuel by enabling high specific energy and energy density while minimizing emissions. The molecules of SAF are fully compatible with fossil jet fuel, allowing them to be blended on a one-for-one basis without causing operational problems for jet engines.

The biggest challenge for SAF is cost. Depending on the technology and feedstock used, SAF is currently 2-10 times more expensive than fossil jet fuel. Airlines operate with single-digit profit margins, and fuel represents 20-30% of operating costs. In other words, there is little room for such high-priced fuel. However, airlines have agreed to purchase small volumes of SAF to help develop the market.

Reducing SAF’s cost is critical to decarbonize air transportation. Besides the U.S. and Europe, South Korea, Japan, Singapore, Brazil, and New Zealand have instituted mandates for SAF to be blended into jet fuel. Each mandate escalates over time for the percentage of SAF to be blended. Scaling up output may help somewhat in reducing SAF’s cost. However, without less costly feedstocks or some unknown technological breakthrough, airlines will face financial pressures that will force them to begin passing along the higher fuel cost to passengers. How much ticket prices can rise before passengers revolt is unknown and something the airlines hope to avoid having to discover.

The DoE has concluded that scaling SAF to meet future emissions targets will only be impossible with government financial support. The SAF Production Tax Credit expires at the end of 2024, while the Clean Fuel Production Tax Credit expires in 2027. Several states, such as Illinois and California, provide tax credits for SAF used at their airports. These credits help ease the airline cost squeeze, but SAF remains hugely expensive.

A recent controversy with SAF focuses on a loophole in the absurdly named Inflation Reduction Act, which incentives farmers to grow new crops for the next generation of clean technologies and help the environment. However, lawmakers failed to limit the incentives to domestic producers. As a result, the incentive rewards a flood of imports.

The Financial Times dug into the issue. They report that farmers who invested in “green fuel” crops—corn, camelina, and soybeans—have yet to see the surge in demand. The Internal Revenue Service has not finalized the rules, so the credits cannot be claimed yet. These farmers are afraid that the incoming Trump administration may scrap the credits.

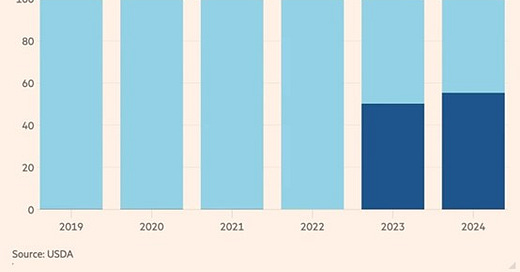

The tax credits are to start on January 1. Still, because they do not require feedstocks to be sourced domestically, the market has favored cheaper imported waste-based feedstocks with lower carbon intensities. According to Department of Agriculture data, China has supplied more than half the U.S. used cooking oil imports this year, up from less than 1% in 2022 when the IRA was signed into law.

China's cooking oil imports are hurting U.S. farmers.

Farmers and agricultural groups are calling for restrictions. A group of senators and House representatives introduced a bill to restrict the tax credit to domestically sourced feedstocks and extend its life for a decade.

Even the European Union has imposed anti-dumping duties on used cooking oil imported from China. This follows warnings that Chinese supplies are undercutting its domestic industry.

The battle over restricting used cooking oil imports has set off a battle between U.S. farmers and biofuel producers. The producers warn that restricting supplies to domestic sources could limit supplies to an industry the government is seeking to help solve its carbon emissions problem. The FT article quoted Bruce Fleming, CEO of Montana Renewables, a SAF producer, warning politicians and regulators. “If you want this to go faster, please don’t pick winners and losers in the feedstock space.”

Conclusion

All three transportation sectors face significant cost pressures to decarbonize. Will the companies be able to absorb the cost increases, or will they be forced to pass them on to customers? Unless new decarbonization solutions emerge that can scale quickly while not upsetting industry economics, it is hard to see heavy-duty trucking, shipping, and air transportation meeting their 2050 net zero emissions targets.